Medical Injection Molding Market Report by System (Hot Runner, Cold Runner), Class (Class I, Class II, Class III), Material (Plastic, Metal), and Region 2025-2033

Medical Injection Molding Market Size:

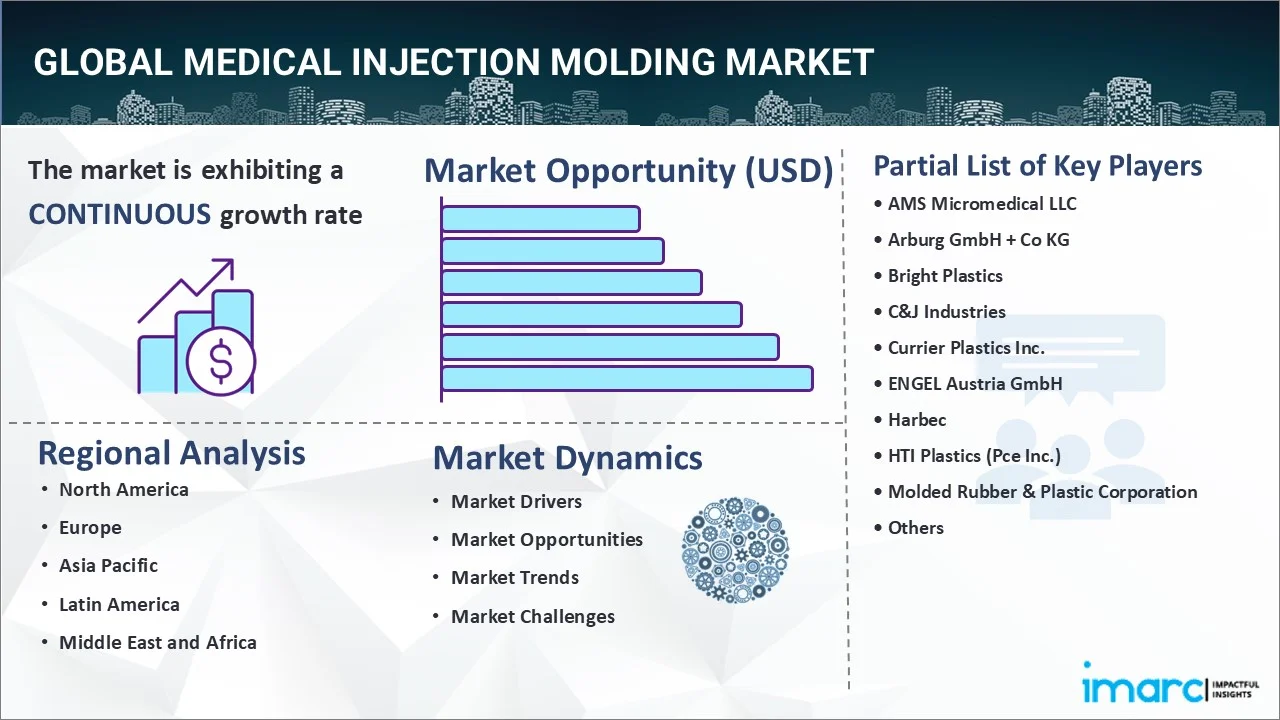

The global medical injection molding market size reached USD 24.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 35.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.99% during 2025-2033. Asia-Pacific dominates the market, driven by increasing adoption of single-use medical devices for infection control and rising aging population. The market is experiencing moderate growth due to high demand for precision and complex medical devices and components and ongoing advancements in materials and technology for biocompatible medical-grade plastics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.3 Billion |

|

Market Forecast in 2033

|

USD 35.2 Billion |

| Market Growth Rate 2025-2033 | 3.99% |

Medical Injection Molding Market Analysis:

- Market Growth and Size: The market is witnessing stable growth, driven by the rising demand for precision and complex medical devices and components, and ongoing advancements in materials and technology for biocompatible medical-grade plastics.

- Increasing Adoption of Single-Use Medical Devices: One of the key drivers of the market is the increasing adoption of single-use medical devices for infection control, as healthcare facilities prioritize safety and hygiene.

- Industry Applications: The market is experiencing high demand from diverse industries, including healthcare, pharmaceuticals, dental, and laboratory, where injection-molded components are integral to various medical products and equipment.

- Geographical Trends: Asia Pacific leads the market, fueled by its expanding healthcare infrastructure, rising healthcare expenditure, and the growing prevalence of chronic diseases, which spur the demand for medical devices and components.

- Competitive Landscape: The market is characterized by intense competition with key players focusing on innovation and product development to maintain their market share and cater to the evolving needs of the healthcare sector.

- Challenges and Opportunities: While the market faces challenges, such as the stringent regulatory requirements and the need for high-quality manufacturing processes, it also presents opportunities for manufacturers to tap into the expanding global healthcare market and leverage technological advancements.

- Future Outlook: The future of the medical injection molding market looks promising, with potential growth in personalized medicine, telemedicine, and the development of innovative medical devices, offering opportunities for market expansion and technological innovation.

To get more information on this market, Request Sample

Medical Injection Molding Market Trends:

Rising Demand for Disposable Medical Devices

The growing preferences for disposable medical devices, such as syringes, catheters, surgical instruments, and diagnostic components, are fueling the market expansion. As per the IMARC Group, the global medical disposables market size was valued at USD 470.53 Billion in 2024. Disposable products minimize the risk of cross-contamination and hospital-acquired infections, making them vital in modern healthcare settings. Injection molding provides economical, high-volume production of precise and sterile components that meet regulatory standards. With rising awareness about infection control and increasing patient volumes, hospitals and clinics are relying on single-use medical products. As global healthcare systems continue to emphasize patient safety, the widespread utilization of disposable medical devices will remain a major growth driver for injection molding solutions.

Growth in Healthcare Infrastructure and Expenditure

Expanding healthcare infrastructure and rising spending on medical facilities worldwide are driving the demand for premium medical components manufactured through injection molding. India's healthcare public spending is projected to be 1.9% of GDP in FY26, according to the Economic Survey 2024-25. Hospitals, diagnostic labs, and clinics require reliable and affordable tools, ranging from intravenous therapy (IV) components to surgical trays, to manage increasing patient volumes. Emerging economies, in particular, are witnessing major investments in healthcare facilities, catalyzing the demand for mass-produced, precision-engineered devices. Developed markets are also upgrading facilities with advanced equipment that often incorporates injection-molded components. As healthcare systems are modernizing and patient care standards are improving, the requirement for safe, standardized, and cost-effective medical devices is growing.

Increasing Aging Population and Chronic Disease Prevalence

The global rise in the elderly population and chronic diseases, such as diabetes, cardiovascular conditions, and respiratory disorders, is creating the need for medical devices and diagnostic tools. As per the United Nations Organization (UNO), by the mid-2030s, there will be 265 Million people aged 80 and above, surpassing the number of infants. Elderly patients require frequent monitoring, drug delivery systems, and mobility aids, many of which rely on injection-molded components. Similarly, chronic disease management often involves devices like insulin pens, inhalers, and dialysis equipment, which depend on precision molding for safe and efficient use. As patient numbers are increasing, healthcare providers are demanding scalable, affordable production of such devices. Injection molding delivers both cost-effectiveness and consistency, ensuring reliability in mass-produced products.

Key Growth Drivers of Medical Injection Molding Market:

Increasing Demand for Miniaturized and Complex Devices

Medical injection molding is essential for producing small, intricate, and highly precise components used in minimally invasive surgeries, diagnostic devices, and wearable medical technologies. With the rise of microfluidics, lab-on-a-chip systems, and portable diagnostic devices, there is a growing need for miniaturized parts that maintain accuracy and functionality. Injection molding allows manufacturers to achieve complex geometries with tight tolerances, ensuring high performance and reliability. As healthcare is shifting towards less invasive procedures and compact, patient-friendly devices, the demand for micro and nano-scale molded parts is accelerating. The ability of injection molding to meet these technical requirements at scale positions it as a critical enabler of medical innovations, significantly fueling the market growth.

Technological Advancements in Injection Molding Processes

Advancements in injection molding technology, such as multi-material molding, micro-molding, and high-precision automated systems, are significantly expanding applications in the medical field. These innovations enable the production of complex devices with enhanced functionality, combining flexibility, strength, and biocompatibility. Automation reduces production errors, improves efficiency, and ensures compliance with stringent medical regulations. Additionally, the assimilation of Industry 4.0 technologies allows immediate oversight, quality control, and customization at scale. Such advancements help manufacturers meet rising demand for reliable, cost-effective devices while maintaining strict safety standards. As technology continues to evolve, medical injection molding is becoming more capable of supporting cutting-edge devices, including implants, wearables, and advanced diagnostic systems. These improvements are a key factor driving the market forward.

Stringent Regulations and Quality Standards

Regulatory bodies are implementing stringent safety, quality, and biocompatibility standards for medical devices. Injection molding supports compliance by producing highly precise, sterile, and standardized components that meet these regulations. Materials used in medical injection molding, such as medical-grade plastics, are approved for biocompatibility, ensuring patient safety. Manufacturers are also employing cleanroom molding processes to meet the evolving hygiene requirements. As regulatory scrutiny is increasing worldwide, companies are choosing injection molding to ensure consistency, reliability, and certification readiness. This adherence to stringent quality standards fosters confidence between healthcare providers and patients. As a result, the increasing focus on regulatory compliance and product safety is driving stronger adoption of injection molding in the medical sector.

Medical Injection Molding Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on system, class, and material.

Breakup by System:

- Hot Runner

- Cold Runner

Hot runner accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the system. This includes hot runner and cold runner. According to the report, hot runner represented the largest segment.

Hot runner systems are a crucial component in medical injection molding, which play a significant role in ensuring the efficient and precise production of medical devices and components. These systems consist of heated components that maintain the molten state of the plastic material in the mold, allowing for reduced cycle times and minimal material waste. In the medical industry, where precision and quality are paramount, hot runner systems excel in producing intricate and high-quality parts. Their ability to eliminate runners, reduce production costs, and enhance productivity has made them the preferred choice in medical injection molding processes.

While hot runner systems dominate the medical injection molding market, cold runner systems also have a crucial place in certain applications. Cold runner systems involve using unheated channels or runners to deliver the plastic material to the mold cavity. They are often employed when cost-effectiveness is a primary consideration or when molding complex parts that require a specific material flow. Cold runner systems may generate more material waste compared to hot runners, but they are still valuable in scenarios where precision and reduced cycle times are not the primary concerns. Depending on the specific requirements of a medical device or component, cold runner systems can offer a viable alternative in medical injection molding processes.

Breakup by Class:

- Class I

- Class II

- Class III

A detailed breakup and analysis of the market based on the class have also been provided in the report. This includes class I, class II, and class III.

Class I medical devices represent the lowest risk category according to regulatory authorities. These devices include products like tongue depressors, bandages, and examination gloves. Medical injection molding is instrumental in producing these disposable and non-invasive devices efficiently and cost-effectively. The simplicity and low risk associated with Class I devices make them a lucrative market segment for injection molding manufacturers, as they can maintain high production volumes while meeting stringent quality standards.

Class II medical devices, which encompass a wide range of products such as infusion pumps, surgical gloves, and diagnostic equipment, contribute substantially to the medical injection molding market. These devices are of moderate risk and complexity, often requiring a high level of precision and quality. Injection molding plays a crucial role in producing intricate components for Class II devices, meeting the demand for consistent and reliable performance. The need for advanced materials and manufacturing techniques in this segment drives innovation and growth in the injection molding sector.

Class III medical devices, which include implantable devices like pacemakers, artificial joints, and prosthetic heart valves, represent the highest risk category and contribute to the medical injection molding market through their specialized and critical requirements. The production of Class III devices demands the highest level of precision, biocompatibility, and quality assurance. Injection molding enables the fabrication of intricate and sterile components that are essential for these life-saving and life-sustaining devices. As the demand for Class III medical devices continues to grow, injection molding manufacturers must adhere to stringent regulatory standards, ensuring the safety and effectiveness of these advanced medical technologies.

Breakup by Material:

- Plastic

- Metal

Plastic represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the mateiral. This includes plastic and metal. According to the report, plastic represented the largest segment.

Plastic materials dominate the medical injection molding market, largely due to their versatility, cost-effectiveness, and suitability for a wide range of medical applications. Plastics offer several advantages, including biocompatibility, ease of molding into complex shapes, and resistance to corrosion and chemicals. These attributes make plastics ideal for manufacturing various medical devices and components such as syringes, IV connectors, and surgical instruments. Additionally, the lightweight nature of plastic materials is advantageous in medical equipment design and patient comfort. With ongoing innovations in medical-grade plastics, they continue to be the preferred choice for injection molding in the healthcare industry.

While plastic materials dominate the medical injection molding market, metals also play a significant role in specific applications within the medical field. Metals like stainless steel and titanium are employed in manufacturing medical devices such as orthopedic implants, dental instruments, and surgical instruments requiring exceptional strength and durability. Metal injection molding (MIM) is utilized for producing intricate metal components. However, the high cost, weight, and challenges related to sterilization and biocompatibility limit the widespread use of metals in medical injection molding compared to plastics. Nevertheless, metals remain indispensable in certain critical medical applications where their unique properties are irreplaceable.

Breakup by Region:

.webp)

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest medical injection molding market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share owing to its rapidly growing healthcare sector, increasing healthcare infrastructure, and the presence of a vast manufacturing base. Countries like China and India are major contributors to the market due to their large population, rising healthcare expenditure, and the demand for affordable medical devices. The region benefits from cost-effective production capabilities, making it a preferred destination for medical injection molding manufacturing.

Europe also maintains a significant position in the medical injection molding market, driven by stringent quality standards and a robust healthcare industry. European countries prioritize precision and regulatory compliance, making them reliable consumers of high-quality medical components and devices. The region fosters innovation and research, contributing to advancements in medical injection molding techniques and materials.

North America, comprising the United States and Canada, represents another growing market for medical injection molding due to its advanced healthcare system, high demand for medical devices, and a concentration of leading medical device manufacturers. The region's emphasis on cutting-edge technology and quality assurance ensures a steady demand for injection-molded medical products.

Latin America further contributes to the medical injection molding market, due to the rising demand for medical devices as healthcare access improves. Local manufacturing capabilities and lower production costs attract medical injection molding suppliers, serving both domestic and export markets.

The Middle East and Africa region also exhibits significant potential in the medical injection molding market, propelled by improving healthcare infrastructure and a rising population. While the market is smaller compared to other regions, it offers growth opportunities as healthcare investments increase, leading to higher demand for medical devices and components.

Leading Key Players in the Medical Injection Molding Industry:

Various key players in the market are actively engaging in several strategic initiatives. They are focusing on research and development (R&D) to innovate new materials and technologies that enhance the biocompatibility and performance of medical-grade plastics used in injection molding. Additionally, these industry leaders are expanding their manufacturing capabilities and global footprint to meet the growing demand for medical devices. They are also emphasizing partnerships and collaborations with healthcare companies and contract manufacturers to offer end-to-end solutions, from design to production. Quality and regulatory compliance are paramount, with investments in state-of-the-art quality control systems and cleanroom facilities to ensure the safety and precision of medical components. Overall, these key players are committed to advancing the medical injection molding industry to meet the evolving needs of the healthcare sector.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AMS Micromedical LLC

- Arburg GmbH + Co KG

- Bright Plastics

- C&J Industries

- Currier Plastics Inc.

- ENGEL Austria GmbH

- Harbec

- HTI Plastics (Pce Inc.)

- Molded Rubber & Plastic Corporation

- Metro Mold & Design

- Milacron (Hillenbrand Inc.)

- Proto Labs Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Medical Injection Molding Market News:

- September 2025: Schivo revealed the purchase of Mecaplast SA, a Swiss manufacturer specializing in high-precision injection-molded plastics, metals, and ceramics for the medical device and life sciences industries. This purchase expanded Schivo’s knowledge in advanced materials and enhanced its position as a reliable partner for intricate MedTech and Life Sciences solutions.

- April 2025: C&J Industries broadened its facility and capabilities in injection molded plastics in Meadville, Pennsylvania. The 25,000 sq. ft. expansion featured a 12,000-sq. ft. fully validated Class 8 Cleanroom that contained 9 functioning presses. C&J enhanced capacity by more than 100,000 production hours by introducing an additional 15 presses to the new Cleanroom and 5 more presses in the White Room.

- February 2025: Arterex acquired Phoenix S.r.l., a European firm focused on medical device development and manufacturing. This purchase furthered the firm’s trajectory of growth, enabling it to offer clients in North America and Europe a range of high-precision medical device manufacturing solutions, encompassing design, development, engineering, compounding, extrusion, injection molding, mold fabrication, along with advanced assembly and packaging services.

- November 2024: Germany’s Sanner Group revealed that it was set to enhance Gilero’s injection molding capacities for the healthcare industry with a new 60,500-square-foot plant in Greensboro, NC. The Greensboro facility would include ISO Class 7 and 8 cleanrooms, injection molding and desiccant filling equipment, quality control laboratories, and humidity-regulated manufacturing zones. Production was scheduled to start in the second quarter of 2025.

- October 2024: Biomerics declared the introduction of its vertically integrated metal injection molding services. Biomerics strengthened its dedication to contract design and manufacturing excellence in the metals domain through the establishment of its new Metal Injection Molding (MIM) Center of Excellence.

Medical Injection Molding Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Systems Covered | Hot Runner, Cold Runner |

| Classes Covered | Class I, Class II, Class III |

| Materials Covered | Plastic, Metal |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AMS Micromedical LLC, Arburg GmbH + Co KG, Bright Plastics, C&J Industries, Currier Plastics Inc., ENGEL Austria GmbH, Harbec, HTI Plastics (Pce Inc.), Molded Rubber & Plastic Corporation, Metro Mold & Design, Milacron (Hillenbrand Inc.), Proto Labs Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global medical injection molding market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global medical injection molding market?

- What is the impact of each driver, restraint, and opportunity on the global medical injection molding market?

- What are the key regional markets?

- Which countries represent the most attractive medical injection molding market?

- What is the breakup of the market based on the system?

- Which is the most attractive system in the medical injection molding market?

- What is the breakup of the market based on the class?

- Which is the most attractive class in the medical injection molding market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the medical injection molding market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global medical injection molding market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical injection molding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global medical injection molding market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical injection molding industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)