Malaysia Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and States, 2026-2034

Malaysia Business Process Management Market Summary:

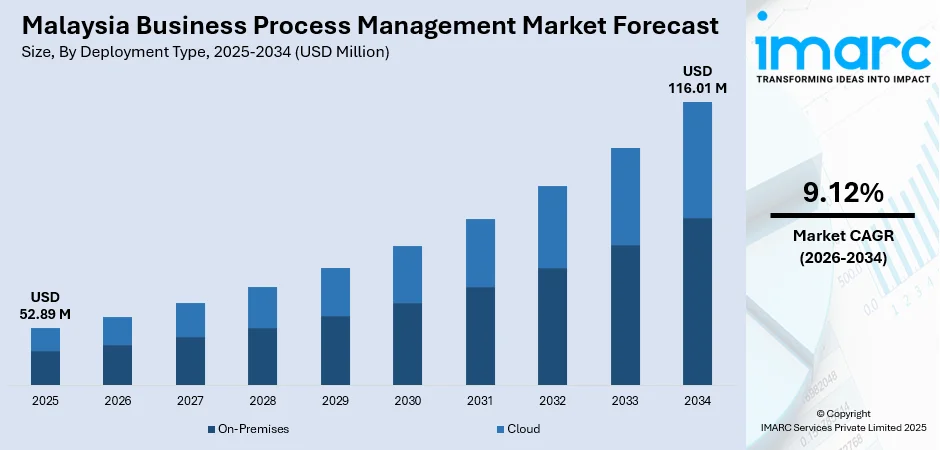

The Malaysia business process management market size was valued at USD 52.89 Million in 2025 and is projected to reach USD 116.01 Million by 2034, growing at a compound annual growth rate of 9.12% from 2026-2034.

Malaysia's business process management market is experiencing robust expansion driven by the nation's accelerated digital transformation agenda under the MyDIGITAL initiative and Malaysia Digital Economy Blueprint. The convergence of government-led digitalization mandates, substantial foreign technology investments, and growing enterprise demand for operational efficiency is fundamentally reshaping the competitive landscape. Rising adoption of cloud-based solutions, artificial intelligence integration, and automation technologies is creating unprecedented opportunities for BPM solution providers across the Malaysia business process management market share.

Key Takeaways and Insights:

- By Deployment Type: Cloud deployment dominates the market with a share of 70% in 2025, driven by government cloud-first policies, cost efficiency advantages, and rapid scalability requirements among Malaysian enterprises.

- By Component: IT solutions lead the market with a share of 60% in 2025, reflecting strong demand for automation, process improvement, and content management capabilities across industries.

- By Business Function: Operation and support represents the largest segment with a market share of 25% in 2025, owing to critical operational efficiency requirements and customer service enhancement priorities.

- By Organization Size: SMEs dominate the market with a share of 55% in 2025, supported by government digitalization grants, affordable cloud solutions, and competitive pressures driving automation adoption.

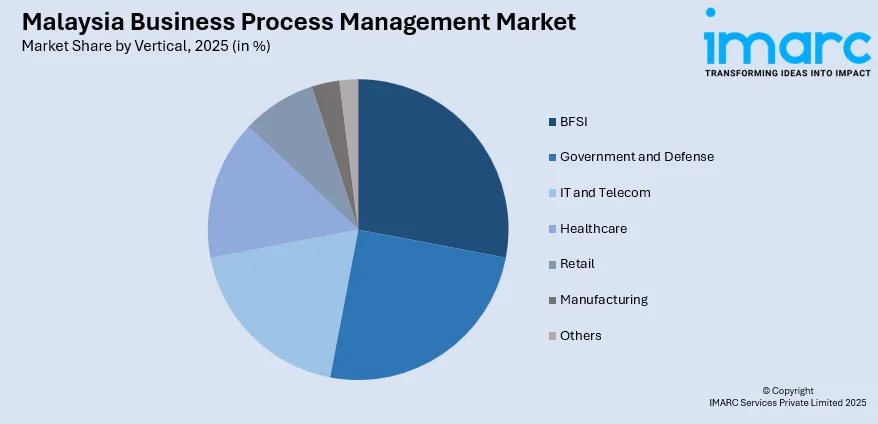

- By Vertical: BFSI leads the market with a share of 22% in 2025, driven by regulatory compliance requirements, digital banking transformation, and customer experience optimization needs.

- Key Players: The Malaysia business process management market exhibits moderate competitive intensity, with multinational technology corporations competing alongside regional system integrators and local service providers across deployment models and industry verticals.

To get more information on this market, Request Sample

The Malaysian market for business process management solutions represents one of the fastest-growing segments within the broader Southeast Asian enterprise software industry. Malaysia's strategic positioning as a regional digital hub has attracted unprecedented technology investments, with major hyperscalers establishing substantial infrastructure presence in the country. In May 2024, in order to promote Malaysia's digital transformation, Microsoft announced a historic investment of USD 2.2 Billion spread over four years. This is the biggest investment in the company's thirty-two-year history in the nation. This investment encompasses cloud and artificial intelligence infrastructure development, skills training for 200,000 Malaysians, and establishment of a national AI Centre of Excellence. The government's allocation of RM10 million for the National AI Office and RM50 million for AI education in Budget 2025 further underscores the strategic emphasis on digital capabilities enhancement across all enterprise segments.

Malaysia Business Process Management Market Trends:

Accelerated Cloud Migration and Hybrid Deployment Adoption

Malaysian enterprises are rapidly transitioning from legacy on-premises systems to cloud-based and hybrid BPM solutions, driven by flexibility requirements and cost optimization imperatives. The government's cloud-first policy and substantial investments in digital infrastructure are accelerating this transition across both public and private sectors. In May 2025, Microsoft announced the general availability of Malaysia West, its first cloud region in the country located in Greater Kuala Lumpur, providing organizations access to scalable, AI-ready hyperscale cloud infrastructure with in-country data residency capabilities. This development is enabling Malaysian enterprises to leverage advanced BPM capabilities while maintaining compliance with local data sovereignty requirements.

Integration of Artificial Intelligence and Intelligent Automation

The integration of artificial intelligence, machine learning, and robotic process automation within BPM platforms is transforming how Malaysian organizations approach workflow optimization and decision-making processes. The Government of Malaysia established the Malaysian National AI Office (NAIO) on August 28th with the goals of promoting innovation, ensuring the ethical development of AI, and accelerating its adoption. The government's AI Nation Framework, built on five key pillars, ensures that AI benefits every citizen while driving economic growth, innovation, and social equity in line with the Madani Economy agenda and the targets of the 13th Malaysia Plan. Organizations are increasingly deploying AI-powered BPM solutions to automate complex workflows, enhance predictive analytics capabilities, and deliver personalized customer experiences.

SME Digital Transformation and Process Automation Focus

Small and medium enterprises, which constitute approximately ninety-seven percent of Malaysian business establishments, are increasingly adopting BPM solutions to enhance competitiveness and operational resilience. The government has allocated RM15 Million for Digital Matching Grants for SMEs in Budget 2025, alongside RM 3.8 Billion in SME loans from Bank Negara Malaysia to support transition to digitalization and automation. The rise of no-code and low-code BPM platforms is particularly significant, enabling SMEs to build applications tailored to their workflows without extensive IT expertise. These accessible solutions are eliminating traditional development bottlenecks and allowing businesses to automate processes, centralize data, and improve decision-making at scale.

Market Outlook 2026-2034:

The Malaysia business process management market demonstrates robust growth potential throughout the forecast period, underpinned by strategic government initiatives, substantial foreign technology investments, and accelerating enterprise digital transformation mandates. The digital economy is projected to contribute 25.5 percent to Malaysia's GDP by 2025, creating up to 500,000 jobs across technology sectors. Malaysia's data center services market size reached USD 71.93 Million in 2025. The market is projected to reach USD 236.34 Million by 2034, growing at a CAGR of 14.13% during 2026-2034, indicating massive infrastructure development that will support BPM solution deployment. The market generated a revenue of USD 52.89 Million in 2025 and is projected to reach a revenue of USD 116.01 Million by 2034, growing at a compound annual growth rate of 9.12% from 2026-2034.

Malaysia Business Process Management Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Deployment Type | Cloud | 70% |

| Component | IT Solutions | 60% |

| Business Function | Operation and Support | 25% |

| Organization Size | SMEs | 55% |

| Vertical | BFSI | 22% |

Deployment Type Insights:

- On-Premises

- Cloud

The cloud deployment segment dominates with a market share of 70% of the total Malaysia business process management market in 2025.

Cloud-based business process management solutions have emerged as the preferred deployment model among Malaysian enterprises, reflecting the nation's comprehensive digital transformation trajectory and cloud-first government policy. The establishment of hyperscale cloud regions by major technology providers is accelerating adoption across industries, with organizations benefiting from enhanced scalability, reduced capital expenditure, and improved disaster recovery capabilities. The cloud deployment segment's dominance is further reinforced by Malaysia's robust digital infrastructure development. Cloud BPM solutions enable Malaysian enterprises to rapidly deploy process automation initiatives without substantial upfront infrastructure investments, making them particularly attractive to cost-conscious organizations seeking operational efficiency improvements.

The preference for cloud-based BPM solutions among Malaysian enterprises reflects broader organizational priorities centered on business agility and rapid time-to-value realization. Cloud deployment enables organizations to access continuously updated software capabilities without the burden of managing on-premises infrastructure or coordinating complex upgrade cycles. Malaysian businesses particularly value the inherent flexibility of cloud BPM platforms, which allow them to scale processing capacity during peak demand periods and seamlessly integrate with other enterprise applications through standardized APIs. The subscription-based pricing model aligns technology expenditure with actual usage patterns, converting capital-intensive technology investments into predictable operational expenses that simplify budgeting and financial planning for organizations across all size categories.

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

The IT Solutions segment leads with a share of 60% of the total Malaysia business process management market in 2025.

IT solutions encompassing process improvement, automation, content management, integration, and monitoring capabilities represent the dominant component segment in Malaysia's BPM market. Malaysian enterprises are increasingly prioritizing software solutions that deliver immediate operational efficiency gains and measurable return on investment. The automation sub-segment is experiencing particularly strong growth as organizations deploy robotic process automation technologies to streamline repetitive tasks across finance, human resources, and customer service functions. Major RPA providers including UiPath, Automation Anywhere, and Blue Prism have established significant presence in Kuala Lumpur, offering comprehensive automation solutions tailored to Malaysian industry requirements. The IT solutions segment benefits from the government's emphasis on technology adoption, with Budget 2025 introducing automation capital allowance of up to 200% on the first RM2 Million expenditure on the purchase of machinery and equipment for business activities, from the year of assessment (YA) 2020 until YA 2023.

Malaysian enterprises are increasingly recognizing that IT solutions within the BPM ecosystem deliver strategic value beyond basic process automation by enabling data-driven decision making and continuous operational improvement. The integration capabilities embedded within modern BPM solutions allow organizations to connect previously siloed systems, creating unified process flows that span multiple departments and eliminate manual data transfer activities. Content and document management functionalities address critical compliance requirements while reducing physical storage costs and accelerating information retrieval processes. Organizations are leveraging monitoring and optimization modules to establish real-time visibility into process performance, enabling proactive identification of bottlenecks and systematic refinement of workflows based on empirical performance data rather than assumptions.

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

The operation and support segment exhibits a clear dominance with a 25% share of the total Malaysia business process management market in 2025.

Operation and support functions have emerged as the primary focus area for BPM implementation among Malaysian enterprises, driven by customer experience enhancement imperatives and operational cost optimization requirements. Organizations are deploying BPM solutions to streamline customer service workflows, optimize ticket management processes, and enhance service level agreement compliance monitoring. The e-invoicing mandate implementation commencing July 2025 is accelerating BPM adoption across operational functions as businesses seek automated solutions for invoice processing, reconciliation, and compliance reporting. Malaysian enterprises are increasingly recognizing that operational excellence directly correlates with customer satisfaction and competitive differentiation, driving investment in sophisticated BPM platforms that deliver real-time visibility and process optimization capabilities.

The emphasis on operation and support functions within BPM implementations reflects Malaysian enterprises' recognition that customer-facing processes directly influence brand perception and long-term customer retention. Organizations are deploying sophisticated workflow automation to ensure consistent service delivery across multiple customer interaction channels, eliminating variability that can result from manual process execution. BPM solutions enable operation managers to establish standardized escalation procedures, automated response triggers, and performance monitoring dashboards that maintain service quality even during periods of high demand. The convergence of customer expectations for rapid response times with organizational requirements for cost efficiency creates compelling justification for BPM investments that simultaneously enhance service quality while reducing per-transaction processing costs.

Organization Size Insights:

- SMEs

- Large Enterprises

The SMEs segment holds the largest share with 55% of the total Malaysia business process management market in 2025.

Small and medium enterprises represent the dominant organization segment in Malaysia's BPM market, reflecting the government's comprehensive support for SME digitalization and the availability of affordable cloud-based solutions. SMEs constitute approximately 97 percent of total business establishments in Malaysia, generating 38.2 percent of the country's gross domestic product and employing 7.3 million people. The government has implemented extensive support mechanisms including RM50 million for Digital Matching Grants for SMEs and RM3.8 billion in SME loans from Bank Negara Malaysia specifically for digitalization and automation initiatives. The rise of no-code and low-code BPM platforms has proven particularly transformative for SMEs, enabling business users to create automated workflows without extensive technical expertise. As of April 2023, 299 SMEs had secured financial approval for matching grants totaling RM109.2 Million through the Industry4WRD Intervention Fund.

The emergence of user-friendly BPM platforms has fundamentally transformed how Malaysian SMEs approach process optimization, removing traditional barriers related to technical complexity and implementation costs. Small business owners are discovering that BPM solutions enable them to formalize institutional knowledge, ensuring consistent process execution even as employees transition between roles or organizations. Cloud-based BPM platforms provide SMEs access to enterprise-grade capabilities previously available only to large corporations, leveling the competitive playing field and enabling smaller organizations to compete effectively on operational efficiency. The collaborative features embedded within modern BPM solutions facilitate seamless coordination between geographically dispersed team members and external partners, supporting the increasingly networked business models that characterize successful Malaysian SMEs.

Vertical Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

The BFSI segment leads the market with a share of 22% share of the total Malaysia business process management market in 2025.

The banking, financial services, and insurance sector leads vertical adoption of BPM solutions in Malaysia, driven by stringent regulatory compliance requirements, digital banking transformation initiatives, and customer experience optimization priorities. Malaysian financial institutions are leveraging BPM platforms to automate customer onboarding processes, streamline loan processing workflows, and enhance fraud detection capabilities. The introduction of digital banking licenses has intensified competition and accelerated BPM adoption among traditional banks seeking operational efficiency improvements. In 2025, YTL Digital Bank received approval to commence operations as Malaysia's first AI-powered digital bank, exemplifying the sector's technology-forward trajectory. Financial institutions are increasingly deploying RPA solutions to automate back-office processes including regulatory change monitoring, compliance verification, and reconciliation activities.

Financial institutions in Malaysia are leveraging BPM solutions to navigate an increasingly complex regulatory environment while simultaneously meeting customer expectations for seamless digital experiences. The sector's adoption of BPM platforms reflects strategic recognition that sustainable competitive advantage requires both operational excellence and superior customer engagement capabilities. Malaysian banks and insurers are deploying intelligent workflow automation to accelerate decision-making processes, reduce manual intervention in routine transactions, and ensure consistent application of credit policies and underwriting guidelines. The integration of BPM capabilities with emerging technologies enables financial institutions to create adaptive processes that respond dynamically to changing market conditions and evolving customer preferences, positioning them for continued relevance in an increasingly digital financial services landscape.

State Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

Selangor dominates the BPM market driven by its concentration of multinational corporations, technology parks, and emerging data center developments. The state's advanced digital infrastructure and skilled workforce availability attract significant enterprise technology investments.

Kuala Lumpur serves as the nation's primary business hub, hosting corporate headquarters and government agencies requiring sophisticated process automation solutions. Financial services and professional services sectors drive substantial BPM adoption across the capital.

Johor is emerging as a critical growth hub for digital services, benefiting from proximity to Singapore and substantial investments in data center infrastructure. Manufacturing and logistics sectors increasingly deploy BPM solutions for operational optimization.

Sarawak represents an expanding market for BPM solutions, supported by state-level digital transformation initiatives and growing adoption among government agencies. The energy sector and public services drive process automation requirements across the region.

Market Dynamics:

Growth Drivers:

Why is the Malaysia Business Process Management Market Growing?

Government-Led Digital Transformation Initiatives Accelerating Enterprise Technology Adoption

The Malaysian government's comprehensive digital transformation agenda under the MyDIGITAL initiative and Malaysia Digital Economy Blueprint is creating substantial momentum for BPM solution adoption across public and private sectors. The digital economy is projected to contribute 25.5% to Malaysia's GDP by 2025, with initiatives designed to position the nation as a regional leader in digital innovation. Budget 2026 reinforced Malaysia's commitment to building an AI Nation by 2030, with allocations supporting digital government expansion, sovereign AI cloud establishment, and talent development programs. The establishment of GovTech Malaysia Unit and expansion of MyDigital ID are streamlining public services and driving standardized digital workflows across government agencies.

Substantial Foreign Technology Investments Strengthening Digital Infrastructure Foundation

Malaysia has emerged as a preferred destination for hyperscale cloud and data center investments, with major technology companies committing unprecedented capital to establish regional infrastructure presence. Oracle followed in October 2024 with a USD 6.5 Billion commitment to open a public cloud region enabling Malaysian organizations to leverage AI infrastructure and migrate mission-critical workloads to Oracle Cloud Infrastructure. Amazon Web Services and Google have similarly established significant presence, with Google committing USD 2 Billion for data center development in Elmina Business Park, Selangor. These investments are fundamentally transforming Malaysia's digital capabilities and creating robust infrastructure foundations that enable sophisticated BPM solution deployment across enterprises of all sizes.

Rising SME Digitalization Demand and Accessible Cloud-Based Solutions

Small and medium enterprises of Malaysian business establishments are increasingly adopting BPM solutions to enhance competitiveness and operational resilience in an increasingly digital marketplace. The proliferation of affordable cloud-based and software-as-a-service BPM solutions has dramatically lowered entry barriers, enabling SMEs to access enterprise-grade process automation capabilities without substantial capital expenditure. No-code and low-code platforms are proving particularly transformative, allowing business users to create customized workflows without technical expertise. Malaysian Investment Development Authority (MIDA) has approved Smart Automation Grants (SAG) of RM138.5 million to 238 enterprises up to June 30, 2022, following the SAG’s introduction in December 2020.

Market Restraints:

What Challenges the Malaysia Business Process Management Market is Facing?

Digital Skills Gap Constraining Implementation and Optimization Capabilities

The shortage of skilled professionals capable of designing, implementing, and managing sophisticated BPM solutions represents a significant constraint on market expansion. Approximately 40 percent of Malaysian SMEs identify digital skills gaps as a primary obstacle to technology adoption, limiting their ability to fully leverage advanced automation and process optimization capabilities. While government initiatives are addressing this challenge through upskilling programs and AI education investments, the current talent deficit continues to impede optimal BPM solution deployment and utilization across enterprises.

High Initial Implementation Costs and Integration Complexity

The upfront costs associated with comprehensive BPM implementation including licensing, customization, integration, and training can present significant barriers for budget-constrained organizations. Integration complexity with existing legacy systems and enterprise applications further compounds implementation challenges, requiring specialized expertise and extended project timelines. These cost and complexity factors are particularly pronounced for smaller organizations lacking dedicated IT resources and extensive technology budgets.

Data Security and Privacy Compliance Concerns

Ensuring data protection and compliance with evolving privacy regulations represents a significant challenge for organizations deploying cloud-based BPM solutions. The Malaysian government's plans to amend the Personal Data Protection Act and introduce new cybersecurity legislation are creating additional compliance requirements that organizations must address. Industries handling sensitive information particularly in financial services and healthcare sectors face heightened scrutiny regarding data handling practices, requiring robust security frameworks and compliance validation mechanisms.

Competitive Landscape:

The Malaysia business process management market exhibits moderate competitive intensity characterized by the presence of multinational technology corporations alongside regional system integrators and local service providers. Market dynamics reflect strategic positioning across cloud and on-premises deployment models, with major vendors competing on comprehensive solution portfolios, industry-specific expertise, and integration capabilities. The competitive landscape is increasingly shaped by artificial intelligence capabilities, low-code development platforms, and partnerships with hyperscale cloud providers. Multinational vendors leverage global technology resources and extensive partner ecosystems, while local and regional players differentiate through deep understanding of Malaysian business requirements and regulatory environment. Strategic collaborations between technology vendors and consulting firms are expanding market reach and enhancing implementation capabilities across enterprise segments.

Recent Developments:

- In May 2025, Greater Kuala Lumpur is home to Microsoft's first cloud region, Malaysia West, which is now generally available. It offers AI-ready hyperscale cloud infrastructure with three availability zones and in-country data residency possibilities. With the cloud region's access to Microsoft Azure, Microsoft 365, and business apps, Malaysian companies can expedite their digital and artificial intelligence transformation projects.

- The new AWS Region in Malaysia will play a vital role in supporting the Malaysian government’s strategic Madani Economy Framework. By 2030, this program seeks to raise everyone's level of life in Malaysia while fostering innovation both domestically and throughout ASEAN. Through 2038, the development and operation of the new AWS Region is expected to boost Malaysia's GDP by over $12.1 Billion (MYR 57.3 Billion) and sustain an average of over 3,500 full-time equivalent jobs at outside companies.

Malaysia Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-Premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Malaysia business process management market size was valued at USD 52.89 Million in 2025.

The Malaysia business process management market is expected to grow at a compound annual growth rate of 9.12% from 2026-2034 to reach USD 116.01 Million by 2034.

The cloud segment dominated the Malaysia business process management market with a share of 70% in 2024, driven by government cloud-first policies, substantial hyperscale investments, cost efficiency advantages, and rapid scalability requirements among Malaysian enterprises.

Key factors driving the Malaysia business process management market include government-led digital transformation initiatives under MyDIGITAL, substantial foreign technology investments exceeding USD 15 billion from hyperscalers, rising SME digitalization demand supported by government grants, and increasing adoption of AI and intelligent automation technologies.

Major challenges include digital skills gaps affecting approximately 40% of SMEs, high initial implementation costs and integration complexity with legacy systems, data security and privacy compliance concerns amid evolving regulations, and organizational resistance to change during digital transformation initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)