Malaysia Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

Malaysia Vegetable Oil Market Overview:

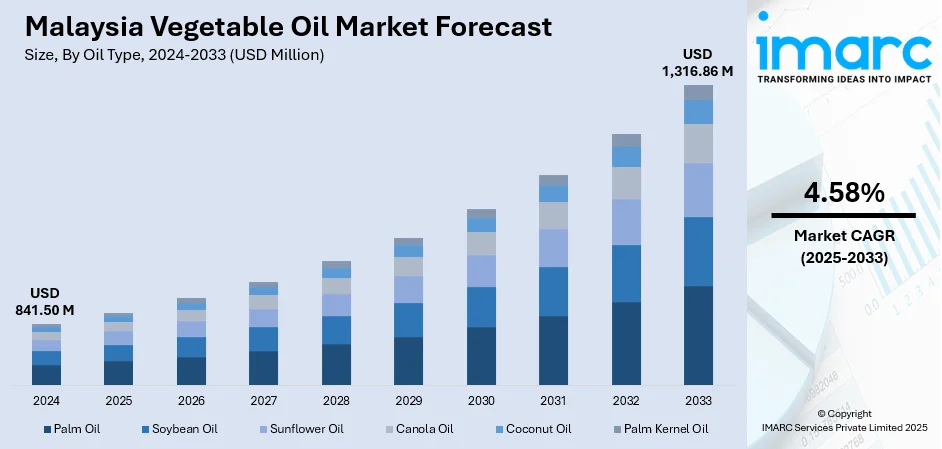

The Malaysia vegetable oil market size reached USD 841.50 Million in 2024. Looking forward, the market is projected to reach USD 1,316.86 Million by 2033, exhibiting a growth rate (CAGR) of 4.58% during 2025-2033. The market is driven by entrenched palm oil consumption across domestic cooking, food processing, and institutional sectors. Malaysia’s export-oriented, vertically integrated refining and oleochemical value chains ensure global trade competitiveness and price stability. Emerging urban preferences for non-palm oils and fortified alternatives are further augmenting the Malaysia vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 841.50 Million |

| Market Forecast in 2033 | USD 1,316.86 Million |

| Market Growth Rate 2025-2033 | 4.58% |

Malaysia Vegetable Oil Market Trends:

Palm Oil Industry as the Cornerstone of National Output

Malaysia is the world’s second-largest producer and exporter of palm oil, and this dominance defines the country’s vegetable oil market structure. According to Malaysia's export data for 2023, the country’s palm oil exports were valued at USD 11.91 Billion, reflecting its continued dominance as a key global supplier and a critical contributor to national trade revenue. The sector supports millions of jobs across plantations, refining, logistics, and export operations. Crude palm oil (CPO) is processed into cooking oil, margarine, and shortening for domestic consumption, while refined palm olein is sold in both branded and bulk formats across Southeast Asia and the Middle East. The government, through the Malaysian Palm Oil Board (MPOB), ensures quality and pricing transparency, while promoting value-added derivatives like fortified oils and vitamin A-enriched variants. Domestic consumption is stable due to the affordability and versatility of palm oil across ethnic cuisines, including Malay, Indian, and Chinese dishes. It is also a staple in foodservice, hawker stalls, and packaged food manufacturing. As Malaysia’s population grows more urban and convenience-focused, palm oil remains an essential ingredient in instant noodles, snack foods, and ready-made meals. Seasonal subsidies and price caps ensure accessibility for low-income households. These deeply rooted domestic linkages across retail, foodservice, and institutional channels solidify palm oil’s dominance in everyday consumption and anchor Malaysia vegetable oil market growth in both social and economic dimensions.

To get more information on this market, Request Sample

Growing Domestic Diversification in Oil Preferences

While palm oil remains dominant, Malaysian consumers, particularly in urban centers like Kuala Lumpur and Penang, are gradually embracing a more diversified portfolio of vegetable oils. Health concerns around saturated fats have prompted some households to explore alternatives such as sunflower, soybean, corn, and olive oil. International retailers and hypermarkets offer these oils as premium options, often marketed with health and nutritional claims. The younger population, influenced by social media and global food trends, is increasingly experimenting with Mediterranean and Korean cuisines that favor light-tasting oils. This has led to steady demand for imported and blended vegetable oil products. Malaysia’s edible oils market is expected to generate USD 329.06 million in 2025, with a per capita revenue of USD 9.15 and average consumption of 1.46 kg per person. By 2030, volume is projected to reach 63.41 million kg, supported by a 5.6% growth in 2026 and a CAGR of 6.61% from 2025 to 2030. Domestic producers are responding by launching fortified and blended oils to cater to these new preferences while maintaining affordability. Additionally, wellness brands and e-commerce platforms have made specialty oils, including rice bran and flaxseed oil, more accessible to niche segments. Government campaigns promoting balanced fat intake and clearer labeling laws also contribute to growing awareness about oil types and usage. This evolving consumer landscape, while still anchored by palm oil, indicates a gradual shift toward oil variety, flavor profiling, and functional nutrition.

Malaysia Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

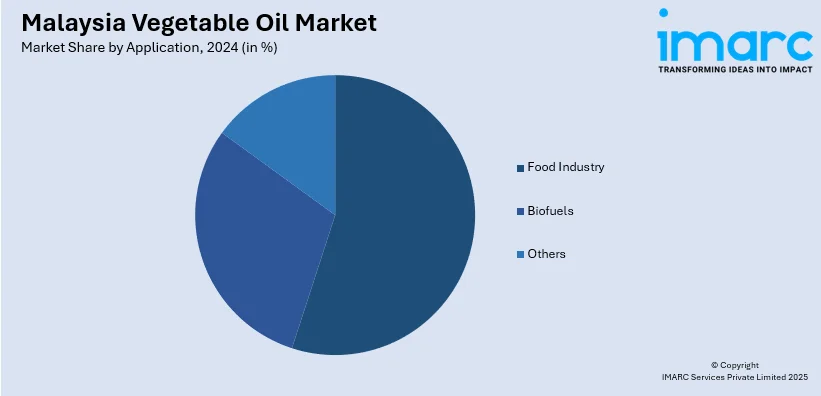

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia vegetable oil market on the basis of oil type?

- What is the breakup of the Malaysia vegetable oil market on the basis of application?

- What is the breakup of the Malaysia vegetable oil market on the basis of region?

- What are the various stages in the value chain of the Malaysia vegetable oil market?

- What are the key driving factors and challenges in the Malaysia vegetable oil market?

- What is the structure of the Malaysia vegetable oil market and who are the key players?

- What is the degree of competition in the Malaysia vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)