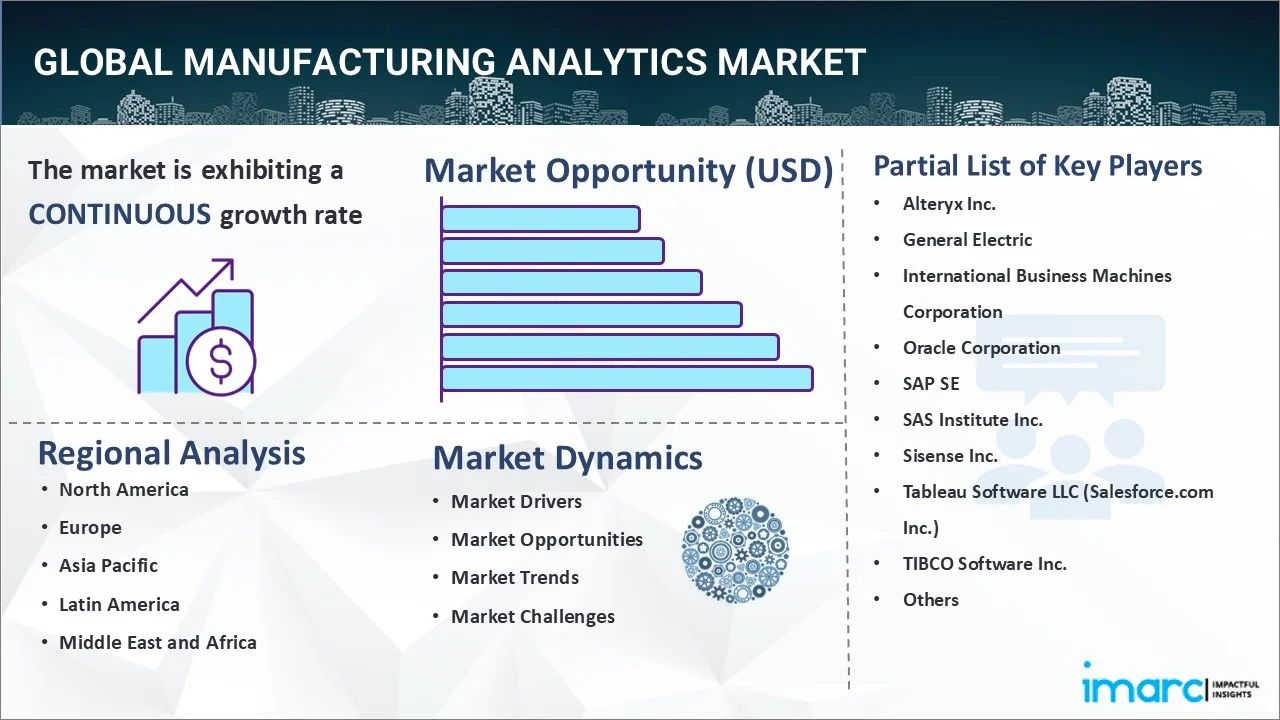

Manufacturing Analytics Market Report by Component (Software, Services), Deployment Model (Cloud-based, On-premises), Application (Predictive Maintenance, Inventory Management, Supply Chain Optimization, and Others), Industry Vertical (Semiconductor and Electronics, Energy and Power, Pharmaceutical, Automobile, Heavy Metal and Machine Manufacturing, and Others), and Region 2025-2033

Global Manufacturing Analytics Market:

The global manufacturing analytics market size reached USD 15.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 65.8 Billion by 2033, exhibiting a growth rate (CAGR) of 17.7% during 2025-2033. North America currently dominates the overall market. The emerging trend of automation in industrial processes, along with the development of Industry 4.0 trends, is primarily augmenting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.2 Billion |

|

Market Forecast in 2033

|

USD 65.8 Billion |

| Market Growth Rate 2025-2033 | 17.7% |

The market is driven by the heightened need for predictive maintenance, wherein manufacturers utilize analytics to monitor equipment health and identify breakdowns before they occur, reducing unplanned downtime and repair costs. Another key driver is the increasing emphasis on quality control, which uses analytics tools to track product quality in real time, spot flaws, and ensure uniformity throughout the production process. Supply chain optimization is also important, as businesses continue to rely on analytics to estimate demand, manage inventory, and improve coordination across procurement, manufacturing, and distribution. The desire for regulatory compliance is promoting the employment of analytics, allowing businesses to better monitor safety standards, environmental norms, and industry laws. The shift towards cloud-based solutions is making analytics more accessible and scalable, encouraging adoption among small and medium-sized manufacturers.

Global Manufacturing Analytics Market Trends:

Increasing competition in manufacturing

Rising competition in manufacturing is fueling the market growth. In a highly competitive environment, manufacturers need accurate and timely insights to make smarter decisions. Manufacturing analytics helps companies monitor performance, identify bottlenecks, and enhance operational efficiency. It allows real-time tracking of key metrics like machine utilization, defect rates, and energy utilization, enabling quick corrective actions. As businesses are facing pressure to deliver better quality products faster and at lower costs, analytics is becoming essential for maintaining consistent output and meeting customer expectations. It also supports strategic planning by highlighting trends. In this race for excellence and efficiency, major players in the thriving manufacturing industry are employing analytics solutions to stay ahead. According to industry reports, the India manufacturing industry is set to grow at a CAGR of 4.8% during 2025-2030.

Rising adoption of Industry 4.0

Increasing employment of Industry 4.0 is propelling the market growth. According to the IMARC Group, the industry 4.0 market size reached USD 164.7 Billion in 2024. Industry 4.0 incorporates cutting-edge technologies, such as automation and robotics, producing large volumes of data throughout manufacturing processes. Manufacturing analytics tools analyze this data to provide immediate insights, allowing manufacturers to enhance efficiency, minimize downtime, and maximize output. With factories progressing towards digitalization, the demand for data-based decision-making is rising, rendering analytics crucial for overseeing machine efficiency, anticipating breakdowns, and controlling quality. Industry 4.0 facilitates customization and flexible manufacturing, which necessitates thorough data analysis for quick modifications. As smart factories are becoming standard, manufacturers continue to depend on analytics to address changing requirements.

Growing utilization of Internet of Things (IoT)

Rising use of the IoT is positively influencing the market. As per industry reports, the IoT market size reached USD 64.8 Billion in 2024. IoT devices continuously monitor operations and generate large volumes of data, which manufacturing analytics tools employ to identify patterns, inefficiencies, and faults. This real-time visibility helps manufacturers improve decision-making, reduce downtime, and optimize resource use. The integration of IoT with analytics allows better quality control and faster response to issues. As more factories are adopting advanced technologies, the need for efficient analytics is growing, helping manufacturers become more agile, data-oriented, and competitive. Thus, IoT acts as a key enabler for the growth of manufacturing analytics solutions.

Key Growth Drivers of Manufacturing Analytics Market:

Rising use of cloud computing

Cloud platforms allow manufacturers to collect and analyze large volumes of data from various sources without investing heavily in on-premise infrastructure. This helps small and medium-sized manufacturers adopt analytics solutions easily. Cloud-based analytics offer scalability, real-time updates, and remote access, enabling faster decision-making and improved collaboration across departments. It also supports integration with enterprise resource planning (ERP) systems and automation tools, creating a unified data environment. As manufacturers are focusing on digital transformation, cloud computing provides the backbone for implementing smart analytics tools. The ability to access insights anytime and from anywhere increases operational agility and efficiency. This convenience and affordability make cloud computing a key driver for the growing utilization of manufacturing analytics.

Need for supply chain optimization

Supply chain optimization is creating the need for real-time insights into every stage of production and distribution. Manufacturers use analytics to oversee stock levels, monitor deliveries, predict demand, and manage supplier performance. By analyzing data from supply chain operations, companies can reduce delays, avoid stockouts, and minimize excess inventory. This helps in improving delivery timelines, lowering costs, and enhancing customer satisfaction. Manufacturing analytics also supports better coordination between procurement, production, and logistics teams, enabling smarter planning and quicker responses to disruptions. As supply chains are becoming more complex and worldwide, the need for accurate, data-oriented decisions is rising. Manufacturers are utilizing analytics solutions to identify inefficiencies, improve transparency, and gain a competitive advantage.

Growing regulatory compliance requirements

Rising regulatory compliance needs are encouraging companies to maintain accurate records, meet safety standards, and follow industry-specific guidelines. Manufacturing analytics helps organizations track and document every step of the production process, ensuring they meet legal and quality requirements. It enables real-time monitoring of operations, which helps detect deviations, prevent violations, and ensure product consistency. With increasing regulations related to safety, emissions, labor, and product standards, manufacturers rely on analytics to generate reports, perform audits, and maintain transparency. Analytics tools also aid in identifying and addressing compliance risks before they escalate. By automating compliance tracking and documentation, companies save time and lower the risk of penalties. As regulatory frameworks are becoming more complex, manufacturers are employing analytics solutions to stay compliant.

Manufacturing Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global manufacturing analytics market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on component, deployment model, application and industry vertical.

Breakup by Component:

- Software

- Services

Software dominates the market

The report has provided a detailed breakup and analysis of the market based on the components. This includes software and services. According to the report, software represented the largest segment.

Leading companies across the globe are developing enhanced software solutions for manufacturing analytics processes for inventory management, real-time quality monitoring, enhancing overall productivity and profitability, etc. This, in turn, is expected to fuel the manufacturing analytics software market over the forecasted period. For example, Datanomix collaborated with Hexagon to introduce its automated production intelligence software to global manufacturing customers. The software simplified the monitoring of production processes and provided enhanced efficiency. Also, the partnership aligned with the vision of Hexagon for autonomous manufacturing and the focus of Datanomix on automated production insights. These collaborations are expected to augment the software segment in the manufacturing analytics market in the coming years.

Breakup by Deployment Model:

- Cloud-based

- On-premises

On-premises exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the deployment model has also been provided in the report. This includes cloud-based and on-premises. According to the report, on-premises accounted for the largest market share.

Breakup by Application:

- Predictive Maintenance

- Inventory Management

- Supply Chain Optimization

- Others

Predictive maintenance currently accounts for the majority of the global market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes predictive maintenance, inventory management, supply chain optimization, and others. According to the report, predictive maintenance represented the largest segment.

Predictive maintenance solutions are gaining extensive traction, owing to factors such as easy access to data, remote access to data, unification of information, reduced costs, and automatic updates, among others, associated with cloud-based deployment. For example, Google Cloud launched Manufacturing Data Engine and Manufacturing Connect, two new solutions specifically designed to enable manufacturers to connect historically siloed assets, improve the visibility from the factory floor to the cloud, and process and standardize data.

Breakup by Industry Vertical:

- Semiconductor and Electronics

- Energy and Power

- Pharmaceutical

- Automobile

- Heavy Metal and Machine Manufacturing

- Others

Currently, automobile exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes semiconductors and electronics, energy and power, pharmaceutical, automobile, heavy metal and machine manufacturing, and others. According to the report, automobile represented the largest segment.

The rising inclination towards more data-driven insights in the automotive industry to avoid the costs associated with over-inventory stocking and faulty assembly is propelling the need for manufacturing analytics for the maintenance of the assembly lines more accurately.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest regional market for manufacturing analytics.

According to the manufacturing analytics market overview, the wide presence of some of the prominent players in North America, such as IBM Corporation, General Electric Company, SAP SE, and TIBCO Software, is primarily propelling the regional market.

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the manufacturing analytics top companies are listed below:

- Alteryx Inc.

- General Electric

- International Business Machines Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Sisense Inc.

- Tableau Software LLC (Salesforce.com Inc.)

- TIBCO Software Inc.

- Wipro Limited

- Zensar Technologies Ltd

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Manufacturing Analytics Market News:

- June 2025: Benteler, the prominent German auto parts supplier, started building its new manufacturing plant in Kenitra. To boost its digital transformation and improve competitiveness, Benteler would incorporate cutting-edge Industry 4.0 technologies created through its ‘SMART FACTORIES’ initiative. This encompassed big data analysis and multiple connectivity solutions for smart, data-informed operations.

- March 2025: HCL Technologies Ltd launched HCLTech Insight, a smart manufacturing solution powered by artificial intelligence (AI), aimed at improving data insights and analytics for manufacturers. The solution was applicable to enterprises in various sectors, such as automotive, aerospace, and electronics, featuring interactive dashboards and AI-based virtual help to address defects instantly, enhancing production quality and cost effectiveness.

- March 2025: Caliber introduced 4 Analytics and AI-oriented solutions to transform pharma manufacturing and quality. CalGenie, a pharmaceutical-centric, AI-based tool was aimed at optimizing the company's internal quality value chain. It provided immediate answers, executed intricate calculations, and created insightful summaries from straightforward prompts, equipping users with timely information.

- January 2025: Tata Elxsi, a worldwide leader in technology and design services, partnered with Minespider, a provider of blockchain-based traceability solutions, to introduce MOBIUS+, an enhanced platform for battery lifecycle management. Created to tackle the increasing demand for sustainability, regulatory adherence, and performance improvement in the battery sector, MOBIUS+ sought to transform the management of batteries from manufacturing through to recycling. This cutting-edge platform combined sophisticated data analysis, live monitoring, and compliance functionalities to provide the full battery ecosystem.

- December 2024: Aegis Software demonstrated leadership by backing a worldwide research initiative aimed at ensuring AI and analytics provide advantages to manufacturers. The research survey concentrated on operations was available for responses throughout December 2024. Created by Tech-Clarity and the Manufacturing Enterprise Solutions Association International (MESA), this survey examined how manufacturers could utilize conventional analytics and metrics alongside predictive AI.

- September 2024: LumaCyte unveiled predictive ‘CAR T Donor Analytics’ to transform cell therapy manufacturing. Utilizing its innovative Laser Force Cytology™ (LFC™) technology and Radiance® instrument, LumaCyte released significant data insights regarding the complex and highly variable cellular starting material sourced from patients and donors, enabling cell therapy developers to anticipate manufacturing success for particular donors or patients.

Manufacturing Analytics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Component, Deployment Model, Application, Industry Vertical, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alteryx Inc., General Electric, International Business Machines Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Sisense Inc., Tableau Software LLC (Salesforce.com Inc.), TIBCO Software Inc., Wipro Limited, Zensar Technologies Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the manufacturing analytics market from 2019-2033.

- The manufacturing analytics market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the manufacturing analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global manufacturing analytics market was valued at USD 15.2 Billion in 2024.

We expect the global manufacturing analytics market to exhibit a CAGR of 17.7% during 2025-2033.

The emerging automation trend in industrial processes, along with the rising adoption of manufacturing analytics, as it assists in demand forecasting, real-time quality monitoring, and inventory management, is primarily driving the global manufacturing analytics market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units, thereby negatively impacting the global market for manufacturing analytics.

Based on the component, the global manufacturing analytics market has been segmented into software and services, where software currently holds the majority of the total market share.

Based on the deployment model, the global manufacturing analytics market can be divided into cloud-based and on-premises. Currently, on-premises exhibit a clear dominance in the market.

Based on the application, the global manufacturing analytics market has been categorized into predictive maintenance, inventory management, supply chain optimization, and others. Among these, predictive maintenance currently accounts for the majority of the global market share.

Based on the industry vertical, the global manufacturing analytics market can be segregated into semiconductor and electronics, energy and power, pharmaceutical, automobile, heavy metal and machine manufacturing, and others. Currently, automobile exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global manufacturing analytics market include Alteryx Inc., General Electric, International Business Machines Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Sisense Inc., Tableau Software LLC (Salesforce.com Inc.), TIBCO Software Inc., Wipro Limited, and Zensar Technologies Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)