Malaysia Alternative Data Market Size, Share, Trends and Forecast by Data Type, Industry, End User, and States, 2026-2034

Malaysia Alternative Data Market Summary:

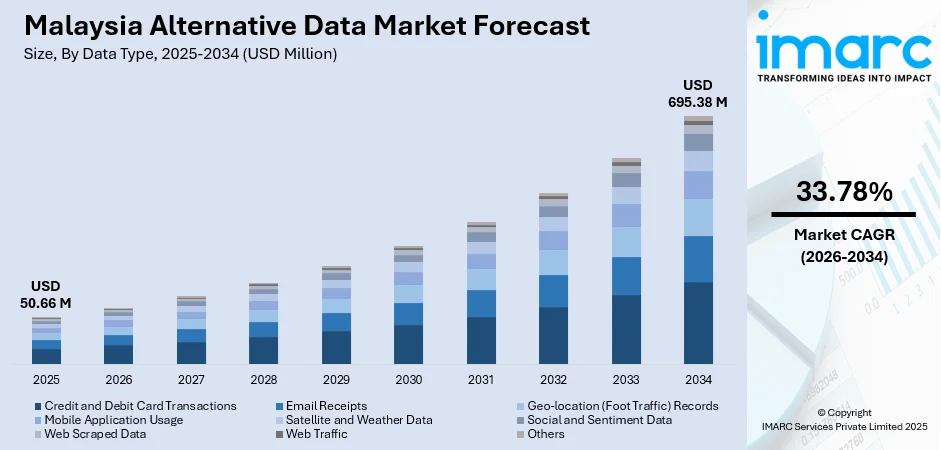

The Malaysia alternative data market size was valued at USD 50.66 Million in 2025 and is projected to reach USD 695.38 Million by 2034, growing at a compound annual growth rate of 33.78% from 2026-2034.

Malaysia's alternative data market is experiencing transformative growth driven by the nation's accelerating digital economy, expanding fintech ecosystem, and rising institutional demand for non-traditional investment signals. The convergence of government-led digital infrastructure expansion, rapid adoption of digital payments and e-commerce platforms, and growing sophistication of data analytics capabilities is fundamentally reshaping how financial institutions, hedge funds, and investment managers access actionable insights for decision-making, driving substantial expansion in Malaysia alternative data market share.

Key Takeaways and Insights:

- By Data Type: Credit and debit card transactions dominates the market with a share of 28% in 2025, driven by the proliferation of digital payment platforms and the critical role of transaction data in credit risk assessment and consumer behavior analytics.

- By Industry: BFSI leads the market with a share of 30% in 2025, owing to financial institutions' increasing reliance on alternative data for fraud detection, credit scoring enhancement, and regulatory compliance monitoring.

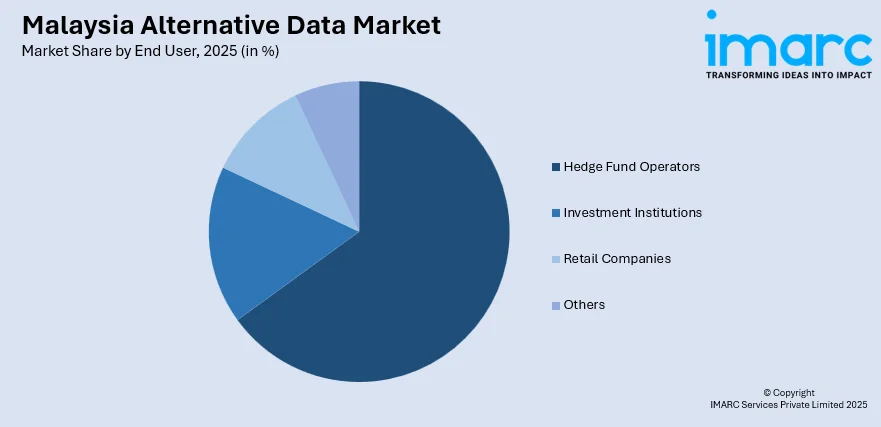

- By End User: Hedge fund operators represent the largest segment with a market share of 65% in 2025, reflecting the growing adoption of alternative data sources for alpha generation and investment strategy optimization.

- Key Players: The Malaysia alternative data market exhibits a dynamic competitive landscape characterized by the presence of global data analytics providers, regional fintech innovators, and specialized credit reporting agencies competing across data sourcing, processing, and analytics capabilities.

To get more information on this market, Request Sample

Malaysia's digital economy transformation is creating unprecedented opportunities for alternative data providers as the nation pursues its goal of becoming a regional technology and fintech hub. The country's robust digital infrastructure, supported by over 20 international submarine cables and extensive domestic fiber networks, enables low-latency data processing essential for real-time analytics applications. Financial institutions increasingly leverage non-traditional data streams including transaction logs, mobile application usage patterns, and geolocation signals to develop more accurate credit models and detect fraudulent activities. This trend is exemplified by the Kenanga Alternative Series: Islamic Global Responsible Strategies Fund, which was introduced in August 2024 in collaboration with Chicago Global Capital. It shows the increasing sophistication of alternative data applications in Malaysia's financial services industry by using big data, artificial intelligence, and machine learning to process complex signals like social sentiment and market anomalies for Shariah-compliant investment decisions.

Malaysia Alternative Data Market Trends:

AI-Powered Analytics and Machine Learning Integration

The integration of artificial intelligence and machine learning technologies into alternative data analytics is fundamentally transforming how financial institutions extract actionable insights from non-traditional data sources. Malaysian financial services providers are increasingly deploying AI-driven platforms that can process complex signals including social sentiment, consumer behavior patterns, and market anomalies in real-time.

Digital Payment Ecosystem Expansion Generating Rich Transaction Data

Malaysia's accelerating transition toward a cashless economy is generating vast volumes of transaction data that serve as valuable alternative data signals for financial analytics. The nation's real-time payment platform DuitNow has emerged as a primary driver of digital payment adoption, with QR code transactions more than doubling from 360 million in 2023 to 870 million in 2024, representing total transaction value of MYR 31.1 Billion. The Malaysian government's target of achieving 90% cashless transactions by 2025 continues to accelerate this digital payment transition, creating rich datasets that enable more nuanced credit risk assessment, fraud detection, and consumer behavior analytics.

Hyperscale Data Center Infrastructure Enabling Advanced Analytics

The rapid expansion of data center infrastructure across Malaysia is creating the foundational computing capacity necessary for storing, processing, and analyzing massive alternative datasets in real-time. Malaysia secured USD 23.3 Billion in investments from North American hyperscalers during the first ten months of 2024, with major technology companies including Microsoft committing USD 2.2 Billion and Google announcing USD 2 Billion for cloud computing and AI infrastructure development. This infrastructure expansion directly supports the rising demand for high-performance computing essential for processing alternative data signals including IoT streams, satellite imagery, and transactional behavior patterns at scale.

Market Outlook 2026-2034:

The Malaysia alternative data market demonstrates exceptional growth potential throughout the forecast period, underpinned by the nation's strategic digital transformation initiatives and expanding financial services ecosystem. The convergence of fintech innovation, regulatory modernization, and increasing institutional adoption of data-driven investment strategies is creating sustained demand for alternative data solutions. According to Bank Negara Malaysia's Annual Report 2024, e-payment transactions grew by 19% to 409 transactions per capita in 2024, with total retail e-payment value generating rich transaction datasets that fuel alternative data analytics applications. The market generated a revenue of USD 50.66 Million in 2025 and is projected to reach a revenue of USD 695.38 Million by 2034, growing at a compound annual growth rate of 33.78% from 2026-2034.

Malaysia Alternative Data Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Data Type |

Credit and Debit Card Transactions |

28% |

|

Industry |

BFSI |

30% |

|

End User |

Hedge Fund Operators |

65% |

Data Type Insights:

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

The credit and debit card transactions leads the market share of 28% of the total Malaysia alternative data market in 2025.

Credit and debit card transaction data has emerged as the most valuable alternative data category in Malaysia, driven by the nation's rapid digital payment transformation and the critical importance of transaction analytics for financial services applications. Financial institutions and fintech providers leverage this transaction data to develop more sophisticated credit scoring models that can assess creditworthiness for underbanked populations with limited traditional credit histories, enabling more inclusive lending decisions while reducing default risks through enhanced behavioral analytics.

Financial institutions and fintech providers leverage card transaction data to develop more sophisticated credit scoring models that can assess creditworthiness for underbanked populations with limited traditional credit histories, enabling more inclusive lending decisions while reducing default risks through enhanced behavioral analytics. The granular nature of transaction data allows analysts to identify spending patterns, income stability indicators, and financial discipline metrics that traditional credit assessment methods cannot capture, creating opportunities for more nuanced and accurate consumer financial profiling.

Industry Insights:

- Automotive

- BFSI

- Energy

- Industrial

- IT and Telecommunications

- Media and Entertainment

- Real Estate and Construction

- Retail

- Transportation and Logistics

- Others

The BFSI segment dominates with a market share of 30% of the total Malaysia alternative data market in 2025.

The banking, financial services, and insurance sector represents the primary adopter of alternative data solutions in Malaysia, utilizing non-traditional data sources for enhanced fraud detection, credit risk assessment, and regulatory compliance applications. Financial institutions increasingly deploy alternative data analytics to identify suspicious transaction patterns, assess borrower creditworthiness using behavioral signals, and segment customers with greater precision. The sector's demand for real-time insights and predictive capabilities drives continuous investment in alternative data acquisition and analytical infrastructure development.

The sector's adoption is further accelerated by the emergence of digital-only banking institutions, which leverage alternative data extensively to provide personalized financial services and extend credit to underserved market segments. These digital banks utilize non-traditional data sources such as payment histories, e-commerce activity, and mobile application usage to develop comprehensive customer profiles and alternative credit scoring frameworks. The competitive pressure to serve previously excluded consumer segments while maintaining prudent risk management practices continues to drive alternative data integration across financial services.

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Others

The hedge fund operators segment leads the market share of 65% of the total Malaysia alternative data market in 2025.

Hedge fund operators represent the dominant end-user category in Malaysia's alternative data market, driven by their continuous pursuit of alpha generation and competitive differentiation through unique data-driven insights. These institutional investors leverage diverse alternative data streams including credit card transaction patterns, satellite imagery, social sentiment analysis, and mobile application usage metrics to develop proprietary trading strategies and enhance investment decision-making. Quantitative hedge fund managers are increasingly turning to AI and machine learning to meet investors' needs for new and diversified sources of return.

The growing sophistication of Malaysia's asset management industry and increasing allocation to quantitative investment strategies continue to fuel demand for alternative data solutions that provide early indicators of consumer behavior, corporate performance, and macroeconomic trends. Hedge fund operators increasingly integrate machine learning and artificial intelligence capabilities to process vast alternative datasets and extract actionable trading signals. This technological evolution enables fund managers to identify market opportunities and risk factors before they become apparent through conventional financial reporting and market analysis channels.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

Selangor dominates Malaysia's alternative data market, leveraging its position as the nation's most industrialized state with extensive digital infrastructure, thriving fintech ecosystem, and concentration of technology companies driving data analytics adoption.

Kuala Lumpur serves as the primary hub for alternative data consumption, hosting major financial institutions, hedge fund operators, and corporate headquarters that require sophisticated data-driven insights for investment decision-making.

Johor emerges as a significant growth market for alternative data, benefiting from strategic proximity to Singapore, expanding data center infrastructure, industrial development corridors, and cross-border economic activities generating valuable transaction data streams.

Sarawak represents an emerging alternative data market, supported by state-led digital transformation initiatives, renewable energy advantages attracting data center investments, and growing e-commerce adoption across urban and rural communities.

Market Dynamics:

Growth Drivers:

Why is the Malaysia Alternative Data Market Growing?

Accelerating Digital Payment Adoption Creating Rich Transaction Data Ecosystems

Malaysia's strategic transition toward a cashless economy is generating unprecedented volumes of transaction data that serve as valuable alternative data signals for financial analytics and investment decision-making. The nation's digital payment infrastructure has experienced remarkable expansion, with the DuitNow real-time payment platform emerging as a primary driver of cashless transaction adoption across both consumer and business segments. The Malaysian government has established ambitious targets of achieving 90% cashless transactions by 2025, supported by regulatory initiatives promoting digital payment adoption and infrastructure investment. This transformation is creating rich datasets encompassing consumer spending patterns, merchant performance metrics, and economic activity indicators that enable more sophisticated credit risk assessment, fraud detection, and market analysis.

Fintech Innovation and Digital Banking Expansion Driving Alternative Data Demand

The rapid expansion of Malaysia's fintech ecosystem and the operational launch of digital banks is fundamentally reshaping demand for alternative data solutions across credit assessment, customer segmentation, and fraud prevention applications. All five licensed digital banks in Malaysia are now fully operational, including GXBank, Boost Bank, Ryt BANK, AEON Bank, and KAF Digital Bank, each deploying alternative data analytics to extend financial services to underserved market segments. These digital-first financial institutions leverage non-traditional data sources including mobile application usage patterns, utility payment histories, and social media signals to assess creditworthiness for individuals and small businesses lacking conventional credit histories, driving substantial demand for alternative data analytics capabilities.

Massive Data Center Infrastructure Investments Enabling Advanced Analytics Capabilities

The unprecedented scale of data center infrastructure investment flowing into Malaysia is creating the foundational computing capacity necessary for processing, storing, and analyzing massive alternative datasets in real-time. Malaysia attracted contributed approximately 45.0% or RM170.4 Billion worth of foreign investment in 2024, with significant allocations directed toward digital infrastructure development. The Malaysian Investment Development Authority announced that RM 141.72 Billion (approximately USD 31.9 Billion) in digital investments were approved in the first ten months of 2024, representing threefold growth compared to full-year 2023 approvals. This infrastructure expansion directly supports the rising demand for high-performance computing essential for alternative data applications including real-time fraud detection, algorithmic trading signal generation, and comprehensive market analytics.

Market Restraints:

What Challenges the Malaysia Alternative Data Market is Facing?

Evolving Data Privacy Regulations Creating Compliance Complexity

Malaysia's Personal Data Protection (Amendment) Act 2024, which came into force in tranches beginning January 2025, introduces more stringent requirements for data collection, processing, and cross-border transfer that create compliance challenges for alternative data providers. The amendments mandate data breach notification within 72 hours, require appointment of Data Protection Officers, and impose increased penalties of up to MYR 1,000,000 for non-compliance, necessitating substantial investment in compliance infrastructure and processes.

Cross-Border Data Transfer Restrictions Limiting Global Data Integration

The amended data protection framework places increased responsibility on data controllers to determine whether recipient jurisdictions offer adequate protection levels equivalent to Malaysian standards, creating operational complexity for alternative data providers operating across multiple markets. Organizations must conduct transfer impact assessments and potentially engage external legal expertise to evaluate cross-border data flows, increasing costs and potentially limiting the integration of global alternative data sources.

Data Quality and Standardization Challenges Across Diverse Sources

The inherent variability in alternative data quality, format consistency, and reliability across different sources presents significant challenges for financial institutions seeking to integrate non-traditional data into their analytical frameworks. Unlike standardized financial data, alternative data streams often lack uniform formatting, verification mechanisms, and historical track records, requiring substantial investment in data cleaning, normalization, and validation processes to ensure analytical reliability.

Competitive Landscape:

The Malaysia alternative data market exhibits a dynamic competitive landscape characterized by the presence of global data analytics providers, regional fintech innovators, and specialized credit reporting agencies competing across data sourcing, processing, and analytics capabilities. Market participants are increasingly differentiating through AI-powered analytics platforms, comprehensive data marketplace offerings, and industry-specific solution development. Strategic partnerships between technology companies and financial institutions are reshaping competitive dynamics, while the emergence of Islamic fintech solutions incorporating alternative data analytics creates additional market opportunities for specialized providers.

Recent Developments:

- August 2025: Bank Negara Malaysia announced that an Exposure Draft for Open Finance will be issued in the second half of 2025 to provide regulatory clarity on participation criteria, mandated datasets, and expectations for consent management and customer protection. The event, co-organised by Bank Negara Malaysia, Securities Commission Malaysia, Malaysia Digital Economy Corporation (MDEC), and the Fintech Association of Malaysia, featured technical development underway through Payments Network Malaysia (PayNet) with support from a pilot group comprising seven banks and the Employees Provident Fund (EPF). Implementation of Open Finance could begin as early as mid-2026, enabling consent-based data sharing that will unlock significant value for alternative data applications in credit assessment and financial services.

- November 2024: S PAY GLOBAL, Sarawak's state-owned e-wallet, formed a strategic partnership with Payments Network Malaysia to integrate DuitNow QR functionality, expanding digital payment data generation across East Malaysia.

Malaysia Alternative Data Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Credit and Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, Others |

| Industries Covered | Automotive, BFSI, Energy, Industrial, IT and Telecommunications, Media and Entertainment, Real Estate and Construction, Retail, Transportation and Logistics, Others |

| End Users Covered | Hedge Fund Operators, Investment Institutions, Retail Companies, Others |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Malaysia alternative data market size was valued at USD 50.66 Million in 2025.

The Malaysia alternative data market is expected to grow at a compound annual growth rate of 33.78% from 2026-2034 to reach USD 695.38 Million by 2034.

The credit and debit card transactions segment dominated the Malaysia alternative data market with a share of 28% in 2024, driven by the proliferation of digital payment platforms and the critical role of transaction data in credit risk assessment and consumer behavior analytics.

Key factors driving the Malaysia alternative data market include accelerating digital payment adoption generating rich transaction data, fintech innovation and digital banking expansion driving alternative data demand, and massive data center infrastructure investments enabling advanced analytics capabilities.

Major challenges include evolving data privacy regulations creating compliance complexity under the Personal Data Protection Amendment Act 2024, cross-border data transfer restrictions limiting global data integration, data quality and standardization challenges across diverse alternative data sources, and the need for substantial investment in AI and machine learning capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)