Malaysia Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2025-2033

Malaysia Air Freight Market Overview:

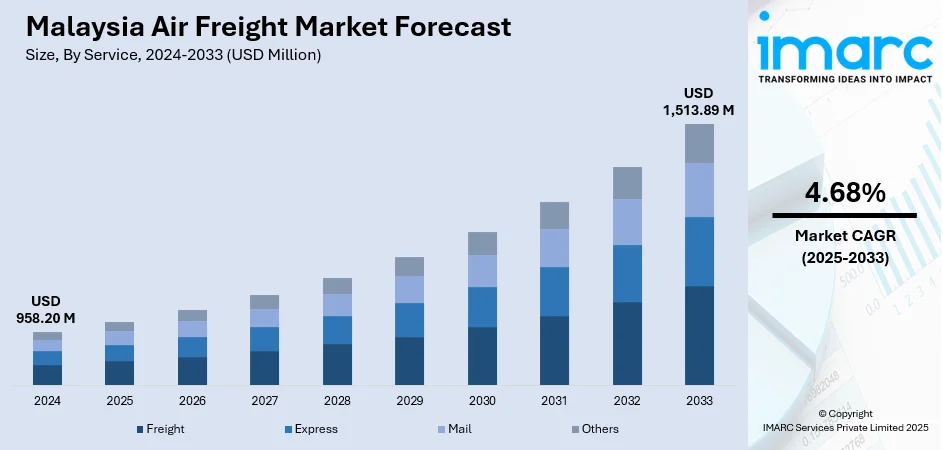

The Malaysia air freight market size reached USD 958.20 Million in 2024. The market is projected to reach USD 1,513.89 Million by 2033, exhibiting a growth rate (CAGR) of 4.68% during 2025-2033. The market is witnessing consistent expansion, supported by the country's growing role in regional and global trade. Diverse service offerings, including time-critical, temperature-sensitive, and bulk cargo solutions, cater to a wide range of industry requirements. The surge in e-commerce, along with rising demand from sectors like electronics, pharmaceuticals, and automotive, continues to fuel growth. Strategically located hubs, such as Kuala Lumpur International Airport, strengthen connectivity and operational efficiency, further contributing to the expanding Malaysia air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 958.20 Million |

| Market Forecast in 2033 | USD 1,513.89 Million |

| Market Growth Rate 2025-2033 | 4.68% |

Malaysia Air Freight Market Trends:

Digital Transformation Enhancing Air Freight Operations

Malaysia's air cargo business is full steam ahead with the adoption of digital technology, becoming a world-class logistics hub nation. Major airports such as Kuala Lumpur International and Penang are adopting automation, IoT-capable cargo tracking, and AI-driven capacity management to maximise operational efficiency. Therefore, the innovations are facilitating faster, more precise processing of cargo and better handling of high-value and time-sensitive commodities like pharmaceuticals, electronics, and perishables. The new Sandakan air cargo terminal, commissioned in April 2025, is an indication of the industry's drive to increase its capacity through world-class infrastructure facilitating increasing trade needs. Concurrently, pilot projects involving drone delivery and autonomous vehicles demonstrate Malaysia's forward-thinking role in enhancing the last-mile connectivity. The technology advancements not only facilitate logistics but also enhance Malaysia's competitiveness on the global scene. In further embracing innovation, these advances accelerate the growth of the Malaysian air freight market, rendering it long-term sustainable and ongoing industry evolution.

To get more information on this market, Request Sample

E-Commerce Surge Reshaping Air Freight Dynamics

Malaysia's air cargo industry is changing at a fast rate, driven primarily by the thriving e-commerce industry. With online shopping still on the uptrend, there has been a sharp surge in demand for fast and secure air cargo services, especially for sensitive items such as electronics, pharmaceuticals, and perishable goods. Major airports like Kuala Lumpur International and Penang are adapting by increasing express cargo terminals and enhancing cold-chain storage capacity to accommodate growing volumes. Malaysia streamlined customs clearance processes in 2024, expediting cross-border deliveries and facilitating quicker delivery for overseas e-commerce purchases. Some recent infrastructure upgrades consist of automatic sorting facilities, sophisticated cargo tracking, and refrigerated logistics, all meant to manage complex shipping needs with efficiency. The industry is also testing drone delivery schemes in outlying areas, geared towards reinforcing last-mile connections. All these combined efforts make Malaysia a premier e-commerce logistics hub in Southeast Asia. With these strategic advancements, Malaysia Air Freight market expansion is being powerfully boosted to keep the industry in shape and competitive in the global supply chain.

Strategic Infrastructure Expansion Reinforces Air Cargo Hub

Malaysia’s air freight sector continues to strengthen its position as a leading logistics hub through ongoing infrastructure upgrades and strategic initiatives Recent developments include the expansion of cargo handling capabilities at Kuala Lumpur International Airport (KLIA), highlighted by the Advanced Cargo Centre, which is designed to manage up to three million tonnes annually. The facility features automated storage systems, real-time tracking technologies, and efficient sorting operations to enhance cargo throughput. Simultaneously, Penang International Airport has achieved near 40% completion of its Phase One expansion, which includes upgraded aprons, taxiways, and modernized freight facilities. Meanwhile, Kota Kinabalu is embarking on a major modernization program, with a RM442 million investment approved in late 2024 to enhance its airside infrastructure and cargo capacity. These enhancements are seamlessly integrated with broader logistics improvements, including advancing aerotrain upgrades and the development of a Free Commercial Zone efforts aimed at improving hub-to-hub efficiency. By investing in these large-scale projects and multimodal connectivity, Malaysia is reinforcing its logistical backbone. These strategic initiatives are crucial to Malaysia air freight market trends, enabling robust capacity growth and affirming Malaysia’s leadership in regional air logistics.

Malaysia Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

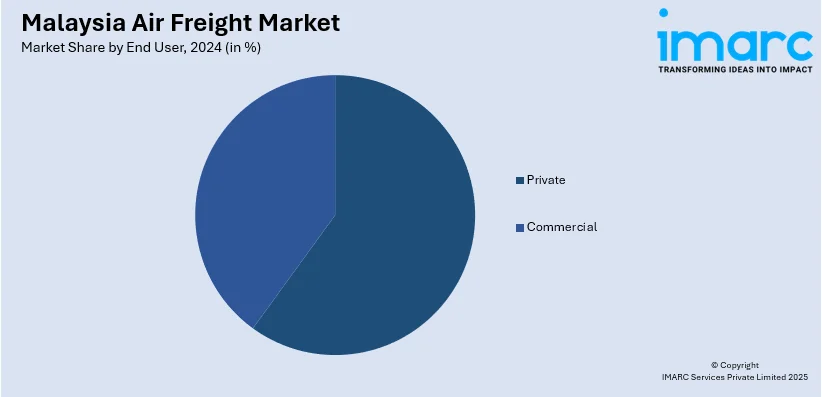

End User Insights:

- Private

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes private and commercial.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Air Freight Market News:

- June 2025: Ascend Airways Malaysia is set to strengthen the nation’s aviation sector with the planned launch of its ACMI and charter cargo services by November 2025. Backed by a conditional Air Service Permit and progressing through its Air Operator Certificate application, the airline aims to offer flexible, cost-effective capacity to regional carriers. Operating from Kuala Lumpur International Airport, it plans to deploy a Boeing fleet to serve growing markets across Southeast Asia, enhancing Malaysia's position as a key air freight and charter hub.

- March 2025: Ascend Airways Malaysia is gearing up to introduce its B2B ACMI charter model in the fourth quarter of 2025. Based at Kuala Lumpur International Airport Terminal 1, the airline will provide flexible aircraft, crew, maintenance and insurance services to regional carriers. Affiliated with Avia Solutions Group and Ascend Airways UK, it aims to offer adaptable capacity solutions across markets like Bangladesh, India and China strengthening its role as a reliable partner in Southeast Asian aviation.

Malaysia Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End Users Covered | Private, Commercial |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia air freight market on the basis of service?

- What is the breakup of the Malaysia air freight market on the basis of destinations?

- What is the breakup of the Malaysia air freight market on the basis of end user?

- What is the breakup of the Malaysia air freight market on the basis of region?

- What are the various stages in the value chain of the Malaysia air freight market?

- What are the key driving factors and challenges in the Malaysia air freight?

- What is the structure of the Malaysia air freight market and who are the key players?

- What is the degree of competition in the Malaysia air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia air freight market and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)