Malaysia ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Malaysia ATM Market Overview:

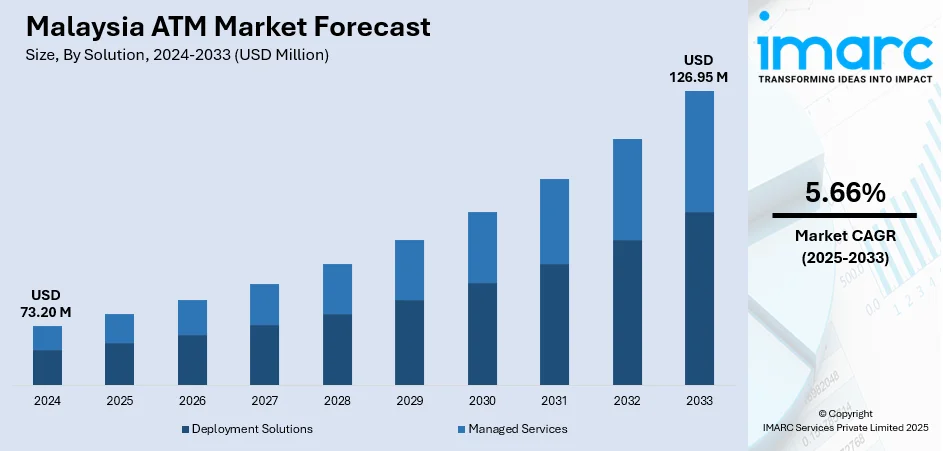

The Malaysia ATM market size reached USD 73.20 Million in 2024. Looking forward, the market is expected to reach USD 126.95 Million by 2033, exhibiting a growth rate (CAGR) of 5.66% during 2025-2033. The market continues to evolve with the growing adoption of digital banking and self-service technologies. Increasing demand for convenient, 24/7 cash access and banking services has also driven ATM deployments across urban and rural areas. Technological innovations, coupled with strong financial infrastructure, are further enhancing user experience and operational efficiency, contributing significantly to overall growth in the Malaysia ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 73.20 Million |

| Market Forecast in 2033 | USD 126.95 Million |

| Market Growth Rate 2025-2033 | 5.66% |

Malaysia ATM Market Trends:

Government Initiatives for Financial Inclusion

The Malaysian government, in partnership with financial institutions, has been actively promoting financial inclusion, especially in underserved and rural regions. With their support for the placement of ATMs and cash-recycling machines in outlying regions, authorities seek to provide basic financial access for every citizen. Initiatives like agent banking and digital financial infrastructure assist in taking ATM services outside of large cities. These initiatives tie in with Malaysia's overall digital economy agenda by narrowing the urban-rural financial access gap. Consequently, ATM installations have risen substantially, spurred by policies that enhance connectivity, infrastructure, and financial awareness. These inclusion-driven policies play a crucial role in strengthening ATM penetration and banking accessibility across the country.

To get more information on this market, Request Sample

Rising Demand for 24/7 Cash Access and Convenience

Consumers in Malaysia increasingly expect around-the-clock access to financial services, which is further driving the Malaysia ATM market growth. ATMs fulfill this demand by offering convenient, real-time access to cash withdrawals, deposits, bill payments, and fund transfers without the need for branch visits. As urban lifestyles grow more fast-paced and retail activity expands, especially in Tier 2 and 3 cities, the demand for ATM installations in accessible public locations such as malls, transit hubs, and convenience stores rises. The high demand for uninterrupted banking access is also boosting ATM deployment in rural areas, where physical bank branches are limited. This sustained consumer need for financial autonomy and convenience continues to be a key factor propelling the expansion of the ATM market across Malaysia. For instance, in July 2024, Seven Bank, the financial division of Japan’s 7-Eleven parent company, expanded its ATM footprint across Southeast Asia, with a primary focus on Malaysia. This move is driven by increasing demand for cash transactions in the region. In Malaysia, it had teamed up with a local firm managing around 2,500 7-Eleven stores, where installation of ATMs was scheduled to begin in November.

Strategic Partnerships and Private Sector Investment

Private banks, fintechs, and technology providers are forming strategic partnerships to expand ATM deployment and services. Collaborations between banks and global ATM manufacturers are bringing high-performance machines to Malaysia, capable of handling multi-function tasks like cheque deposit, bill payment, and currency exchange. Additionally, third-party ATM operators and white-label services are gaining traction, helping to increase reach without burdening bank infrastructure. These partnerships lower the cost of ATM deployment and maintenance while expanding service availability in high-traffic and underserved locations. The private sector’s ongoing investments in innovative solutions, along with efficient service models and network expansion strategies, significantly support the market’s long-term growth and accessibility across both urban and semi-urban regions.

Malaysia ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

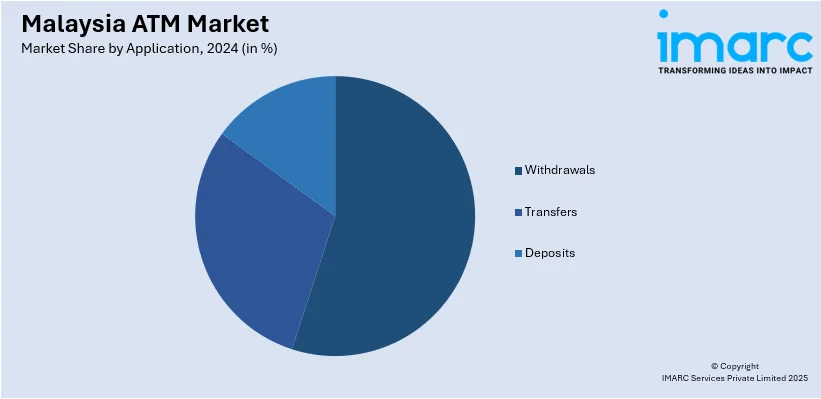

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia ATM Market News:

- In January 2025, Seven Bank, the financial arm of the 7-Eleven Group, extended its ATM operations into Malaysia, becoming its fourth international market following expansions in the United States, Indonesia, and the Philippines. The bank initiated this venture by setting up its first cash recycling ATM in Rawang, with plans underway to install an additional 100 machines across key regions, including Kuala Lumpur, Selangor, Penang, and Johor.

- In May 2024, Euronet, a prominent global provider of financial technology and payment solutions, officially finalized the acquisition of ATM terminals from the Malaysian Electronic Payment System (MEPS), operated by Payments Network Malaysia Sdn Bhd (PayNet), the country’s central financial infrastructure and national payment network. With this acquisition, Euronet strengthens its position as Malaysia’s largest non-bank operator of ATM terminals.

Malaysia ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia ATM market on the basis of solution?

- What is the breakup of the Malaysia ATM market on the basis of screen size?

- What is the breakup of the Malaysia ATM market on the basis of application?

- What is the breakup of the Malaysia ATM market on the basis of ATM type?

- What is the breakup of the Malaysia ATM market on the basis of region?

- What are the various stages in the value chain of the Malaysia ATM market?

- What are the key driving factors and challenges in the Malaysia ATM market?

- What is the structure of the Malaysia ATM market and who are the key players?

- What is the degree of competition in the Malaysia ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)