Mexico Aircraft Line Maintenance Market Size, Share, Trends and Forecast by Service, Type, Aircraft Type, Technology, and Region, 2025-2033

Mexico Aircraft Line Maintenance Market Overview:

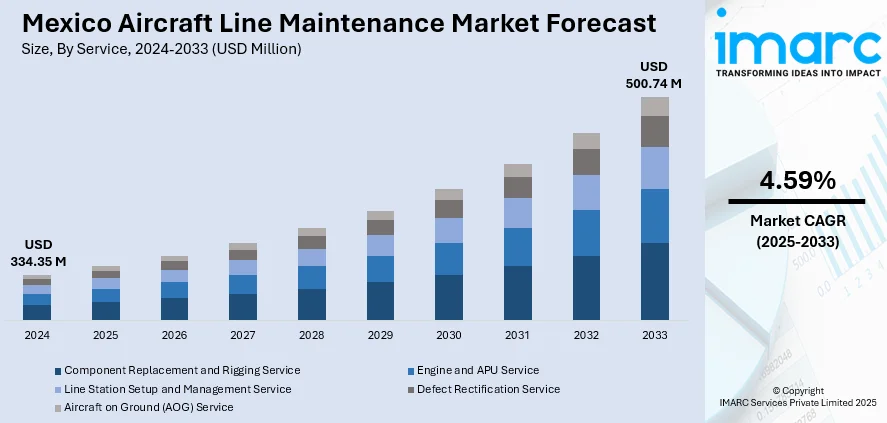

The Mexico aircraft line maintenance market size reached USD 334.35 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 500.74 Million by 2033, exhibiting a growth rate (CAGR) of 4.59% during 2025-2033. The rapid expansion of low-cost carriers, increasing domestic and regional air travel, fleet modernization with fuel-efficient aircraft, and the growing demand for quicker turnaround times is impelling the market growth. Government support for aviation infrastructure and rising tourism also contribute to sustained maintenance service growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 334.35 Million |

| Market Forecast in 2033 | USD 500.74 Million |

| Market Growth Rate 2025-2033 | 4.59% |

Mexico Aircraft Line Maintenance Market Trends:

Digitalization and Predictive Maintenance Adoption

Digital transformation is reshaping how line maintenance is conducted across Mexico. Airlines and maintenance, repair, and overhaul (MRO) providers are adopting predictive maintenance technologies using real-time data analytics, Internet of Things (IoT) sensors, and artificial intelligence (AI) tools to monitor aircraft health. These innovations allow for earlier detection of potential issues, minimizing unplanned downtime and improving operational efficiency. Mexican carriers are increasingly integrating digital platforms that centralize maintenance records, automate reporting, and streamline compliance with aviation regulations. This digital shift also includes mobile maintenance apps for technicians and digital twins to simulate and test systems. While full adoption is still emerging, major players are investing heavily in training and infrastructure to keep up with global MRO trends.

Rising Demand Due to Low-Cost Carriers (LCCs)

The rapid growth of low-cost carriers (LCCs) such as Volaris and Viva Aerobus is transforming Mexico’s aviation sector. These airlines prioritize high aircraft utilization and quick turnarounds, significantly increasing demand for efficient, reliable line maintenance services. Viva Aerobus, for example, operates a fleet of 113 Airbus aircraft as of April 2025, with an average fleet age of just 7.7 years highlighting the shift toward modern, fuel-efficient models. To support rising operations, LCCs are partnering with third-party maintenance providers and expanding in-house capabilities. Growing domestic travel driven by tourism and a rising middle class is increasing flight frequency and maintenance intervals. This trend is fueling investments in skilled workforce training, digital tools, and infrastructure upgrades at key hubs like Mexico City, Monterrey, and Cancún, ensuring maintenance providers can support newer aircraft systems effectively.

Workforce Development and Skilled Labor Shortage

One of the biggest challenges in Mexico’s line maintenance sector is the shortage of skilled labor. As aircraft fleets grow and modernize, there is a rising need for qualified technicians, particularly those certified for next-generation aircraft like the Airbus A320neo and Boeing 737 MAX. The demand is outpacing supply, pushing MRO providers and airlines to invest in workforce development. Technical training institutes and partnerships with aviation schools are expanding, but certification processes and limited bilingual training pose barriers. Companies are also offering on-the-job training and incentives to retain talent. In the long term, addressing this labor gap will be critical for sustaining safety, turnaround efficiency, thus strengthening the Mexico aircraft line maintenance market growth.

Mexico Aircraft Line Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on service, type, aircraft type, and technology.

Service Insights:

- Component Replacement and Rigging Service

- Engine and APU Service

- Line Station Setup and Management Service

- Defect Rectification Service

- Aircraft on Ground (AOG) Service

The report has provided a detailed breakup and analysis of the market based on the service. This includes component replacement and rigging service, engine and APU service, line station setup and management service, defect rectification service, and aircraft on ground (AOG) service.

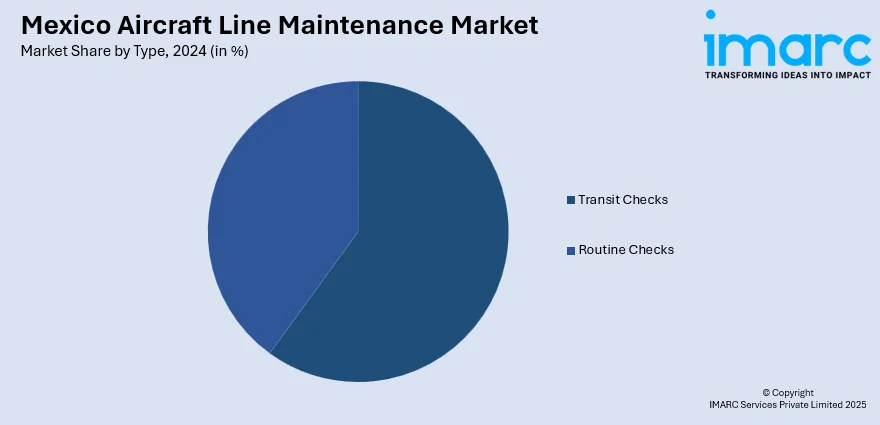

Type Insights:

- Transit Checks

- Routine Checks

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes transit checks and routine checks.

Aircraft Type Insights:

- Narrow Body Aircraft

- Wide-Body Aircraft

- Very Large Body Aircraft

- Others

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes narrow body aircraft, wide-body aircraft, very large body aircraft, and others.

Technology Insights:

- Traditional Line Maintenance

- Digital Line Maintenance

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes traditional line maintenance and digital line maintenance.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Aircraft Line Maintenance Market News:

- In March 2025, Embraer added Fly Across MRO at Toluca International Airport (MMTO) to its authorized service network. The facility will service Phenom, Praetor, and Legacy 450/500 jets, offering scheduled, unscheduled, and AOG maintenance. Following a strict evaluation process, Fly Across is now a key regional provider. This move strengthens Embraer’s MRO presence in Mexico as part of its broader service network expansion across the Americas.

- In January 2025, Safran Aircraft Engines acquired Component Repair Technologies (CRT), a U.S.-based specialist in large engine parts repair. CRT will serve as Safran’s center of excellence for engine component repairs in the Americas, enhancing MRO support for CFM56 and LEAP engines. The move is part of Safran’s €1 billion global MRO expansion, complementing existing operations including its key facility in Querétaro, Mexico.

Mexico aircraft line maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Component Replacement and Rigging Service, Engine and APU Service, Line Station Setup and Management Service, Defect Rectification Service, Aircraft on Ground (AOG) Service |

| Types Covered | Transit Checks, Routine Checks |

| Aircraft Types Covered | Narrow Body Aircraft, Wide-Body Aircraft, Very Large Body Aircraft, Others |

| Technologies Covered | Traditional Line Maintenance, Digital Line Maintenance |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico aircraft line maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico aircraft line maintenance market on the basis of service?

- What is the breakup of the Mexico aircraft line maintenance market on the basis of type?

- What is the breakup of the Mexico aircraft line maintenance market on the basis of aircraft type?

- What is the breakup of the Mexico aircraft line maintenance market on the basis of technology?

- What is the breakup of the Mexico aircraft line maintenance market on the basis of region/country?

- What are the various stages in the value chain of the Mexico aircraft line maintenance market?

- What are the key driving factors and challenges in the Mexico aircraft line maintenance market?

- What is the structure of the Mexico aircraft line maintenance market and who are the key players?

- What is the degree of competition in the Mexico aircraft line maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico aircraft line maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico aircraft line maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico aircraft line maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)