Mexico Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2026-2034

Mexico Air Freight Market Summary:

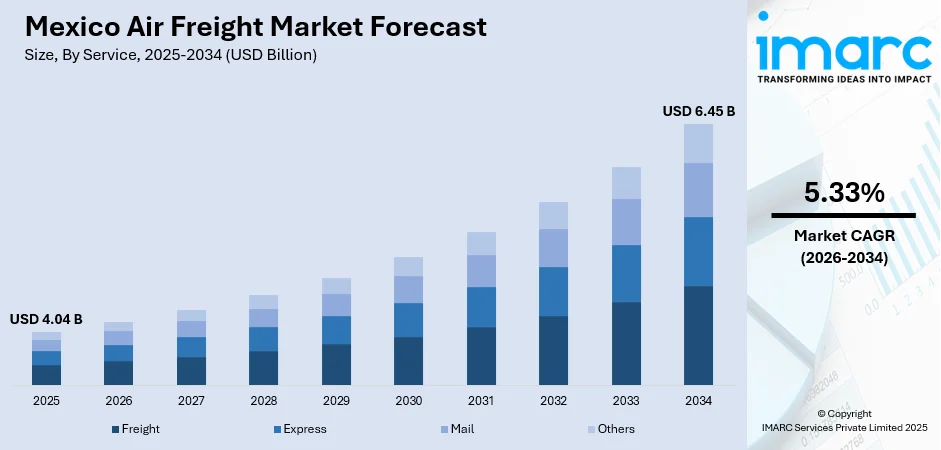

The Mexico air freight market size was valued at USD 4.04 Billion in 2025 and is projected to reach USD 6.45 Billion by 2034, growing at a compound annual growth rate of 5.33% from 2026-2034.

The market is driven by the country's strategic geographic position as a gateway between North America and Latin America, strong trade relationships under the USMCA agreement, and expanding manufacturing sectors requiring efficient cargo transportation. Growing e-commerce activities and rising demand for time-sensitive deliveries across industries continue to accelerate air freight adoption. Infrastructure modernization at major airports and increasing investments in logistics hubs further strengthen the Mexico air freight market share.

Key Takeaways and Insights:

-

By Service: Freight dominates the market with a share of 68% in 2025, driven by the substantial volume of manufacturing exports, automotive components, and electronics requiring reliable cargo transportation across international trade corridors.

-

By Destination: International leads the market with a share of 59% in 2025, owing to Mexico's position as a major exporter to the United States, growing cross-border trade relationships, and expanding global supply chain networks.

-

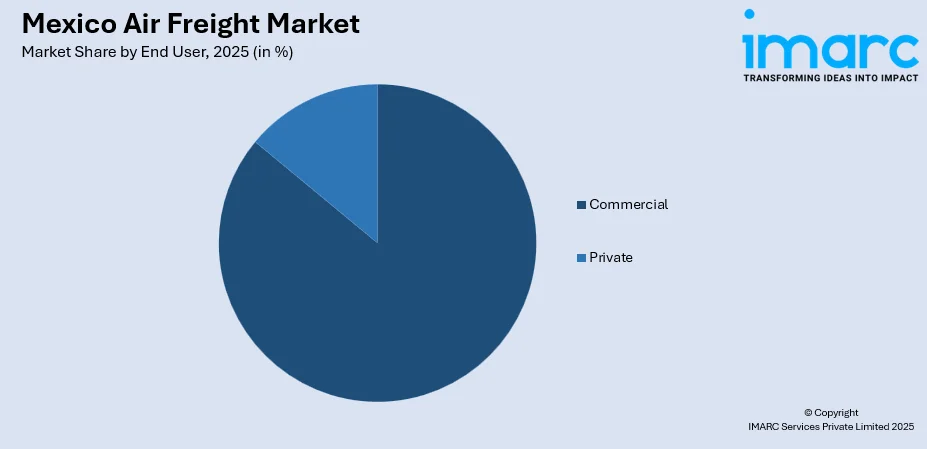

By End User: Commercial represents the largest segment with a market share of 86% in 2025, attributed to substantial demand from manufacturing industries, retail enterprises, and technology companies requiring efficient cargo logistics solutions.

-

Key Players: The Mexico air freight market exhibits a moderately consolidated competitive structure, with international logistics providers and regional carriers competing across service portfolios. Market participants focus on fleet modernization, digital tracking capabilities, and strategic partnerships to enhance operational efficiency.

To get more information on this market Request Sample

The Mexico air freight market continues to expand as nearshoring trends reshape North American supply chains, with numerous multinational corporations relocating manufacturing closer to the United States. This strategic repositioning has intensified demand for rapid cargo transportation services that connect industrial hubs with international markets. The automotive, electronics, and pharmaceutical sectors are driving significant air freight volumes, requiring time‑sensitive delivery of high‑value components and finished products. Enhanced airport infrastructure and expanding cargo handling facilities across major metropolitan areas are supporting growing throughput capacity. In May 2024, DHL Express completed 80% of its $120 Million expansion of the Domestic Air Operations Center in Queretaro, Mexico, adding 30,000 m² and boosting processing capacity to 41,000 shipments per hour. Additionally, the integration of digital technologies enables real‑time tracking, improved operational visibility, and greater efficiency throughout the logistics chain. As global trade patterns evolve, Mexico’s air freight sector is becoming increasingly critical to competitive and reliable supply chain operations.

Mexico Air Freight Market Trends:

Digital Transformation and Real-Time Tracking Solutions

The air freight industry is witnessing accelerated adoption of digital technologies that enhance supply chain visibility and operational efficiency. Advanced tracking systems enable shippers to monitor cargo movements in real time, providing transparency throughout the transportation process. In April 2025, Kale Info Solutions partnered with México Cargo Handling to digitize Mexico City Airport’s cargo operations using the GALAXY system, enabling real-time shipment tracking and paperless processes. Moreover, artificial intelligence (AI) and machine learning (ML) applications optimize route planning and capacity utilization, reducing transit times and operational costs. Cloud-based platforms facilitate seamless coordination between freight forwarders, airlines, and ground handlers, streamlining documentation processes and improving customer service delivery across the logistics ecosystem.

Expansion of E-Commerce Fulfillment Networks

Rapid growth in online retail activities is transforming air freight demand patterns as consumers increasingly expect faster delivery timelines. E-commerce platforms are establishing dedicated fulfillment centers near major airports to expedite last-mile distribution capabilities. As per sources, in 2025, Mercado Libre announced a US$3.4 billion investment in Mexico to expand its logistics network, distribution centers, and cargo operations, enhancing cross-border e-commerce fulfillment and technological infrastructure. Moreover, cross-border e-commerce shipments between Mexico and the United States continue expanding, driven by growing consumer purchasing power and digital marketplace accessibility. Air cargo operators are adapting service offerings to accommodate smaller, more frequent shipments while maintaining cost efficiency and delivery reliability for retail and consumer goods sectors.

Sustainable Aviation and Green Logistics Initiatives

Environmental sustainability is emerging as a significant consideration in air freight operations as stakeholders prioritize carbon footprint reduction. Airlines and logistics providers are exploring sustainable aviation fuel alternatives and implementing operational practices that minimize emissions during ground handling and flight operations. In June 2025, Airbus and Volaris partnered to support sustainable aviation fuel (SAF) development in Mexico through ICAO’s ACTSAF program, advancing feasibility studies and future SAF adoption in the country. Moreover, cargo facilities are adopting energy-efficient technologies and green building standards to reduce environmental impact. Industry participants are investing in fleet modernization programs featuring newer aircraft with improved fuel efficiency, reflecting broader commitments to environmental responsibility and corporate sustainability objectives.

Market Outlook 2026-2034:

The Mexico air freight market demonstrates promising growth prospects as trade volumes expand and manufacturing investments accelerate throughout the forecast period. Continued infrastructure development at key airports and the establishment of new cargo facilities will enhance throughput capacity and operational capabilities. Nearshoring activities are expected to sustain strong demand for cross-border freight services, while digital transformation initiatives improve service quality and efficiency. The market is projected to generate substantial revenue growth as commercial and industrial sectors increasingly rely on air cargo solutions. The market generated a revenue of USD 4.04 Billion in 2025 and is projected to reach a revenue of USD 6.45 Billion by 2034, growing at a compound annual growth rate of 5.33% from 2026-2034.

Mexico Air Freight Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Service |

Freight |

68% |

|

Destination |

International |

59% |

|

End User |

Commercial |

86% |

Service Insights:

- Freight

- Express

- Others

Freight dominates with a market share of 68% of the total Mexico air freight market in 2025.

Freight represents the foundational component of Mexico's air cargo industry, handling substantial volumes of manufactured goods, automotive parts, and industrial equipment. The segment benefits from established trade routes connecting Mexican manufacturing centers with international markets, particularly the United States. Strong demand from export-oriented industries ensures consistent utilization of dedicated freighter aircraft and belly cargo capacity on passenger flights. Advanced cargo handling facilities at major airports enable efficient processing of diverse freight categories, supporting the seamless movement of goods across supply chains. In August 2025, Felipe Ángeles International Airport completed a US$69 Million expansion, adding six cargo warehouses and an expanded apron, doubling annual cargo handling capacity and enabling multiple freighter operations.

The growing complexity of global supply chains has intensified requirements for specialized freight handling capabilities and temperature-controlled transportation solutions. Pharmaceutical manufacturers and perishable goods exporters rely on air freight services to maintain product integrity throughout transit. Logistics providers continue expanding their freight networks to accommodate increasing shipment volumes from nearshoring activities. Investment in modern cargo terminals equipped with automated sorting systems and enhanced security measures strengthens operational efficiency and positions freight services for sustained growth.

Destination Insights:

- Domestic

- International

International leads with a share of 59% of the total Mexico air freight market in 2025.

International benefit from Mexico's strategic position as a major trading partner with the United States and growing export relationships with markets across Europe, Asia, and Latin America. The USMCA trade agreement facilitates seamless cross-border cargo flows, reducing administrative barriers and transit times for shipments moving between North American destinations. Manufacturing industries concentrated in northern border regions generate substantial international freight volumes, with automotive components and electronics comprising significant export categories requiring efficient air transportation solutions.

Rising global demand for Mexican manufactured products continues driving international freight growth as multinational corporations expand production capacity within the country. E-commerce shipments to international destinations are experiencing rapid expansion as digital marketplaces enable Mexican sellers to reach global consumers. Airlines and freight forwarders are enhancing route networks and increasing frequency on key international corridors to capture growing trade volumes. Strategic partnerships between Mexican and international carriers expand connectivity options and improve service reliability for time-sensitive international shipments. In April 2025, My Freighter Airlines and Aeroméxico launched an interline partnership, enhancing cargo connectivity between Mexico and Central Asia and enabling seamless international air freight solutions

End User Insights:

Access the comprehensive market breakdown Request Sample

- Private

- Commercial

The commercial exhibits a clear dominance with 86% share of the total Mexico air freight market in 2025.

Commercial across manufacturing, retail, and technology sectors constitute the primary demand generators for air freight services in Mexico. Automotive manufacturers require rapid transportation of just-in-time components to maintain production schedules at assembly plants throughout the country. As per sources, in 2024, cargopartner launched a new air consolidation route between Frankfurt and Felipe Ángeles International Airport, enhancing reliable air freight services for automotive and retail shipments to Mexico. Moreover, electronics companies depend on air cargo for distributing high-value products to domestic retailers and international markets within tight delivery windows. The pharmaceutical industry utilizes air freight for transporting temperature-sensitive medications and medical supplies that require expedited handling and controlled environmental conditions throughout transit.

Enterprises increasingly rely on air freight services to replenish inventory and fulfill customer orders within compressed timeframes driven by e-commerce expectations. The growth of omnichannel distribution strategies has elevated the importance of air cargo in commercial supply chains, enabling businesses to respond quickly to market demands. Industrial equipment suppliers utilize air freight for urgent shipments of replacement parts that minimize operational downtime for customers. Commercial users continue driving innovation in air freight services as their requirements for visibility, reliability, and speed shape industry development priorities.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico dominates the air freight landscape due to its proximity to the United States border and concentration of manufacturing facilities. Major cities including Monterrey, Tijuana, and Ciudad Juárez serve as critical logistics hubs connecting industrial parks with international markets. The region benefits from advanced airport infrastructure and numerous cross-border transportation corridors that facilitate efficient cargo movement.

Central Mexico functions as the nation's primary distribution hub, anchored by Mexico City and Guadalajara metropolitan areas. Benito Juárez International Airport handles substantial cargo volumes serving domestic and international destinations. High population density and consumer concentration drive e-commerce fulfillment activities, while established industrial corridors in the Bajío region generate consistent freight demand.

Southern Mexico is experiencing growing logistics relevance as infrastructure investments enhance regional connectivity. Government initiatives including the Inter-Oceanic Corridor of the Isthmus of Tehuantepec are creating new freight pathways. Agricultural exports and tourism-related cargo activities contribute to air freight demand, while emerging industrial developments attract logistics investments.

Others in Mexico contribute to air freight activities through specialized cargo requirements including agricultural products, mining outputs, and regional manufacturing operations. Secondary airports provide connectivity for areas beyond major metropolitan centers, supporting economic development and market access for businesses operating in less urbanized areas.

Market Dynamics:

Growth Drivers:

Why is the Mexico Air Freight Market Growing?

Nearshoring Activities Driving Manufacturing Expansion

The strategic relocation of manufacturing operations from distant regions to Mexico has emerged as a powerful catalyst for air freight growth. Multinational corporations seeking to reduce supply chain vulnerabilities and improve proximity to North American markets are establishing production facilities throughout the country. This manufacturing expansion generates substantial demand for inbound component shipments and outbound finished product distribution. According to sources, Mexico’s industrial parks are projected to attract US $6 billion in 2025, driven by nearshoring and reshoring initiatives supporting manufacturing expansion and logistics network growth. Furthermore, the automotive, electronics, and medical device sectors are particularly active in nearshoring investments, creating sustained freight volume growth. Enhanced trade relationships under the USMCA framework further support this trend by providing regulatory stability and preferential market access.

Strategic Geographic Position and Trade Connectivity

Mexico's geographic location between North and South America provides exceptional advantages for air freight operations serving diverse international markets. The country's extensive network of airports offers multiple gateway options for cargo entering and exiting the region. Proximity to the United States enables efficient cross-border trade flows that support integrated supply chains spanning both countries. Growing trade relationships with European and Asian markets expand destination options for Mexican exports requiring air transportation. The establishment of dedicated cargo terminals and free trade zones at strategic locations enhances Mexico's competitiveness as a regional logistics hub. According to sources, in May 2025, Aguascalientes International Airport launched a strategic air cargo expansion, enhancing infrastructure and handling capacity to strengthen the region’s logistics role and support industrial growth.

E-Commerce Expansion and Consumer Demand Evolution

The rapid penetration of e-commerce platforms throughout Mexico is transforming retail logistics and generating new air freight requirements. Growing consumer expectations for faster delivery timelines are compelling retailers to utilize air transportation for inventory replenishment and order fulfillment. Cross-border e-commerce shipments between Mexico and international markets continue expanding as digital marketplaces enable broader product accessibility. The development of fulfillment centers near major airports supports efficient last-mile distribution networks. According to sources, in 2025, Cainiao inaugurated a new logistics center in the State of Mexico near major urban and airport hubs, enhancing e-commerce fulfillment and supporting faster last-mile air cargo deliveries. Moreover, mobile commerce adoption and expanding internet connectivity in secondary cities are broadening the geographic reach of e-commerce activities requiring air cargo support.

Market Restraints:

What Challenges the Mexico Air Freight Market is Facing?

Infrastructure Capacity Limitations at Key Airports

Congestion at major airport facilities presents operational challenges that constrain cargo handling efficiency and throughput capacity. Limited availability of dedicated freighter parking positions and cargo terminal space during peak periods creates bottlenecks. Ground handling infrastructure requires continued investment to accommodate growing freight volumes and evolving shipper requirements for specialized cargo treatment.

Fuel Price Volatility and Operating Cost Pressures

Fluctuations in aviation fuel prices create cost uncertainty that affects service pricing and profitability across the air freight industry. Airlines and freight operators face challenges balancing competitive pricing with sustainable margins during periods of elevated fuel costs. Operating expenses including labor, insurance, and regulatory compliance add additional pressure on service providers navigating thin profit margins.

Competition from Alternative Transportation Modes

Ground transportation options including trucking and rail services compete with air freight for certain cargo categories where transit time requirements are less stringent. Cost-conscious shippers may opt for surface transportation when delivery schedules permit longer transit periods. Infrastructure improvements enhancing highway and rail connectivity intensify competitive pressure from alternative modes offering lower transportation costs.

Competitive Landscape:

The Mexico air freight market features a diverse competitive environment comprising international logistics conglomerates, regional cargo carriers, and specialized freight forwarders. Global players leverage extensive network reach and integrated service portfolios to serve multinational corporate clients with complex supply chain requirements. Regional operators compete through localized market knowledge, flexible service offerings, and responsive customer relationships. Competition centers on service reliability, transit time performance, tracking capabilities, and value-added solutions including customs brokerage and warehousing. Market participants pursue differentiation through technology investments, fleet modernization programs, and strategic partnerships that expand geographic coverage.

Recent Developments:

-

In June 2025, AeroUnion launched Avianca Cargo Mexico, introducing a second A330 P2F aircraft to enhance capacity for oversized and temperature-controlled cargo. The new brand strengthens Mexico’s global airfreight connectivity, supporting key sectors such as technology, automotive, pharmaceuticals, and perishables, while expanding network reach to over 350 international destinations.

Mexico Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico air freight market size was valued at USD 4.04 Billion in 2025.

The Mexico air freight market is expected to grow at a compound annual growth rate of 5.33% from 2026-2034 to reach USD 6.45 Billion by 2034.

Freight held the largest market share, fueled by high manufacturing exports, automotive component shipments, and industrial equipment transport. Strong demand across international trade corridors has reinforced its leading position, supporting Mexico’s growing role in global logistics and supply chains.

Key factors driving the Mexico air freight market include nearshoring activities expanding manufacturing capacity, strategic geographic positioning facilitating cross-border trade, growing e-commerce penetration requiring expedited delivery services, and continued infrastructure investments enhancing airport cargo capabilities.

Major challenges include infrastructure capacity constraints at key airports, fuel price volatility affecting operating costs, competition from ground transportation alternatives, regulatory compliance requirements, and the need for continued investment in cargo handling facilities and technology systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)