Malaysia Edtech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and States, 2025-2033

Malaysia Edtech Market Overview:

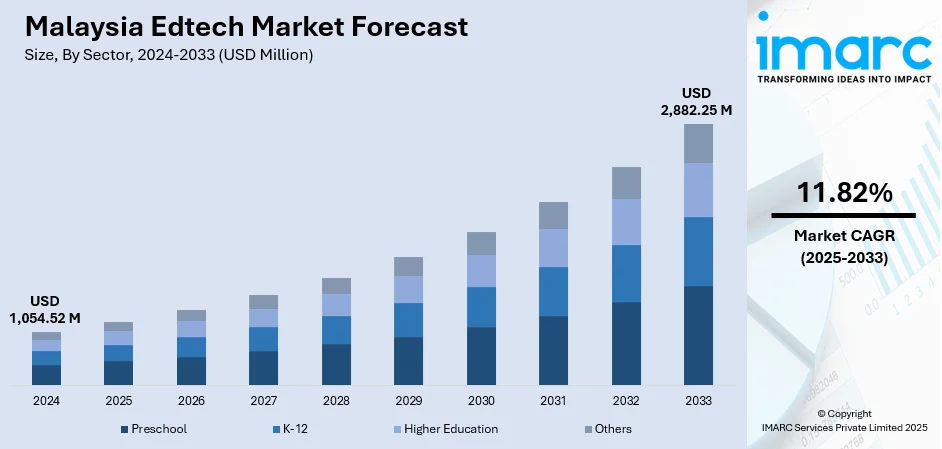

The Malaysia Edtech market size reached USD 1,054.52 Million in 2024. The market is projected to reach USD 2,882.25 Million by 2033, exhibiting a growth rate (CAGR) of 11.82% during 2025-2033. The market is growing due to the increased use of digital classrooms and gamified platforms in schools. In addition, government support for AI-based learning and cross-border education initiatives continues to support Malaysia EdTech market share across public and private education sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,054.52 Million |

| Market Forecast in 2033 | USD 2,882.25 Million |

| Market Growth Rate 2025-2033 | 11.82% |

Malaysia Edtech Market Trends:

Student-led startups gain strong traction

Malaysia’s education technology space is seeing stronger participation from youth-led ventures, with student entrepreneurs building tools tailored to digital-native learners. Younger founders gain direct exposure to today’s classroom experience, which enables them to design platforms that resonate with how children actually learn and engage. This shift is visible in how investors and education stakeholders are giving more space to early-stage ideas developed by teens and university students. A major sign of this trend emerged in June 2025 when Minedu AI launched an AI-integrated Minecraft learning platform designed for primary school learners. The startup, founded by two young Malaysians, offers gamified lessons aligned with the national curriculum and uses familiar digital environments to teach academic content in a way that feels natural to children. Backed by Google Malaysia, the initiative combines entertainment with learning outcomes, eschewing traditional models. Its approach suggests a growing market for tools designed by students, for students. As younger founders continue to enter the scene, their influence is pushing Malaysian EdTech toward platforms that feel more like the digital spaces children already inhabit rather than classroom extensions. This shift is likely to shape how both pedagogy and investment decisions evolve across the sector.

To get more information on this market, Request Sample

Regional exposure drives investment interest

Malaysia EdTech market growth is increasingly shaped by its place within Southeast Asia’s education reform efforts. Cross-border visibility has become a crucial driver for both funding and policy alignment, particularly as investors seek scalable ideas with regional potential. Startups and schools with proven outcomes are receiving more attention, not just for their products but also for how well they align with the broader ASEAN education goals. In June 2025, this trend saw a boost with the launch of the ASEAN School Awards by 21C Learning. The program invited Malaysian participants to compete with peers from 10 other ASEAN nations, creating a platform to showcase digital innovation to a wider audience. Local EdTech providers used the opportunity to highlight how their platforms address learning challenges specific to the region, including multilingual classrooms, resource gaps, and curriculum diversity. This exposure is raising the bar for what success looks like in Malaysian EdTech pushing developers to design tools that are not only locally relevant but also regionally adaptable. The increased collaboration and benchmarking across countries are accelerating the pace of innovation while attracting investors who view ASEAN as a connected, high-growth education market.

Malaysia Edtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

The report has provided a detailed breakup and analysis of the market based on the type. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

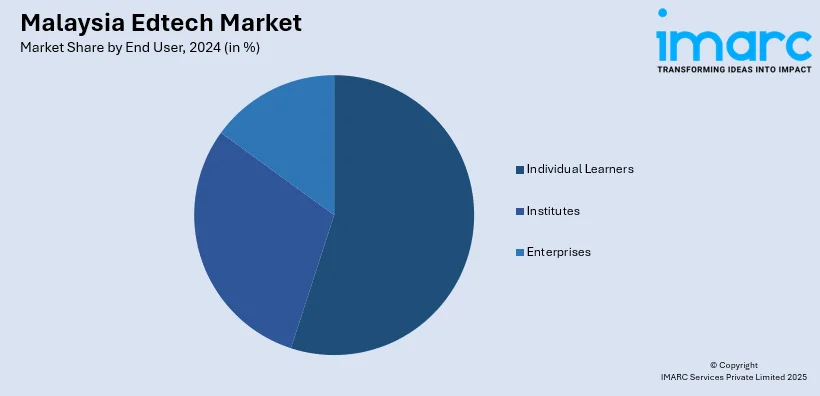

End User Insights:

- Individual Learners

- Institutes

- Enterprises

The report has provided a detailed breakup and analysis of the market based on the end user. This includes individual learners, institutes, and enterprises.

States Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major states markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Edtech Market News:

- June 2025: 21C Learning launched the ASEAN School Awards, inviting EdTech innovators from 11 ASEAN nations, including Malaysia. This initiative encouraged Malaysian schools and providers to showcase digital learning advancements, boosting regional collaboration, visibility, and investment in Malaysia’s growing education technology ecosystem.

- May 2025: Duolingo’s shift to an AI-first model impacted Malaysia’s EdTech market by reducing reliance on local freelancers for content creation. This automation trend signaled a shift in global EdTech operations, urging Malaysian digital educators to adapt through upskilling and AI collaboration to remain competitive.

Malaysia Edtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia Edtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia Edtech market on the basis of sector?

- What is the breakup of the Malaysia Edtech market on the basis of type?

- What is the breakup of the Malaysia Edtech market on the basis of deployment mode?

- What is the breakup of the Malaysia Edtech market on the basis of end user?

- What is the breakup of the Malaysia Edtech market on the basis of states?

- What are the various stages in the value chain of the Malaysia Edtech market?

- What are the key driving factors and challenges in the Malaysia Edtech market?

- What is the structure of the Malaysia Edtech market and who are the key players?

- What is the degree of competition in the Malaysia Edtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia Edtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia Edtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia Edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)