Luxury Footwear Market Size, Share, Trends and Forecast by Product, End User, Distribution Channel, and Region, 2026-2034

Luxury Footwear Market Size and Share:

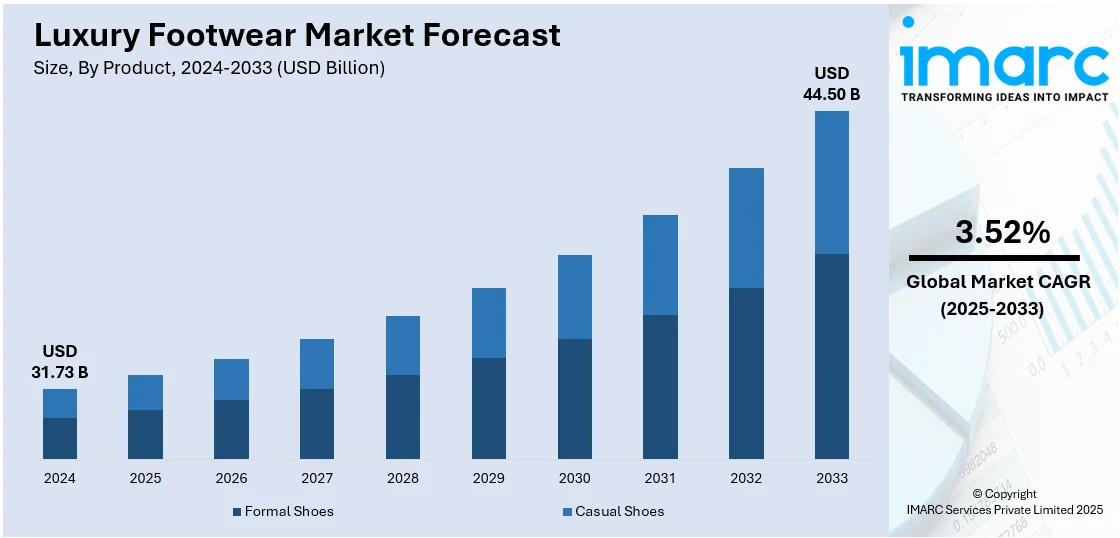

The global luxury footwear market size was valued at USD 31.73 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 44.50 Billion by 2034, exhibiting a CAGR of 3.52% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 35.0% in 2024. The market is driven by rising consumer preference for premium footwear based on high-quality materials, comfort, and durability. and growing inclination toward exclusivity and sophistication. Moreover, the desire to own premium brands like Gucci, Louis Vuitton, and Prada as a status symbol further fuel the market growth across the region.

Market Size & Forecasts:

- Luxury footwear market was valued at USD 31.73 Billion in 2024.

- The market is projected to reach USD 44.50 Billion by 2033, at a CAGR of 3.52% from 2025-2033.

Dominant Segments:

- Product: Formal shoes dominate the luxury footwear market, due to their timeless appeal, craftsmanship, versatility, and association with professionalism and status.

- End User: With a commanding 46.8% share, women lead the market, accredited to high demand for fashionable, elegant designs, and brand-driven luxury preferences.

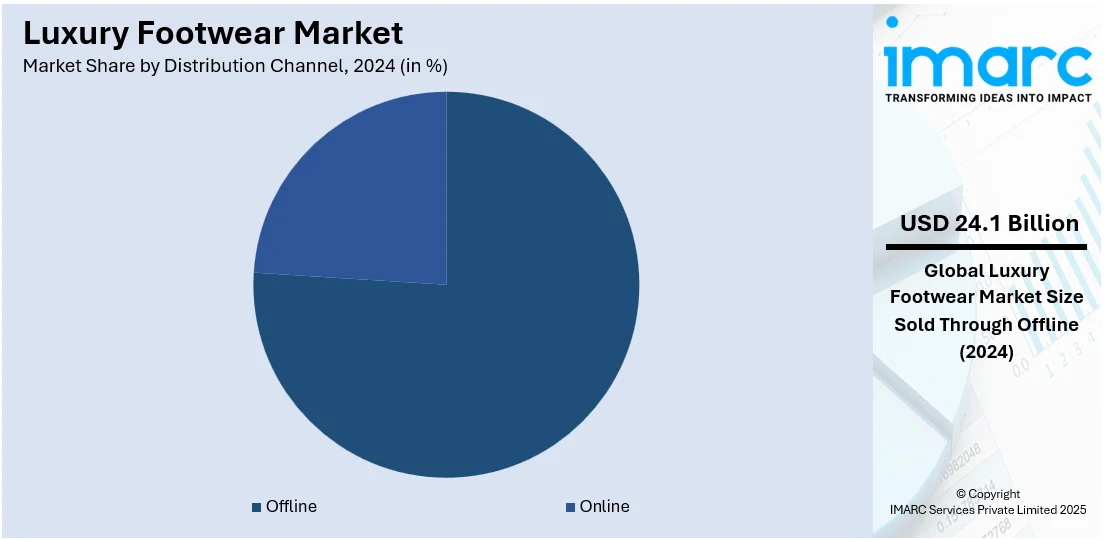

- Distribution Channel: Offline holds the biggest market share, accounting 75.8% in 2024. The dominance of the segment is attributed to the personalized shopping experience, exclusivity, and the tactile appeal of luxury products.

- Region: Asia Pacific leads the market, holding a dominant 35.0 % share. This regional advantage is driven by rising disposable incomes, increasing fashion consciousness, a growing middle class, and strong demand for luxury brands in key countries like China and Japan.

Key Players:

- The leading companies in luxury footwear market include A.Testoni (Sitoy Group Holdings Ltd), Adidas AG, Base London, Burberry, Chanel S.A. (CHANEL International B.V.), Dr. Martens (Airwair Group Limited), Hermès International S.A., Lottusse - Mallorca, LVMH Moët Hennessy - Louis Vuitton, Prada S.p.A (LUDO srl), Salvatore Ferragamo S.P.A., and Silvano Lattanzi srl.

Key Drivers of Market Growth:

- Shifting User Preferences: The growing disposable incomes and changing lifestyles are driving a shift in user preferences towards luxury footwear, leading to increased demand.

- Fashion Trends and Brand Prestige: The growing emphasis on fashion trends and brand prestige is driving the demand for luxury footwear, as people seek shoes that reflect their personal style and status. Luxury brands respond quickly to trends by offering exclusive, high-quality designs, enhancing their reputation and attracting a wider user base.

- E-commerce and Global Reach: E-commerce is expanding the reach of luxury footwear by offering global access to exclusive styles and brands, previously limited to physical stores. Online platforms help connect buyer with luxury brands, enhancing shopping experiences and allowing for greater market reach and accessibility.

- Sustainability and Ethical Practices: The growing emphasis on sustainability and ethical practices is positively influencing the market, as individuals become more aware about their environmental and social impact. Luxury brands are responding by utilizing sustainable resources, ethical labor standards, and environment-friendly manufacturing techniques, which appeal to conscientious buyers and strengthen brand image.

Future Outlook:

- Strong Growth Outlook: The market is projected to experience strong growth, driven by increasing disposable incomes, a growing demand for high-end fashion, and expanding online retail channels, particularly in emerging markets.

- Market Evolution: The market is evolving with trends, such as sustainability, digitalization, and customization, as individuals seek personalized, eco-friendly options alongside traditional luxury craftsmanship and exclusivity.

Rising disposable incomes and increasing urbanization have led to greater consumer spending on high-end fashion, including premium footwear. Consumers, especially millennials and Gen Z, seek shoes that combine comfort, craftsmanship, and exclusivity, making luxury brands highly desirable. Celebrity endorsements, fashion influencer collaborations, and social media exposure significantly boost brand appeal and product visibility. E-commerce has enhanced accessibility, allowing global consumers to shop high-end footwear conveniently. Additionally, the increasing demand for sustainable and ethically made products is influencing brand strategies. Limited-edition releases and personalized offerings also appeal to consumers seeking uniqueness. Altogether, evolving lifestyle preferences and brand-driven aspirations are fueling the consistent growth of the global market.

To get more information on this market, Request Sample

The U.S. luxury footwear market is witnessing significant growth, influenced by various major factors. High disposable income among affluent consumers fuels demand for premium products that offer exclusivity and superior craftsmanship. The rise of e-commerce platforms has enhanced accessibility, allowing consumers to explore and purchase luxury footwear conveniently. Celebrity endorsements and collaborations with renowned designers amplify brand visibility and desirability, particularly among younger demographics. Additionally, the increasing popularity of limited-edition releases and the influence of social media trends contribute to heightened consumer interest. For instance, in August 2023, Designer Brands Inc., a leading global designer, manufacturer, and retailer of footwear and accessories, announced the introduction of Le TIGRE's inaugural footwear line, a legendary sportswear brand from New York City that has been challenging traditional casual American fashion since 1977. Designer Brands is demonstrating its strength as a brand-development powerhouse with a daring entry into the athleisure footwear market.

Luxury Footwear Market Trends:

Growing Disposable Income and Changing User Preferences

A significant factor contributing to the expansion of the luxury shoe market is the change in user preferences, driven by increasing disposable incomes and changing lifestyle choices. With the growth of global economies, disposable income is consistently rising, resulting in higher expenditure on luxury items, such as shoes. The United Nations anticipates that worldwide disposable income will increase by 2.7% each year until 2030, especially notable in developing markets like China and India. The expanding middle class in these areas is catalyzing the demand for luxury goods. Furthermore, the growth of online shopping platforms is simplifying access for individuals to a wide variety of luxury shoe choices, further enhancing the market reach. Shoppers are currently focusing on uniqueness, elegance, and quality, choosing shoes that showcase their identity and social standing. As a result, luxury shoe brands are expanding their product lines to meet these changing needs, strengthening the growth of the market.

Evolving Fashion Trends and Brand Consciousness

The increasing focus on fashion trends and brand recognition is propelling the luxury footwear market demand. Contemporary buyers are very style-aware, looking for footwear that reflects their individual tastes while also symbolizing their identity and social standing. As fashion trends change swiftly, luxury shoe brands promptly adjust, presenting unique, trendy styles that meet user demand for elegance and rarity. These brands, celebrated for their exceptional craftsmanship and creativity, are turning into icons of prestige, catalyzing higher demand. With an increasing number of people looking for shoes that enhance their appearance, luxury brands prosper by offering top-notch, fashion-forward items. An instance of this is the Ermenegildo Zegna Group, which revealed intentions in 2024 to establish a luxury footwear and leather goods plant in Sala Baganza, Italy, by 2026. This 12,500 sq. meter facility will concentrate on artisan education, customization, and Italian craftsmanship, further boosting the brand's allure.

Expansion of E-commerce Platforms

E-commerce is allowing luxury footwear to reach a worldwide market, enabling shoppers to easily explore and buy from the convenience of their residences. This change is broadening the scope of luxury footwear brands beyond conventional physical stores, opening up opportunities in novel and varied markets. Due to online shopping, buyers can discover numerous luxury shoe choices, such as limited-edition drops and unique designs, which might not be found in their local stores. E-commerce sites provide tailored shopping experiences and convenient delivery choices, enhancing the appeal of luxury footwear for an expanding global audience. This heightened accessibility is aiding luxury brands in reaching emerging markets. For instance, MereCatch, an online marketplace founded by De’Juan Parker, was spotlighted for curating high-end footwear from brands like Rick Owens and Maison Margiela. Launched in late 2024, it connected luxury boutiques with a broader audience through a commission-based model. The platform aimed to expand inventory and add accessories and collaborations.

Sustainability and ethical practices

Another significant factor impelling the growth of the market revolves around the burgeoning emphasis on sustainability and ethical practices. Today's consumers are increasingly conscientious about the environmental and social impact of their purchasing decisions. According to recent surveys, 63% of respondents actively took steps to live a more sustainable lifestyle, while 55% were willing to pay a premium for environment-friendly brands. Luxury footwear brands have been quick to respond to this growing concern by integrating sustainable materials, ethical labor practices, and eco-friendly production processes into their operations. This unwavering commitment to sustainability resonates deeply with socially responsible consumers. Moreover, it serves as a powerful tool for enhancing brand image and reputation. This concerted effort to align with sustainability principles not only attracts a new segment of eco-conscious buyers but also bolsters the loyalty of existing customers.

Luxury Footwear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global luxury footwear market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, end user, and distribution channel.

Analysis by Product:

- Formal Shoes

- Casual Shoes

In the market, formal shoes represent the most significant segment. This can be attributed to the global corporate culture's demand for sophisticated and elegant footwear. Business professionals and corporate executives, especially in urban areas, gravitate towards high-quality, formal footwear for their durability and style, which aligns with professional attire standards. Additionally, the growing trend of incorporating formal shoes into semi-formal and smart casual dress codes further solidifies their position in the market.

Analysis by End User:

- Men

- Women

- Children

Women leads the market with around 46.8% of the luxury footwear market share in 2024. Women constitute the largest consumer group in the high-end shoe market. This dominance is a reflection of the diverse range of styles and designs available, catering to various occasions and preferences. The women's segment sees constant innovation, with designers and brands frequently introducing new collections. The continuous influx of new designs and collections keeps the offerings fresh and in line with emerging fashion trends. The key driving force behind this sustained demand is the combination of women's growing economic independence and a heightened awareness of fashion trends. The market's responsiveness to women's diverse footwear needs, ranging from professional settings to casual outings, reinforces their leading position in this sector.

Analysis by Distribution Channel:

- Online

- Offline

As per the luxury footwear market forecast, offline leads the market with around 75.8% of market share in 2024. Offline channels, encompassing brick-and-mortar stores, remain predominant in the distribution of high-end shoes. This preference is due to the tactile and personalized shopping experience they offer, which is particularly important in the luxury segment where fit, comfort, and material quality are paramount. Customers often prefer trying on footwear before purchasing to ensure the perfect fit, a factor that significantly favors physical stores. Moreover, the luxury shopping experience offered by boutique and brand stores, with their exclusive services and ambiance, plays a crucial role in attracting consumers who seek more than just a product, but an entire shopping experience.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 35.0%. The Asia Pacific luxury footwear market is expanding due to increasing urbanization, changing lifestyle preferences, and the rise of luxury tourism. The region's expanding middle and upper class, particularly in countries such as China, Japan, and South Korea, is also driving demand for premium footwear brands. Additionally, the growing interest in international travel has led to the rise of luxury tourism, where affluent consumers are increasingly purchasing high-end footwear while traveling. It is anticipated that the number of international visitors to Asia Pacific will rise from 619 Million in 2024 to 762 Million in 2026, as per the Pacific Asia Travel Association (PATA). Moreover, by 2026, 49.3 million tourists are expected to visit Japan, recording an increase of 55% in comparison to 2019. Local luxury brands are also gaining popularity, offering a unique blend of regional craftsmanship and modern design to appeal to both domestic and international consumers.

Key Regional Takeaways:

North America Luxury Footwear Market Analysis

The North American luxury footwear market is experiencing robust growth, driven by several key factors. Inflating income levels and a growing affluent population have increased demand for premium, high-quality footwear. Consumers are increasingly seeking products that offer both style and comfort, leading to a surge in demand for fashionable and comfortable footwear. Social media trends and celebrity endorsements have also been very important in influencing customer preferences and increasing brand awareness. Additionally, the expansion of e-commerce platforms has made luxury footwear more accessible to a broader audience, facilitating convenient shopping experiences. Sustainability concerns are prompting brands to adopt eco-friendly materials and ethical production practices, aligning with consumer values. Furthermore, the increasing participation of women and children in sports and fitness activities has expanded the market, with athletic and casual luxury footwear gaining popularity. Overall, these factors collectively contribute to the robust growth of the luxury footwear market in North America.

United States Luxury Footwear Market Analysis

In 2024, the United States accounted for over 88.20% of the luxury footwear market in North America. Rising disposable incomes, a growing fashion-conscious consumer base, and increased demand for high-quality, premium products primarily drive the United States luxury footwear market. As affluence grows among consumers, particularly Gen Z and Millennials, there is a greater willingness to invest in luxury footwear brands that symbolize status and exclusivity. Social media influence and celebrity culture also play a significant role, as high-end footwear brands are frequently showcased by influencers and celebrities, fueling desire and aspiration. According to a 2022 study, 41% of adults under the age of 30 years, 33% of adults aged 30 to 39 years, and 22% of adults aged 50 years and older reported purchasing a product due to a social media influencer’s recommendation in the United States. Additionally, an increasing focus on sustainability and ethical practices has prompted luxury footwear brands to adopt eco-friendly materials and responsible production methods, attracting eco-conscious consumers. The growth of athleisure trends, blending performance and style, has also contributed to luxury footwear demand, with consumers seeking both comfort and high-end design. Furthermore, limited-edition collections and collaborations between luxury footwear brands and popular designers or artists create a sense of exclusivity, which drives consumer interest and enhances brand prestige.

Europe Luxury Footwear Market Analysis

The Europe luxury footwear market is significantly influenced by shifting consumer preferences, an emphasis on craftsmanship, and the expansion of retail channels. According to reports, approximately 5% of the revenue generated by European economies comes from retail trade. As consumers become more discerning in their purchasing decisions, they are increasingly drawn to footwear that exemplifies quality, comfort, and design excellence. European brands are renowned for their superior craftsmanship, often using premium materials such as fine leather and exotic skins, which attract consumers seeking exclusivity and superior quality. The rise in personalized luxury products, with numerous brands offering bespoke options, also contributes to this trend. Additionally, the growing popularity of experiential retail is reshaping the market, with brands focusing on creating immersive, high-end shopping experiences both in-store and online. Luxury footwear brands are also tapping into the rising demand for multi-functional footwear, blending both elegance and practicality, which appeals to modern consumers. The increasing prevalence of fashion-forward, sustainability-focused collections, particularly those incorporating eco-conscious materials or ethical production practices, is another important driver, as younger generations are prioritizing responsible consumption. The prominence of Europe as a fashion hub, hosting major fashion events and collaborations, further strengthens the market’s position, attracting global consumers.

Latin America Luxury Footwear Market Analysis

The luxury footwear market in Latin America is greatly benefitting from rising disposable incomes, growing urbanization, and increasing brand consciousness. As the region's middle and upper classes expand, more consumers are seeking high-end footwear as a symbol of status and sophistication. Urbanization in countries, such as Brazil, Mexico, and Argentina, has also led to greater access to luxury retail outlets, both physical and online. Overall, 88.1% of the population of Latin America lived in urban areas in 2024, equating to 383,659,794 individuals, as per recent industry reports. Additionally, the influence of global fashion trends and the increasing presence of international luxury brands in the region contribute to luxury footwear market growth. Furthermore, the rising focus on sustainability and ethical production practices in luxury footwear is attracting environmentally conscious consumers, further driving the market.

Middle East and Africa Luxury Footwear Market Analysis

The Middle East and Africa luxury footwear market is being increasingly propelled by an expanding middle class and increased investment in luxury retail infrastructure. As more consumers in the region become brand-conscious, there is a rising demand for high-end, stylish footwear that offers both comfort and prestige. Moreover, the region’s younger population, highly influenced by global trends, is fueling the luxury footwear demand. Additionally, the rise of e-commerce also plays a crucial role, allowing consumers to purchase luxury footwear online, further boosting the market. According to a report published by the IMARC Group, the Middle East e-commerce market reached USD 1,888 Billion in 2024 and is forecasted to grow at a CAGR of 21.58% from 2025-2033. The increasing number of luxury fashion events and collaborations in the region further supports the demand for luxury footwear.

Competitive Landscape:

The luxury footwear market is highly competitive, dominated by globally recognized brands such as Gucci, Louis Vuitton, Christian Louboutin, Jimmy Choo, and Prada. These players compete on factors like craftsmanship, exclusivity, brand heritage, and innovative designs. The market also sees frequent collaborations with celebrities, artists, and fashion influencers to boost brand appeal and reach younger consumers. New entrants and niche luxury labels are gaining traction by offering sustainable and customizable options. E-commerce platforms have intensified competition by broadening global reach and enabling direct-to-consumer strategies. Companies are investing in digital marketing, immersive retail experiences, and product innovation to maintain market share. Regional brands in Asia-Pacific and North America are also emerging as strong competitors with localized strategies and cultural relevance.

The report provides a comprehensive analysis of the competitive landscape in the luxury footwear market with detailed profiles of all major companies, including:

- A.Testoni (Sitoy Group Holdings Ltd.)

- Adidas AG

- Base London

- Burberry

- Chanel S.A. (CHANEL International B.V.)

- Dr. Martens (Airwair Group Limited)

- Hermès International S.A.

- Lottusse - Mallorca

- LVMH Moët Hennessy - Louis Vuitton

- Prada S.p.A (LUDO srl)

- Salvatore Ferragamo S.P.A.

- Silvano Lattanzi srl

Latest News and Developments:

- April 2025: Saucony unveiled its new luxury footwear collection, Saucony SILO. The SS25 collection blends Saucony’s heritage and advanced technology with high-fashion influences, redefining luxury sneakers through premium materials and refined designs. Featuring five key silh ouettes,the collection emphasizes innovation, comfort, and style. Previewed at Paris Fashion Week, Saucony SILO offers a bold, future-focused experience for modern consumers seeking sophisticated, performance-driven footwear.

- April 2025: Crimzon, a luxury footwear brand known for its ultra-lightweight, ergonomic designs, launched its first flagship boutique in New Delhi, India. The store offers personalized services, including bespoke customization of heel heights, straps, and colors, catering especially to brides and special occasions. Crimzon emphasizes comfort with features like rebound cushioning and anti-skid soles, blending style with function. Committed to sustainability, it produces small batches with zero waste. The brand is expanding rapidly in India and internationally, with plans to launch a men's line soon.

- September 2024: New Balance partnered with Italian luxury brand Loro Piana to create a $1,500 sneaker, elevating the popular "dad shoe" trend. The collaboration features the iconic New Balance 990v6 model crafted from Loro Piana’s signature Pecora Nera wool, sourced from New Zealand, replacing traditional mesh and leather. Launching on September 5 at Loro Piana boutiques, this ultra-premium sneaker marks New Balance's significant entry into high-end fashion, building on prior collaborations and emphasizing quiet luxury over athletic performance.

- August 2024: Sara Blakely, founder of Spanx, launched Sneex, a luxury shoe brand featuring hybrid heels that combine high heel style with sneaker comfort. Crafted from fine Italian and Spanish leather, Sneex addresses common high heel issues: lack of foot support, pressure on the ball of the foot, and toe squeezing, using a patent-pending design. Available in three styles and ten colors, these handcrafted shoes offer comfort without sacrificing elegance.

- June 2024: OCEEDEE, a modern Indian luxury footwear brand known for its craftsmanship and contemporary designs, announced its expansion plans into Southeast Asia to reach fashion-forward consumers. The brand, which blends Indian artisanal techniques with modern aesthetics, aims to enhance accessibility through strategic partnerships with local retailers and distributors. OCEEDEE, recognized for its presence in global fashion weeks and celebrity endorsements, emphasizes sustainable, ethical production and plans to open multiple stores in India alongside its international growth.

Luxury Footwear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Formal Shoes, Casual Shoes |

| End Users Covered | Men, Women, Children |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | A.Testoni (Sitoy Group Holdings Ltd), Adidas AG, Base London, Burberry, Chanel S.A. (CHANEL International B.V.), Dr. Martens (Airwair Group Limited), Hermès International S.A., Lottusse - Mallorca, LVMH Moët Hennessy - Louis Vuitton, Prada S.p.A (LUDO srl), Salvatore Ferragamo S.P.A., Silvano Lattanzi srl, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the luxury footwear market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global luxury footwear market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the luxury footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury footwear market was valued at USD 31.73 Billion in 2024.

The luxury footwear market is projected to exhibit a CAGR of 3.52% during 2025-2033, reaching a value of USD 44.50 Billion by 2033.

Key factors driving the luxury footwear market include rising disposable incomes, increased fashion consciousness, and demand for premium-quality, stylish products. Brand collaborations, celebrity endorsements, and limited-edition releases boost appeal. E-commerce growth and social media influence also enhance accessibility and visibility, especially among millennials and Gen Z consumers.

Asia Pacific currently dominates the luxury footwear market due to growing fashion awareness, rapid urbanization, and increasing popularity of premium international brands across the region.

Some of the major players in the luxury footwear market include A.Testoni (Sitoy Group Holdings Ltd), Adidas AG, Base London, Burberry, Chanel S.A. (CHANEL International B.V.), Dr. Martens (Airwair Group Limited), Hermès International S.A., Lottusse - Mallorca, LVMH Moët Hennessy - Louis Vuitton, Prada S.p.A (LUDO srl), Salvatore Ferragamo S.P.A., Silvano Lattanzi srl, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)