Malaysia E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and State, 2025-2033

Malaysia E-Invoicing Market Overview:

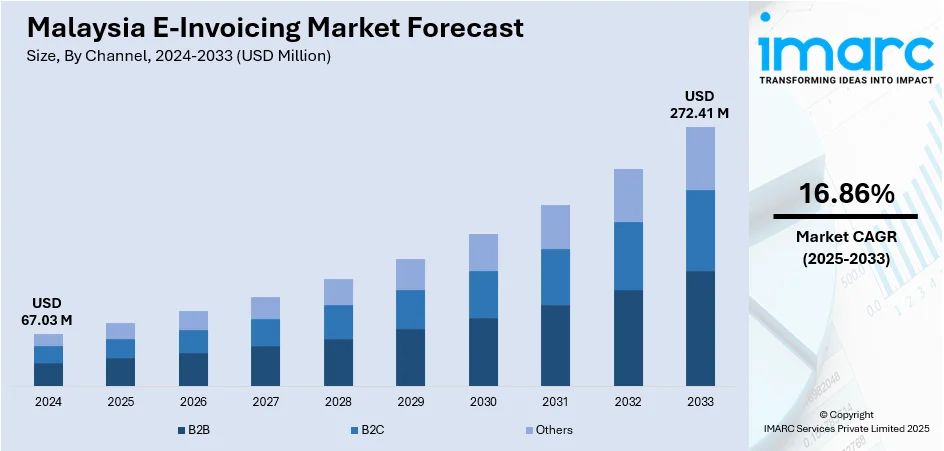

The Malaysia e-invoicing market size reached USD 67.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 272.41 Million by 2033, exhibiting a growth rate (CAGR) of 16.86% during 2025-2033. Mandatory implementation by the Inland Revenue Board, increasing digital adoption by SMEs, cost-saving potential through automation, demand for real-time tax reporting, and alignment with global trade practices that encourage paperless, standardized electronic transactions across business sectors are some of the factors contributing to Malaysia e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 67.03 Million |

| Market Forecast in 2033 | USD 272.41 Million |

| Market Growth Rate 2025-2033 | 16.86% |

Malaysia E-Invoicing Market Trends:

Real-Time Validation Gaining Ground in E-Invoicing Push

Malaysia is moving toward real-time digital validation for business invoices. Through a government-led system that checks each transaction before it’s finalized, businesses are being pushed to digitize their billing and reporting. The approach cuts manual paperwork and reduces errors, helping companies lower admin costs and stay on top of tax compliance. With oversight from tax authorities, the model ensures tighter control and transparency in financial reporting. This shift signals a growing focus on automation and regulatory alignment, especially for firms handling large volumes of invoices. As the system becomes mandatory in phases, many are now accelerating tech upgrades and adjusting internal workflows to meet the new validation rules without slowing down operations. These factors are intensifying the Malaysia e-invoicing market growth. For example, in June 2024, Malaysia's MyInvois e-invoicing system marked a major step in the country’s digitalization drive. Led by the Inland Revenue Board (IRBM), the system uses a Continuous Transaction Control (CTC) model to validate e-invoices in real time. It aims to improve tax compliance, reduce administrative costs, and streamline financial processes for businesses across Malaysia under the Ministry of Finance’s oversight.

To get more information on this market, Request Sample

Integrated E-Invoicing Terminals

Malaysia is testing payment terminals that generate and send tax-compliant invoices automatically with each transaction. Designed for businesses of all sizes, including SMEs, these devices eliminate separate invoicing steps by embedding the process directly into payment flows. The system helps users stay aligned with national tax regulations while easing the reporting burden. It’s currently in pilot with selected merchants. This development reflects a move toward practical, compliance-focused tools that simplify operations for merchants and improve reporting accuracy without additional back-end integration. Adoption is expected to rise as businesses look for ways to manage digital tax requirements without extra administrative load. For instance, in December 2024, CIMB Bank and PayNet launched Malaysia’s first payment terminal with built-in e-invoicing, supporting LHDN’s compliance requirements. Aimed at businesses, including SMEs, the terminal automates invoice creation and delivery, cutting down manual work. Currently in pilot with selected merchants, a full deployment is expected by Q2 2025, aligning with the country’s push for efficient, tax-compliant digital transactions.

Malaysia E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and state levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

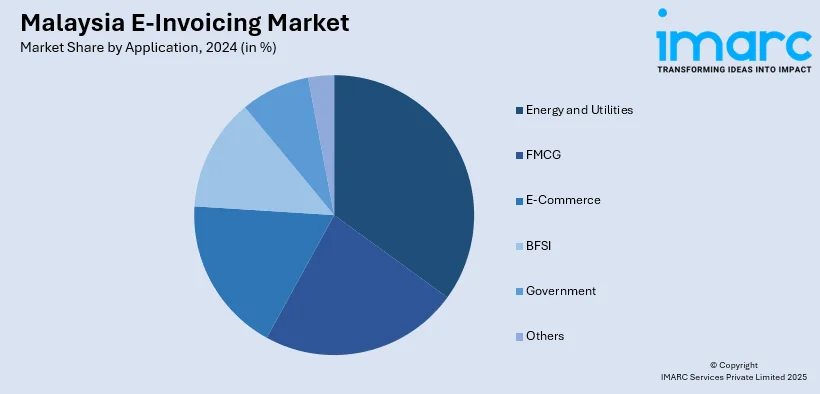

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

State Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major state markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia E-Invoicing Market News:

- In February 2025, Hotelogix integrated e-invoicing into its hotel property management system (PMS) for hotels in Malaysia, enabling automated invoice generation and real-time verification via the tax authority's portal. This move supports compliance with Malaysia’s mandatory e-invoicing rules, enforced from August 2024 by the Inland Revenue Board (LHDNM), aiming to improve tax administration and curb evasion across the hospitality sector and other industries.

Malaysia E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia e-invoicing market on the basis of channel?

- What is the breakup of the Malaysia e-invoicing market on the basis of deployment type?

- What is the breakup of the Malaysia e-invoicing market on the basis of application?

- What is the breakup of the Malaysia e-invoicing market on the basis of state?

- What are the various stages in the value chain of the Malaysia e-invoicing market?

- What are the key driving factors and challenges in the Malaysia e-invoicing market?

- What is the structure of the Malaysia e-invoicing market and who are the key players?

- What is the degree of competition in the Malaysia e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)