Malaysia Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and State, 2025-2033

Malaysia Logistics Market Overview:

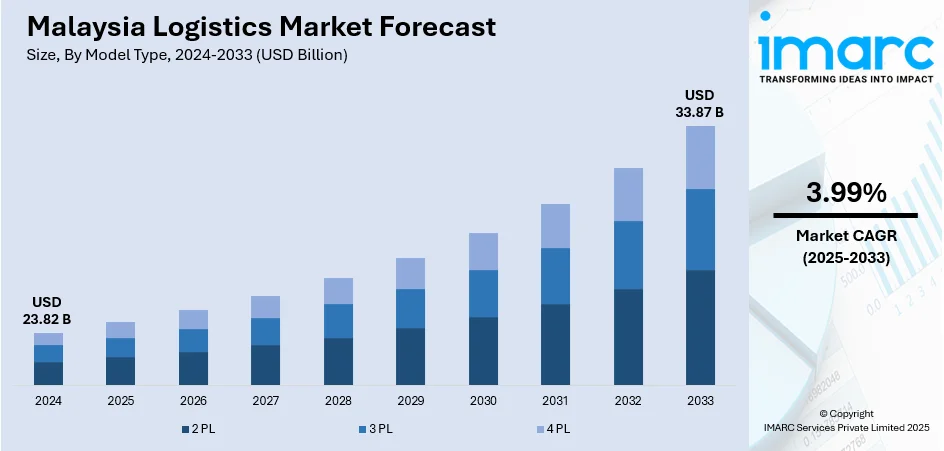

The Malaysia logistics market size reached USD 23.82 Billion in 2024. The market is projected to reach USD 33.87 Billion by 2033, exhibiting a growth rate (CAGR) of 3.99% during 2025-2033. The market is seeing strong growth owing to drivers like strategic investment in infrastructure, advancements in technology, and preferential trade pacts. Government programs like the construction of the East Coast Rail Link and the ASEAN Express are also boosting connectivity and efficiency. The growth of e-commerce and the practice of sustainable business practices are further fueling the Malaysia logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 23.82 Billion |

| Market Forecast in 2033 | USD 33.87 Billion |

| Market Growth Rate 2025-2033 | 3.99% |

Malaysia Logistics Market Trends:

Infrastructure Development and Connectivity Enhancements

Malaysia's logistics industry is immensely supported by huge investment in infrastructure for enhancing connectivity and operational effectiveness. Supporting this is the government's determination through initiatives such as the East Coast Rail Link (ECRL), which, upon completion, will ensure easy passage of goods between the country's western and eastern sides. Moreover, the launch of the ASEAN Express, a cross-country international freight train service linking Malaysia to its neighbors, has cut transit times, thus increasing the efficiency of cross-border trade. These are crucial for cementing Malaysia as a logistics hub in Southeast Asia, directly contributing to the Malaysia logistics market growth. The Malaysian logistics sector is experiencing digitalization, where it incorporates new technologies to optimize processes and enhance service delivery. For instance, as per recent reports, Malaysia and Thailand aim to lead ASEAN’s effort to become a global logistics hub, leveraging the region’s strategic location. Success depends on enhancing infrastructure, easing trade barriers, improving customs, and embracing sustainability, digital innovation, and AI. The ASEAN Connectivity Master Plan 2025 supports this vision, which could unlock trillions in trade value. Key to this transformation are seamless connectivity, regulatory consistency, and sustainable logistics, positioning ASEAN as a central player in global supply chains and driving regional economic growth.

To get more information on this market, Request Sample

Technological Integration and Digital Transformation

The implementation of automation, artificial intelligence (AI), and the Internet of Things (IoT) has facilitated more effective supply chain management, real-time monitoring, and predictive analysis. These advances in technology do not only provide improved operational efficacy but also address the increasing demand for quicker and more secure logistics services, thus driving the Malaysia logistics market growth. For instance, in 2025, Malaysia announced plans to develop an AI-driven container port in Port Dickson to ease Klang Valley’s logistics congestion. The site offers strategic benefits including cost-effective development, reduced traffic, regional growth balance, and access to the Malacca Strait. Emphasizing AI, automation, and green technologies, the port reflects a national shift toward digital and smart logistics infrastructure. This initiative supports Malaysia’s goal to modernize supply chains and decentralize growth, directly boosting operational efficiency and contributing to Malaysia logistics market growth through digital transformation.

Malaysia Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/state levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

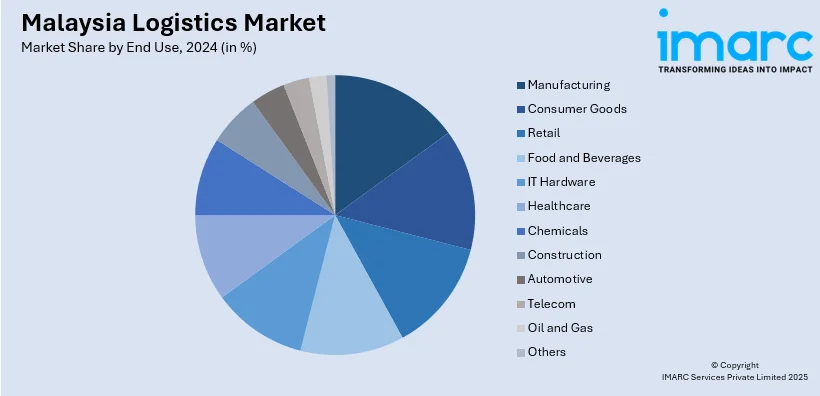

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

State Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Logistics Market News:

- In June 2025, Malaysia’s KGW Group formed a joint venture with China’s Mingkun to strengthen logistics integration amid ongoing US-China trade tensions. The partnership aims to support Chinese manufacturers relocating to Malaysia to avoid high US tariffs by offering comprehensive, one-stop logistics solutions. KGW is also expanding in Southeast Asia to enhance US-bound freight networks.

- In October 2024, DHL Express launched its RM300 million Kuala Lumpur Gateway facility at KLIA, its largest investment in Malaysia. The fully automated centre can process 10,000 shipments per hour, four times more than before, boosting import-export efficiency amid growing international trade. It follows earlier investments in Penang and Johor. This expansion enhances Malaysia’s logistics infrastructure and supports its rise in global logistics rankings, reflecting a strong push for improved connectivity and operational performance in the country’s growing logistics sector.

Malaysia Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia logistics market on the basis of model type?

- What is the breakup of the Malaysia logistics market on the basis of transportation mode?

- What is the breakup of the Malaysia logistics market on the basis of end use?

- What is the breakup of the Malaysia logistics market on the basis of state?

- What are the various stages in the value chain of the Malaysia logistics market?

- What are the key driving factors and challenges in the Malaysia logistics market?

- What is the structure of the Malaysia logistics market and who are the key players?

- What is the degree of competition in the Malaysia logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positiobns of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)