Malaysia Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and State, 2025-2033

Malaysia Toys Market Overview:

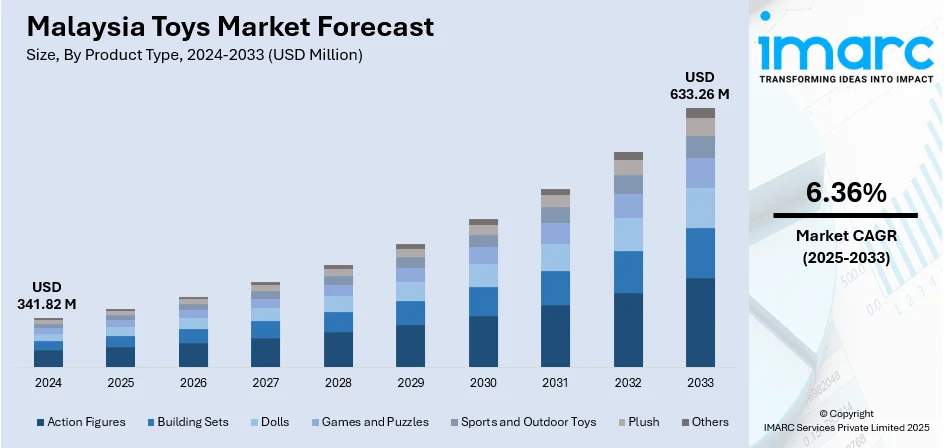

The Malaysia toys market size reached USD 341.82 Million in 2024. The market is projected to reach USD 633.26 Million by 2033, exhibiting a growth rate (CAGR) of 6.36% during 2025-2033. The market is witnessing steady growth driven by rising disposable incomes, urbanization, and increased demand for educational and interactive toys. Parents are increasingly investing in products that combine play with learning, while the popularity of character-based and digital toys continues to rise. E-commerce platforms are enhancing accessibility and product variety, further contributing positively to the Malaysia toys market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 341.82 Million |

| Market Forecast in 2033 | USD 633.26 Million |

| Market Growth Rate 2025-2033 | 6.36% |

Malaysia Toys Market Trends:

Growth in Educational and STEM Toys

In Malaysia, the growing interest in toys that foster education and STEM learning is a significant driver behind the market growth. Parents increasingly seek products that go beyond entertainment, opting for toys and kits that develop problem-solving, analytical thinking, and hands-on skills. STEM toys ranging from basic building blocks and simple science experiment kits to robotics, coding sets, and interactive math games are gaining popularity among families and educational institutions alike. For instance, in October 2023, AEON Fantasy Malaysia announced its partnership with Artec to introduce Artec Logic Puzzles in Toy Master corners at edutainment facilities nationwide. This initiative aims to enhance children’s STEM skills and cognitive development through play. The puzzles cater to various age groups, promoting analytical thinking and decision-making while expanding educational offerings. Retailers and manufacturers are responding with an expanded range of curriculum-aligned playthings targeted at different age groups, from preschoolers to tweens. This shift reflects a broader awareness of future-ready skills and holistic development, reinforced by school curricula emphasizing science and technology. E-commerce platforms have further amplified access, making a diverse selection of STEM toys readily available across urban and suburban areas, contributing positively to the Malaysia toys market growth.

To get more information on this market, Request Sample

Expansion of Online Toy Sales

The rapid growth of e-commerce is significantly transforming the Malaysia toys market, with online platforms emerging as a preferred purchasing channel for consumers. According to the data published by the Ministry of Communications, Malaysia's e-commerce revenue exceeded RM1 Trillion in 2021, with a target of RM1.65 Trillion by 2025, according to MDEC CEO Mahadhir Aziz. The #SayaDigital campaign has helped 500,000 businesses, generating over RM4.6 Billion from 85 Million transactions. Meta's initiative will offer digital upskilling to over 4,000 participants. Parents and gift-buyers are increasingly turning to digital marketplaces due to the convenience of home delivery, broader product selection, and competitive pricing. Online stores allow users to browse a wide range of toy categories ranging from educational kits to licensed character merchandise all in one place, often supported by customer reviews and recommendations. Promotional campaigns, festive discounts, and easy return policies further enhance the appeal of buying toys online. Additionally, smaller and local toy brands are gaining visibility by leveraging digital platforms to reach a national audience. This digital shift increases market accessibility and supports the growth of niche segments, making e-commerce a critical driver in the evolving landscape of the Malaysia toys market.

Malaysia Toys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and sales channel.

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes action figures, building sets, dolls, games and puzzles, sports and outdoor toys, plush, and others.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes up to 5 years, 5 to 10 years, and above 10 years.

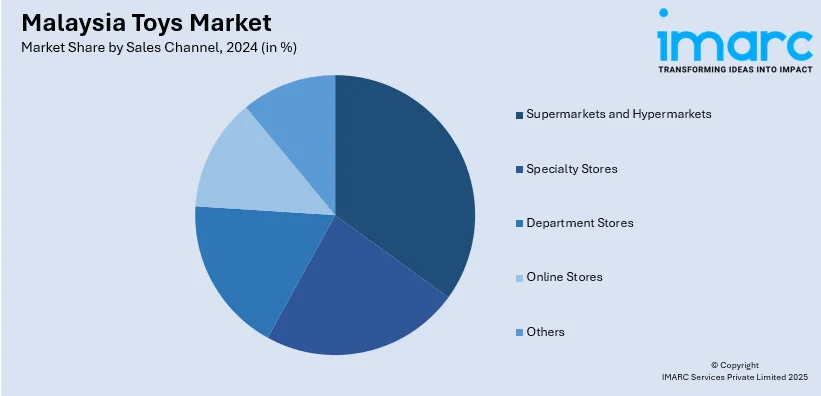

Sales Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, department stores, online stores, and others.

State Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Toys Market News:

- In December 2024, Toys R Us Malaysia announced the successful launch of the Jurassic World Chaos Theory campaign. The event featured exclusive rewards, including a Jurassic World Kids Watch with a minimum purchase and a chance to win a Glow-In-The-Dark Mini Backpack. More Jurassic World experiences are on the way.

- In September 2024, Toys“R”Us Malaysia launched its flagship store at Mid Valley Megamall, featuring the innovative Toy+Play Concept and Kiztopia indoor play park. This revamped store offers a diverse selection of toys, special themed sections, and immersive play areas, aiming to inspire families to bond through fun and learning.

Malaysia Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia toys market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia toys market on the basis of product type?

- What is the breakup of the Malaysia toys market on the basis of age group?

- What is the breakup of the Malaysia toys market on the basis of sales channel?

- What is the breakup of the Malaysia toys market on the basis of state?

- What are the various stages in the value chain of the Malaysia toys market?

- What are the key driving factors and challenges in the Malaysia toys market?

- What is the structure of the Malaysia toys market and who are the key players?

- What is the degree of competition in the Malaysia toys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia toys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia toys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)