Malaysia Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End-User, and State, 2025-2033

Malaysia Online Education Market Overview:

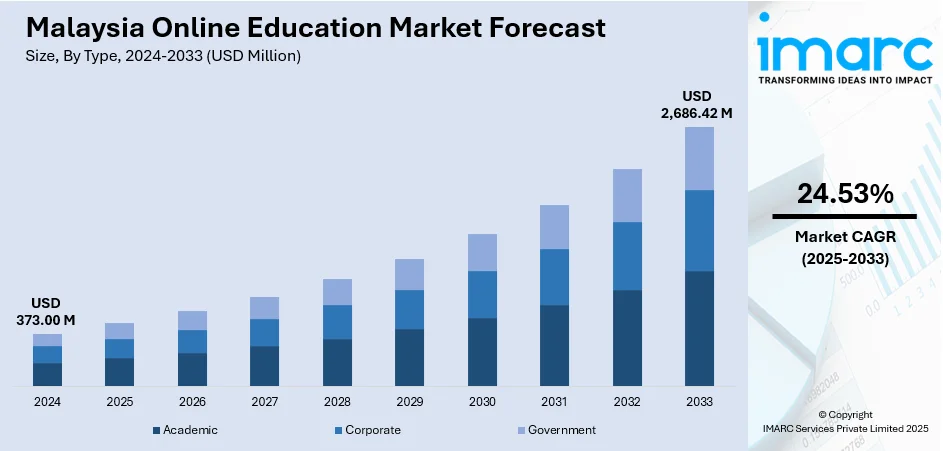

The Malaysia online education market size reached USD 373.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,686.42 Million by 2033, exhibiting a growth rate (CAGR) of 24.53% during 2025-2033. Increasing demand for quality and flexible education, government initiatives promoting digital transformation, rising internet penetration and tech-savviness, and the need for upskilling or reskilling among professionals are some of the factors contributing to Malaysia online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 373.00 Million |

| Market Forecast in 2033 | USD 2,686.42 Million |

| Market Growth Rate 2025-2033 | 24.53% |

Malaysia Online Education Market Trends:

Empowering Digital Fluency in Learning

A notable development is reshaping the digital education sphere in Malaysia. A cooperative effort between a prominent technology provider and a crucial higher education body is dramatically broadening pathways to advanced technological instruction. This alliance offers a wide student population within vocational and community-focused institutions critical proficiencies in areas like artificial intelligence and cloud technologies. Leveraging an extensive collection of digital learning resources, this initiative cultivates a more equitable environment for gaining sought-after digital expertise. This evolution highlights a deepening commitment to furnishing the nation's future talent with fundamental capabilities, thereby boosting career prospects and accelerating technological advancement throughout the nation. These factors are intensifying the Malaysia online education market growth. For example, in September 2024, AWS and Malaysia's Ministry of Higher Education (MOHE) agency, JPPKK, partnered to introduce new AI training initiatives. This collaboration provides 140,000 students in polytechnics and community colleges access to over 200 AWS cloud and AI online courses, aiming to democratize AI skills for Malaysia's future workforce.

To get more information on this market, Request Sample

AI-Enhanced Academic Integrity in Online Learning

A notable development is revolutionizing online learning in Malaysia. Educational technology advancements are introducing sophisticated artificial intelligence capabilities to bolster assessment practices and ensure the trustworthiness of academic endeavors. This aligns seamlessly with the national higher education body's strategic emphasis on expanding digital learning opportunities to cultivate essential skills and improve career readiness. With the national qualifications authority already facilitating online credit accumulation while upholding stringent academic benchmarks, these technological innovations present a substantial opportunity. They allow Malaysian higher education institutions to significantly strengthen the integrity of their rapidly expanding digital education provisions, fostering greater confidence in qualifications earned through virtual platforms. For instance, in June 2024, Coursera introduced new GenAI features for online education, enhancing assessments and academic integrity. This aligns with Malaysia's Ministry of Higher Education's push for online learning to boost skills and employability. The Malaysian Qualifications Agency allows 30% online credits, emphasizing rigorous standards. These AI innovations offer significant opportunities for Malaysian universities to strengthen academic integrity within their growing online education sector.

Malaysia Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and state levels for 2025-2033. Our report has categorized the market based on type, provider, technology, and end-user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, K-12 education), corporate (large enterprises, SMBs), and government.

Provider Insights:

- Content

- Services

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

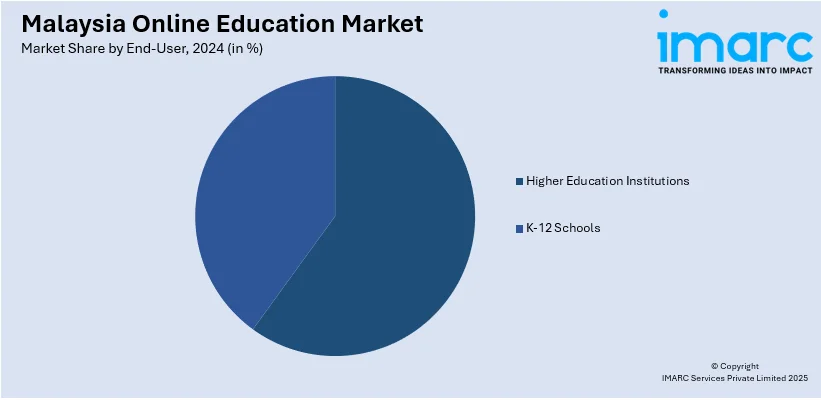

End-User Insights:

- Higher Education Institutions

- K-12 Schools

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes higher education institutions and K-12 schools.

State Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major state markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Online Education Market News:

- In October 2024, EdgePoint Towers launched its first digital classroom in Malaysia at Sekolah Kebangsaan (SK) Sungai Dua in Karak, Pahang, as part of its "Connectivity for Communities" program. This initiative aims to bridge the digital divide by providing internet access and digital resources to underserved areas, thereby boosting Malaysia's online education market.

Malaysia Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia online education market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia online education market on the basis of type?

- What is the breakup of the Malaysia online education market on the basis of provider?

- What is the breakup of the Malaysia online education market on the basis of technology?

- What is the breakup of the Malaysia online education market on the basis of end-user?

- What is the breakup of the Malaysia online education market on the basis of states?

- What are the various stages in the value chain of the Malaysia online education market?

- What are the key driving factors and challenges in the Malaysia online education market?

- What is the structure of the Malaysia online education market and who are the key players?

- What is the degree of competition in the Malaysia online education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia online education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)