Malaysia Cement Market Size, Share, Trends and Forecast by Type, End-Use, and States, 2025-2033

Malaysia Cement Market Overview:

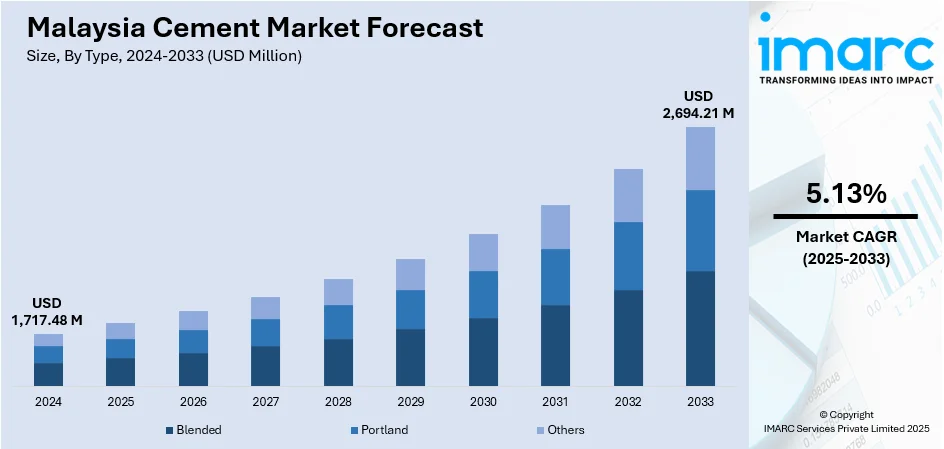

The Malaysia cement market size reached USD 1,717.48 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,694.21 Million by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The cement market is supported by government infrastructure plans and climate-resilient development. National projects ensure consistent demand through long-term civil works, while climate adaptation initiatives drive growth in high-strength cement use. These efforts stabilize usage across economic cycles and expand the Malaysia cement market share beyond traditional construction segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,717.48 Million |

| Market Forecast in 2033 | USD 2,694.21 Million |

| Market Growth Rate 2025-2033 | 5.13% |

Malaysia Cement Market Trends:

Infrastructure Spending and Development Targets

Malaysia construction sector is experiencing sustained cement demand, largely driven by government-funded infrastructure and ongoing private real estate activity. Long-term national plans such as the 12th Malaysia Plan continue to prioritize transportation links, housing, and essential utilities, ensuring that cement remains central to implementation. In 2024, Deputy Economy Minister Hanifah Hajar Taib emphasized that infrastructure development was a national priority to stimulate GDP growth and elevate Malaysia’s competitiveness. Under this, major investments had been directed toward highways, seaports, and rural access networks, with specific focus on underserved regions like Sabah and Sarawak. Efforts were also being made to enhance clean water supply, electricity distribution, and digital connectivity in those areas, all of which involve significant construction and cement-based civil works. Cement demand is particularly strong in large-scale, multi-year infrastructure builds, including roadbeds, bridge supports, drainage systems, and foundations for energy projects. As these developments unfold, contractors place high-volume orders on a rolling basis, creating reliable and prolonged demand. Federal and state budget allocations provide further momentum, with project rollouts occurring across both public and mixed-investment models. Even during periods when commercial construction slows due to market conditions, these state-backed efforts help stabilize the cement market.

To get more information on this market, Request Sample

Climate-Resilient Infrastructure and Flood Mitigation Works

Malaysia’s increased exposure to flooding and extreme weather is leading to a shift in infrastructure priorities, with a strong emphasis on climate resilience. Cement plays a central role in the construction of flood defense systems, stormwater management channels, and structurally reinforced roadways. These projects demand durable, high-strength cement formulations for use in culverts, retaining walls, and embankments capable of withstanding repeated water stress. In 2025, the government advanced this agenda by launching the National Adaptation Plan (MyNAP), backed by a €2.8 million Green Climate Fund grant. Spearheaded by the Ministry of Natural Resources and Environmental Sustainability, MyNAP involves over 100 stakeholders from across sectors to coordinate and implement adaptation strategies. The plan outlines goals for resilient infrastructure development, including slope stabilization, drainage expansion, and protection of vulnerable settlements. These efforts are designed not only to mitigate environmental risk but also to safeguard economic activity in flood-prone areas. Such construction activity sits outside conventional commercial or residential development, yet contributes meaningfully to national cement demand. Projects under MyNAP also encourage the use of diversified financing models, increasing the pace and scale of work. As these climate-oriented builds progress, cement usage rises steadily in response to design standards that call for robust, long-lasting materials. This environmental infrastructure push is contributing to the Malaysia cement market growth, driven by public planning and international funding partnerships.

Malaysia Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and state levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

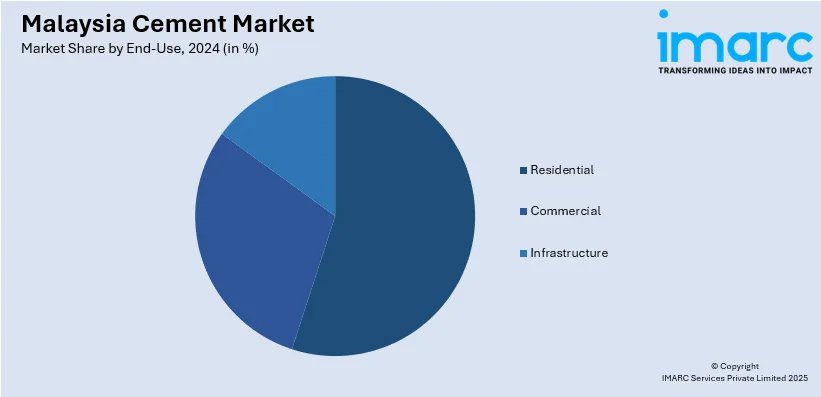

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential, commercial, and infrastructure.

States Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Cement Market News:

- In February 2025, Cement Industries of Malaysia Bhd (CIMA) launched NS OptimoCrete, Malaysia’s first 52.5-strength Portland Limestone Cement (PLC). The product offers superior strength, enhanced sustainability, and up to 10% lower carbon emissions. It supports Malaysia’s 2050 carbon neutrality goal.

- In June 2024, Sabah’s first integrated clinker and cement plant by Makin Teguh Sdn Bhd in Lahad Datu received two key certifications from Construction Research Institute of Malaysia (CREAM) and Construction Industry Development Board (CIDB). This milestone marked a major step toward self-sufficiency in cement production, reducing reliance on imports. The plant aimed to meet Sabah’s annual demand of 1.2–1.4 million metric tons and support local economic growth.

Malaysia Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia cement market on the basis of type?

- What is the breakup of the Malaysia cement market on the basis of end-use?

- What is the breakup of the Malaysia cement market on the basis of states?

- What are the various stages in the value chain of the Malaysia cement market?

- What are the key driving factors and challenges in the Malaysia cement market?

- What is the structure of the Malaysia cement market and who are the key players?

- What is the degree of competition in the Malaysia cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)