Malaysia Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2025-2033

Malaysia Animal Health Market Overview:

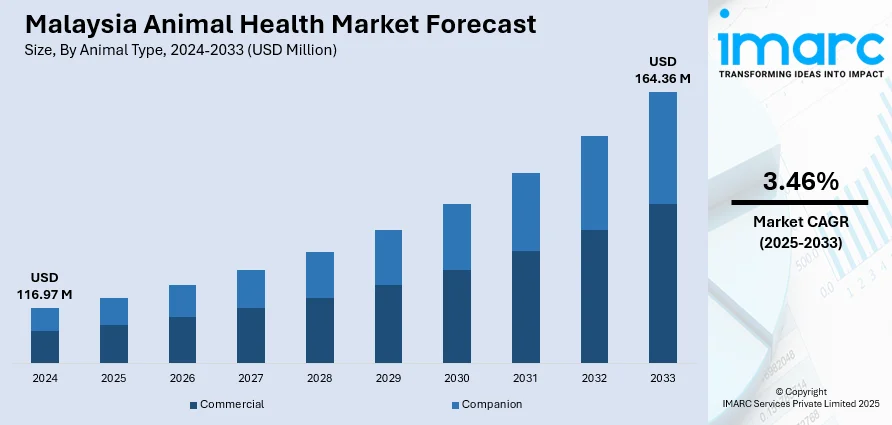

The Malaysia animal health market size reached USD 116.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 164.36 Million by 2033, exhibiting a growth rate (CAGR) of 3.46% during 2025-2033. At present, the increased incidence of zoonotic diseases, including avian flu, leptospirosis, and rabies, is encouraging government officials as well as private sector players to place greater emphasis on animal health in Malaysia. Moreover, Malaysia is witnessing a consistent increase in livestock production. Additionally, heightened pet adoption, particularly in cities, is expanding the Malaysia animal health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 116.97 Million |

| Market Forecast in 2033 | USD 164.36 Million |

| Market Growth Rate 2025-2033 | 3.46% |

Malaysia Animal Health Market Trends:

Enhanced Livestock Production and Commercial Agriculture

Malaysia is witnessing a consistent increase in livestock production, which is considerably driving the demand for animal health solutions. Farmers and commercial entities are diversifying poultry, swine, and cattle operations to address the growing domestic and export demands for meat, dairy, and eggs. Consequently, they are investing more in veterinary care, vaccines, nutritional supplements, and disease control solutions to sustain high levels of productivity. This change is also being instigated by increasing recognition of the economic costs associated with animal disease outbreaks, which are motivating farmers to focus on preventive care. Additionally, government subsidies and programs for developing livestock are also inducing more entrants into the market, adding further to the demand for sound animal health infrastructure. Firms competing in this market are taking advantage of these trends by launching sophisticated diagnostics, automated health monitoring systems, and tailored veterinary solutions designed for high-density, contemporary farms. In 2025, the Ministry of Agriculture and Food Security declared enhanced actions to modernize the agri-food sector via infrastructure improvements, intelligent farming, and incentives for private investment. At present, more than 90% of Malaysia’s demand for poultry and fish is satisfied domestically, making the poultry industry a fundamental part of the nation's protein provision.

To get more information of this market, Request Sample

Increasing Pet Adoption and Companion Animal Care

Malaysia animal health sector is driven by increasing pet adoption, particularly in cities. Increasing numbers of Malaysians are taking up dogs, cats, and exotic animals as pets with lifestyle changes and growing disposable incomes. As per the American Pet Products Association’s (APPA) 2025 Report, cat adoption reached 34% and dog adoption reached 20% in Malaysia. Pet parents are becoming more emotionally and financially attached to their pets' health, and so they are demanding quality veterinary care, regular check-ups, vaccinations, and professional treatments. Clinics and pet hospitals are reacting by upgrading services and stockpiling pharmaceuticals, diagnostics, and wellness products for companion animals. Additionally, awareness campaigns and social media influencers are promoting responsible pet care, encouraging preventive health practices and regular veterinary visits. Pet insurance and wellness plans are also becoming more popular, further increasing veterinary spending.

Increased Prevalence of Zoonotic Diseases and Compliance with Regulations

Increased incidence of zoonotic diseases, including avian flu, leptospirosis, and rabies, is encouraging government officials as well as private sector players to place greater emphasis on animal health in Malaysia. Regulating agencies are imposing stricter health and safety measures on livestock farms, pet businesses, and animal trade industries to prevent the spread of diseases from animals to humans. This is leading to increased surveillance, enhanced vaccination programs, and more stringent biosecurity controls, thereby supporting the Malaysia animal health market growth. Veterinary pharmaceutical corporations and diagnostic service providers are creating sophisticated tools and therapies to address these new needs, as well as comply with international standards established by agencies. In parallel, public health campaigns and veterinarian training programs are being increased to promote effective identification and control of possible outbreaks.

Malaysia Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

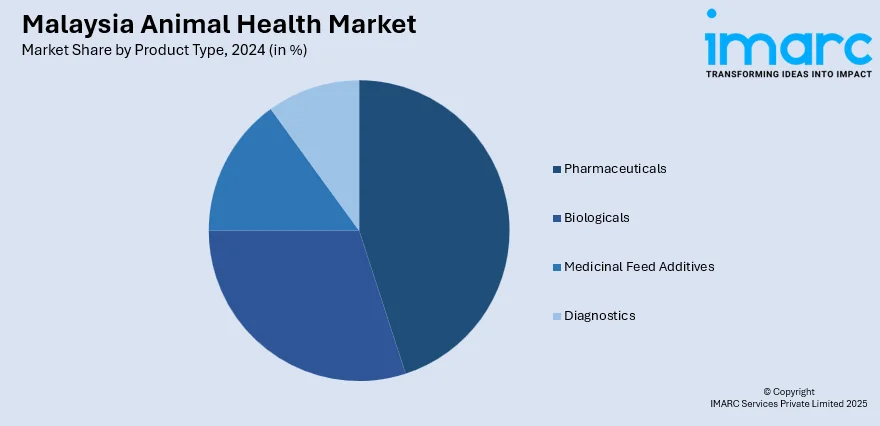

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia animal health market on the basis of animal type?

- What is the breakup of the Malaysia animal health market on the basis of product type?

- What is the breakup of the Malaysia animal health market on the basis of region?

- What are the various stages in the value chain of the Malaysia animal health market?

- What are the key driving factors and challenges in the Malaysia animal health market?

- What is the structure of the Malaysia animal health market and who are the key players?

- What is the degree of competition in the Malaysia animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)