Machine Tools Market Size, Share, Trends and Forecast by Tool Type, Technology, End Use Industry, and Region, 2025-2033

Machine Tools Market Size and Share:

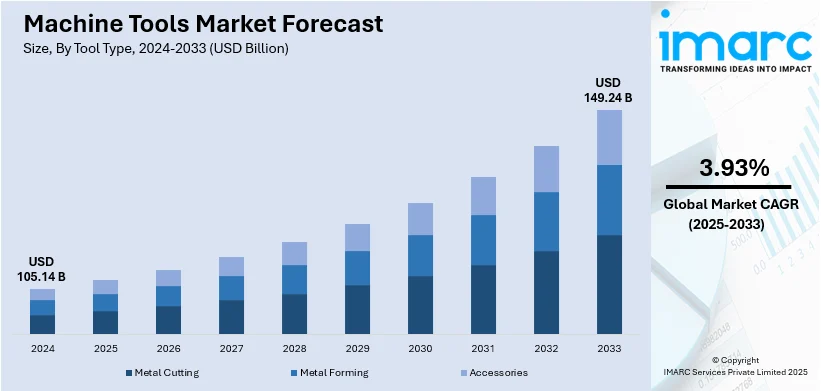

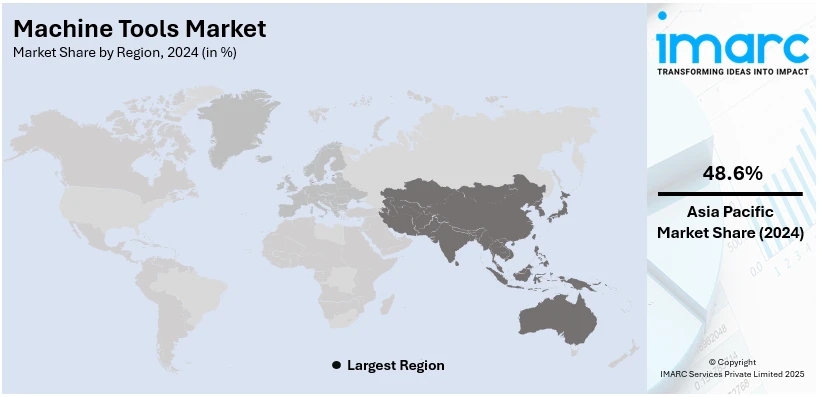

The global machine tools market size was valued at USD 105.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 149.24 Billion by 2033, exhibiting a CAGR of 3.93% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 48.6% in 2024. The rising demand for precision engineering in various sectors such as automotive, aerospace, and electronics, technological advancements in CNC and digital manufacturing technologies, and the shift towards smart manufacturing and Industry 4.0 are some of the major factors augmenting the machine tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 105.14 Billion |

|

Market Forecast in 2033

|

USD 149.24 Billion |

| Market Growth Rate 2025-2033 | 3.93% |

The market is primarily driven by the rising adoption of multi-axis and hybrid machine tools, which enables complex part production with greater precision and fewer setups. Additionally, increasing investments in automation across aerospace and marine manufacturing facilities are expanding the market for high-speed machining centers. Furthermore, increasing demand for sustainable lightweight materials is driving the adoption of advanced cutting technologies within the machine tools market. A recent study highlights the significant greenhouse gas (GHG) intensity associated with conventional polyacrylonitrile-based carbon fibers, which release 24 kg of CO₂ per kilogram produced. Therefore, alternatives such as Galvorn carbon nanomaterial are emerging as sustainable, high-performance options. The machining of such next-generation materials requires specialized tools capable of maintaining structural integrity during high-precision operations. As manufacturers transition to these alternatives, the need for customized, high-speed, and wear-resistant machine tools is becoming critical to ensure efficiency and consistency in processing sustainable composites.

The United States market is witnessing notable growth driven by the rapid expansion of domestic semiconductor and EV manufacturing facilities. According to an industry report, the number of establishments in the semiconductor and related device manufacturing sector increased from 1,876 in the first quarter of 2020 to 2,545 by the first quarter of 2024. This expansion is fueling demand for ultra-precision machine tools designed for highly specialized fabrication processes. Also, one of the emerging machine tools market trends is the integration of real-time monitoring systems with cloud platforms, thereby enabling predictive analytics and encouraging companies to upgrade their machinery. Additionally, workforce shortages are prompting U.S.-based manufacturers to adopt automated machining solutions to maintain productivity. Besides this, the rise of defense procurement contracts is strengthening investments in metal-cutting equipment designed for defense-grade components. Apart from this, the implementation of initiatives to restore production, particularly in critical sectors like medical devices and aerospace, is increasing reliance on digitally controlled turning equipment.

Machine Tools Market Trends:

Technological Advancements and Innovation

The continuous technological advancements and innovations is positively impacting the machine tools market outlook. These advancements include the integration of automation, internet of things (IoT), and artificial intelligence (AI) in machine tools, leading to enhanced precision, efficiency, and productivity in manufacturing processes. For instance, the global number of IoT-connected devices is increasing by 13% to 18.8 Billion. This evolution is particularly crucial in industries such as automotive, aerospace, and defense, where precision and efficiency are paramount. Furthermore, the development of advanced materials necessitates the use of sophisticated machine tools capable of handling complex tasks. The market is witnessing a growing demand for computer numeric control (CNC) machines, which offer higher precision and flexibility compared to conventional machines. This shift towards more technologically advanced machine tools is facilitating the production of complex and high-quality products, thereby driving market growth.

Increase in Manufacturing Activities in Developing Countries

The expansion of manufacturing sectors in developing countries is a major factor propelling the machine tools market growth. Nations such as China, India, and Brazil are experiencing significant industrial growth, fueled by government initiatives, lower labor costs, and the establishment of manufacturing hubs. According to India Brand Equity Foundation, India's manufacturing sector is poised to reach USD 1 Trillion by 2025-26. This growth is attributed to the rising domestic demand and the global outsourcing of manufacturing activities to these regions. The automotive and electronics industries, in particular, are witnessing substantial growth in these countries, necessitating the adoption of advanced machine tools. The influx of foreign direct investment (FDI) in these regions, aimed at leveraging the lower production costs and growing markets, is also a key driver. This factor enhances the local economies and contributes to the global supply chain, thereby augmenting the demand for machine tools.

Rising Demand for Automation in Manufacturing

The rising requirement for automation in manufacturing processes is increasing the machine tools market demand. Automation is becoming essential for manufacturers seeking to improve productivity, reduce operational costs, and maintain competitiveness in the global market. In addition, the integration of machine tools with automated systems such as robotics and AI-driven solutions enables faster production times, consistent quality, and minimal human error. This demand is particularly evident in sectors such as automotive, aerospace, and consumer electronics, where precision and efficiency are crucial. Along with this, the growing trend towards Industry 4.0, which emphasizes the digitalization of manufacturing processes, further fuels the demand for automated machine tools. For instance, the yearly funding of Industry 4.0 start-ups has grown by +319% between 2011 and 2021. In 2021, a total of USD 2.2 billion was invested in startups that create Industry 4.0-related technology. Companies are investing in smart and connected machine tools that can optimize production processes, offer predictive maintenance, and provide real-time data analysis, thus driving market growth.

Machine Tools Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global machine tools market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on tool type, technology type, and end use industry.

Analysis by Tool Type:

- Metal Cutting

- Metal Forming

- Accessories

Metal cutting leads the market with around 60.8% of market share in 2024 due to their extensive use in manufacturing sectors. Metal cutting tools are necessary for metal component shaping with high accuracy, catering to industries such as automotive, aerospace, defense, construction, and general engineering. CNC-based metal cutting tools are becoming increasingly crucial as firms focus on automation, consistency, and productivity. Major categories are milling machines, lathes, drilling machines, and grinding machines, each supporting various phases of component manufacturing. The continued move towards electric cars and sophisticated industrial machinery is further increasing demand for high-performance, long-lasting cutting tools that can handle harder alloys and composite materials. With the modernization of industries, metal cutting tools continue to be irreplaceable when it comes to obtaining close tolerances and high surface finishes in intricate parts.

Analysis by Technology Type:

- Conventional

- CNC (Computerized Numerical Control)

Computerized numerical control (CNC) leads the market with around 71.1% of market share in 2024. It supports automated, high-precision, and reproducible machining operations, which are critical for high-volume and high-complexity manufacturing. CNC technology is extensively implemented across milling, turning, grinding, and other metal cutting machines to support automotive, aerospace, electronics, and medical device industries. Digital programs and machine control enhance production speed, minimize human errors, and make quality consistent. Several manufacturers are investing in CNC machines to achieve tighter tolerances and better efficiency of operations. The move towards intelligent factories and Industry 4.0 is increasing the adoption of CNC, given that these devices are compatible with digital monitoring, remote diagnostics, and predictive maintenance. The emerging economies also are shifting to CNC tools from manual tools for competitiveness, turning CNC technology into a core constituent in contemporary production environments.

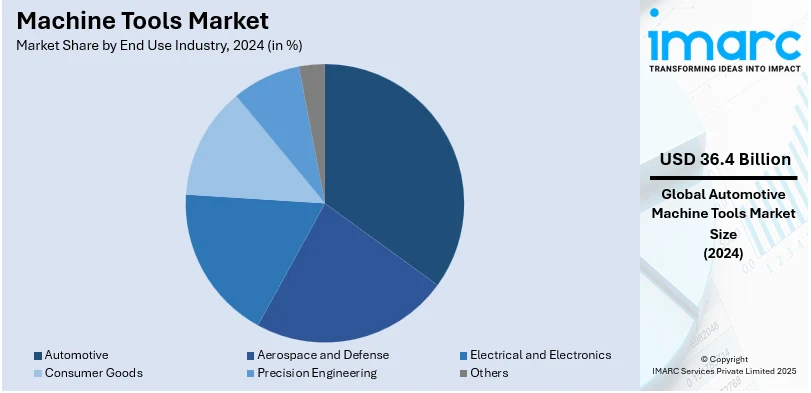

Analysis by End Use Industry:

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Consumer Goods

- Precision Engineering

- Others

Automotive leads the market with around 34.6% of market share in 2024. Machine tools play a central role in making important car parts such as engine blocks, transmission systems, drive shafts, and braking components. The growth of electric vehicles (EV) is revamping the demand scenario, driving investments in sophisticated machining systems for battery enclosures, electric powertrains, and lightweight materials such as aluminum and composites. Automotive equipment manufacturers and automotive suppliers depend significantly on CNC-based metal cutting tools to deliver high production volumes with consistent quality and dimensional precision. The drive for quicker model turnaround and individualization is further fueling the demand for flexible, automated machining solutions. Nations with robust automotive production continue to be leading consumers of machine tools, affirming the sector's status as a fundamental pillar of market development and technological advancement.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 48.6% fueled by industrialization, robust manufacturing performance, and favorable government policies. Countries like China, Japan, South Korea, and India are major manufacturing bases for automotive, electronics, aerospace, and heavy machinery industries that are all hugely dependent on high-quality machine tools. China is a production and consumption leader, aided by such programs as "Made in China 2025" that focus on high-end equipment production. Japan and South Korea specialize in precision engineering and CNC technology innovation. India is experiencing increased demand because of government initiatives such as "Make in India," encouraging investment in infrastructure and indigenous manufacturing. A strong supply base, minimal production expenses, and increased demand for automated and digitized machine tools. These factors render the Asia Pacific the most impactful area in driving the direction and tempo of machine tools market expansion.

Key Regional Takeaways:

United States Machine Tools Market Analysis

The United States holds a substantial share of the North America machine tools market with 87.50% in 2024. United States is witnessing an increase in machine tools adoption due to growing investment in the automotive sector. For instance, since the start of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the U.S. Expanding vehicle production is fueling demand for precision manufacturing, encouraging industries to invest in advanced machining solutions. The rise of electric vehicle manufacturing is further accelerating machine tools deployment, as companies seek efficient machining capabilities for lightweight materials and battery components. Automation in automotive sector manufacturing is enhancing the need for CNC machines and robotic integration to optimize production speed and accuracy. The push toward domestic vehicle production is leading to substantial investments in machining centers, fostering innovation in cutting, milling, and grinding processes. Increased research and development are supporting machine tools advancements, aligning with evolving automotive sector requirements. The rising requirement for fuel-efficient and high-performance vehicles is propelling machining technology upgrades, ensuring high-quality components. The rising presence of automotive suppliers is strengthening investments in machine tools infrastructure.

Asia Pacific Machine Tools Market Analysis

Asia-Pacific is experiencing rapid machine tools adoption due to growing electrical and electronics sector. According to industry reports, the domestic electronics production of India, a well-known manufacturing hub, increased from USD 29 billion in 2014–15 to USD 101 billion in 2022–2023. The surge in semiconductor manufacturing and PCB production is creating demand for precision machining, leading to increased deployment of high-speed milling and laser cutting machines. Expanding consumer electronics production necessitates ultra-precise machining for compact and intricate components, fueling investments in CNC and multi-axis machining technologies. The rise in home appliances manufacturing is further increasing machine tools adoption, as companies enhance efficiency to meet market demand. Miniaturization trends in electrical and electronics sector are compelling manufacturers to integrate high-precision grinding and micro-machining solutions. Rising demand for automation and smart manufacturing is fostering the deployment of robotics-integrated machine tools.

Europe Machine Tools Market Analysis

Europe is experiencing steady machine tools adoption due to growing technological advancements in CNC and digital manufacturing technologies, driven by increasing production across industries. According to reports, the EU's industrial production increased by 8.5% in 2021. In comparison to 2021 in comparison to 2020, it increased by 0.4% in 2022. The integration of AI and real-time data analytics in CNC systems is enhancing machining precision, enabling manufacturers to optimize production workflows. The rise of smart factories is accelerating the adoption of automated machine tools, reducing manual intervention and improving operational efficiency. Advancements in multi-axis machining and hybrid manufacturing are enhancing the ability to produce complex geometries with minimal material waste. Digital manufacturing technologies are improving process control, supporting high-speed machining and adaptive programming for customized production. Growing investments in sustainable machining solutions are driving the development of energy-efficient machine tools.

Latin America Machine Tools Market Analysis

Latin America is seeing increased machine tools adoption due to growing consumer goods sector, supported by rising disposable income. According to reports, Latin America’s total disposable income is expected to grow by nearly 60% from 2021 to 2040. Expanding production of household appliances and personal care products is creating a demand for high-speed and precision machining solutions. Manufacturers are deploying automated machining technologies to streamline mass production and reduce operational costs. The rise of furniture manufacturing is driving investments in CNC routers and multi-functional machining centres to enhance productivity. Increasing demand for packaged consumer goods is accelerating the integration of advanced machining solutions in production lines. The push for enhanced design customization in consumer goods sector is fostering technological advancements in flexible and high-precision machine tools.

Middle East and Africa Machine Tools Market Analysis

Middle East and Africa are experiencing rising machine tools adoption due to growing investment in the manufacturing sector. For instance, the goal of Saudi Arabia's Advanced Manufacturing Hub Strategy is to diversify the industrial sector by identifying over 800 investment opportunities worth USD 273 billion. Saudi Arabia wants to expand its factory count from the current 10,000 to 36,000 by 2035, with 4,000 of those plants being entirely automated. In addition to this, expanding industrialization and infrastructure development are fostering the need for advanced machining solutions. The growing demand for efficient metal cutting, drilling, and forming technologies is increasing across diverse manufacturing applications. Automation and CNC machining are enhancing production capabilities in machinery and equipment fabrication.

Competitive Landscape:

The market for metal tools is competitive, with many global and regional players competing based on product quality, price, technological advancement, and geographical reach. The players are shifting focus towards diversifying product portfolios to cater to automotive, aerospace, construction, and general manufacturing industries. Continuous advances in technology, such as automation and intelligent tools, are emerging as major differentiators. Manufacturers are putting more money into research and development (R&D) activities to create precision tools with enhanced durability and efficiency. Customization, rapid delivery, and after-sales service also play key roles in retaining customers. Additionally, players are broadening their presence in emerging markets through joint ventures and distribution agreements to leverage surging demand. Competitive intensity remains high due to low switching costs and the presence of several medium- and small-scale manufacturers offering cost-effective alternatives. Sustainability initiatives such as energy-efficient production technologies and recyclable materials are increasingly becoming popular within the market.

The report provides a comprehensive analysis of the competitive landscape in the machine tools market with detailed profiles of all major companies, including:

- Allied Machine & Engineering Corp.

- Amada Co., Ltd.

- DMG Mori Co., Ltd.

- Falcon Machine Tools Co., Ltd.

- General Technology Group Dalian Machine Tool Co., Ltd. (China General Technology (Group) Co., Ltd.)

- Hyundai WIA Corporation (Hyundai Motor Group)

- JTEKT Corporation

- Komatsu NTC Ltd.

- Makino Inc.

- Okuma Corporation

- Trumpf SE + Co. KG

- Yamazaki Mazak Corporation

Latest News and Developments:

- October 2024: ANCA CNC Machines launched AIMS Connect, a job management and production control software for tool manufacturing. The software optimized processes, enhanced quality, and reduced costs. Designed for smarter operations, it boosted productivity by 20% or more. AIMS Connect set a new benchmark for efficiency in the industry.

- September 2024: Brother Industries, Ltd. completed a new machine tool factory near Bengaluru, India, under its subsidiary BROTHER MACHINERY INDIA PRIVATE LTD. This marked its third machine tool facility after Japan and China, with operations set to begin in December 2024. The factory, located in the Japan Industrial Township, strengthened Brother’s industrial equipment business, targeting growth in machine tools for automobiles, motorcycles, and medical fields.

- September 2024: Okuma Corporation introduced the MA-4000H, a new CNC horizontal machining center with a large machining area and high spindle power for efficiency. Designed for heavy-duty and variable-volume production, it featured a compact footprint and advanced chip management. The MA-4000H was showcased at IMTS 2024 in Chicago from September 9–14. This addition enhanced Okuma’s lineup of high-performance metal machining solutions.

- July 2024: Meltio, Jupiter Machine Tool, and UnionMT collaborated to launch JMT Hybrid CNC Machines with integrated additive and subtractive capabilities. The machines featured Meltio’s patented directed energy deposition (DED) technology for wire-laser metal 3D printing. This partnership aimed to enhance manufacturing efficiency by combining CNC precision with advanced metal 3D printing.

- May 2024: Mitsubishi Electric India launched the M80LA CNC, an advanced controller for the turning segment, enhancing manufacturing efficiency. The unveiling took place at the CNC eXPerience Park in Bengaluru, highlighting its cutting-edge features. Key executives, including Managing Director Kazuhiko Tamura, led the event alongside industry experts. This innovation aligned with India's evolving industrial landscape, increasing productivity.

- March 2024: At MODEX 2024 in Atlanta, FANUC America demonstrated Power Motion i-MODEL A Plus (PMi-A Plus), a new PLC/CNC motion controller. FANUC's motion control capabilities for a range of automation applications were improved by the PMi-A Plus. A live demo featured the controller operating Alpha i-D Series Servos and an ASRS with a CRX-10iA robot. Visitors witnessed precise seven-axis motion control in action.

Machine Tools Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tool Types Covered | Metal Cutting, Metal Forming, Accessories |

| Technology Types Covered | Conventional, CNC (Computerized Numerical Control) |

| End Use Industries Covered | Automotive, Aerospace and Defense, Electrical and Electronics, Consumer Goods, Precision Engineering, Others |

| Regions Covered | Asia Pacific, Europe, North America, Middle East and Africa, Latin America |

| Companies Covered | Allied Machine & Engineering Corp., Amada Co., Ltd., DMG Mori Co., Ltd., Falcon Machine Tools Co., Ltd., General Technology Group Dalian Machine Tool Co., Ltd. (China General Technology (Group) Co., Ltd.), Hyundai WIA Corporation (Hyundai Motor Group), JTEKT Corporation, Komatsu NTC Ltd., Makino Inc., Okuma Corporation, Trumpf SE + Co. KG, Yamazaki Mazak Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the machine tools market from 2019-2033.

- The machine tools market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the machine tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The machine tools market was valued at USD 105.14 Billion in 2024.

The machine tools market is projected to exhibit a CAGR of 3.93% during 2025-2033, reaching a value of USD 149.24 Billion by 2033.

The market is driven by the rising demand for precision manufacturing in automotive and aerospace industries, rapid industrial automation, adoption of CNC technology, increased metal cutting and forming applications, and growing investments in smart factories. Additionally, supportive government policies promoting domestic manufacturing and the resurgence of production activities across developing economies are contributing to sustained market growth.

Asia Pacific currently dominates the machine tools market, accounting for a share of 48.6% in 2024. The dominance is fueled by large-scale manufacturing in China and India, rising industrial automation, supportive government policies, and rising foreign investments, and strong demand from automotive, electronics, and heavy machinery sectors.

Some of the major players in the machine tools market include Allied Machine & Engineering Corp., Amada Co., Ltd., DMG Mori Co., Ltd., Falcon Machine Tools Co., Ltd., General Technology Group Dalian Machine Tool Co., Ltd. (China General Technology (Group) Co., Ltd.), Hyundai WIA Corporation (Hyundai Motor Group), JTEKT Corporation, Komatsu NTC Ltd., Makino Inc., Okuma Corporation, Trumpf SE + Co. KG, and Yamazaki Mazak Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)