Malaysia Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2025-2033

Malaysia Board Games Market Overview:

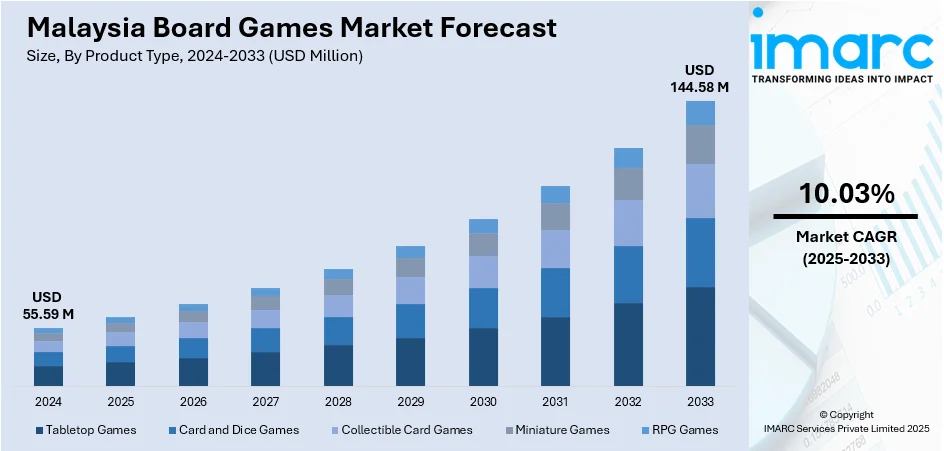

The Malaysia board games market size reached USD 55.59 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 144.58 Million by 2033, exhibiting a growth rate (CAGR) of 10.03% during 2025-2033. At present, families and friends are looking for interactive and screen-free forms of entertainment. Moreover, the increasing focus on enhancing product offerings and outreach programs by e-commerce platforms is contributing to the market growth. Apart from this, the heightened demand for learning and skill development games is expanding the Malaysia board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 55.59 Million |

| Market Forecast in 2033 | USD 144.58 Million |

| Market Growth Rate 2025-2033 | 10.03% |

Malaysia Board Games Market Trends:

Rising Trend of Social and Family Entertainment

The Malaysian board game industry is witnessing strong growth as families and friends are increasingly looking for interactive and screen-free forms of entertainment. Families are focusing on quality time together, and board games are proving to be a perfect platform for bonding and promoting interpersonal interaction. The trend is highly relevant in urban areas where a hectic lifestyle leaves little scope for meaningful in-person interactions. Distributors and retailers are taking advantage of this demand by increasing product offerings to incorporate traditional, contemporary, and specialty board games appealing to various age groups. Cafes and community centers in local areas are also hosting board game nights and tournaments, further facilitating a healthy gaming culture. With this demand increasing, manufacturers are getting creative with locally based content and dual-language editions to meet Malaysia's multicultural population. By providing a cost-effective and flexible means of recreation, board games are emerging as a preferred option for family entertainment. In May 2025, International TableTop Day was celebrated in Malaysia, where people gathered and participated in board games and a lot more. The event is coordinated by KakiTabletop, an excellent network that has been fostering and linking Malaysia’s tabletop gaming community for more than ten years, so a big thank you to the team for this.

To get more information on this market, Request Sample

Growth of E-commerce and Digital Marketing Channels

The increasing focus on enhancing product offerings and outreach programs by e-commerce platforms is contributing to the Malaysia board games market growth. E-commerce is facilitating greater accessibility, with consumers in both urban and rural regions being able to buy a wide variety of games with ease. Online shopping platforms are aggressively pushing board games through curated product listings, targeted marketing, and festive promotions that are attracting new segments. Influencers and creators are now showcasing more unboxing content, tutorials, and reviews of gameplay, which is informing and engaging people to test out new titles. Such digital exposure is also supporting physical retail, giving local publishers and global brands wider visibility. Logistics enhancements and rapid delivery services are making sure orders conveniently reach consumers, increasing satisfaction and re-purchase rates. As the penetration of the internet becomes more profound and mobile commerce increases, internet-based platforms are becoming instrumental in influencing consumer behavior and broadening the scope of the board games market in Malaysia. According to GlobalData, the Malaysian e-commerce market is projected to show a compound annual growth rate (CAGR) of 8.5% from 2024 to 2028, arriving at $15.7 Billion (MYR67.1 billion).

Increasing Demand for Learning and Skill Development Games

Malaysian parents and educators are increasingly appreciating the potential of board games as learning tools and for intellectual development, driving the demand for educational and capability-improving board games. Board games are introduced into school curricula, workshops, and enrichment programs to build critical thinking, problem-solving, and interpersonal skills in children and youth. This trend is establishing a niche segment specifically addressing parents looking for alternatives to digital learning tools. Publishers are constantly developing games aligned with education, language acquisition, and soft skill development, which is also broadening the appeal of the market. Retailers are actively merchandising these games through partnerships with schools, teacher recommendations, and interactive showcases at bookstores and education fairs. The focus on collaborative and experiential learning is keeping board games relevant in the digital era, promoting creativity and curiosity among young minds.

Malaysia Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

The report has provided a detailed breakup and analysis of the market based on the game type. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

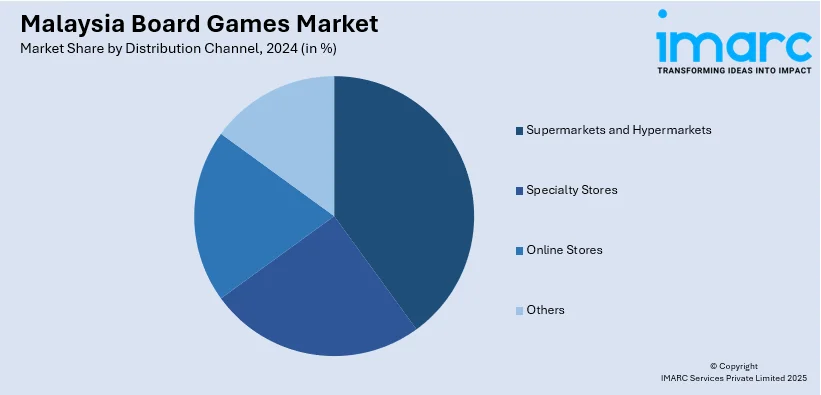

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia board games market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia board games market on the basis of product type?

- What is the breakup of the Malaysia board games market on the basis of game type?

- What is the breakup of the Malaysia board games market on the basis of age group?

- What is the breakup of the Malaysia board games market on the basis of distribution channel?

- What is the breakup of the Malaysia board games market on the basis of region?

- What are the various stages in the value chain of the Malaysia board games market?

- What are the key driving factors and challenges in the Malaysia board games market?

- What is the structure of the Malaysia board games market and who are the key players?

- What is the degree of competition in the Malaysia board games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)