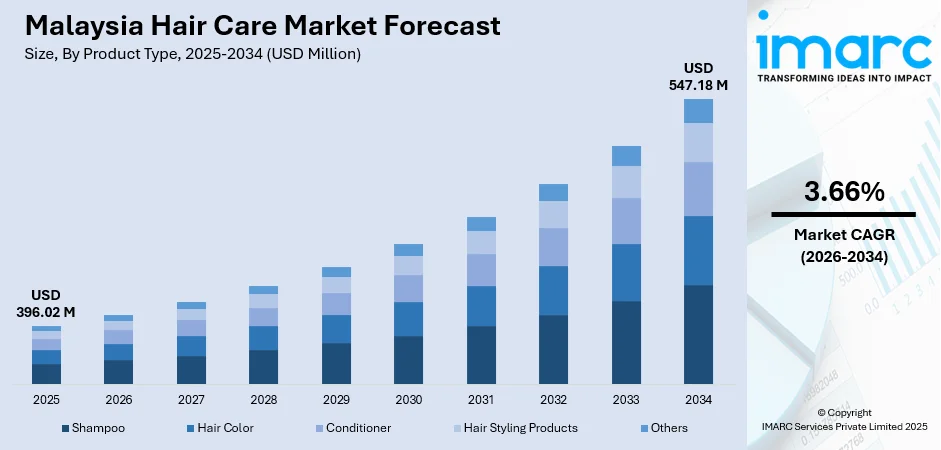

Malaysia Hair Care Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Malaysia Hair Care Market Summary:

The Malaysia hair care market size was valued at USD 396.02 Million in 2025 and is projected to reach USD 547.18 Million by 2034, growing at a compound annual growth rate of 3.66% from 2026-2034.

The Malaysia hair care market demonstrates robust growth driven by urban developments, rising grooming consciousness, and evolving user preferences toward specialized formulations. Modern retail infrastructure proliferation, coupled with digital commerce adoption, facilitates broader product accessibility across diverse demographics. The growing emphasis on personal appearance, influenced by social media trends and increasing disposable incomes, propels demand for innovative solutions addressing specific hair concerns while natural ingredient preferences reshape product development strategies nationwide.

Key Takeaways and Insights:

- By Product Type: Shampoo dominates the market with a share of 45% in 2025, for addressing diverse hair concerns from cleansing to specialized treatments.

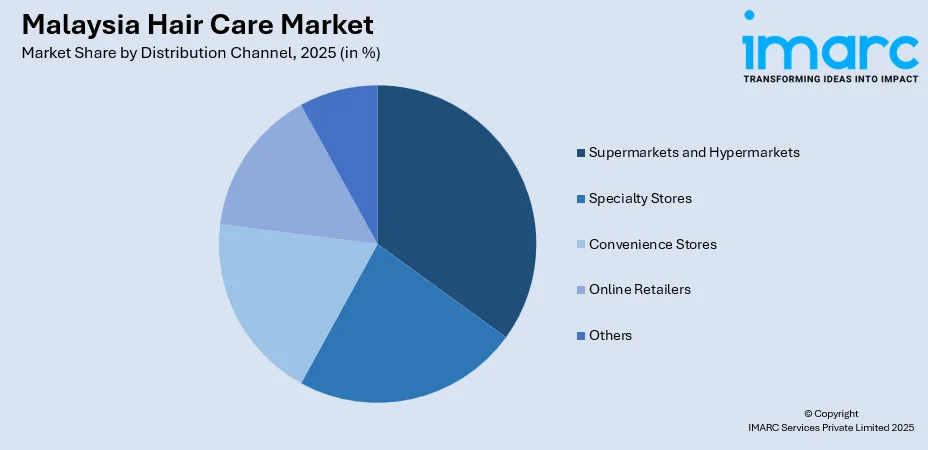

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 40% in 2025, owing to their extensive product assortments, competitive pricing strategies, convenient one-stop shopping experiences, and strategic urban location presence.

- Key Players: The Malaysia hair care market demonstrates moderate competitive intensity, characterized by multinational personal care corporations maintaining dominant positions through extensive distribution networks, aggressive marketing investments, and localized formulations.

To get more information on this market, Request Sample

The Malaysia hair care market experiences dynamic growth propelled by multifaceted catalysts reshaping end user behavior and industry dynamics. Accelerating urbanization concentrates populations in metropolitan areas where modern retail infrastructure and beauty consciousness flourish, creating expanded market opportunities. Rising disposable incomes enable consumers to allocate greater expenditure toward personal grooming and premium hair care solutions beyond basic necessities. As per the Ministry of Economy Department of Statistics Malaysia, the country’s median household income attained RM 7,017 in 2024, increasing by 5.1% each year. The average household income rose to RM9,155, marking a growth rate of 3.8%. Moreover, social media's pervasive influence, coupled with beauty influencers and digital marketing campaigns, dramatically shapes purchasing decisions and drives demand for trending formulations. Additionally, Malaysia's tropical climate necessitates targeted solutions for humidity-induced challenges, while cultural diversity demands varied formulations addressing different hair types and textures prevalent across ethnic communities.

Malaysia Hair Care Market Trends:

Rise of Natural and Herbal Formulations

Malaysians are increasingly gravitating toward hair care products featuring natural, organic, and herbal ingredients, reflecting heightened health consciousness and concerns about synthetic chemical exposure. Brands respond by developing products highlighting plant-based compounds, essential oils, and naturally-derived actives, appealing to environmentally conscious demographics. In 2024, Singapore’s EVERSOFT introduced its first new shampoo line in five years. The company invested approximately four years in creating products at Wipro’s Research & Innovation (R&I) Center in Malaysia, which hosts more than 60 scientists and researchers from various disciplines, including molecular biology, chemistry, and biochemistry. The introduction of Nature’s Therapy enhances the brand is standing in the hair care market by offering more focused, result-oriented products while remaining committed to our principle of nature-infused therapy.

Personalization and Customized Hair Care Solutions

The market is witnessing significant traction in personalized hair care approaches, with brands offering customized formulations tailored to individual hair types, scalp conditions, and specific concerns. The country is also prioritizing in expanding the artificial intelligence (AI) landscape, which is further improving the smart and customized hair assessment process. The National AI Office (NAIO), part of the Ministry of Digital Malaysia, signified its initial 100 days of promoting Malaysia’s AI-focused transmutation. Since its inception on December 12, 2024, NAIO has played a pivotal role in influencing Malaysia's AI ecosystem, boosting socio-economic progress, and strengthening the nation's international competitiveness.

Growth of Men's Grooming and Gender-Inclusive Products

Men's hair care emerges as a rapidly expanding segment, driven by evolving masculinity perceptions and increased male grooming consciousness across Malaysian society. Products specifically formulated for men's hair characteristics, scalp health, and styling preferences proliferate, encompassing anti-dandruff solutions, hair growth treatments, and styling aids designed for shorter hairstyles. In 2025, NatureLab Tokyo, the famous Japanese haircare brand established in 2017, debuted in Malaysia. NatureLab Tokyo features two primary highlights in its product line, including the Saisei and Kiseki collections, each addressing distinct hair and scalp requirements. Clinical studies have demonstrated the patent’s ability to reverse hair greying in 73% of male and female participants noted less grey hair following 3 months of regular use.

Market Outlook 2026-2034:

The Malaysia haircare market is experiencing robust growth owing to several factors. The market generated a revenue of USD 396.02 Million in 2025 and is projected to reach a revenue of USD 547.18 Million by 2034, growing at a compound annual growth rate of 3.66% from 2026-2034. The market is primarily driven by heightened investments in urban developments, demographic shifts toward younger populations with higher beauty consciousness, and digital commerce proliferation.Modern retail formats continue expanding nationwide, improving product accessibility across previously underserved regions. Innovation in formulations addressing tropical climate challenges, halal-certified offerings catering to religious preferences, and premium segment growth driven by affluent middle-class expansion collectively support market development.

Malaysia Hair Care Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Shampoo |

45% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

40% |

Product Type Insights:

- Shampoo

- Hair Color

- Conditioner

- Hair Styling Products

- Others

Shampoo dominates with a market share of 45% of the total Malaysia hair care market in 2025.

Shampoo products dominate the Malaysia hair care market, serving as the foundational cleansing category with universal consumer penetration across demographic segments. The segment encompasses diverse formulations addressing specific concerns including anti-dandruff, moisturizing, volumizing, color protection, and damage repair variants. Tropical climate conditions necessitate frequent hair washing, driving consistent consumption patterns and repeat purchase behaviors.

Innovation focusing on scalp health, microbiome-friendly formulas, and sustainable packaging differentiates brands within this highly competitive product category commanding substantial market share. In 2024, the Italian cosmetics brand Pupa Milano announced its plans to launch hair care items in Malaysia during the third quarter of the year. The complete hair care range includes 12 items, comprising shampoos, masks, and styling products such as volumizing powder.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retailers

- Others

Supermarkets and hypermarkets lead with a share of 40% of the total Malaysia hair care market in 2025.

Supermarkets and hypermarkets command the dominant distribution position, offering comprehensive hair care assortments spanning mass-market to premium segments under single-roof convenience. These formats leverage high foot traffic, strategic urban and suburban locations, competitive pricing through bulk purchasing economies, and prominent shelf placement maximizing product visibility.

End users appreciate comparison shopping opportunities, promotional activities, and bundled offers frequently featured across these channels. Modern retail chains including major operators maintain extensive hair care sections organized by brand, product type, and price points, facilitating informed purchasing decisions. In 2025, SilkPro is announced to be available exclusively at Watsons Malaysia. The launch event, hosted at Grotto, Confetti KL on 26 September, was attended by notable guests, media personnel, and partners from Watsons Malaysia.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

Selangor leads the regional market through concentrated population density, diversified economic base, and extensive retail infrastructure spanning traditional outlets to modern shopping complexes.

Kuala Lumpur captures substantial market share as Malaysia's capital, characterized by affluent urban demographics, concentration of premium retail outlets, international brand flagship stores, and professional salon density.

Johor demonstrates strong performance driven by southern region economic development, cross-border shopping dynamics with Singapore influencing end user behaviors, and growing middle-class expansion.

Sarawak represents notable East Malaysia market contribution, featuring unique demographic compositions including indigenous communities and Chinese populations with distinct hair care preferences.

Remaining regions collectively encompass states including Penang, Perak, Pahang, Kedah, Terengganu, Kelantan, Negeri Sembilan, Melaka, Perlis, Sabah, and Labuan, exhibiting varied growth trajectories influenced by localized economic conditions, urbanization rates, and retail infrastructure development. These markets present opportunities through expanding middle-class demographics, gradual modern retail format penetration, and increasing beauty consciousness supported by digital connectivity and social media influence.

Market Dynamics:

Growth Drivers:

Why is the Malaysia Hair Care Market Growing?

Accelerating Urbanization and Lifestyle Transformation

Malaysia's rapid urbanization fundamentally reshapes consumer behaviors, grooming priorities, and purchasing patterns favoring hair care market expansion. The Malaysian government has traditionally encouraged foreign direct investment (FDI), which has contributed significantly to its economic development. Malaysia reported $85.8 billion of approved foreign investments in 2024. The United States was once again Malaysia’s top investor with $7.4 billion in approved investments in 2024. Metropolitan concentration increases exposure to modern retail formats, international beauty standards, and professional grooming expectations prevalent in corporate environments and social contexts. Urban lifestyles characterized by pollution exposure, air-conditioned environments, and water quality variations create specific hair challenges necessitating specialized product solutions.

Rising Disposable Incomes and Middle-Class Expansion

Malaysia's economic development trajectory generates expanding middle-class demographics with enhanced purchasing power allocated toward personal care and beauty products beyond basic necessities. Rising disposable incomes enable consumers to explore premium segments, experiment with specialized formulations, and invest in preventative hair health rather than solely addressing existing problems. Growing financial capacity supports willingness to pay premium prices for natural ingredients, innovative technologies, and international brands perceived as superior quality. Economic prosperity correlates with increased beauty consciousness as consumers prioritize appearance for professional advancement and social positioning. In October, the World Bank revised its forecast for Malaysia's economic growth in 2025 to 4.1 percent from its previous estimate of 3.9%.

Digital Influence and Social Media Marketing Effectiveness

Social media's pervasive presence profoundly impacts Malaysian consumer purchasing decisions, brand awareness, and product discovery through influencer partnerships, beauty content creators, and peer recommendations. Platforms showcasing hair transformation journeys, product reviews, and styling tutorials educate consumers about available solutions while creating desire for featured brands and formulations. E-commerce integration within social platforms enables seamless purchasing journeys from content discovery to transaction completion, reducing friction in conversion processes. IMARC Group predicts that the Malaysia e-commerce market is projected to extend to USD 961.88 Billion by 2033, exhibiting a growth rate (CAGR) of 28.17% during 2025-2033.

Market Restraints:

What Challenges the Malaysia Hair Care Market is Facing?

Price Sensitivity and Economic Fluctuations

Significant consumer segments demonstrate pronounced price sensitivity, particularly among lower and middle-income demographics who prioritize affordability over brand prestige or advanced formulations. Economic uncertainties, inflation pressures affecting household budgets, and fluctuating disposable incomes constrain premium product adoption and limit willingness to experiment beyond established value offerings.

Intense Market Competition and Brand Proliferation

The Malaysia hair care landscape exhibits saturated competitive conditions with numerous international corporations and local manufacturers vying for limited shelf space and consumer attention. Brand proliferation creates marketplace confusion, diminishing individual brand visibility and necessitating substantial marketing investments maintaining consumer awareness.

Counterfeit Products and Consumer Trust Challenges

Counterfeit and imitation products proliferate throughout distribution networks, particularly in traditional retail channels and unauthorized online platforms, undermining legitimate brand investments and consumer trust. Substandard formulations masquerading as established brands create safety concerns, potential adverse reactions, and negative experiences that tarnish authentic brand reputations.

Competitive Landscape:

The Malaysia hair care market exhibits dynamic competitive intensity characterized by multinational personal care corporations maintaining dominant market positions through extensive product portfolios, powerful distribution networks, and substantial marketing investments. These industry leaders leverage economies of scale, research capabilities, and established brand equity competing across multiple product categories and price segments. International brands command premium positioning through innovation investments, celebrity endorsements, and professional salon partnerships establishing credibility and aspirational appeal.

Recent Developments:

- In August 2025, See Young, the top botanical hair care brand from China, has been officially introduced in Malaysia. China’s top silicone-free scalp care brand has launched in the Malaysian market via a nationwide rollout specifically at Guardian stores, in partnership with exclusive distributor i-Care Marketing Sdn Bhd.

- In September 2025, Blackstone Inc has committed to a major investment in the premium hair care company Juno from South Korea. The alternative asset manager from the US will collaborate with Juno's founder, Yun-Seon Kang, to accelerate growth and international expansion.

Malaysia Hair Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shampoo, Hair Color, Conditioner, Hair Styling Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retailers, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Malaysia hair care market size was valued at USD 396.02 Million in 2025.

The Malaysia hair care market is expected to grow at a compound annual growth rate of 3.66% from 2026-2034 to reach USD 547.18 Million by 2034.

Shampoo products command the largest market share of 45%, serving as the foundational cleansing category with universal consumer penetration across all demographic segments, driven by tropical climate necessitating frequent hair washing and diverse formulations addressing varied hair concerns.

Key factors driving the Malaysia hair care market include rise in populations in metropolitan areas with modern retail infrastructure, social media influence shaping purchasing decisions through beauty influencers and digital marketing, e-commerce expansion facilitating convenient product accessibility, and increasing demand for natural formulations and specialized solutions addressing tropical climate challenges.

Major challenges include pronounced price sensitivity among significant consumer segments limiting premium product adoption, counterfeit product proliferation undermining brand trust and legitimate manufacturer revenues, currency fluctuation, regulatory compliance requirements, environmental sustainability pressures demanding eco-friendly packaging innovations, and rapidly changing preferences maintaining market relevance across diverse demographic segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)