Material Testing Market Report by Type (Universal Testing Machines, Servohydraulic Testing Machines, Hardness Testing Machines, Impact Testing Machines, Non-Destructive Testing Machines), Material (Metals and Alloys, Plastics, Rubber and Elastomers, Ceramics and Composites, and Others), End Use Industry (Automotive, Construction, Education, Aerospace and Defense, Oil and Gas, Energy and Power, and Others), and Region 2026-2034

Material Testing Market Size:

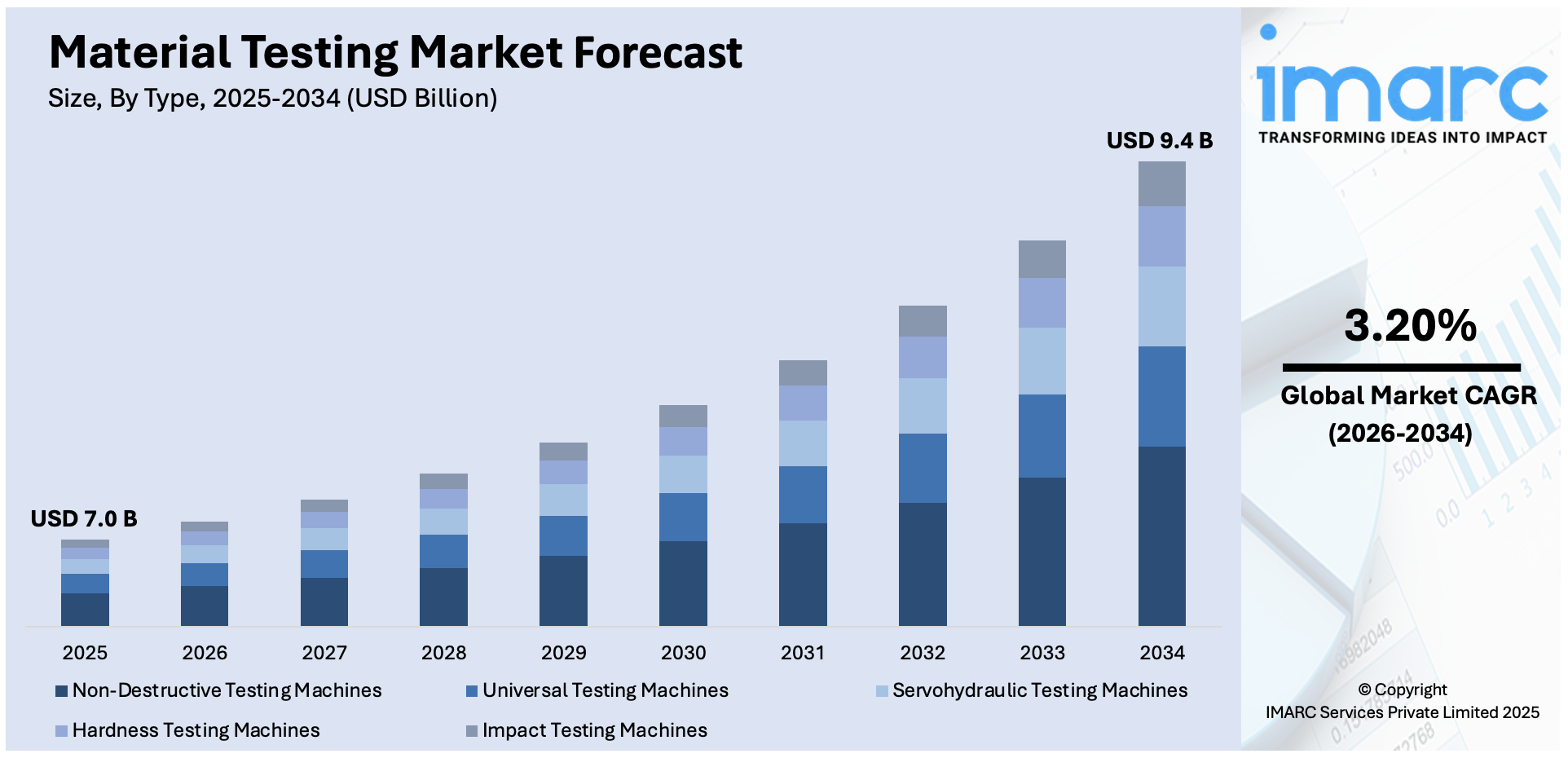

The global material testing market size reached USD 7.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.20% during 2026-2034. The market is experiencing robust growth, driven by the rapid technological advancements in testing equipment, growing construction and infrastructure development projects, widespread expansion of end-use industries, increasing emphasis on quality assurance and regulatory compliance, rising investment in research and development (R&D), and a heightened focus on sustainability and environmental impact.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.0 Billion |

| Market Forecast in 2034 | USD 9.4 Billion |

| Market Growth Rate 2026-2034 | 3.20% |

Material Testing Market Analysis:

- Major Market Drivers: Technological advancements in testing equipment, such as the incorporation of digital technology and automation, which improve the precision, efficiency, and capacities of material testing, are supporting the market growth. Furthermore, the increased demand for quality assurance and control in industries such as automotive, aerospace, and construction, as well as a greater emphasis on safety and regulatory compliance, are driving the market growth.

- Key Market Trends: The rising adoption of non-destructive testing (NDT) methods due to their ability to assess material integrity without causing damage is one of the major trends in the market. Moreover, advancements in material science and nanotechnology, which lead to the development of novel materials, coupled with the hike in product demand from the construction industry to ensure the quality and durability of building materials, are boosting the market growth.

- Geographical Trends: The Asia Pacific region is dominating the market owing to growing industrialization, urbanization, and substantial infrastructure development projects. Other regions are also experiencing growth as a result of increased investment in infrastructure and industrial sectors, as well as severe regulatory norms that need extensive material testing.

- Competitive Landscape: Some of the major market players in the material testing industry include ADMET, Inc., AMETEK, Inc., Applied Test Systems, Bureau Veritas, DNV, Hegewald & Peschke, Illinois Tool Works Inc., Mitutoyo America Corporation, MTS Systems, Shimadzu Corporation, Smithers, Tinius Olsen, Wirsam Scientific, Zwick Roell, among many others.

- Challenges and Opportunities: The material testing industry overview highlights that the high cost of specialized testing equipment is a major barrier for small and medium-sized businesses. However, the development and adoption of cost-effective and innovative testing solutions designed to satisfy the specific needs of diverse industries is providing considerable growth opportunities.

To get more information on this market Request Sample

Material Testing Market Trends:

Rapid Technological Advancements in Testing Equipment

The material testing market analysis highlighted that rapid improvements in testing equipment technology are a major market driver. Technological innovations have enhanced the way materials are tested for numerous properties such as tensile strength, hardness, fatigue, and impact resistance. Advanced testing equipment that is more precise, efficient, and capable of handling a broader range of materials and testing conditions is favoring the market growth. For example, advances in non-destructive testing (NDT) technologies are boosting the capability to detect even the smallest imperfections or damages in materials and components used in aerospace applications, such as aircraft, missiles, satellites, and other defense systems. These include computed tomography (CT) scanning and digital radiography. CT scanning, for instance, is effective for inspecting composite materials, providing three-dimensional (3D) images that can reveal defects like water ingress, crush damage, and the integrity of metal inserts in hybrid structures.

Growth in the Infrastructure and Construction Sector

The rise of the infrastructure and construction sectors is a major driver propelling the material testing market share. There have been increasing fund allocations in infrastructure development, leading to a spike in construction activities. For example, in the United States, more than $350 billion in Bipartisan Infrastructure Law (BIL) funding has been announced in October 2023. Among these, $174.7 billion was allocated for the development of highways, bridges, and major projects, $34.1 billion for public transportation, and $9.8 billion for passenger and freight rail. These large-scale projects are creating the need for materials that meet rigorous safety, durability, and performance requirements. Additionally, testing of these materials is essential for determining their quality, assessing the performance of new construction materials, and assuring conformity with national and international building rules.

Expansion of End-Use Industries

The burgeoning expansion of end-use industries is contributing to the material testing market growth. Major industries such as automotive, aerospace, construction, and electronics are experiencing rapid growth, which is creating the need for effective material testing equipment. For instance, the automotive industry is witnessing a surge in production and innovation, particularly with the advent of electric vehicles (EVs) and autonomous driving technologies. As per the IMARC Group report, the electric vehicle market is growing at a rapid pace of 22.1% annually. It is expected to reach US$ 4,918.7 billion by 2032. Consequently, the autonomous vehicle market is exceeding at a rate of 33.5% globally. These developments necessitate the use of new materials and composites, which require rigorous testing to ensure their suitability and performance, thereby creating the need for material testing equipment.

Material Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, material, and end use industry.

Breakup by Type:

- Universal Testing Machines

- Servohydraulic Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Non-Destructive Testing Machines

Non-destructive testing machines accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes universal testing machines, servohydraulic testing machines, hardness testing machines, impact testing machines, and non-destructive testing machines. According to the report, non-destructive testing machines represented the largest segment.

As per the material testing market forecast and overview, non-destructive testing (NDT) machines represented the largest segment due to their critical role in ensuring the integrity and safety of materials without causing any damage. They include ultrasonic, radiographic, magnetic particle, and eddy current testing, that allow for thorough inspection of materials and components in industries such as aerospace, automotive, construction, and energy. These methods are essential for detecting flaws, discontinuities, and other defects that could compromise the performance and safety of critical structures and products. Moreover, the growing demand for high-quality and reliable materials in increasingly complex industrial applications is driving the material testing market value.

Breakup by Material:

- Metals and Alloys

- Plastics

- Rubber and Elastomers

- Ceramics and Composites

- Others

Metals and alloys hold the largest share of the industry

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metals and alloys, plastics, rubber and elastomers, ceramics and composites, and others. According to the report, metals and alloys accounted for the largest market share.

Based on the material testing market analysis and segmentation, metals and alloys constituted the largest segment, driven by their widespread application across numerous industries, including automotive, aerospace, construction, and manufacturing. Moreover, the rigorous testing of metals and alloys is essential to ensure they meet the required mechanical, chemical, and physical properties for specific applications. Along with this, the increasing utilization of methods such as tensile, hardness, fatigue, and impact testing to assess the strength, durability, and reliability of these materials is boosting the material testing market revenue.

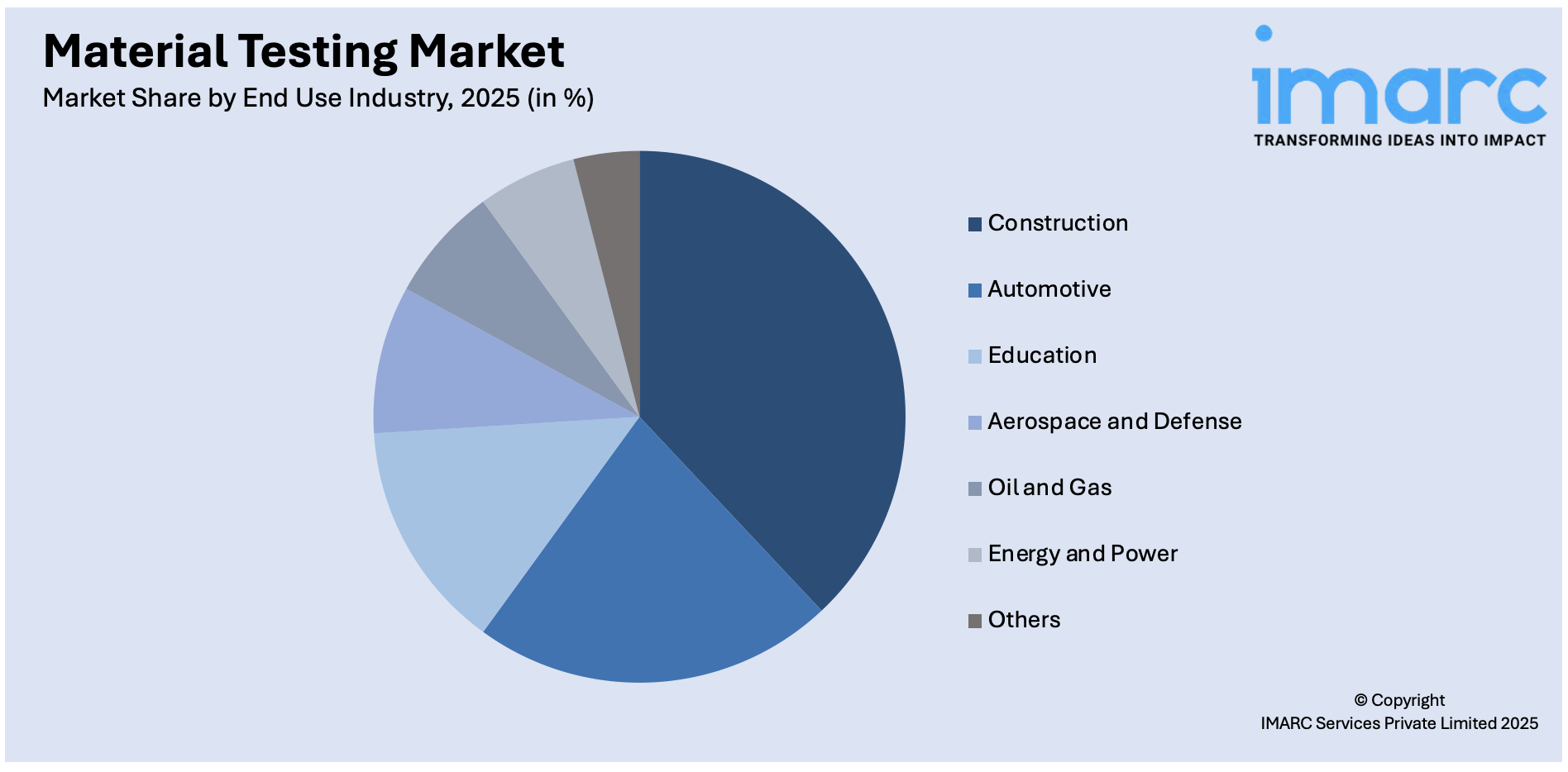

Breakup by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Automotive

- Construction

- Education

- Aerospace and Defense

- Oil and Gas

- Energy and Power

- Others

Construction represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, construction, education, aerospace and defense, oil and gas, energy and power, and others. According to the report, construction represented the largest segment.

According to the material testing market trends and research report, the construction industry represented the largest segment, driven by the imperative to ensure the safety, durability, and compliance of construction materials. In line with this, materials such as concrete, steel, asphalt, and composites undergo rigorous testing to verify their structural integrity and performance under various environmental conditions. Additionally, the imposition of various standards and regulations that mandate comprehensive testing protocols to ensure materials meet specific strength, resilience, and durability criteria is boosting the material testing demand.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest material testing market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for material testing.

Based on the material testing market report and outlook, the Asia Pacific region accounted for the largest market share, driven by rapid industrialization, urbanization, and economic growth. Moreover, the burgeoning construction sector, fueled by extensive infrastructure development projects and a growing population, is contributing to the market growth. Additionally, the expanding automotive and aerospace industries, characterized by increased production and innovation, that require rigorous testing of metals, composites, and other materials to ensure safety and performance is fueling the material testing market size.

Competitive Landscape:

The major material testing companies are focusing on technological innovation and strategic partnerships to strengthen their market positions. They are investing in research and development (R&D) to introduce advanced testing equipment with enhanced precision, automation, and digital capabilities. For instance, several companies are integrating artificial intelligence (AI) and machine learning (ML) to offer predictive maintenance and real-time data analysis, thereby improving the efficiency and accuracy of testing processes. Additionally, they are expanding their product portfolios to cater to diverse industry needs, such as automotive, aerospace, construction, and medical devices. Along with this, key players are focusing on strategic acquisitions and collaborations to broaden their geographical reach and tap into emerging markets.

The report provides a comprehensive analysis of the competitive landscape in the global material testing market with detailed profiles of all major companies, including:

- ADMET, Inc.

- AMETEK, Inc.

- Applied Test Systems

- Bureau Veritas

- DNV

- Hegewald & Peschke

- Illinois Tool Works Inc.

- Mitutoyo America Corporation

- MTS Systems

- Shimadzu Corporation

- Smithers

- Tinius Olsen

- Wirsam Scientific

- Zwick Roell

Material Testing Market News:

- In October 2023, Shimadzu Corporation released an automatic universal testing system in China for measurements of metal materials. This system completely automates strength testing, including Shimadzu universal testing machines. It was developed in collaboration with Shishi (Shanghai) Automation Technology Co., Ltd. (Shanghai), a startup in the field of robotics. The system is said to be sold all over China to manufacturers of automobiles, parts, and iron and steel as a measurement application for metal materials.

- In June 2023, ZwickRoell introduced two touch screen Rockwell hardness testing instruments, the ZHR4150 and ZHR8150. They provide either classic Rockwell or combined Rockwell and Superficial Rockwell hardness testing respectively. The touchscreen interface has been designed with simple user experience as its guiding principle. It helps in simplifying test setup parameters, testing procedures, and results handling to ensure that the latest machines are efficient to use.

Material Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Universal Testing Machines, Servohydraulic Testing Machines, Hardness Testing Machines, Impact Testing Machines, Non-Destructive Testing Machines |

| Materials Covered | Metals and Alloys, Plastics, Rubber and Elastomers, Ceramics and Composites, Others |

| End Use Industries Covered | Automotive, Construction, Education, Aerospace and Defense, Oil and Gas, Energy and Power, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | ADMET, Inc., AMETEK, Inc., Applied Test Systems, Bureau Veritas, DNV, Hegewald & Peschke, Illinois Tool Works Inc., Mitutoyo America Corporation, MTS Systems, Shimadzu Corporation, Smithers, Tinius Olsen, Wirsam Scientific, Zwick Roell, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the material testing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global material testing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the material testing industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global material testing market was valued at USD 7.0 Billion in 2025.

According to the estimates by IMARC Group, the global material testing market is expected to reach a value of USD 9.4 Billion by 2034, exhibiting a CAGR of 3.20% during 2026-2034.

Rapid industrialization, along with significant growth in the construction sector, represents some of the key drivers for the global material testing market.

Increasing adoption of material testing equipment in the medical sector to test material integrity, surface morphology, and adhesion capacities of several medical devices, represents one of the key industry trends in the global material testing market.

Sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary shutdown of numerous end-use industries for material testing, thereby negatively impacting the global market.

On the basis of the type, the market has been bifurcated into universal testing machines, servohydraulic testing machines, hardness testing machines, impact testing machines, and non-destructive testing machines. Currently, non-destructive testing machines hold the majority of the total market share.

Based on the material, the market has been segmented into metals and alloys, plastics, rubber and elastomers, ceramics and composites, and others. Among these, metals and alloys represent the largest segment.

On the basis of the end use industry, the market has been bifurcated into automotive, construction, education, aerospace and defense, oil and gas, energy and power, and others. Among these, the construction sector holds the largest market share.

Region-wise, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where Asia Pacific dominates the global market.

The key companies in the global material testing market are ADMET, Inc., AMETEK, Inc., Applied Test Systems, Bureau Veritas, DNV, Hegewald & Peschke, Illinois Tool Works Inc., Mitutoyo America Corporation, MTS Systems, Shimadzu Corporation, Smithers, Tinius Olsen, Wirsam Scientific, and Zwick Roell.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)