Managed Security Services Market Report by Type (Managed SIEM, Managed UTM, Managed DDoS, Managed XDR, Managed IAM, Managed Risk and Compliance, and Others), Deployment Mode (On-premises, Cloud-based), Enterprises Size (Small and Medium-Sized Enterprises, Large Enterprises), Vertical (BFSI, Healthcare, Manufacturing, IT and Telecom, Retail, Defense/Government, and Others), and Region 2025-2033

Global Managed Security Services Market:

The global managed security services market size reached USD 35.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 94.6 Billion by 2033, exhibiting a growth rate (CAGR) of 10.94% during 2025-2033. The rising concerns towards cybersecurity threats, the growing need for compliance with stringent data protection and privacy regulations, and the increasing focus on scalability and cost-effectiveness in organizational operations represent some of the key factors stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 94.6 Billion |

| Market Growth Rate (2025-2033) | 10.94% |

Global Managed Security Services Market Analysis:

- Major Market Drivers: The increasing need for immediate incident response and continuous monitoring in case of data breaches and cyberattacks is one of the key factors propelling the managed security services market demand. Furthermore, the growing focus of small-scale and large organizations on their core competencies instead of resource diversion in managing security operations is also acting as another significant growth-inducing factor.

- Key Market Trends: The rising trend of adopting cloud computing services is positively influencing the managed security services market outlook. Besides this, the growing usage of the Internet of Things (IoT) devices is fueling the global market. Moreover, the inflating number of enhanced MSS providers that enable organizations to maintain regulatory compliance and mitigate risks is further driving the managed security services market share.

- Geographical Trends: According to the managed security services market report, North America exhibits clear dominance, accounting for the largest market share. The rising prevalence of cyber threats, including ransomware attacks and data breaches, owing to a well-developed digital infrastructure, is escalating the demand for managed security services across the region. Additionally, continuous technological advancements are expected to fuel the market growth over the forecasted period.

- Competitive Landscape: Some of the common managed security services market companies include AT&T Inc., Atos SE, BAE Systems plc, Broadcom Inc., BT Group plc, Capgemini SE, DXC Technology Company, International Business Machines Corporation, SecureWorks Inc. (Dell Inc), Trustwave Holdings Inc., Verizon, and Wipro Limited, among many others.

- Challenges and Opportunities: One of the primary challenges hindering the managed security services market revenue includes a shortage of cybersecurity professionals. This shortage can make it difficult for MSSPs to retain and hire skilled personnel, which is crucial for providing high-quality security services. Moreover, integrating managed security services with a client's existing IT infrastructures can be complex, thereby negatively impacting the global market. However, the cost-effectiveness and scalability offered in managed security services and the proliferation of the Internet of Things (IoT) devices are anticipated to bolster the managed security services market over the forecasted period.

Global Managed Security Services Market Trends:

Increasing Cases of Cybersecurity Threats

The rising incidences of ransomware attacks, data breaches, and advanced persistent threats are increasing the need among businesses for strengthening their security measures, thereby propelling the managed security services market statistics. For example, in November 2022, Fortinet, a global leader in integrated, broad, and automated cybersecurity solutions, introduced the FortiGate Cloud-Native Firewall on Amazon Web Services to detect real-time malicious internal and external threats. In addition to this, in September 2022, Check Point Software Technologies Ltd. developed Check Point Horizon, a prevention-focused suite to enhance defense across the cloud and network endpoints and prevent future cyberattacks. Moreover, the widespread popularity of managed security services providers, as they offer advanced technologies, proactive security measures, specialized expertise, etc., are further acting as significant growth-inducing factors. For instance, in September 2023, MicroAge, a digital transformation expert, announced the launch of MicroAge Managed Security Services (MSS) that aid in providing expert security monitoring. Additionally, in January 2024, Atturra partnered with Sydney-based startup MyCISO to introduce its managed service for security program management in the commercial and education sectors. The MyCISO SaaS platform is specifically designed to deliver management and assessments of security programs.

Rising Need for Compliance with Regulatory Requirements

The implementation of stringent rules and regulations by government bodies across countries to protect the privacy rights of individuals is catalyzing the managed security services market's recent prices. For instance, the General Data Protection Regulation (GDPR) was enacted by the European Union to protect personal data. Similarly, the California Consumer Privacy Act (CCPA) focuses on consumer privacy rights. In line with this, the Personal Information Protection and Electronic Documents Act (PIPEDA) is for private-sector organizations. Moreover, this regulation applies to private enterprises that are based in Canada that collect consumer data in the course of commercial activities, as well as international companies that target customers across the country. Consequently, this complex compliance landscape is escalating the demand for managed security services (MSS) providers to assist organizations in implementing robust security measures.

Growing Number of Strategic Partnerships

One of the managed security services market's recent developments is the wide presence of both small- and medium-sized enterprises and global players who are using strategies, such as collaborations and mergers and acquisitions (M&A), to improve their services and gain a competitive advantage. For example, in November 2023, AT&T announced an agreement to create a standalone managed cybersecurity services business. Moreover, the managed cybersecurity joint venture was done to select security software solutions, enhance security consulting resources, hold associated managed security operations, etc. In line with this, SepteWipro collaborated with Palo Alto Networks to offer next-generation security and end-to-end security to protect critical data by offering easy-to-manage solutions. These key players are also developing enhanced services, which is one of the managed security services market's recent opportunities. For example, in October 2023, Trustwave Holdings Inc. announced the introduction of Trustwave Managed SIEM for Microsoft Sentinel. Trustwave's offering is specially designed to help businesses using Microsoft Sentinel with optimized return on investment, improved security capabilities, rapid response times, etc.

Global Managed Security Services Market Segmentation:

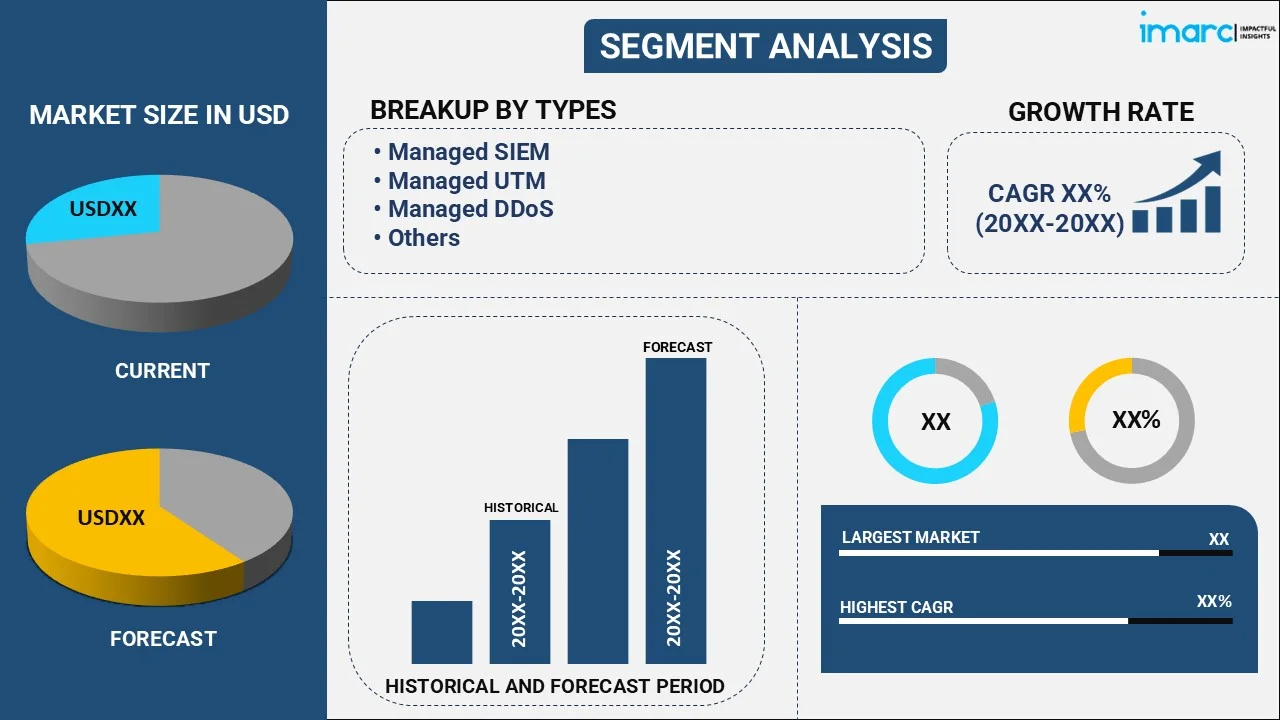

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the type, deployment mode, enterprises size, and vertical.

Breakup by Type:

- Managed SIEM

- Managed UTM

- Managed DDoS

- Managed XDR

- Managed IAM

- Managed Risk and Compliance

- Others

Managed SIEM dominates the managed security services market

The report has provided a detailed breakup and analysis of the market based on the type. This includes managed SIEM, managed UTM, managed DDoS, managed XDR, managed IAM, managed risk and compliance, and others. According to the report, managed SIEM accounted for the largest market share.

The widespread adoption of managed SIEM services by organizations, on account of the increasing complexities of cyber threats and the growing need for improving their response capabilities and threat detection, is primarily propelling the global market. Apart from this, outsourcing managed SIEM providers in organizations allows them to leverage the specialized skills and technologies that they lack to manage their SIEM systems effectively. For instance, Tata Communications offers managed detection and response (MDR) services to detect and automate the threat response across IT and OT infrastructures. Furthermore, the implementation of stringent regulatory compliance mandates, including HIPAA and GDPR, is propelling the demand for managed SIEM services to establish compliance.

Breakup by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based represents the largest managed security services market segment

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based. According to the report, the cloud-based accounted for the largest market share.

The shifting preference towards cloud-based deployment, as it offers scalability and flexibility, represents one of the primary factors catalyzing the global market. Apart from this, the easy availability of remote accessibility in cloud-based security services, thereby resulting in secured data and systems regardless of location, is further acting as another significant growth-inducing factor. For example, SepteWipro collaborated with Palo Alto Networks to offer next-generation security and end-to-end security to secure critical data by providing easy-to-manage solutions.

Breakup by Enterprises Size:

- Small and Medium-Sized Enterprises

- Large Enterprises

Large enterprises represent the largest segment in the managed security services market

The report has provided a detailed breakup and analysis of the market based on the enterprises size. This includes small and medium-sized enterprises and large enterprises. According to the report, large enterprises accounted for the largest market share.

The increasing inclination among large enterprises towards outsourcing services, such as managed security services, is primarily augmenting the market growth in this segmentation. Moreover, large enterprises deal with complex IT environments that usually involve various networks, systems, and endpoints. By using managed security services, they are able to effectively secure their entire ecosystem and manage complexity. Besides this, these enterprises also benefit from these services, as they aid them in mitigating their higher security risks and meeting stringent compliance regulations. Additionally, large enterprises can outsource security management, which, in turn, allows in-house IT teams to focus on core business functions.

Breakup by Vertical:

- BFSI

- Healthcare

- Manufacturing

- IT and Telecom

- Retail

- Defense/Government

- Others

BFSI holds a significant share in the managed security services market

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, healthcare, manufacturing, IT and telecom, retail, defense/government, and others. According to the report, BFSI accounted for the largest market share.

The growth of this segment is primarily propelled, owing to the implementation of stringent regulations by government bodies necessitating compliance with data protection and security requirements in the BFSI sector. Moreover, this can be ensured via managed security services by protecting sensitive customer information and adhering to standards, including the Payment Card Industry Data Security Standard (PCI DSS). Apart from this, managed security services are gaining extensive traction in the BFSI industry, as they help in preventing financial losses by thwarting and detecting unauthorized access to financial systems.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest managed security services market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The rising need for streamlining IT functions is bolstering the managed security services market in North America. Furthermore, the inflating popularity of Bring your Own Device (BYOD), particularly in countries, including the United States, on account of the widespread adoption of smartphones and tablets, is also acting as another significant growth-inducing factor. Apart from this, companies in North America are integrating IT solutions tailored to business needs, which is further positively influencing the managed security services market across the region. For example, Managed Solution, a U.S.-based company, integrated technical skillsets, and the required resources to discover challenges, custom design, and execute a comprehensive technology, making customers more compliant, secure, and efficient. SD-WAN managed service providers across North America also differentiate themselves by security offerings. For example, Cato Networks offers a cloud-native platform that includes a secure web gateway, NGFW, advanced threat prevention, cloud and mobile access protection, etc. As per the managed security services market overview, these factors will continue to drive the regional market in the coming years.

Competitive Landscape:

The top players in the global managed security services market are conducting extensive research and development (R&D) activities focusing on comprehensive and innovative solutions while addressing evolving cybersecurity challenges. They are focusing on enhancing their threat intelligence capabilities by leveraging artificial intelligence (AI) and machine learning (ML) algorithms to analyze large-scale security data in real-time. In line with this, the major companies are expanding their service offerings to include a wide range of managed security services in their portfolio to provide end-to-end security services. Furthermore, the key players are entering into strategic partnerships and collaborations with technology providers, system integrators, and industry experts to access new customer segments and gain a competitive edge.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AT&T Inc.

- Atos SE

- BAE Systems plc

- Broadcom Inc.

- BT Group plc

- Capgemini SE

- DXC Technology Company

- International Business Machines Corporation

- SecureWorks Inc. (Dell Inc)

- Trustwave Holdings, Inc.

- Verizon

- Wipro Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Managed Security Services Market News:

- February 2024: Accenture has made a strategic investment through Accenture Ventures in Tenchi Security, a third-party cyber risk management company. Accenture will leverage Tenchi’s SaaS platform as a new component of its managed security services offering to assist organizations in reducing cyber risks across their supply chain.

- January 2024: Kyndryl, one of the largest technology infrastructure services providers, announced two new security edge services developed jointly with Cisco to help customers in enhancing their security controls and proactively address and respond to cyber incidents.

- January 2024: Judy Security, a cybersecurity provider, and Strike Graph, a compliance operations and certification specialist, have entered a strategic partnership aimed at cybersecurity and compliance management for small and medium-sized businesses (SMBs).

Managed Security Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Managed SIEM, Managed UTM, Managed DDoS, Managed XDR, Managed IAM, Managed Risk and Compliance, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprises Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Healthcare, Manufacturing, IT and Telecom, Retail, Defense/Government, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AT&T Inc., Atos SE, BAE Systems plc, Broadcom Inc., BT Group plc, Capgemini SE, DXC Technology Company, International Business Machines Corporation, SecureWorks Inc. (Dell Inc), Trustwave Holdings, Inc., Verizon, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global managed security services market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global managed security services market?

- What is the impact of each driver, restraint, and opportunity on the global managed security services market?

- What are the key regional markets?

- Which countries represent the most attractive managed security services market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the managed security services market?

- What is the breakup of the market based on the deployment mode?

- Which is the most attractive deployment mode in the managed security services market?

- What is the breakup of the market based on the enterprises size?

- Which is the most attractive enterprises size in the managed security services market?

- What is the breakup of the market based on the vertical?

- Which is the most attractive vertical in the managed security services market?

- What is the competitive structure of the global managed security services market?

- Who are the key players/companies in the global managed security services market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the managed security services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global managed security services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the managed security services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)