Malaysia Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and States, 2025-2033

Malaysia Medical Tourism Market Overview:

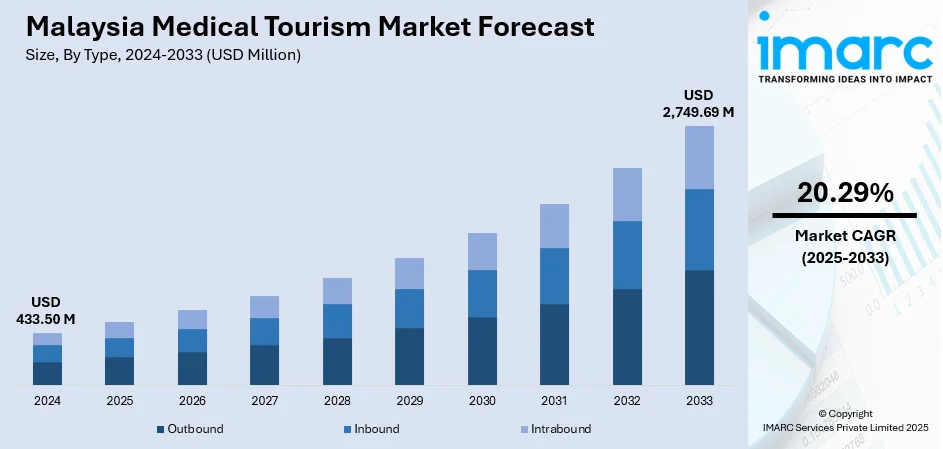

The Malaysia medical tourism market size reached USD 433.50 Million in 2024. Looking forward, the market is projected to reach USD 2,749.69 Million by 2033, exhibiting a growth rate (CAGR) of 20.29% during 2025-2033. The market is driven by structured government promotion, internationally accredited hospitals, and seamless healthcare traveler coordination. Malaysia’s multilingual, culturally inclusive environment fosters trust among patients from Muslim-majority and South Asian countries. Additionally, cost-effective treatments in high-demand specialties and transparent billing are further augmenting the Malaysia medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 433.50 Million |

| Market Forecast in 2033 | USD 2,749.69 Million |

| Market Growth Rate 2025-2033 | 20.29% |

Malaysia Medical Tourism Market Trends:

Public-Private Synergy and Government Branding Initiatives

Malaysia's medical tourism ecosystem is distinguished by coordinated public-private collaboration led by the Malaysia Healthcare Travel Council (MHTC). The government strategically positions Malaysia as a safe, affordable, and high-quality destination for international patients, primarily from Indonesia, China, India, Australia, and the Middle East. MHTC supports hospital accreditation, international marketing, and streamlined patient facilitation through its “Malaysia Healthcare” brand. Key hospitals such as Prince Court Medical Centre, Gleneagles, and KPJ Group offer JCI-accredited services with transparent pricing and bundled care packages. On May 28, 2025, IHH Healthcare announced that Malaysia is poised to become a leading medical tourism destination, supported by skilled professionals, advanced hospital infrastructure, and a favorable exchange rate. The group’s medical tourism revenue rose from 5% to 7%, and is projected to reach 14% upon full integration of Island Hospital in Penang. With patients arriving from the UK, Turkiye, and Australia, Malaysia's affordability and expertise continue to attract global demand for surgical and specialist care.

To get more information on this market, Request Sample

In line with this, Malaysia’s visa-on-arrival policies and healthcare traveler fast-tracks at airports further enhance patient experience. The government actively promotes health travel through wellness campaigns, medical conferences, and roadshows in source countries. Moreover, patients benefit from a centralized call center and appointment portal that connects them with vetted providers. This integrated, government-backed infrastructure ensures trust, consistency, and convenience. On April 8, 2025, Malaysia announced its target to generate USD 2.7 Billion in annual medical tourism revenue by 2030, backed by increasing international patient inflow and expanding hospital capacity. The country welcomed 1.52 million international patients in 2024, up from over one million in 2023, contributing nearly USD 500 Million. Emphasizing affordability, personalized care, and advanced diagnostics, Malaysia is strengthening its competitive edge in the regional medical tourism landscape. Such institutional alignment with the private healthcare sector—unique in the region—has earned Malaysia a reputation for reliability, supporting Malaysia medical tourism market growth and anchoring its appeal across Southeast Asia and beyond.

Affordable and Transparent Healthcare in High-Demand Specialties

Malaysia’s affordability in delivering high-quality care—particularly in cardiology, fertility treatments, orthopedics, oncology, and cosmetic surgery—continues to draw patients from costlier medical markets. Hospitals offer comprehensive treatment packages with transparent pricing structures, allowing international patients to plan financially without hidden fees. In vitro fertilization (IVF), coronary bypass, and cosmetic procedures are priced far below rates in Australia, the U.S., and the UK, with comparable medical outcomes and internationally trained specialists. Regional competition is also prevalent, for instance, on February 17, 2025, the Klang Valley overtook Penang as Malaysia’s leading medical tourism hub, attracting approximately 560,700 international patients and generating RM886 Million (around USD 187 Million) in revenue. This accounted for 41.6% of national medical tourism income and 44.5% of patient volume. Despite fewer visitors, Penang’s revenue rose to RM866 Million (USD 183 Million), showing the growing value per patient in Malaysia’s competitive medical tourism landscape. In line with this, Malaysian facilities maintain modern diagnostic infrastructure, digital patient records, and multilingual coordination teams to manage cross-border care. Post-treatment services, such as telehealth check-ins and hotel partnerships for recovery stays, add to patient convenience. Malaysia’s proximity to Singapore and Indonesia, combined with direct air connectivity to regional capitals, strengthens its pull as a quick-access medical destination. International insurance providers increasingly recognize Malaysian hospitals in their global networks, reducing out-of-pocket costs for covered patients. These economic and operational efficiencies make Malaysia a compelling option for value-conscious patients seeking evidence-based, private medical care across a range of specialties.

Malaysia Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

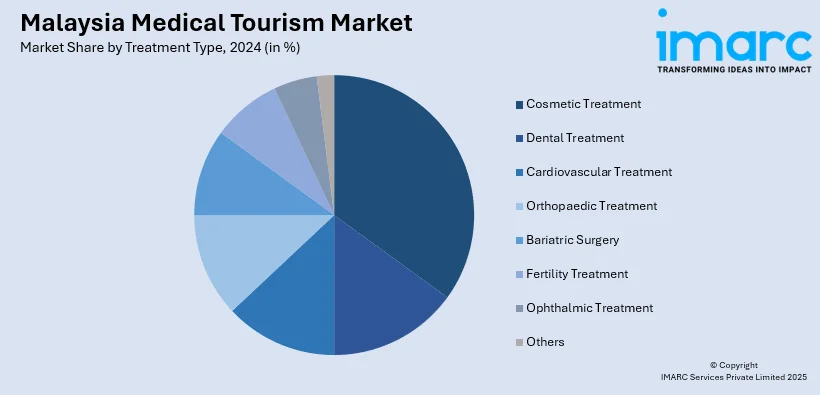

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

States Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Medical Tourism Market News:

- On June 26, 2025, KPJ Healthcare Bhd announced plans to expand its medical tourism segment by targeting the 54 million Indonesians who seek treatment abroad, 40% of whom already choose Malaysia. The group invested RM406 Million (USD 86 Million) in FY2024 for hospital upgrades and digital expansion, including launching its 30th hospital. KPJ expects 70% of 2025 revenue from age-related and non-communicable diseases, aligning with Malaysia’s ageing demographic and rising demand for specialized care.

Malaysia Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia medical tourism market on the basis of type?

- What is the breakup of the Malaysia medical tourism market on the basis of treatment type?

- What is the breakup of the Malaysia medical tourism market on the basis of states?

- What are the various stages in the value chain of the Malaysia medical tourism market?

- What are the key driving factors and challenges in the Malaysia medical tourism market?

- What is the structure of the Malaysia medical tourism market and who are the key players?

- What is the degree of competition in the Malaysia medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)