Malaysia Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and States, 2025-2033

Malaysia Steel Market Overview:

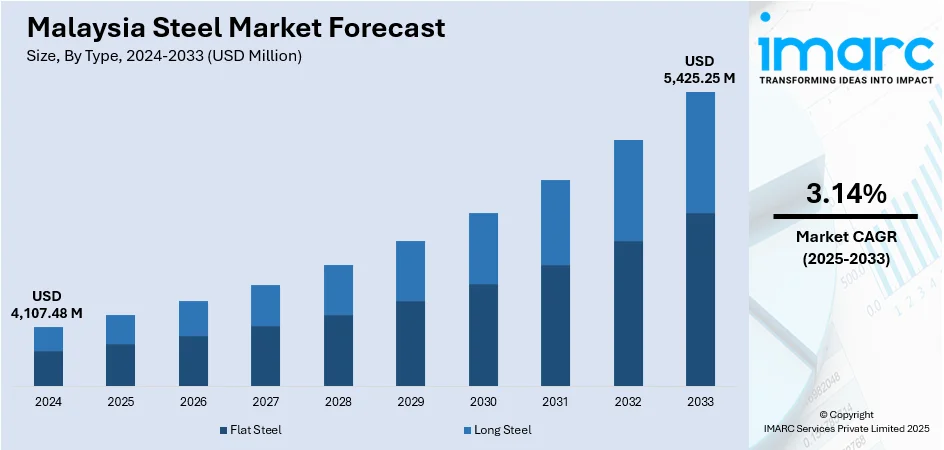

The Malaysia steel market size reached USD 4,107.48 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,425.25 Million by 2033, exhibiting a growth rate (CAGR) of 3.14% during 2025-2033. At present, the government and private sector are constantly investing in road, bridge, housing, and commercial property development, all of which are dependent on durable products. This, along with the rise in implementation of government policies, is supporting the market growth. Moreover, increasing innovations in the automotive industry are expanding the Malaysia steel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,107.48 Million |

| Market Forecast in 2033 | USD 5,425.25 Million |

| Market Growth Rate 2025-2033 | 3.14% |

Malaysia Steel Market Trends:

Accelerating Infrastructure Growth and Urbanization

The Malaysian steel industry is driven by the fast development of infrastructure schemes and developments. The government and private sector are constantly investing in road, bridge, housing, and commercial property development, all of which are dependent on steel products. The constant development of transport networks such as highways, railways, and airports is analyzing the demand for steel. Besides this, the trend of urban developments is leading to an increase in the need for residential and commercial construction, hence rising the usage of steel products. The Malaysian economy grew by 4.4% in the first quarter of 2025 (4Q 2024: 4.9%), fueled by consistent growth in domestic demand. As cities are growing and urban populations are increasing, the demand for materials that are strong and adaptable for construction, such as steel, is also on the rise. All this increased emphasis on infrastructure and urbanization is generating a consistent demand for steel products, propelling the market growth.

To get more information on this market, Request Sample

Government Policies and Regulations

The government is working earnestly to enact policies that are supporting the Malaysia steel market growth. Measures to strengthen the industrial base of the country and improve manufacturing capacity are promoting the utilization of domestically produced steel. Policies are also working towards decreasing dependence on imports, thereby opening up space for local steel players to increase their market share. State support through subsidies, tax benefits, and other interventions is constantly improving the competitiveness of domestic steel manufacturers. Additionally, regulatory systems are being revised to achieve sustainability and conformity with environmental requirements, which are prompting the implementation of cleaner, more efficient steel manufacturing methods. All these continuous government initiatives are encouraging the development of the steel sector, making its overall contribution to the Malaysian economy even greater. In 2025, Eastern Steel Sdn Bhd introduced Malaysia’s inaugural Environmental Product Declaration (EPD) for crude steel, representing a significant advancement in industrial responsibility. The groundbreaking initiative was made possible by E-C Digital, a carbon measurement technology company that recently established a Malaysian branch to promote regional sustainability objectives.

Increased Demand from the Automobile Industry

The Malaysian automotive industry is continually driving the need for steel for manufacturing automobile components. Car producers are constantly integrating better steel materials into their manufacturing processes to address safety, durability, and efficiency demands. With growth in the Malaysian automotive industry, especially local assembly and production, there remains a steady requirement for quality steel. In addition, the transition to electric vehicles (EVs) is also catalyzing the demand for certain types of steel required for the manufacture of lighter yet stronger car bodies to hold EV batteries and other components. The steady demand for steel from the motor industry, thus, has a vital function to ensure that the momentum of the steel market in Malaysia continues.

Malaysia Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

The report has provided a detailed breakup and analysis of the market based on the product. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

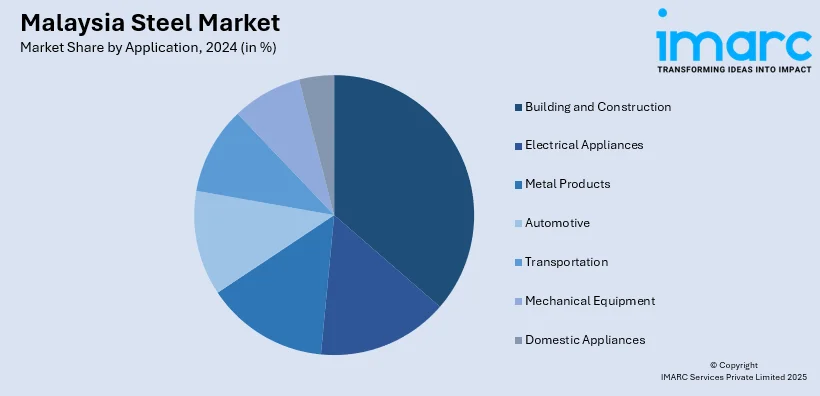

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

States Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia steel market on the basis of type?

- What is the breakup of the Malaysia steel market on the basis of product?

- What is the breakup of the Malaysia steel market on the basis of application?

- What is the breakup of the Malaysia steel market on the basis of states?

- What are the various stages in the value chain of the Malaysia steel market?

- What are the key driving factors and challenges in the Malaysia steel market?

- What is the structure of the Malaysia steel market and who are the key players?

- What is the degree of competition in the Malaysia steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)