Malaysia Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and States, 2026-2034

Malaysia Gaming Market Overview:

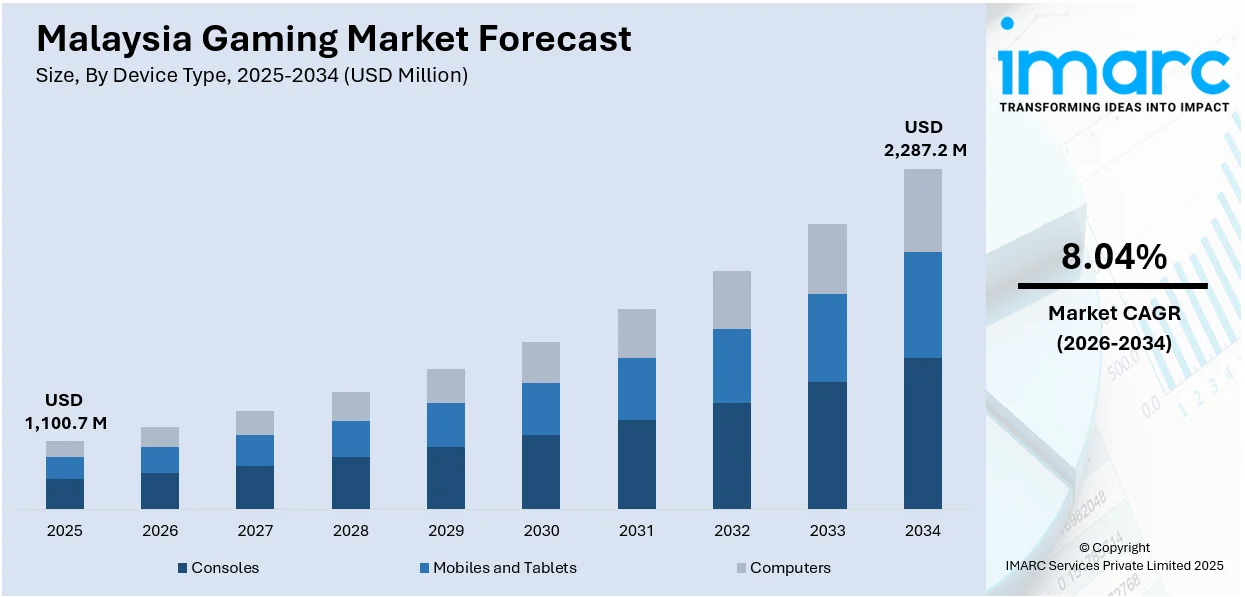

The Malaysia gaming market size reached USD 1,100.7 Million in 2025. The market is projected to reach USD 2,287.2 Million by 2034, exhibiting a growth rate (CAGR) of 8.04% during 2026-2034. The market is fueled by the rising usage of smartphones and enhanced internet connectivity, facilitating mass penetration of mobile gaming. Aside from this, the development of eSports popularity, coupled with increased interest from local as well as overseas investors, further propels market development. Also, the growth of digital payment platforms and incorporation of virtual reality (VR) and augmented reality (AR) technology in gaming experience is fueling innovation, thus augmenting the Malaysia gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,100.7 Million |

| Market Forecast in 2034 | USD 2,287.2 Million |

| Market Growth Rate 2026-2034 | 8.04% |

Malaysia Gaming Market Trends:

Rise of Mobile Gaming and Increased Smartphone Penetration

The industry is experiencing a shift towards mobile platforms driven by the fast penetration of smartphones and enhanced internet availability. According to industry reports, as of early 2024, internet penetration in Malaysia stood at 97.4% of the population. With readily available and affordable mobile data plans, mobile games are now the prevailing mode of the game, well ahead of traditional PC and console gaming. Furthermore, global developers' titles, in addition to local titles, have become more popular due to ease of access, freemium business models, and social connectivity. Significantly, the increase in esports-supportive mobile games has broadened the market base among Gen Z and millennial consumers. Besides, app store economies and in-game monetization generate massive revenues from advertising and microtransactions. Local developers are also increasingly interested in culturally relevant mobile content, leading to increased user engagement. This mobile gaming is supplemented by government efforts to develop digital entertainment as one component of the overall digital economy.

To get more information on this market Request Sample

Expansion of Esports Infrastructure and Competitive Gaming

Esports has become a core pillar of the country's gaming economy, with the nation positioning itself as a regional competitive gaming hub in Southeast Asia. Additionally, strategic investments by the government, including under the Malaysia Digital Economy Blueprint (MyDIGITAL) and efforts by the Malaysia Digital Economy Corporation (MDEC), have positioned esports as a recognized sport that is also funded. These policies have helped in the establishment of training centers, national competitions, and esports academies for the development of professional talent. In line with this, private sector engagement in sponsorships, team investments, and tournament staging has propelled ecosystem maturity. Besides this, educational institutions have also started incorporating esports programs, facilitating amateur-to-professional career paths. Furthermore, the increasing professionalism, media coverage, and inclusion of esports in SEA Games have further legitimized it, drawing international partnerships and facilitating the Malaysia gaming market growth.

Growth of Game Development and Local Content Creation

Malaysia's game development industry is seeing consistent growth, backed by both foreign investments and local talent. The government's attention to turning the nation into a game development center has resulted in tax breaks, funding, and capacity-building initiatives for game studios. Moreover, the existence of foreign studios, together with an increasing number of domestic developers, is providing an impetus to the market. Further, indigenous studios are increasingly producing original intellectual properties (IPs), combining local culture, myths, and stories with contemporary gameplay mechanics to attract both regional and global audiences. Also, collaborative programs between schools and game studios are cultivating competent professionals in animation, game design, and coding. With a strong creative economy and growing access to international publishing markets such as Steam and Google Play, Malaysia's game development industry is placed as a major player in Southeast Asia's gaming innovation ecosystem.

Malaysia Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobile and tablets, and computers.

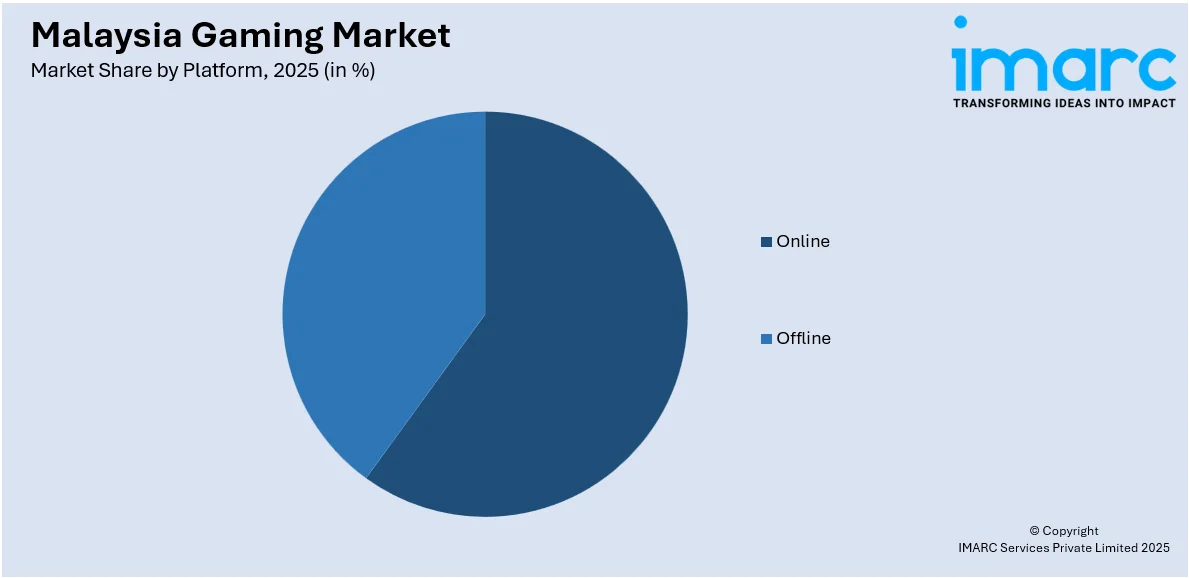

Platform Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchases, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

A detailed breakup and analysis of the market based on the type also been provided in the report. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

States Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Gaming Market News:

- On May 14, 2025, MOONTON Games and the Malaysia Esports Federation (MESF) formalized a Memorandum of Agreement (MoU) to jointly develop Malaysia’s national Mobile Legends: Bang Bang teams, both men’s and women’s, for the upcoming 2025 Southeast Asian (SEA) Games. Under the collaboration, MOONTON will provide comprehensive financial, technical, and promotional support, empowering MESF to select, train, and prepare top-tier athletes for the regional competition. This strategic partnership underscores the shared ambition of both organizations to advance the country’s esports ecosystem.

- On June 19, 2025, REDMAGIC officially launched the flagship 10S Pro gaming smartphone in Malaysia. The product features a Qualcomm Snapdragon 8 Elite Leading Version processor, up to 24 GB RAM and 1 TB storage, and next‑generation ICE‑X cooling with Liquid Metal 2.0, a vapor chamber, and a 23,000 RPM turbofan. The device also includes a large 7,050 mAh battery with 80 W fast charging, a 6.85‑inch 1.5K 144 Hz AMOLED display, a customizable RGB fan, shoulder triggers, and Google Gemini AI enhancements.

Malaysia Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia gaming market on the basis of device type?

- What is the breakup of the Malaysia gaming market on the basis of platform?

- What is the breakup of the Malaysia gaming market on the basis of revenue type?

- What is the breakup of the Malaysia gaming market on the basis of type?

- What is the breakup of the Malaysia gaming market on the basis of age group?

- What is the breakup of the Malaysia gaming market on the basis of states?

- What are the various stages in the value chain of the Malaysia gaming market?

- What are the key driving factors and challenges in the Malaysia gaming market?

- What is the structure of the Malaysia gaming market and who are the key players?

- What is the degree of competition in the Malaysia gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia gaming market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)