Memory Chip Market Size, Share, Trends and Forecast by Type, Application, Sales Channel, and Region, 2026-2034

Memory Chip Market Size:

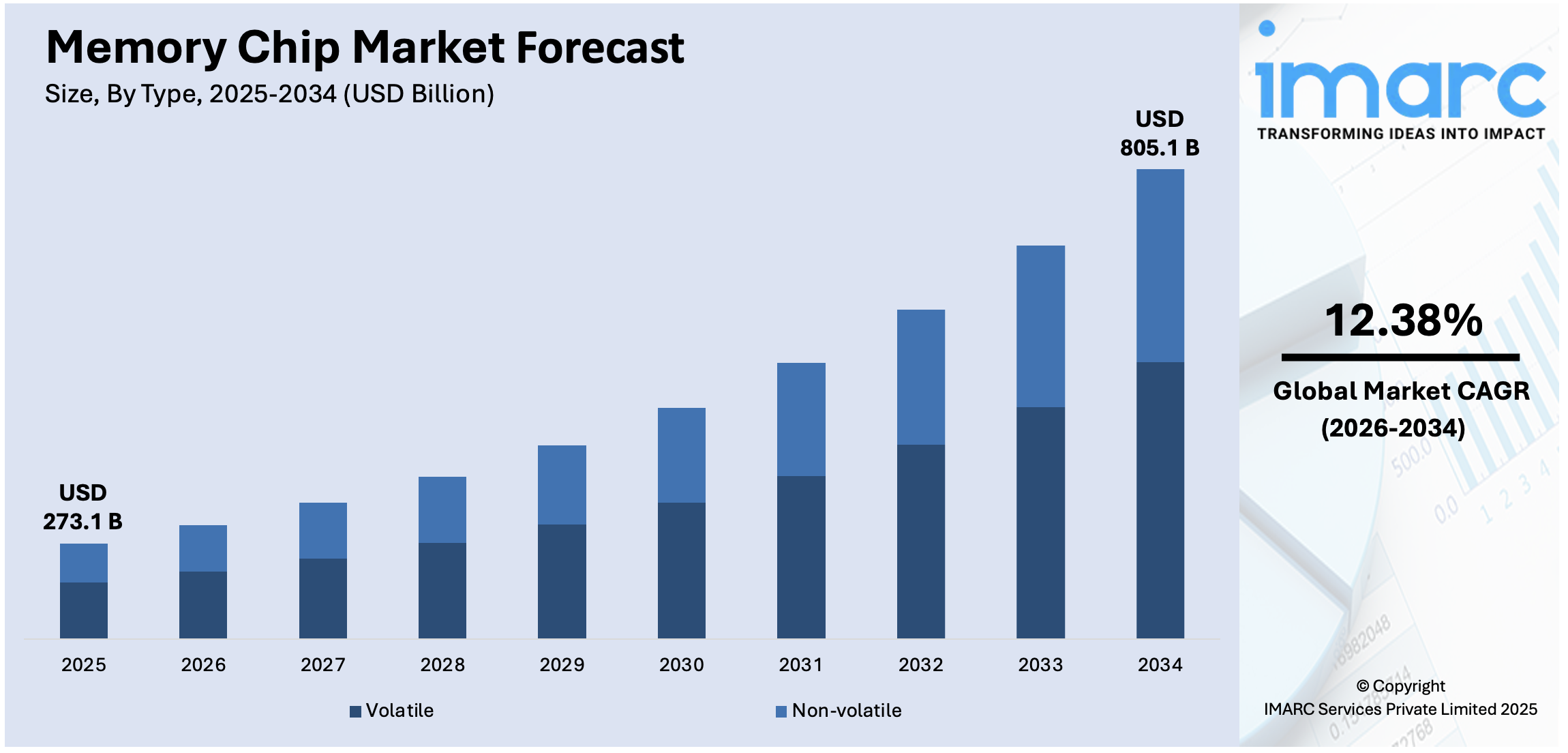

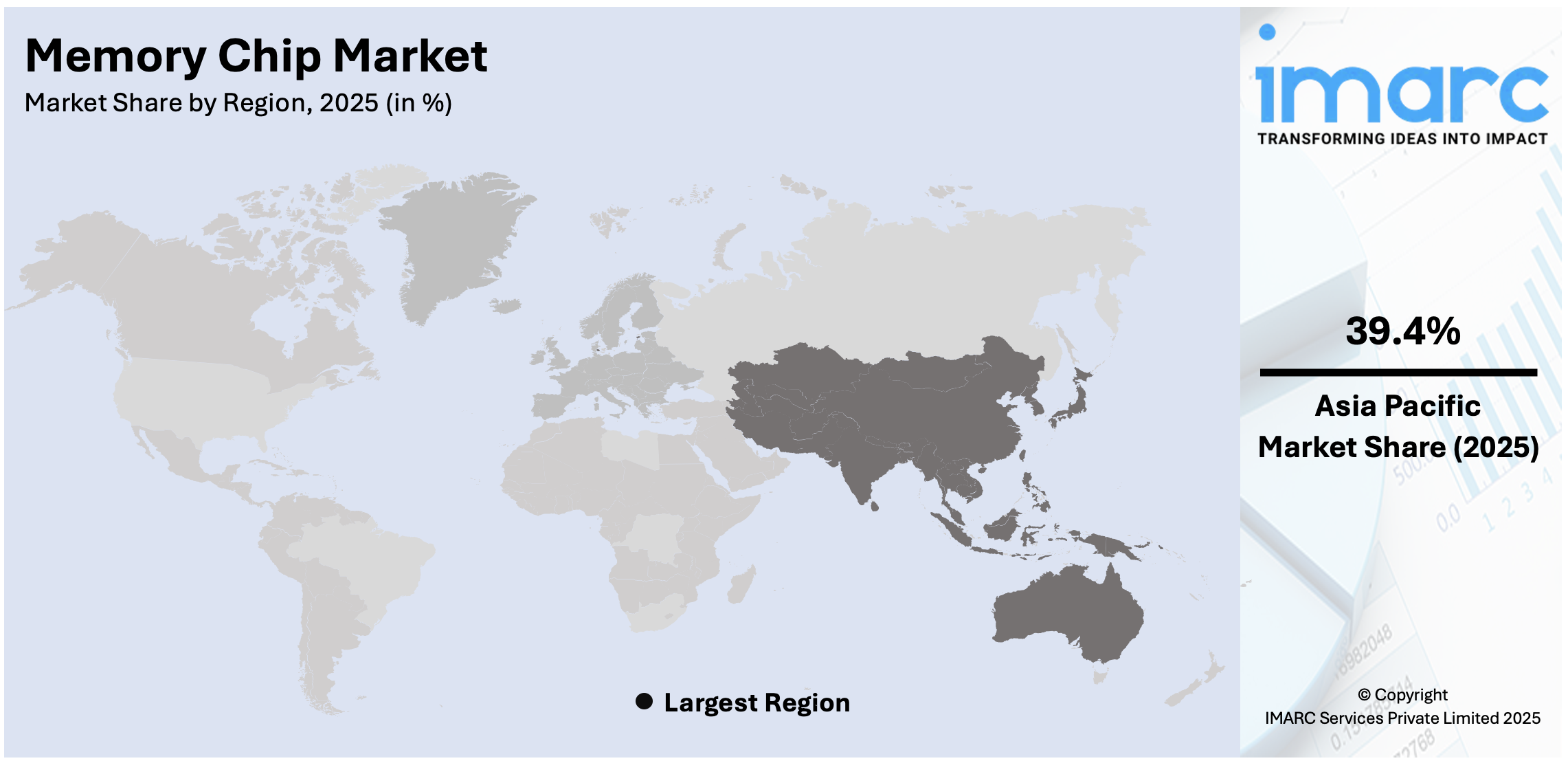

The global memory chip market size was valued at USD 273.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 805.1 Billion by 2034, exhibiting a CAGR of 12.38% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of 39.4% in 2025. The dominance of the region is attributed to its strong manufacturing base, technological improvements, and robust consumer electronics industry. The region's significant investments in research activities, along with its role as a hub for semiconductor production, further solidify its dominance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 273.1 Billion |

|

Market Forecast in 2034

|

USD 805.1 Billion |

| Market Growth Rate 2026-2034 | 12.38% |

Memory Chip Market Analysis:

- Market Growth and Size: The global memory chip market is experiencing strong growth, driven by increasing demand for memory-intensive applications. The market size is substantial, with billions of dollars in annual revenue, and it is expected to continue expanding at a healthy rate.

- Technological Advancements: Technological advancements are leading to higher memory chip densities and faster data transfer rates. Emerging technologies like 3D NAND and MRAM (Magnetoresistive RAM) are shaping the future of memory chips. Moreover, improved power efficiency and data security features are becoming standard in memory chip designs.

- Industry Applications: Memory chips find applications in a wide range of industries, including consumer electronics, automotive, healthcare, and data centers. They are integral to the functioning of smartphones, laptops, autonomous vehicles, and cloud computing infrastructure.

- Geographical Trends: Asia-Pacific, led by countries like South Korea and Taiwan, dominates memory chip production. North America and Europe are significant consumers of memory chips, particularly in data center and automotive applications. Emerging markets in Latin America and Africa are showing increasing demand.

- Competitive Landscape: Major players in the memory chip market include Samsung, SK Hynix, Micron Technology, and Intel. Intense competition leads to ongoing innovation and technological advancements. Consolidation through mergers and acquisitions is a prevalent strategy among market leaders.

- Challenges and Opportunities: Challenges include cyclical demand patterns, price fluctuations, and supply chain disruptions. Opportunities lie in expanding memory chip applications in emerging technologies like AI, IoT, and 5G.

- Future Outlook: The future of the memory chip market looks promising, with continued growth driven by technological advancements and expanding applications. As data-centric technologies become more prevalent, memory chips will play a critical role in shaping the digital landscape.

To get more information on this market Request Sample

The increase in data usage, propelled by the rising adoption of smartphones, Internet of Things (IoT) gadgets, and cloud services, is driving the need for memory chips. With the continuous generation and processing of data, the demand for high-performance memory solutions rises, contributing to the market demand across various sectors, ranging from consumer electronics to enterprise storage. Besides this, the swift advancement and utilization of artificial intelligence (AI), machine learning (ML), deep learning, and natural language processing (NLP), need significant quantities of data to train models and facilitate real-time decision-making. High-speed memory chips are essential for these functions, as they efficiently and rapidly store and manage data. These chips are also utilized in both cloud and edge devices for managing intricate algorithms, processing real-time data, and handling substantial datasets.

The United States represents a vital part of the market, propelled by technological progress in memory chip innovation, including greater memory capacities and enhanced processing speeds. These advancements address the growing need for effective memory solutions that can manage the sophisticated data processing demands of AI tasks. For example, in 2024, SK Hynix announced that it had started mass production of a 12-layer version of its high-bandwidth memory chip, HBM3E, designed for AI workloads. The new chip, with a 36GB capacity, provided a 50% increase in memory over the previous version and was expected to be delivered by the end of the year. Additionally, cloud gaming platforms and streaming services in the US are driving the need for high-performance memory chips. These platforms, which require real-time data processing and large storage capacities, rely heavily on memory solutions to deliver seamless user experiences.

Memory Chip Market Trends:

Increasing Demand for Mobile Devices

The memory chip industry growth is greatly driven by the rising need for mobile gadgets like smartphones, laptops, and tablets. Global smartphone shipments increased by 2.4% year-over-year to 331.7 Million units in Q4 2024, achieving six straight quarters of growth. According to industry data, for the entire year, shipments rose by 6.4%, totaling 1.24 Billion units. As the global adoption of these devices continues to rise, there is a higher demand for greater storage capacity and quicker processing speeds. Memory chips, as essential elements in these gadgets, gain from this rise in demand. The ongoing progress in mobile technology, particularly with the launch of 5G networks, requires improvements in memory chip technology to manage higher data volumes and faster speeds. This demand goes beyond consumer electronics, encompassing multiple sectors where mobile technology is essential, further bolstering the growth of the market.

Expansion of Data Centers

The rapid increase in data production and the transition towards cloud computing are resulting in a notable rise in data centers globally. A market report indicated that worldwide cloud infrastructure expenditures increased by 20% to USD 86 Billion in Q4 2024 and totaled USD 321.3 Billion for the year, rising from USD 267.7 Billion. Memory chips play a crucial role in the effective operation of these data centers, as they retain and handle large volumes of data. The growing dependence on big data analytics, IoT applications, and AI for business functions is catalyzing the demand for sophisticated memory solutions. This pattern is especially noticeable in industries, such as e-commerce, finance, and healthcare, where the ability to process and store data is essential. As a result, the need for high-capacity and high-speed memory chips in data centers is a major factor influencing the memory chip market.

Technological Advancements

Improvements in memory chip design and production technology are significant contributors to the market growth. Kioxia and Sandisk unveiled new 3D flash memory featuring a speed of 4.8Gb/s, enhanced power efficiency, and greater density, aimed at supporting AI-related data expansion and next-gen SSDs and storage systems. Technological advancements like 3D NAND, enabling higher storage capacity in a more compact area, along with enhancements in DRAM chips for quicker data processing, are essential. These innovations address the growing demand for compact and efficient memory solutions across multiple applications, ranging from consumer electronics to industrial automation. Moreover, the drive to lower power usage while enhancing performance corresponds with the larger movement towards energy efficiency and sustainability in the tech sector. This continual advancement in memory chip technology not only addresses current market needs but also influences upcoming trends and applications in the industry.

Adoption of IoT and AI Technologies

The expansion of AI and IoT technologies serves as another key factor propelling the memory chip market growth. A market analysis projected that the worldwide AI sector will surge from USD 189 Billion in 2023 to USD 4.8 Trillion by 2033, increasing 25-fold over the next decade. AI and IoT devices produce and handle vast amounts of data, requiring effective memory solutions for rapid data storage and access. Memory chips play a crucial role in facilitating the real-time processing skills needed for AI applications, ranging from consumer devices to industrial automation. With the growth of the IoT ecosystem, which includes everything from home devices to industrial sensors, the need for sophisticated memory chips capable of managing varied and intricate tasks is anticipated to increase significantly.

Memory Chip Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global memory chip market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, application, and sales channel.

Analysis by Type:

- Volatile

- DRAM

- SRAM

- Non-volatile

- PROM

- EEPROM

- NAND Flash

- Others

Volatile (DRAM and SRAM) stands as the largest component in 2025, holding 57.7% of the market. The dominance of the segment is because of its rapid speed, effectiveness, and crucial function in multiple computing applications. Volatile memory is greatly preferred for its capacity to temporarily hold data and deliver fast read and write processes. This type of memory chip is essential for enabling real-time operations in devices that need constant data retrieval, including computers, smartphones, and servers. The rising need for quicker processing speeds and enhanced performance drives the preference for volatile memory. Its affordability, ability to scale, and ongoing technological improvements further strengthen its leading position in the market. The capacity to rapidly store and access data, along with its energy efficiency, makes volatile memory crucial for contemporary computing requirements, ranging from personal devices to intricate data center functions.

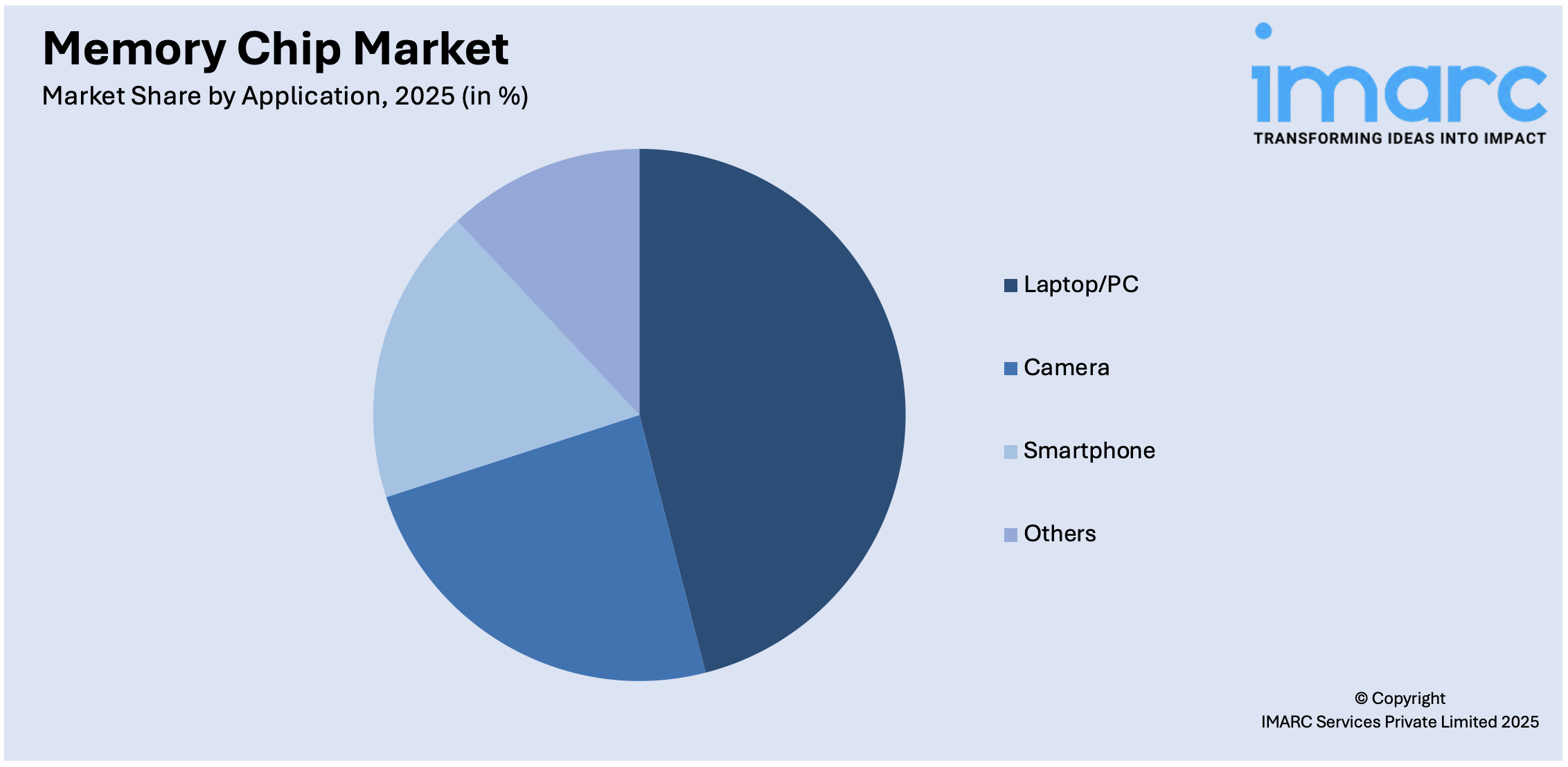

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Laptop/PC

- Camera

- Smartphone

- Others

Laptop/PC lead the market with 45.2% of market share in 2025, owing to their extensive use and ongoing need for high-performance computing. These gadgets need sophisticated memory chips to enable multitasking, data handling, and smooth operation of intricate applications. With user preferences moving towards quicker and more efficient computing experiences, the need for high-capacity memory solutions in laptops and PCs is increasing significantly. The growing popularity of remote work, online gaming, and digital content creation is catalyzing the demand for improved memory features in these devices. Moreover, innovations in memory chip design enhance system performance, lower power usage, and extend battery lifespan, all of which are vital for laptop and PC users. These elements, along with the rising use of memory-intensive applications, guarantee that laptops and PCs continue to be the primary platform for memory chip use, strengthening their dominance in the market.

Analysis by Sales Channel:

- OEM

- Aftermarket

OEM refers to the direct supply of memory chips to manufacturers of electronic devices such as computers, smartphones, and other consumer electronics. In this segment, memory chips are integrated into the original products during the production process. OEM sales are characterized by large volume orders, long-term contracts, and stable relationships between chip manufacturers and device producers. Additionally, OEM clients often seek high-performance, customized memory chips to enhance the overall functionality and competitiveness of their devices.

The aftermarket segment involves the sale of memory chips through retail channels or third-party suppliers, typically targeting end users or businesses for upgrades or replacements. This includes the sale of memory chips for individuals looking to enhance the performance of their existing devices, such as upgrading a PC or laptop's RAM. The aftermarket segment benefits from a diverse client base, including both individuals and businesses, and is characterized by smaller order volumes but a broader range of products catering to different user needs and device types.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of 39.4%, attributed to its strong manufacturing capabilities, technological progress, and extensive production infrastructure. The region's strength arises from the notable presence of major semiconductor producers, who take advantage of low-cost manufacturing and economies of scale. The Asia Pacific region features a highly talented workforce and substantial investments in research activities, fostering ongoing innovation in memory chip technology. The increasing need for consumer electronics, cloud computing, and automotive uses, along with the area's swift embrace of advanced technologies like IoT and 5G, further supports the market growth. In 2025, China’s telecom operators, including China Mobile, China Unicom, and China Telecom, launched 5G-Advanced (5G-A) networks in over 300 cities, marking a major step toward 6G integration. The 5G-A infrastructure offers faster speeds, higher connection density, and supports innovations like low-altitude drone operations and IoT. The blend of competitive production, technological dominance, and a growing domestic market guarantees that Asia Pacific continues to be the leading region in the market.

Key Regional Takeaways:

United States Memory Chip Market Analysis

In North America, the market portion held by the United States was 84.80%, influenced by increasing demand for high-performance computing to facilitate AI and ML tasks across various sectors. Moreover, the expedited deployment of 5G infrastructure, facilitating quicker and more dependable data transfer, is enhancing market accessibility. By the end of 2024, it has been noted that the US and Canada surpassed 182 million 5G connections, indicating a 20% yearly growth rate, with US 5G SA speeds hitting 388.44 Mbps in early 2025. Apart from this, the swift advancement in autonomous vehicle technology, necessitating sophisticated real-time processing, is increasing market attractiveness. In addition, the rise of smart consumer gadgets with built-in storage is broadening the market's scope. The government's strategic initiative for local semiconductor production, which promotes capital investment and enhances supply chains, is impelling the memory chip market growth. Additionally, the increased significance of cybersecurity, requiring strong memory architectures, is improving market opportunities.

North America Memory Chip Market Analysis

The North American memory chip industry is influenced by various crucial elements, such as the area's robust technological framework and the rising need for high-performance computing in fields like AI, ML, and cloud services. The existence of prominent technology firms and research organizations in North America drives ongoing innovation and advancement in memory solutions, especially in storage and processing functionalities. The increasing demand for sophisticated memory chips in data centers, consumer electronics, and automotive uses, particularly in electric vehicles (EVs), further support the market growth. Moreover, government efforts to encourage semiconductor production and research in the US reinforce the area’s leadership. The expansion of IoT and the increasing adoption of 5G networks, with almost half of all mobile connections in North America expected to run on 5G by 2025, as per the GSMA report, further driving the demand for faster, more efficient memory solutions.

Europe Memory Chip Market Analysis

The memory chip market in Europe is supported by the increasing use of EVs, which necessitates dependable and energy-efficient memory for sophisticated automotive electronics. The VDA, or German Association of the Automotive Industry, forecasted 873,000 new EV registrations in Germany by 2025, representing a 53% increase from 2024, fueled by a 75% surge in BEVs and an 8% growth in PHEVs. Moreover, the growth of renewable energy infrastructure, which requires advanced memory solutions for managing smart grids and metering, is contributing to the market growth. In addition, the continuous digital transformation of Europe’s healthcare industry, which broadens the application of secure storage in medical devices and patient record systems, is offering a favorable memory chip market outlook. The robust data privacy laws in the region, promoting the need for dependable and safe memory architectures, are enhancing market attractiveness.

Asia Pacific Memory Chip Market Analysis

The Asia Pacific market is primarily fueled by the growing usage of mobile devices, which requires high-capacity storage solutions. Moreover, substantial investment in cutting-edge smartphones with enhanced memory capabilities is boosting local usage. In May 2025, Alcatel re-entered India following a seven-year pause, collaborating with NxtCell and Padget Electronics, and committing USD 30 Million to manufacture smartphones locally, targeting a position among the top three with the new V3 series. Furthermore, the swift implementation of smart manufacturing and factory automation is facilitating increased integration of memory within industrial systems. The growing adoption of wearable gadgets and smart home technologies is catalyzing the demand for embedded memory applications. Additionally, strong government efforts in nations like South Korea, Taiwan, and China are driving investment in advanced manufacturing facilities and memory research, guaranteeing the Asia Pacific's ongoing dominance in worldwide memory chip production and technological advancement.

Latin America Memory Chip Market Analysis

The memory chip sector in Latin America is growing due to the swift rise of digital banking and fintech services, both of which necessitate secure, high-speed memory for real-time transactions and data handling. An industry report indicates that in the first quarter of 2025, the FinTech sector in Latin America generated USD 352 Million through 27 transactions, with Brazil at the forefront, having attained four major deals, an increase from three the previous year. Moreover, the rising investment in local data centers to enhance digital infrastructure is further driving the memory chip market demand. The continuous implementation of smart farming technologies, which incorporate IoT sensors and automated equipment, is encouraging the utilization of embedded memory for accurate agriculture. Furthermore, state-driven efforts to enhance national semiconductor capabilities, backed by partnerships with international tech firms, are promoting local manufacturing and innovation in the memory industry.

Middle East and Africa Memory Chip Market Analysis

Increasing investment in smart city initiatives in the Middle East and Africa is a major factor contributing to the market growth, as these projects necessitate sophisticated memory solutions for interconnected infrastructure and IoT applications. For instance, in March 2025, Abu Dhabi ranked among the top 10 in the Smart City Index 2024, fueled by a USD 2.5 Billion AI collaboration and a USD 3.3 Billion initiative to become the world's first entirely AI-native city by 2027. Moreover, the swift deployment of 5G networks in key urban areas is driving the need for high-capacity, low-latency memory parts to facilitate next-generation connectivity. Furthermore, the growing use of digital healthcare solutions, such as telehealth and electronic health records (EHRs), is catalyzing the demand for safe and reliable memory storage. Additionally, government plans for diversification are enhancing local semiconductor production via collaborations and technology exchanges, strengthening the region's supply chain resilience.

Competitive Landscape:

Major participants in the industry are concentrating on enhancing technology to fulfill the increasing need for faster, larger capacity, and energy-saving solutions. They are making significant investments in research operations to promote advancements in memory designs, manufacturing techniques, and miniaturization. These firms are also enhancing their production capacities to meet the growing demand across multiple sectors, such as consumer electronics, data centers, aerospace, and the automotive industry. For example, in 2025, Micron Technology launched its first space-qualified memory chip, a high-density, radiation-tolerant 256 Gb SLC NAND product. This memory is designed for the growing space economy, enabling AI-driven space operations like autonomous navigation and real-time analysis. The product has passed extensive testing, including radiation and temperature resilience, ensuring its functionality in harsh space environments. Besides this, strategic alliances, mergers, and acquisitions are sought to enhance market positions and broaden product ranges.

The report provides a comprehensive analysis of the competitive landscape in the memory chip market with detailed profiles of all major companies, including:

- ADATA Technology Co. Ltd.

- Fujitsu Semiconductor Limited (Fujitsu Limited)

- Intel Corporation

- Kingston Technology Corporation

- Micron Technology Inc.

- NXP Semiconductors N.V.

- Samsung Electronics Co. Ltd.

- SK hynix Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Texas Instruments Incorporated

- Toshiba Corporation

- Transcend Information Inc.

- Western Digital Corporation.

Latest News and Developments:

- June 2025: Samsung began preparing to launch LPDDR6 memory chips using advanced 1c DRAM to regain leadership amid rising competition from rivals like SK Hynix, Micron, and China's CXMT. These chips promise faster performance, improved efficiency, and are expected in next-gen laptops and smartphones by early 2026.

- May 2025: Nvidia announced plans to launch a lower-cost Blackwell-based AI GPU for China, priced at USD 6,500–USD 8,000, below the banned H20 model. Using GDDR7 memory and excluding advanced packaging, the chip aligns with U.S. export rules while maintaining competitiveness against Huawei in China’s USD 50 Billion data center market.

- May 2025: UK-based SCI Semiconductor raised GBP 2.5 Million to launch the world’s first ‘memory safe’ chip, addressing 70% of cyberattack causes. Backed by Mercia Ventures and NPIF II, SCI’s CHERI-based ICENI chips aim to transform cybersecurity in critical sectors, with key customers including Google Research.

- April 2025: Micron Technology reorganized its operations to meet soaring AI-driven demand, launching a new cloud memory unit focused on high-bandwidth memory (HBM) chips. This strategic shift challenges SK Hynix’s market lead and aligns with HBM’s projected 31.3% CAGR growth from 2023 to 2031, reinforcing Micron’s adaptive legacy.

- November 2024: Samsung and SK Hynix unveiled advanced chips like GDDR7, HBM3E, and CXL DDR5 at CIIE in Shanghai, highlighting rising Chinese demand for high-performance memory. SK Hynix’s AiMX and GDDR6-AiM chips, optimized for AI tasks, reinforce South Korea’s role as a critical supplier amid intensifying U.S.-China tech tensions.

- October 2024: Chinese start-up Numemory launched the NM101, a 64GB storage-class memory (SCM) chip, marking a major domestic breakthrough amid U.S. tech sanctions. The chip combines DRAM and NAND features, aiming to reduce reliance on foreign memory technologies and support China’s push for semiconductor self-sufficiency.

Memory Chip Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Laptop/PC, Camera, Smartphone, Others |

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ADATA Technology Co. Ltd., Fujitsu Semiconductor Limited (Fujitsu Limited), Intel Corporation, Kingston Technology Corporation, Micron Technology Inc., NXP Semiconductors N.V., Samsung Electronics Co. Ltd., SK hynix Inc., Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, Toshiba Corporation, Transcend Information Inc., Western Digital Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the memory chip market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global memory chip market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the memory chip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The memory chip market was valued at USD 273.1 Billion in 2025

The memory chip market is projected to exhibit a CAGR of 12.38% during 2026-2034, reaching a value of USD 805.1 Billion by 2034.

The memory chip market is primarily driven by the growing demand for data storage, advancements in technology, and the rise of data-intensive applications. Additionally, the increasing adoption of AI, IoT, and cloud computing, along with the demand for faster and more efficient memory solutions, plays a crucial role in supporting the market growth and innovation.

Asia Pacific currently dominates the memory chip market, accounting for a share of 39.4%. The dominance of the region is attributed to its strong manufacturing base, technological improvements, and robust consumer electronics industry. The region's significant investments in research activities, along with its role as a hub for semiconductor production, further solidify its dominance.

Some of the major players in the memory chip market include ADATA Technology Co. Ltd., Fujitsu Semiconductor Limited (Fujitsu Limited), Intel Corporation, Kingston Technology Corporation, Micron Technology Inc., NXP Semiconductors N.V., Samsung Electronics Co. Ltd., SK hynix Inc., Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, Toshiba Corporation, Transcend Information Inc., Western Digital Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)