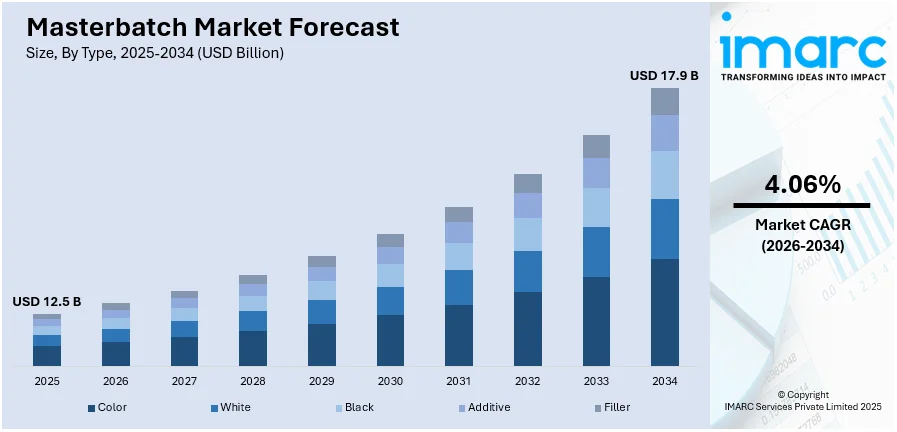

Masterbatch Market Report by Type (Color, White, Black, Additive, Filler), Polymer Type (PP, LDPE/LLDPE, HDPE, PVC, PUR, PET, PS, and Others), Application (Packaging, Building & Construction, Consumer Goods, Automotive, Textile, Agriculture, and Others), and Region 2026-2034

Masterbatch Market Overview:

The global masterbatch market size reached USD 12.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 17.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.06% during 2026-2034. The demand for food packaging, increasing modular construction, rising focus on sustainable and bio-based solutions, and ongoing innovations in the technology are some of the key factors strengthening the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 12.5 Billion |

|

Market Forecast in 2034

|

USD 17.9 Billion |

| Market Growth Rate (2026-2034) | 4.06% |

Masterbatch Market Analysis:

- Major Market Drivers: There is a rise in the use of plastic in the automotive industry. This, along with the increasing focus on sustainable solutions, is strengthening the market growth.

- Key Market Trends: The growing implementation of advanced technological solutions and rising investments in research and development (R&D) activities is positively influencing the market.

- Geographical Trends: Asia Pacific holds the largest segment because of the growth of industries like packaging, textile, and automotive and ongoing innovations in technology.

- Competitive Landscape: Some of the major market players in the masterbatch industry include A. Schulman Inc., Americhem, Inc., Ampacet Corporation, Cabot Corporation, Clariant AG, Gabriel-Chemie GmbH, Hubron (International) Ltd., Penn Color, Inc., Plastiblends India Ltd., Plastika Kritis S.A., PolyOne Corporation, Polyplast Müller GmbH, RTP Company, Inc. and Tosaf Compounds Ltd., among many others.

- Challenges and Opportunities: The market faces challenges like the fluctuations in raw materials prices, which impacts the market, it also encounters opportunities in the replacement of traditional pigments and additives.

To get more information on this market Request Sample

Masterbatch Market Trends:

Increasing demand for food packaging

As per the IMARC Group’s report, the global food packaging industry recached US$ 385.1 Billion in 2023. Masterbatches are used in food packaging to provide attractive colors and enhance the visual appeal of packaging materials. Bright and appealing packaging can attract consumers and differentiate products on the shelf. Moreover, masterbatches are formulated to enhance the barrier properties of packaging materials, such as oxygen, moisture, and light barriers. This plays a vital role in the preservation of food products and prolonging their shelf life and quality. In addition to this, packaging materials for food products must meet high regulatory requirements for safety and hygiene. These requirements can be met by developing masterbatches that will make the packaging materials safe for direct food contact.

Rising trend of modular construction

Modular construction mainly uses plastic materials including panels, modules, fittings and finishes. These plastic components need to be colored using masterbatches to meet aesthetic and functional needs. Additionally, masterbatches enable color matching and differentiation, which is essential in modular construction as the components are expected to have similar color tones. Moreover, masterbatches can contain additives including UV stabilizers and flame retardants that improve the quality of plastic material used in modular construction. This is particularly important as modular units can be exposed to different conditions during the transportation and installation processes. The IMARC group’s report shows that the global modular construction market is expected to reach US$ 137.2 Billion by 2032.

Growing focus on sustainable solutions

Sustainable solution is the creation of bio-based masterbatches. These are derived from natural sources like starches, vegetable oil or other bio sourced polymers. Bio-based masterbatches are derived from renewable raw materials. This helps to minimize the carbon footprint and reliance on fossil fuels. In addition, there is an increasing pressure from people, regulatory bodies, and corporations to reduce plastic waste and enhance sustainability. Masterbatch manufacturers are responding by developing products that incorporate high levels of recycled content without compromising on quality or performance. For instance, in 2024, Cabot Corporation announced the launch of its new REPLASBLAK product family of circular black masterbatches with certified material. With this release, Cabot introduced three products which will be sold as the company’s first-ever International Sustainability & Carbon Certification (ISCC PLUS) certified black masterbatch products powered by EVOLVE Sustainable Solutions.

Masterbatch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, polymer type and application.

Breakup by Type:

- Color

- White

- Black

- Additive

- Filler

White accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes color, white, black, additive and filler. According to the report, white represents the largest segment.

White masterbatch is gradually becoming popular in all industries because of the multi-functionality and indispensable role of colorants and modifiers of polymer materials. A primary reason for its prominence is its role in providing opacity and brightness to plastics, which is crucial for achieving desired visual effects in end products. Sectors like packaging, automotive, and construction often require white masterbatch to impart a clean, uniform appearance to their products, enhancing their aesthetic appeal. Moreover, white masterbatch can be easily incorporated with other colors to offer personalized shades to the producers without having to affect the clarity or brilliance of the final product.

Breakup by Polymer Type:

- PP

- LDPE/LLDPE

- HDPE

- PVC

- PUR

- PET

- PS

- Others

PP holds the largest share of the industry

A detailed breakup and analysis of the market based on the polymer type have also been provided in the report. This includes PP, LDPE/LLDPE, HDPE, PVC, PUR, PET, PS and others. According to the report, PP accounts for the largest market share.

PP is a versatile thermoplastic polymer with high chemical and heat stability, cost-effectiveness, and high durability, meaning that it can be applied in the packaging, automotive, textiles, and consumer goods. Concentrated additives that add color or improve the properties or functionality of plastics during processing are known as masterbatches and is widely used in improving the characteristics of PP. Furthermore, PP is widely used due to its excellent balance between performance and cost, which makes it acceptable for those firms whose products require certain visual or functional enhancements in their products.

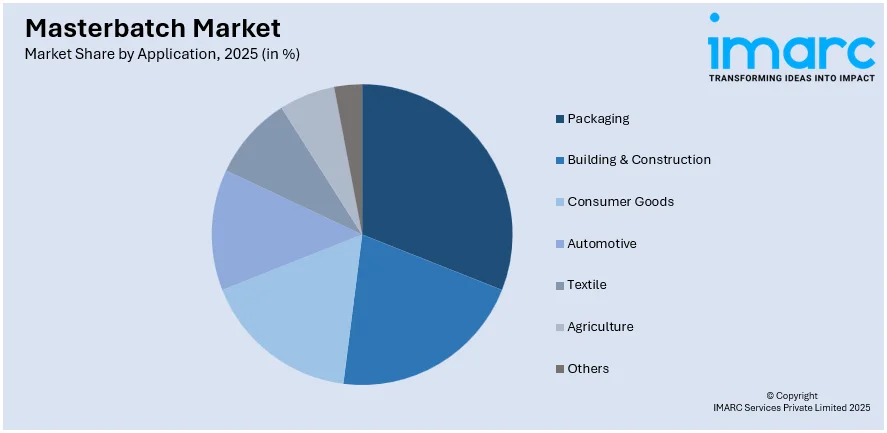

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Packaging

- Building & Construction

- Consumer Goods

- Automotive

- Textile

- Agriculture

- Others

Packaging represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes packaging, building and construction, consumer goods, automotive, textile, agriculture, and others. According to the report, packaging represents the largest segment.

Masterbatches refer to pigments or additives that are incorporated into a carrier resin and are important in improving the characteristics of plastics employed in packaging. The main factors for dominance of packaging include its use in food and beverages, pharmaceuticals, cosmetics and toiletries, and industrial goods. All these sectors require packaging solutions that not only shield the products but also retain their life and quality. The contribution that masterbatches bring is color, UV protection, antimicrobial, and barrier properties that are crucial for shelf life and safety issues, and to meet the required regulations.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest masterbatch market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for masterbatch.

As per the website of the National Bureau of Statistics of China, in 2023 the urbanization rate of permanent residents reached 66.16 percent, 0.94 percentage points higher than that at the end of 2022. Urbanization leads to an increasing construction activity for residential and commercial spaces in China, necessitating extensive use of plastic materials in pipes, fittings, insulation, and structural components. Masterbatches are integral in ensuring these materials meet specific performance requirements such as strength, weather resistance, and aesthetic appeal. Moreover, the robust economic growth of region is also leading to an increasing individual spending, driving the demand for packaged goods and durable products, further bolstering the masterbatch market size.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the masterbatch industry include A. Schulman Inc., Americhem, Inc., Ampacet Corporation, Cabot Corporation, Clariant AG, Gabriel-Chemie GmbH, Hubron (International) Ltd., Penn Color, Inc., Plastiblends India Ltd., Plastika Kritis S.A., PolyOne Corporation, Polyplast Müller GmbH, RTP Company, Inc. and Tosaf Compounds Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players are investing in research and development (R&D) activities to develop innovative masterbatch formulations that offer improved performance characteristics, such as enhanced durability, ultraviolet (UV) resistance, and color consistency. They are also forming alliances with raw material suppliers, end-users, and technology providers to strengthen supply chains, access new markets, and co-develop customized solutions. In addition, companies are introducing a wide range of masterbatch products catering to various applications across industries like packaging, automotive, food products, consumer goods, and construction. They are also expanding production capacities and establishing new manufacturing facilities in strategic locations to cater to regional demand and reduce lead times. For instance, in 2023, Israel-based masterbatch specialist Tosaf Color Service developed and introduced a new masterbatch carrier system for food contact applications.

Masterbatch Market News:

- May 2024: Ampacet, a global masterbatch leader, expanded its ELTech™ portfolio to include a range of high-performance color masterbatches based on a Polybutylene Terephthalate (PBT) carrier resin and specifically designed for optical fiber cable PBT jacketing.

- April 28, 2023: Penn, Color, Inc. announced the commencement of its world-class facility in Rayong Province, Thailand to expand its manufacturing capabilities. The objective of this new plant was to enable the company to deliver high-quality colorant & additive masterbatches across the Asia-Pacific market.

Masterbatch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Color, White, Black, Additive, Filler |

| Polymer Types Covered | PP, LDPE/LLDPE, HDPE, PVC, PUR, PET, PS, Others |

| Applications Covered | Packaging, Building & Construction, Consumer Goods, Automotive, Textile, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A. Schulman Inc., Americhem, Inc., Ampacet Corporation, Cabot Corporation, Clariant AG, Gabriel-Chemie GmbH, Hubron (International) Ltd., Penn Color, Inc., Plastiblends India Ltd., Plastika Kritis S.A., PolyOne Corporation, Polyplast Müller GmbH, RTP Company, Inc., Tosaf Compounds Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the masterbatch market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global masterbatch market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the masterbatch industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global masterbatch market was valued at USD 12.5 Billion in 2025.

We expect the global masterbatch market to exhibit a CAGR of 4.06% during 2026-2034.

The rising applications of masterbatch as a coloring agent in the manufacturing of plastic products that are used across various sectors, such as automotive, textile, packaging, etc., are primarily driving the global masterbatch market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for masterbatches.

Based on the type, the global masterbatch market can be segmented into color, white, black, additive, and filler. Currently, white holds the majority of the total market share.

Based on the polymer type, the global masterbatch market has been divided into PP, LDPE/LLDPE, HDPE, PVC, PUR, PET, PS, and others. Among these, PP currently exhibits a clear dominance in the market.

Based on the application, the global masterbatch market can be categorized into packaging, building & construction, consumer goods, automotive, textile, agriculture, and others. Currently, the packaging industry accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global masterbatch market include A. Schulman Inc., Americhem, Inc., Ampacet Corporation, Cabot Corporation, Clariant AG, Gabriel-Chemie GmbH, Hubron (International) Ltd., Penn Color, Inc., Plastiblends India Ltd., Plastika Kritis S.A., PolyOne Corporation, Polyplast Müller GmbH, RTP Company, Inc., and Tosaf Compounds Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)