Malaysia IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Region, 2025-2033

Malaysia IT Training Market Overview:

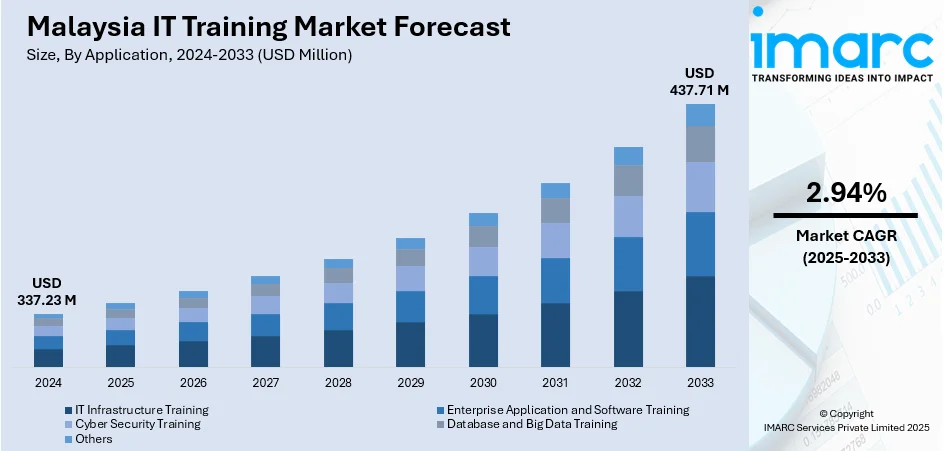

The Malaysia IT training market size reached USD 337.23 Million in 2024. The market is projected to reach USD 437.71 Million by 2033, exhibiting a growth rate (CAGR) of 2.94% during 2025-2033. The market is driven by government-led digital transformation initiatives, rapid expansion of digital infrastructure, and strong private-sector demand for upskilling. National policies encourage technology adoption across industries, pushing organizations to enhance their digital capabilities. Investments in fifth generation (5G) networks, data centers, and cloud platforms further boost the need for skilled information technology (IT) professionals. At the same time, companies across sectors prioritize employee reskilling in emerging technologies like artificial intelligence (AI), cloud computing, and cybersecurity to remain competitive in the evolving digital economy thus strengthening the Malaysia IT training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 337.23 Million |

| Market Forecast in 2033 | USD 437.71 Million |

| Market Growth Rate 2025-2033 | 2.94% |

Malaysia IT Training Market Trends:

Rapid Expansion of Digital Infrastructure & Tech Investments

Malaysia is experiencing rapid growth in digital infrastructure, marked by nationwide 5G rollout, fiber optic upgrades, and smart city development. This transformation is reinforced by major investments from global tech giants like Google, which is investing US$2 billion in a data center and cloud hub in Selangor, expected to create 26,500 jobs by 2030. These efforts are making Malaysia a major digital gateway in the region. With industries embracing sophisticated technologies such as AI, IoT, and cloud platforms, there is an increased demand for a highly qualified IT workforce to operate new systems, provide cybersecurity, and promote digital innovation. This demand drives Malaysia's IT training market growth, compelling both fresh graduates and professionals to pursue higher training in cloud computing, networking, data analytics, and other new tech skills needed to survive in the changing digital economy.

To get more information on this market, Request Sample

Private‑Sector Demand for Upskilling Amid Emerging Tech Growth

Another significant Malaysia IT training market trend is the increasingly embracing digital technologies to remain competitive in local and international markets. Companies across industries such as finance, manufacturing, and e-commerce are integrating digital tools, automation, and data-driven processes into their operations. This shift requires a workforce with new technical competencies in areas like software development, cloud services, artificial intelligence, and cybersecurity. As technology evolves, businesses recognize that upskilling and reskilling their employees is not optional but essential for success. Many firms are investing in IT training to close skill gaps, improve efficiency, and foster innovation. Additionally, the growing importance of digital customer engagement and remote working models pushes organizations to equip staff with versatile IT skills. This strong corporate emphasis on digital capability building is a key factor driving sustained growth in Malaysia’s IT training market.

Government‑Led Digital Transformation & Policy Initiatives

The Malaysian government is actively driving nationwide digital transformation to enhance the country’s global competitiveness. Through national plans and digital economy blueprints, it promotes technologies such as cloud computing, artificial intelligence, cybersecurity, and smart manufacturing across various industries. A key part of this initiative is building digital talent, evidenced by over 1.3 million Malaysians participating in free technology courses—including AI, blockchain, and quantum computing—through the Digital Citizen Portal as of February 2025. To further support this, the government offers incentives, grants, and skill development schemes encouraging businesses to invest in IT training programs. These efforts have created steady demand for structured training in cloud platforms, AI applications, and cybersecurity management. Strong government backing also attracts both local and international investors, emphasizing the need for skilled professionals and positioning IT training providers as vital contributors to Malaysia IT training market growth.

Malaysia IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, database and big data training, and others.

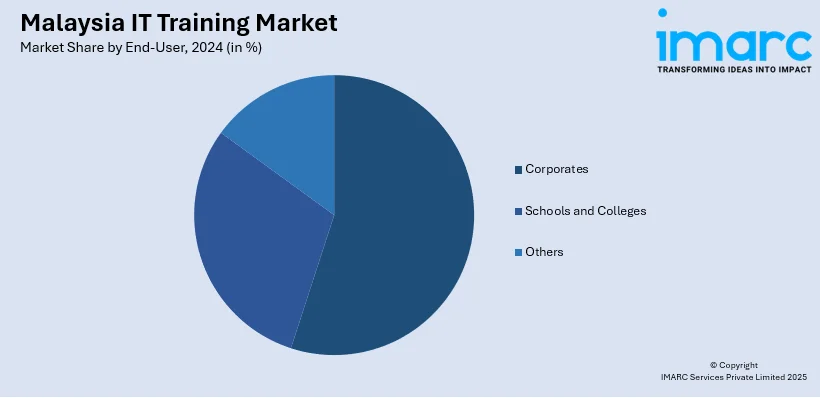

End-User Insights:

- Corporates

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes corporates, schools and colleges, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia IT Training Market News:

- In June 2025, Malaysia launched its first large-scale AI and cybersecurity training programme for Technical and Vocational Education and Training (TVET) institutions, upskilling over 6,700 individuals, including 1,100 educators and 5,600 students. Led by SOLS Foundation with IBM SkillsBuild, and supported by the Ministry of Digital Malaysia and MyDIGITAL Corporation, the initiative covered 230 colleges nationwide, focusing on equipping students, especially from the B40 group, with essential digital skills for future careers.

- In May 2025, Microsoft officially launched its first cloud region in Malaysia, called Malaysia West, located in Greater Kuala Lumpur. This new region offers services like Azure, Microsoft 365, storage, cybersecurity, and data analytics, aimed at supporting Malaysia’s digital and AI ambitions. Key companies such as PETRONAS and TNG Digital are already leveraging the infrastructure. IDC predicts the region will generate US$10.9 billion and create over 37,000 jobs, including nearly 6,000 skilled IT roles.

Malaysia IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporate, Schools and Colleges, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Malaysia IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia IT training market on the basis of application?

- What is the breakup of the Malaysia IT training market on the basis of end-user?

- What is the breakup of the Malaysia IT training market on the basis of region?

- What are the various stages in the value chain of the Malaysia IT training market?

- What are the key driving factors and challenges in the Malaysia IT training market?

- What is the structure of the Malaysia IT training market and who are the key players?

- What is the degree of competition in the Malaysia IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)