Malaysia Ecotourism Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Sales Channel, and Region, 2025-2033

Malaysia Ecotourism Market Overview:

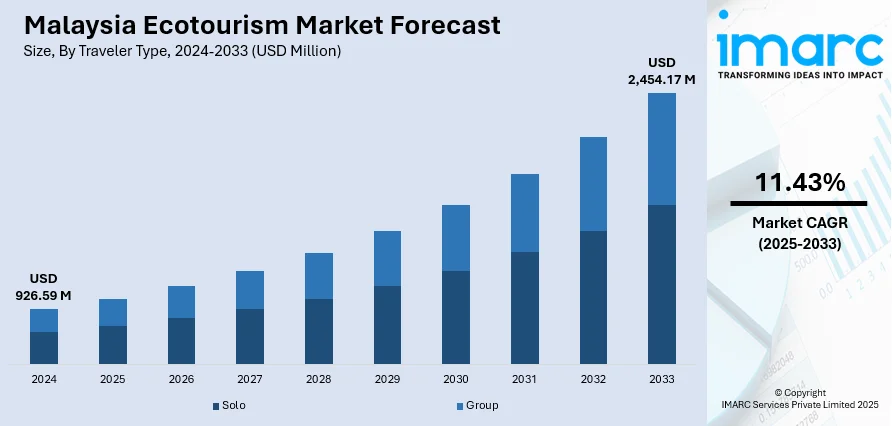

The Malaysia ecotourism market size reached USD 926.59 Million in 2024. The market is projected to reach USD 2,454.17 Million by 2033, exhibiting a growth rate (CAGR) of 11.43% during 2025-2033. The market is propelled by the nation's rich natural resources, such as tropical rainforests, national parks, and marine life, which draw eco-conscious tourists. Furthermore, the adoption of government policies like the National Ecotourism Plan and certifications for sustainable tourism also drives infrastructure growth and sustainable travel practices. Additionally, increasing global demand for true cultural experiences and rural tourism has spurred community-based ecotourism businesses, which are also augmenting the Malaysia ecotourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 926.59 Million |

| Market Forecast in 2033 | USD 2,454.17 Million |

| Market Growth Rate 2025-2033 | 11.43% |

Malaysia Ecotourism Market Trends:

Expansion of Protected and Biodiverse Tourism Zones

The expansion and formal recognition of protected areas is driving increased activity within the market. Industry reports indicate that Malaysia retains over half of its land area under forest cover, totaling approximately 18.2 Million hectares, which equates to around 54% to 55%, depending on the calculation methods and assumptions applied. In Peninsular Malaysia specifically, forests currently cover 43.4% of the region's land area. However, under the National Physical Plan IV, the government aims to raise this figure to 50% by the year 2040. If this target is achieved, it would result in the addition of roughly 900,000 hectares of forested land across the country. With its abundant natural heritage, Malaysia features dense forests and a multitude of conservation zones, making it one of the most biodiverse environments in Southeast Asia. Additionally, the government has prioritized tourism diversification through the development of ecotourism zones in areas such as Taman Negara, Royal Belum, and Tun Mustapha Marine Park. These destinations are equipped with sustainable tourism infrastructure that enhances accessibility while minimizing environmental impact. The implementation of biodiversity corridors and Ramsar site protections has also encouraged long-haul travelers interested in birdwatching, wildlife tracking, and conservation-based travel. Furthermore, strategic collaboration with international conservation bodies and adoption of ecotourism standards under the ASEAN Tourism Strategic Plan further institutionalize responsible tourism practices. This trend aligns ecological conservation with tourism revenue generation.

To get more information of this market, Request Sample

Adoption of Smart and Green Tourism Technologies

The growing adoption of smart and green tourism technologies aimed at enhancing sustainability, visitor engagement, and operational efficiency is positively impacting the Malaysia ecotourism market growth. Moreover, digital platforms, such as interactive eco-travel apps and augmented reality guides, are increasingly employed in national parks and eco-destinations to deliver real-time information on flora, fauna, trail routes, and conservation messages. Green infrastructure investments, including solar-powered accommodations, water harvesting systems, and waste-to-energy initiatives, are integrated into eco-resorts and nature lodges. According to industry reports, private green investments across six surveyed Southeast Asian economies rose by 43% in 2024, reaching a total of USD 8 Billion compared to the previous year. Malaysia and Singapore accounted for more than 60% of the total investment activity. Ecotourism operators are also leveraging data analytics to monitor tourist flow, carbon footprints, and biodiversity impacts, which aid in implementing adaptive management strategies. In addition to this, contactless payments, QR-coded self-guided tours, and e-ticketing are enhancing eco-travel convenience while reducing paper waste. The use of electric vehicles and bicycles for last-mile travel within ecotourism zones is also gaining traction. Also, government policies under the Malaysia Smart Tourism 4.0 framework support these tech-enabled transitions, positioning the sector to attract tech-savvy, sustainability-oriented travelers while minimizing environmental disruption.

Malaysia Ecotourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on traveler type, age group, and sales channel.

Traveler Type Insights:

- Solo

- Group

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes solo and group.

Age Group Insights:

- Generation X

- Generation Y

- Generation Z

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes generation X, generation Y, and generation Z.

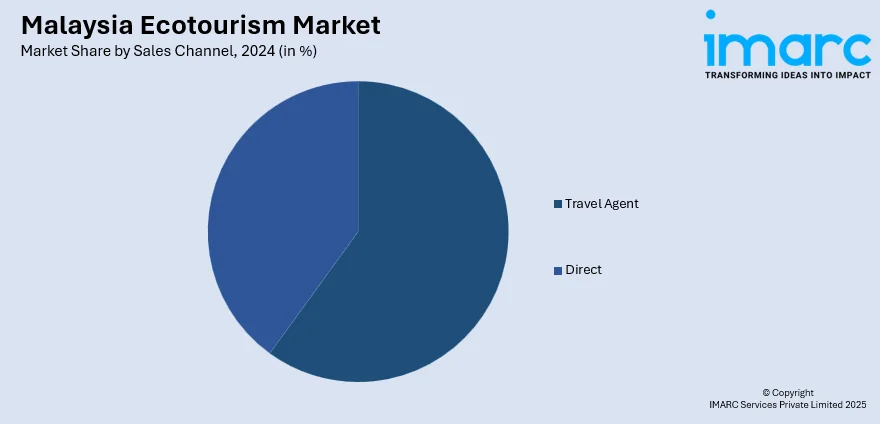

Sales Channel Insights:

- Travel Agent

- Direct

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes travel agent and direct.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Ecotourism Market News:

- On March 5, 2024, Tourism Malaysia unveiled four new eco‑cultural niche travel packages at the ITB Berlin 2024 trade fair, showcasing offerings such as the Pulau Pinang & Kedah Archaeotourism and Geotourism Packages, Perlis Ecotourism Package. Malaysia's pavilion, its 51st in a row, featured a 504 m² exhibit of national tourism products, cultural demonstrations, and networking opportunities with European industry stakeholders. The initiative supports Malaysia's sustainable tourism agenda and promotes the upcoming Visit Malaysia Year 2026.

Malaysia Ecotourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Generation X, Generation Y, Generation Z |

| Sales Channels Covered | Travel Agent, Direct |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia ecotourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia ecotourism market on the basis of traveler type?

- What is the breakup of the Malaysia ecotourism market on the basis of age group?

- What is the breakup of the Malaysia ecotourism market on the basis of sales channel?

- What is the breakup of the Malaysia ecotourism market on the basis of region?

- What are the various stages in the value chain of the Malaysia ecotourism market?

- What are the key driving factors and challenges in the Malaysia ecotourism market?

- What is the structure of the Malaysia ecotourism market and who are the key players?

- What is the degree of competition in the Malaysia ecotourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia ecotourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia ecotourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia ecotourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)