Marine Propulsion Engine Market Size, Share, Trends and Forecast by Engine Type, Power Source, Power Range, Vessel Type, and Region, 2025-2033

Marine Propulsion Engine Market Size and Share:

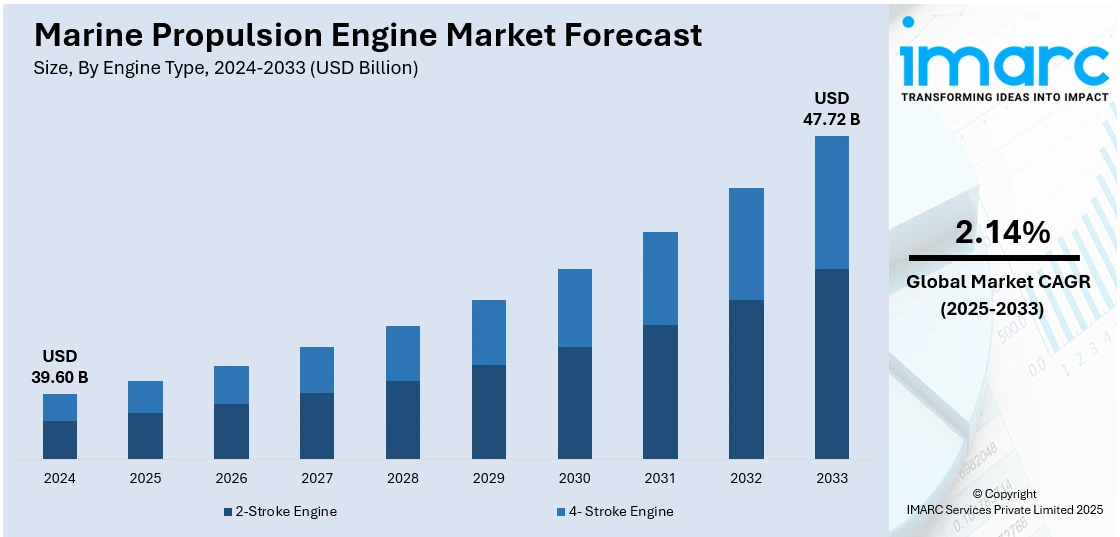

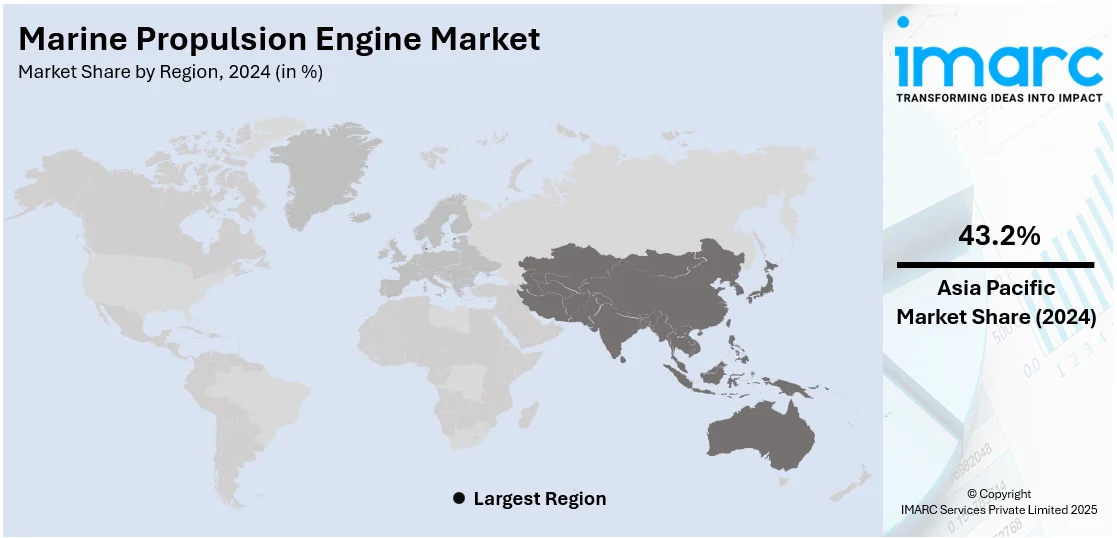

The global marine propulsion engine market size was valued at USD 39.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 47.72 Billion by 2033, exhibiting a CAGR of 2.14% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of around 43.2% in 2024. The market is driven by the growing requirement for energy-saving, environmentally friendly solutions, spearheaded by stricter environmental laws and increasing use of alternative fuels such as LNG, biofuels, and hydrogen. Advances in technology, including carbon capture solutions and smart shipping, are further driving market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 39.60 Billion |

|

Market Forecast in 2033

|

USD 47.72 Billion |

| Market Growth Rate (2025-2033) | 2.14% |

The marine propulsion engine market is largely fueled by the increasing need for energy-efficient solutions in the shipping sector, as nations increasingly tighten environmental regulations to limit maritime emissions. In tandem with this, the rising emphasis on minimizing carbon footprints is driving the use of green propulsion technologies like electric and hybrid systems, which provide cleaner alternatives to conventional fossil fuel-powered engines. On April 10, 2025, MAN Energy Solutions made an announcement on the selection of its MAN 175D engines for a carbon capture and storage (CCS) project at sea. The engines will be part of a system used for the capture of ships' CO2 emissions and the promotion of marine operations' environmental sustainability. This step is an indication of the increasing acceptance of cutting-edge technologies in the shipping industry for regulatory compliance and curtailing the carbon footprint of the industry. The market is witnessing a shift toward substitute fuel sources such as LNG, biofuels, and hydrogen, one of the essential marine propulsion engine market drivers that further boosts the growth momentum. The advances being made in intelligent shipping technologies as smart sensors and autonomous control systems improve engine performance and lower fuel consumption are also spurring growth.

The United States is a significant regional market, led by the growing use of environmentally friendly shipping solutions and the mounting pressure to lower maritime emissions. In line with this, advancements in green propulsion technologies such as hydrogen-powered vessels and biofuel-driven engines are contributing to the market’s expansion. Moreover, the U.S. government’s implementation of stricter environmental regulations for the shipping industry is creating a demand for more efficient and eco-friendly propulsion systems, positively impacting the. The growing marine propulsion engine market demand is also fueled by increasing international trade, which necessitates a larger fleet of container ships and bulk carriers. On March 6, 2025, U.S.-based Cummins announced that it had received DNV (Det Norske Veritas) approval in principle for its new methanol-ready marine engine. This engine is designed to support the shipping industry's transition to more sustainable fuel sources. The approval marks a significant step toward enabling global shipping fleets to reduce emissions and move toward cleaner energy alternatives in the marine sector. The growing interest in reducing operational costs by improving fuel efficiency is also acting as a driving force for the market. Besides this, the increasing focus on the global decarbonization efforts and compliance with international maritime standards is encouraging the use of alternative fuels and cleaner propulsion systems.

Marine Propulsion Engine Market Trends:

Growth in Global Trade

The rising international trade due to globalization and industrialization is significantly boosting the demand for marine propulsion engines, particularly for container ships. According to UNCTAD, global trade reached an all-time high of USD 33 Trillion in 2024, growing by 3.7% or USD 1.2 Trillion compared to the previous year. Of this increase, services were the main driver, rising by 9%, while goods trade saw a 2% increase, adding USD 500 Billion to the global trade volume. This robust growth in trade necessitates the expansion of marine transportation capabilities, especially for vessels carrying goods such as oil, natural gas, mineral ores, and consumer products-which is one of the major marine propulsion engine market growth factors,. As more goods are traded globally, there is an increasing need for larger and more efficient shipping fleets, driving the market further.

Rising Demand for Energy Efficiency and Sustainable Solutions

With a growing emphasis on reducing fossil fuel consumption and improving energy efficiency, the marine industry is increasingly adopting marine electric propulsion engines. This is further evidenced by a coalition at COP 29 that called for tripling energy efficiency investments to USD 1.8 Trillion annually by 2030, with the goal of increasing improvement rates from 1% to 4%. The rising focus on energy efficiency is accelerating the adoption of sustainable propulsion technologies in the marine sector, including nuclear propulsion and liquefied natural gas (LNG) engines, which are increasingly seen as more environmentally friendly alternatives to traditional fuel-powered engines. This push for sustainability not only helps to mitigate climate change impacts but also aligns with stricter environmental regulations being enforced across the globe.

Technological Advancements and Adoption of Alternative Fuels

According to the marine propulsion engine market analysis, the adoption of alternative fuels for marine propulsion engines is gaining momentum as technology continues to advance. These include fuels such as bio-methane and algal oils, which contribute to reducing exhaust gas emissions and enhancing sustainability. Furthermore, Shell's LNG Outlook 2025 projects that global LNG demand will increase by approximately 60% by 2040, reaching 630–718 Million Tonnes annually. The growing utilization of LNG, along with the push for cleaner technologies, is playing a pivotal role in transforming the marine propulsion engine market. This trend is also supported by ongoing efforts to improve the efficiency of marine propulsion engines, which enhances cargo holding capacity in next-generation tankers. As fuel alternatives like LNG become more widely used, the technology behind propulsion engines will need to evolve, integrating more advanced fuel systems and further improving fuel efficiency.

Marine Propulsion Engine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global marine propulsion engine market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on engine type, power source, power range, and vessel type.

Analysis by Engine Type:

- 2-Stroke Engine

- 4- Stroke Engine

The 2-stroke engine segment leads the market with approximately 60.3% market share in 2024. This dominance can be attributed to the engine's high efficiency and reliability in large vessels, particularly those operating in the bulk carrier and container ship categories. 2-stroke engines are highly regarded for their power output and fuel efficiency, making them ideal for long-haul maritime transport. They also have fewer moving parts, which contributes to their lower maintenance costs and longer lifespan compared to 4-stroke engines. Additionally, the rising demand for larger vessels, which require more powerful engines, is driving the preference for 2-stroke engines in the global marine propulsion engine market.

Analysis by Power Source:

- Diesel

- Gas Turbine

- Natural Gas

- Steam Turbine

- Fuel Cell

- Others

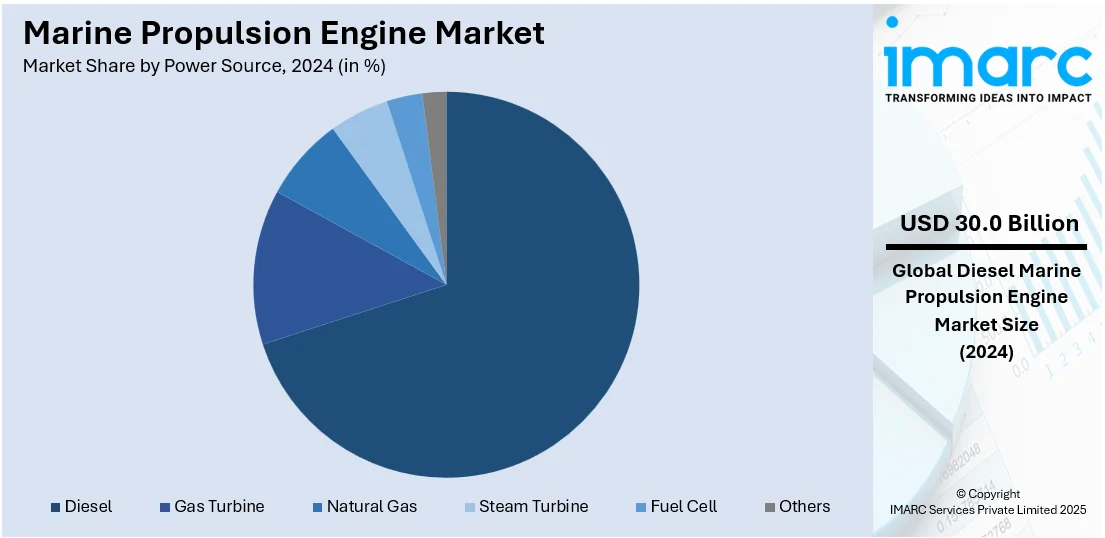

The diesel segment is the largest in the market, holding around 75.7% of the global market share in 2024. Diesel engines dominate the marine propulsion engine market because of their robustness, fuel efficiency, and long operational life. Diesel engines are favored due to their ability to deliver high torque at low speeds, making them particularly suitable for heavy-duty ships, such as tankers and container ships. Additionally, the availability and cost-effectiveness of diesel as a marine fuel further contributes to its continued dominance. Diesel-powered propulsion engines are also capable of running efficiently for extended periods, thus offering significant fuel savings for shipping companies, which is critical in the competitive global trade environment, and is contributing to the overall marine propulsion engine market demand.

Analysis by Power Range:

- 80-750 HP

- 751-5000 HP

- 5001-10,000 HP

- 10,001-20,000 HP

- Above 20,000 HP

The above 20,000 HP power range is the leading segment in the market, commanding 38.4% of the market share in 2024. This is mainly due to the demand for higher power engines in large-scale vessels such as container ships, bulk carriers, and oil tankers, which require engines capable of handling vast amounts of cargo. As the global demand for trade and transportation continues to rise, the need for more powerful and efficient propulsion engines has grown significantly. Engines in the Above 20,000 HP range are necessary for vessels that operate on long routes and carry heavy loads, offering higher speeds and greater fuel efficiency. The increasing globalization of trade, especially in the transportation of bulk goods and energy, is further propelling the market for these high-powered marine propulsion engines.

Analysis by Vessel Type:

- Bulk Carriers

- Container Ships

- Passenger Ships

- Support Vessels

- Tankers

- Gas Carriers

- Military Vessels

- Others

Passenger ships dominate the market in 2024 due to rising global demand for cruise tourism, urban water transport, and ferries. These ships require high-performance engines for long-distance travel, safety, and onboard comfort, driving consistent investments in advanced propulsion systems. Regulatory pressure to reduce emissions has further encouraged the adoption of modern, fuel-efficient engines on these vessels. Additionally, ongoing fleet expansion and refurbishment programs among cruise operators and public transit agencies boost engine demand. The passenger ship segment also benefits from steady government support in infrastructure and coastal connectivity, reinforcing its position as the leading contributor in the global market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The Asia Pacific region, with a market share of approximately 43.2% in 2024, is leading the global market. The dominance of this region is largely due to the presence of major shipping hubs such as China, Japan, and South Korea, which are some of the largest shipbuilders and marine fleet operators globally. Asia Pacific's demand for marine propulsion engines is driven by the increasing industrialization, expanding international trade routes, and the rapid development of new ports and shipping infrastructure. Additionally, the rising focus on energy-efficient solutions and environmental regulations is prompting significant investments in advanced propulsion technologies across the region. As Asia Pacific continues to be a major player in global trade and shipping, it is expected that the demand for advanced marine propulsion engines will remain strong, further driving the growth of the market.

Key Regional Takeaways:

United States Marine Propulsion Engine Market Analysis

The United States holds a substantial share of the North America marine propulsion engine market with around 87.80% in 2024. The market is led mainly by growing offshore oil and gas investments, which is driving demand for high-performance deep-sea propulsion systems. As per this, increasing use of LNG-powered ships to meet emission control regulations is fueling technology advancements in alternative fuel-based engines and driving the market. Likewise, expansion in naval modernization programs to improve fleet capabilities is increasing demand for advanced propulsion solutions and enhancing the market demand. The growing cruise and leisure boat market is also adding to market growth through demand for efficient, low-noise propulsion technologies. As per the Cruise Lines International Association's 2024 State of the Cruise Industry report, the United States experienced a growth of 2.7 million cruise passengers, in 2023, a 19% increase from 2019. In addition, continued investment in port infrastructure stimulating fleet renewal with engines that comply with new efficiency standards, are driving market growth. Moreover, several federal clean maritime technology incentives affecting engine selections, are promoting market demand. Furthermore, growth in commercial cargo on the Great Lakes and sea freight corridors servicing ongoing engine purchase, is driving a stimulus in the market.

Europe Marine Propulsion Engine Market Analysis

The marine propulsion engine market in Europe is influenced by stricter environmental regulations. Similarly, the introduction of EU’s Fit for 55 packages, compelling shipowners to invest in compliant propulsion technologies, is also propelling market growth. Furthermore, growth in short-sea shipping, supported by EU transport policies, is augmenting market demand for efficient, low-emission engines. The expansion of offshore wind energy projects in the North Sea and Baltic Sea increasing the need for specialized vessels with advanced propulsion systems, is augmenting product sales. The Energy Ministers of the 9 North Seas countries reaffirmed plans to render Europe’s green power hub, targeting 9.5 GW turbine capacity by the end of 2025, EUR 10 billion in supply chain investments, and launching a dedicated offshore financing facility to support hybrid wind projects. Additionally, rising retrofit activities across commercial fleets driving upgrades to meet efficiency benchmarks, are encouraging higher product uptake. The region’s leadership in electric and hybrid marine propulsion is also fueling market innovation. Moreover, accelerated investment in autonomous vessels influencing engine design requirements, is enhancing market accessibility. Besides this, the resurgence of shipbuilding activity in key countries like Germany and Italy is expanding the market scope.

Asia Pacific Marine Propulsion Engine Market Analysis

The market in Asia Pacific is being driven by the rapid expansion of regional seaborne trade, particularly in containerized and bulk cargo. In addition to this, favorable government-led shipbuilding initiatives, especially in China, South Korea, and India, reinforcing domestic production capabilities, are bolstering market development. Furthermore, increasing investment in coastal and inland water transport infrastructure encouraging the deployment of modern engine technologies, is fostering market expansion. The heightened push for fleet modernization across commercial and defense segments accelerating the shift toward more fuel-efficient and low-emission engines, is stimulating market appeal. Similarly, continual technological adoption in green propulsion systems, including methanol and ammonia-based engines, is gaining traction in the market. Moreover, rising regional demand for cruise tourism supporting the need for quieter, cleaner, and more efficient propulsion alternatives across newly constructed passenger vessels, is creating lucrative market opportunities. Government data shows that cruise tourism in India hit a record 4.7 lakh passengers in 2023–24, exceeding pre-pandemic levels. Domestic tourist participation rose by 85% compared to 2019–20, reflecting the increasing appeal of cruise travel within the country.

Latin America Marine Propulsion Engine Market Analysis

In Latin America, the marine propulsion engine market is propelled by growing maritime trade through strategic ports along the Atlantic and Pacific coasts. Similarly, expansion of offshore oil and gas activities, particularly in Brazil, fueling investments in high-capacity engines for support vessels, is driving market growth. Brazil’s oil and gas sector is expected to receive over BRL 609 Billion (USD 122 Billion) in investments from 2025 to 2029, as per the National Agency of Petroleum, Natural Gas, and Biofuels (ANP). Nearly 90% will go on offshore projects, with BRL 347 Billion for the Santos Basin and BRL 195.8 Billion for the Campos Basin. The rising interest in renewable marine transport solutions encouraging adoption of hybrid and low-emission engines across regional fleets, is escalating market reach. Apart from this, supportive government initiatives to modernize naval and coast guard fleets are driving demand for advanced, efficient propulsion systems, thereby impelling the market.

Middle East and Africa Marine Propulsion Engine Market Analysis

The market in the Middle East and Africa is advancing due to expanding maritime trade routes through the Suez Canal and the Red Sea. In accordance with this, significant investments in port development and free trade zones encouraging fleet upgrades with efficient engine systems, are stimulating market appeal. As of August 2024, investments in Saudi Arabia’s maritime sector have exceeded USD 6.7 Billion, driven by partnerships between the Saudi Ports Authority and global firms. Notable projects include Maersk’s USD 346 Million investment at Jeddah Port and 17 new logistics zones in Jeddah and Dammam. The rising adoption of LNG and dual-fuel vessels across regional shipping fleets supporting cleaner propulsion alternatives, is also expanding the market scope. Additionally, growing offshore energy exploration activities, particularly in West Africa and the Arabian Gulf, bolstering the need for reliable engines in support vessels and drilling operations, are positively influencing the market.

Competitive Landscape:

The key players in the market are focusing on technological innovations, such as the development of eco-friendly propulsion systems using LNG, biofuels, and hydrogen, to meet stringent environmental regulations. They are expanding partnerships with shipbuilders and fuel suppliers to enhance product offerings and improve operational efficiency. Furthermore, companies are investing in the digitalization of their products, incorporating smart technologies like IoT and AI to optimize performance and reduce maintenance costs. As the market grows, key players are continuously expanding into emerging markets to capitalize on increasing maritime activities. These strategic moves are expected to favor the marine propulsion engine market outlook and enhance the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the marine propulsion engine market with detailed profiles of all major companies, including:

- AB Volvo

- Caterpillar Inc.

- Cummins Inc.

- Fairbanks Morse

- Hyundai Heavy Industries Group

- Man SE (Volkswagen Group)

- Masson Marine

- Mitsubishi Heavy Industries Ltd.

- Rolls-Royce Plc

- Wärtsilä Oyj Abp

Latest News and Developments:

- April 2025: Kirloskar Oil Engines secured an INR 270 crore contract from the Indian Navy to develop a 6MW marine diesel engine under the Make-I initiative. The project supports naval propulsion self-reliance and expands domestic capability for 3–10MW engine systems.

- February 2025: China State Shipbuilding Corporation delivered the world’s largest methanol dual-fuel marine engine, the 10X92DF-M, in Shanghai. The engine, developed by CSSC Winthur Engine Co., Ltd. (WinGD), exhibits 64,500 kW output and over 95% methanol use, cutting CO₂ emissions by 7.5%.

- January 2025: John Deere unveiled the JD14 and JD18 marine engines, expanding its power range to 803 HP. These new engines, expected to be launched in 2026, target commercial fishing, passenger vessels, and tugboats with IMO Tier 2, EPA Tier 3, and EU RCD II compliance.

- September 2024: Scania introduced its advanced 13-litre DI13 marine engine. Designed for propulsion and auxiliary use, it offers up to 8% better fuel efficiency, reduced CO2 emissions, and compatibility with biodiesel and HVO.

- August 2024: YANMAR Marine International announced the launch of its first electric propulsion system, the E-Saildrive. Offered in 7 kW, 10 kW, and 15 kW models, it is reportedly a plug-and-play and emissions-free solution.

Marine Propulsion Engine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Engine Types Covered | 2-Stroke Engine, 4- Stroke Engine |

| Power Sources Covered | Diesel, Gas Turbine, Natural Gas, Steam Turbine, Fuel Cell, Others |

| Power Ranges Covered | 80-750 HP, 751-5000 HP, 5001-10,000 HP, 10,001-20,000 HP, Above 20,000 HP |

| Vessel Types Covered | Bulk Carriers, Container Ships, Passenger Ships, Support Vessels, Tankers, Gas Carriers, Military Vessels, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Caterpillar Inc., Cummins Inc., Fairbanks Morse, Hyundai Heavy Industries Group, Man SE (Volkswagen Group), Masson Marine, Mitsubishi Heavy Industries Ltd., Rolls-Royce Plc and Wärtsilä Oyj Abp., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the marine propulsion engine market from 2019-2033.

- The marine propulsion engine market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the marine propulsion engine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global marine propulsion engine market was valued at USD 39.60 Billion in 2024.

The growth of the global marine propulsion engine market is driven by increasing international trade, rising demand for eco-friendly propulsion technologies, and regulatory pressures to reduce emissions. Additionally, the rising adoption of LNG and hybrid propulsion systems, advancements in digitalization and smart technologies, and the growing focus on energy efficiency are fueling market expansion. Technological innovations, such as the shift to biofuels and hydrogen, also play a significant role in the market’s growth.

The marine propulsion engine market is projected to reach USD 47.72 Billion by 2033, exhibiting a CAGR of 2.14% from 2025-2033.

The Asia Pacific region, with a market share of approximately 43.2% in 2024, is leading the global market. This dominance is attributed to the augmenting demand for energy-saving, environmentally friendly solutions, increasing use of alternative fuels such as LNG, biofuels, and hydrogen as well as advances in technology, including carbon capture solutions and smart shipping.

Some of the major players in the marine propulsion engine market include Wärtsilä Corporation, MAN Energy Solutions, Mitsubishi Heavy Industries, Rolls-Royce plc, Caterpillar Inc., General Electric Company, and Volvo Penta, among others. These companies are focusing on technological advancements, partnerships, and expanding their product portfolios to maintain their competitive edge.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)