Malaysia Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and States, 2025-2033

Malaysia Meat Market Overview:

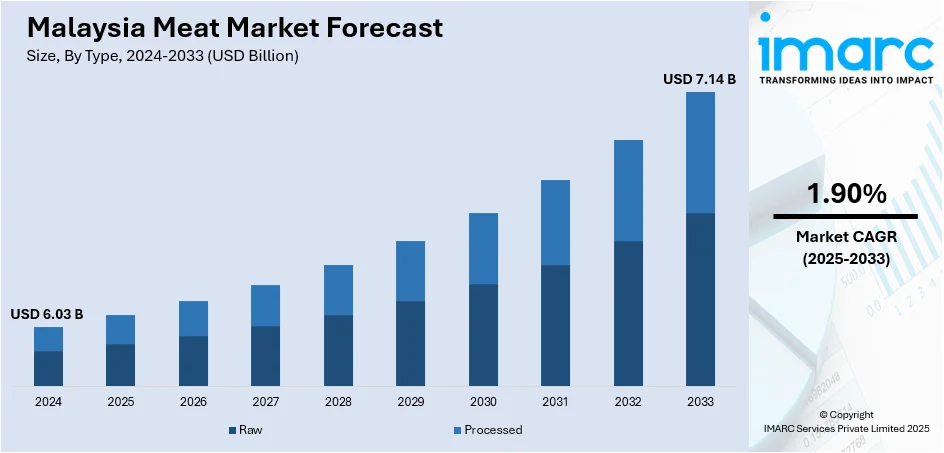

The Malaysia meat market size reached USD 6.03 Billion in 2024. The market is projected to reach USD 7.14 Billion by 2033, exhibiting a growth rate (CAGR) of 1.90% during 2025-2033. The market is driven by the rising disposable incomes, increasing urbanization, and changing dietary habits that favor protein-rich diets. Growing awareness of food safety, halal certification, and convenience is influencing consumer preferences toward packaged and processed meat. The expansion of e-commerce and modern retail channels makes meat products more accessible. Additionally, population growth and a younger demographic open opportunity for diverse meat offerings, including ready-to-cook, marinated, and alternative protein products tailored to evolving tastes and lifestyles further surging the Malaysia meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.03 Billion |

| Market Forecast in 2033 | USD 7.14 Billion |

| Market Growth Rate 2025-2033 | 1.90% |

Malaysia Meat Market Trends:

Growing Demand for Plant-Based and Alternative Proteins

Shift toward plant-based and alternative protein products is a key driver in the Malaysia meat market trends. More consumers are becoming health-conscious, environmentally aware, and curious about meat substitutes. This trend is not only driven by vegetarians or vegans, but also by flexitarians who are reducing their meat intake without giving it up entirely. Food producers are responding by offering meat-free versions of familiar Malaysian dishes using legumes, mushrooms, and new plant-based protein blends. Halal certification remains essential, and local flavors are critical to consumer acceptance. Challenges remain around taste, texture, and affordability, but growing awareness and innovation are helping overcome these hurdles. While traditional meats still dominate, alternative proteins are carving a niche, particularly among younger, urban consumers who are more open to experimenting with new food formats aligned with health and sustainability goals.

To get more information on this market, Request Sample

Rise of Convenience and Online Meat Shopping

Urbanization and fast-paced lifestyles are reshaping how Malaysians buy and consume meat. Busy urban dwellers increasingly seek convenience, driving demand for marinated cuts, frozen options, and ready-to-cook meals. The rise of digitalization has boosted online meat shopping, with e-commerce for meat and fish expected to hit US $255 million by 2025, growing at 22.8% annually. Consumers, especially younger ones and working families, now prefer ordering meat online for doorstep delivery, valuing hygiene, halal certification, and time-saving convenience. Delivery apps and online butchers are stepping in to meet these needs, offering quick, reliable access to quality products. While wet markets still hold cultural value, digital platforms and modern retail formats are becoming dominant, especially in urban centers. This shift marks a major transformation in Malaysia’s meat market, where speed, safety, and convenience now define consumer preferences and industry strategies.

Strong Preference for Red Meat and Import Dependency

Red meat, particularly beef and lamb, remains highly popular among Malaysian consumers, especially during festivals and special occasions. This demand continues to grow steadily, fueled by cultural preferences and increasing awareness of protein-rich diets. However, Malaysia relies heavily on imported red meat owing to limited domestic production capacity. This makes the market vulnerable to fluctuations in international prices, supply chain disruptions, and currency exchange rates. Local production is challenged by high feed costs, limited land, and the need for better livestock management systems. Despite these hurdles, there's growing interest in strengthening domestic meat supply chains. Some consumers are becoming more supportive of locally sourced meat for its perceived freshness and national pride. Going forward, government policies, investments in agriculture, and sustainable farming practices will play key roles in reducing import dependency and supporting the local meat industry thus bolstering the Malaysia meat market growth.

Malaysia Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

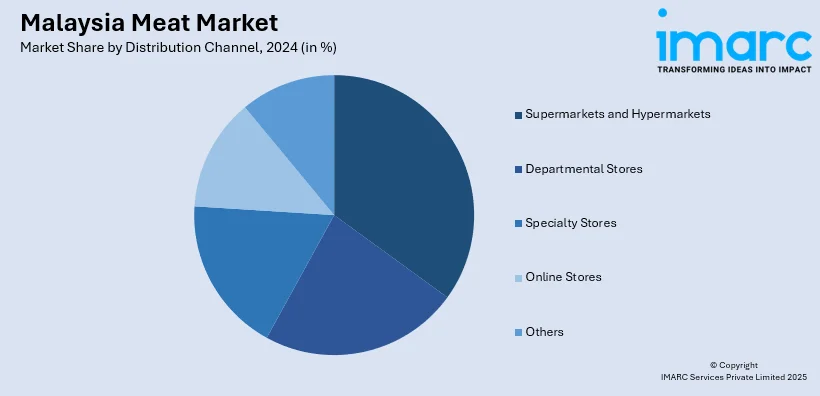

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

States Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and Others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Meat Market News:

- In April 2024, Malaysian food-tech company ULTIMEAT launched its new product, Ultimeat Mycoprotein, at an exclusive six-course dinner event held at Nimbus Restaurant. The event showcased the versatility of mycoprotein in gourmet dishes. CEO Edwin Lee expressed excitement about bringing the sustainable, protein-rich ingredient to Malaysian consumers, emphasizing the company’s commitment to innovative, eco-friendly food solutions. The launch marks a significant step in expanding alternative protein options in Malaysia.

- In March 2024, Singapore-based cultivated seafood startups UMAMI Bioworks and Shiok Meats are merging, with UMAMI acquiring Shiok’s assets in a stock deal. The move aims to accelerate UMAMI’s scale-up and expand its product line to include crustaceans like shrimp and crab. Facing a tough funding climate, both companies saw strategic alignment. UMAMI’s B2B, asset-light model offers a clearer growth path, while Shiok contributes valuable infrastructure and R&D capabilities.

Malaysia Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia meat market on the basis of type?

- What is the breakup of the Malaysia meat market on the basis of product?

- What is the breakup of the Malaysia meat market on the basis of distribution channel?

- What is the breakup of the Malaysia meat market on the basis of states?

- What are the various stages in the value chain of the Malaysia meat market?

- What are the key driving factors and challenges in the Malaysia meat market?

- What is the structure of the Malaysia meat market and who are the key players?

- What is the degree of competition in the Malaysia meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)