Mexico Alcoholic Beverages Market Size, Share, Trends and Forecast by Category, Alcoholic Content, Flavor, Packaging Type, Distribution Channel, and Region, 2026-2034

Mexico Alcoholic Beverages Market Summary:

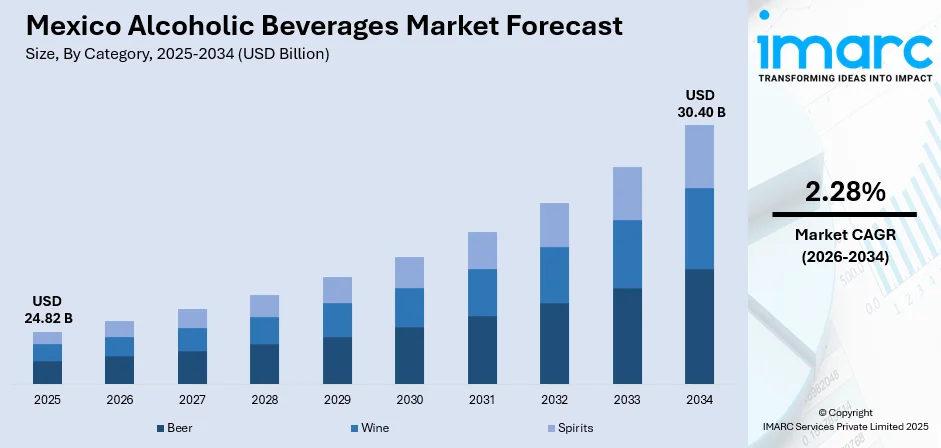

The Mexico alcoholic beverages market size was valued at USD 24.82 Billion in 2025 and is projected to reach USD 30.40 Billion by 2034, growing at a compound annual growth rate of 2.28% from 2026-2034.

The Mexico alcoholic beverages market stands as one of the most vibrant and culturally significant sectors in Latin America, deeply rooted in centuries of tradition and heritage. The market benefits from strong domestic production capabilities, particularly in iconic spirits like tequila and mezcal, while maintaining substantial beer consumption patterns. Rising disposable incomes, expanding urbanization, and evolving consumer preferences toward premium and craft products continue driving market expansion across diverse product categories and distribution channels.

Key Takeaways and Insights:

-

By Category: Beer dominates the market with a share of 71% in 2025, reflecting the deep-rooted cultural integration of beer consumption in Mexican social gatherings, celebrations, and everyday life across all demographic segments.

-

By Alcoholic Content: Medium leads the market with a share of 50% in 2025, driven by consumer preference for balanced beverages that offer enjoyable drinking experiences without excessive intoxication effects.

-

By Flavor: Unflavored represent the largest segment with a market share of 76% in 2025, owing to traditional preferences for classic beer, tequila, and mezcal that showcase authentic ingredient profiles and craftsmanship.

-

By Packaging Type: Glass bottles dominate with a share of 54% in 2025, benefiting from consumer perception of superior quality preservation, premium positioning, and recyclability supporting sustainability goals.

-

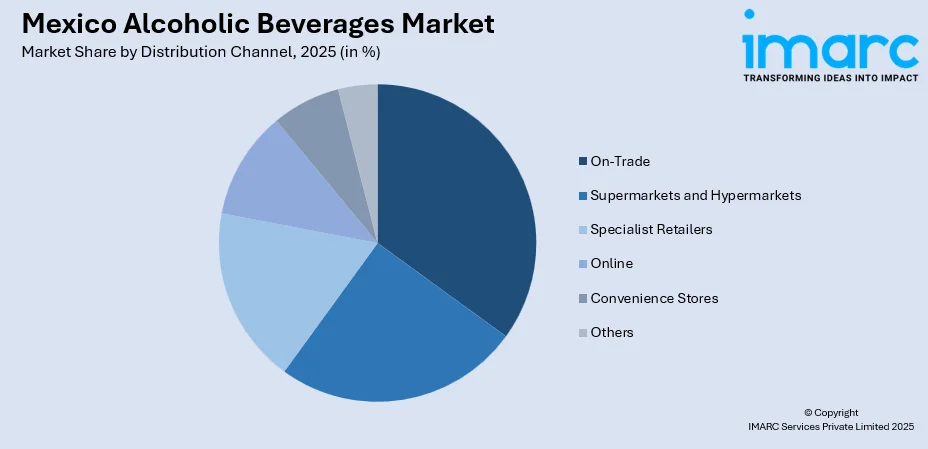

By Distribution Channel: On-trade leads with a share of 28% in 2025, fueled by Mexico's vibrant nightlife culture, expanding hospitality sector, and growing tourism industry that drives consumption in bars and restaurants.

-

By Region: Central Mexico dominated with a share of 45% in 2025, due to growing urban lifestyles, rising disposable incomes, strong tourism inflows, expanding on-trade channels, and established alcohol distribution infrastructure.

-

Key Players: The Mexico alcoholic beverages market features a competitive landscape dominated by established multinational brewing corporations alongside traditional Mexican spirits producers. Market participants leverage brand heritage, distribution networks, and product innovation to capture diverse consumer segments across premium and mass-market categories.

To get more information on this market Request Sample

The Mexico alcoholic beverages industry benefits from a unique confluence of cultural heritage and modern consumer dynamics that sustains robust market growth. For example, tequila exports from Mexico increased by about 29% in January 2025, with the United States accounting for 86% of shipments, underscoring the strength of international demand for Mexico’s signature spirit. Traditional spirits including tequila and mezcal maintain strong domestic consumption while commanding growing international recognition and export demand. The beer segment remains dominant through established brands that resonate with Mexican identity and social traditions. Emerging trends including premiumization, craft production, and health-conscious alternatives reshape competitive dynamics while expanding product diversity. The market experiences continuous evolution through innovative product launches, sustainable production practices, and expanding distribution channels that enhance consumer accessibility across urban and rural markets throughout the country.

Mexico Alcoholic Beverages Market Trends:

Premiumization and Craft Spirits Revolution

Mexican consumers increasingly gravitate toward premium and artisanal alcoholic beverages that emphasize quality ingredients, traditional production methods, and authentic craftsmanship. For example, Mezcaleria Alma, a curated New York spirits bar, was named among the best new bars of 2025 for showcasing high-quality mezcal, tequila, and regional Mexican agave spirits. Craft beer production has witnessed substantial expansion with local microbreweries offering unique flavor profiles that appeal to discerning palates. Premium tequila and aged mezcal are growing rapidly as consumers pay more for artisanal, heritage spirits.

Ready-to-Drink Cocktails and Convenience Culture

The ready-to-drink segment emerges as one of the fastest-growing categories in Mexico's alcoholic beverages market, driven by convenience-seeking consumers and younger demographics. Mexico’s leading tequila‑based RTD brand, New Mix, sold over 11 million 9‑liter cases in fiscal 2025, reflecting strong consumer demand for convenient, locally flavored pre-mixed beverages. Pre-mixed cocktails featuring traditional Mexican flavors including tamarind, hibiscus, and agave-based spirits attract consumers seeking portable, quality beverages for social occasions. Major beverage companies invest in RTDs, blending local flavors with competitive pricing and packaging.

E-commerce and Digital Distribution Expansion

Digital transformation reshapes alcohol distribution in Mexico as e-commerce platforms and delivery services gain significant consumer adoption. Alcoholic beverages are a top online category in Mexico, with 76 % buying online and 93 % planning continued digital purchases. Online alcohol sales accelerated during recent years, establishing new purchasing behaviors that persist through convenient ordering, home delivery options, and broader product accessibility. Specialized alcohol delivery applications and direct-to-consumer channels enable smaller craft producers to reach wider audiences while established brands strengthen their digital presence and customer engagement capabilities.

Market Outlook 2026-2034:

The Mexico alcoholic beverages market demonstrates favorable growth prospects throughout the forecast period, supported by expanding middle-class consumption, tourism industry recovery, and sustained innovation across product categories. The market is expected to benefit from premiumization trends driving value growth, increasing craft spirits popularity, and expanding distribution through modern retail and digital channels. Traditional segments including beer and tequila maintain dominant positions while emerging categories like ready-to-drink cocktails and low-alcohol alternatives capture growing consumer interest. The market generated a revenue of USD 24.82 Billion in 2025 and is projected to reach a revenue of USD 30.40 Billion by 2034, growing at a compound annual growth rate of 2.28% from 2026-2034.

Mexico Alcoholic Beverages Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Category | Beer | 71% |

| Alcoholic Content | Medium | 50% |

| Flavor | Unflavored | 76% |

| Packaging Type | Glass Bottles | 54% |

| Distribution Channel | On-Trade | 28% |

| Region | Central Mexico | 45% |

Category Insights:

- Beer

- Wine

- Still Light Wine

- Sparkling Wine

- Spirits

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

The beer dominates with a market share of 71% of the total Mexico alcoholic beverages market in 2025.

Beer maintains commanding market leadership through deep cultural integration in Mexican social traditions, celebrations, and everyday consumption patterns. The segment benefits from established domestic brands like Corona, Modelo, and Tecate that resonate with national identity. According to the BrandZ Most Valuable Brands 2025 ranking, Corona was recognized as Mexico’s most valuable brand and one of the world’s most valuable beer brands, highlighting its strong cultural and commercial presence in 2025. Growing craft beer production and premium lager offerings expand consumer choices while maintaining beer's dominant position across all demographic segments and consumption occasions throughout Mexico.

Additionally, beer’s dominance is reinforced by its affordability, widespread availability, and strong on-trade presence across bars, restaurants, and informal outlets nationwide. Favorable climate conditions further support high beer consumption, particularly in central and northern regions. Major brewers continue investing in capacity expansion, marketing, and sustainable packaging, while innovations in flavor variants and low-alcohol options attract younger and health-conscious consumers, ensuring sustained growth and resilience of the beer segment within Mexico’s alcoholic beverages market.

Alcoholic Content Insights:

- High

- Medium

- Low

The medium leads with a share of 50% of the total Mexico alcoholic beverages market in 2025.

Medium alcohol content beverages dominate consumer preferences by delivering balanced drinking experiences suitable for extended social occasions without excessive intoxication effects. This segment encompasses popular beer varieties, wine, and ready-to-drink cocktails that align with moderate consumption patterns. Major beverage companies are reinforcing this trend with significant investments: for example, Heineken announced in 2025 that it will invest about US $2.7 billion in Mexico through 2028 to expand production capacity, including new facilities that will support a broad portfolio of beers and other moderate‑alcohol products tailored to local demand.

This preference is further supported by evolving health awareness and regulatory messaging promoting moderation over high-strength consumption. Medium-alcohol beverages offer flexibility across on-trade and off-trade channels, fitting casual home gatherings as well as restaurants and bars. Product innovations such as session beers, light wines, and balanced RTD formulations strengthen appeal, while competitive pricing and broad brand portfolios ensure accessibility, reinforcing the segment’s leadership in Mexico’s alcoholic beverages market.

Flavor Insights:

- Unflavored

- Flavored

The unflavored dominates with a market share of 76% of the total Mexico alcoholic beverages market in 2025.

Unflavored alcoholic drinks lead Mexico’s alcohol market as consumers increasingly favor products that preserve original taste profiles and cultural identity. Beverages such as tequila, mezcal, and traditional lagers are closely associated with artisanal production, regional heritage, and minimal alteration. Government-backed origin certifications and a growing preference for premium offerings further strengthen demand. Their suitability for both casual and celebratory occasions, combined with ease of mixing or straight consumption, supports sustained growth.

The continued dominance of unflavored alcoholic beverages in Mexico is supported by trust in traditional recipes and transparent ingredient compositions. Consumers view tequila, mezcal, and classic beers as reliable representations of national identity and quality standards. Rising interest in premium brands and legally protected origins elevates their market value. Additionally, their acceptance across demographics and flexibility in consumption styles, from neat servings to mixed drinks, keeps this segment central to overall market performance.

Packaging Type Insights:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

The glass bottles leads with a share of 54% of the total Mexico alcoholic beverages market in 2025.

Glass bottle packaging maintains market leadership through consumer perception of superior quality preservation, premium product positioning, and enhanced sustainability credentials. The format aligns with Mexican traditions of sharing beer and spirits in glass containers that preserve authentic flavor profiles. In 2025, Grupo Modelo reported recycling and reusing around 96 % of its glass bottles in Mexico, showcasing widespread adoption of returnable glass systems and reinforcing consumer confidence in sustainable packaging. Growing environmental consciousness reinforces glass packaging preference due to recyclability benefits and reduced environmental impact compared to alternative materials.

Glass bottles also benefit from well-established returnable and refillable systems widely used by major brewers in Mexico, supporting cost efficiency and circular economy goals. Strong infrastructure for glass recycling enhances supply chain reliability and sustainability outcomes. Moreover, glass packaging remains the preferred choice for on-trade establishments, where presentation, durability, and temperature retention are critical, further reinforcing its dominant position in Mexico’s alcoholic beverages market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

The on-trade dominates with a market share of 28% of the total Mexico alcoholic beverages market in 2025.

On-trade distribution channels, including bars, restaurants, hotels, and nightclubs, retain a strong market presence, fueled by Mexico’s dynamic nightlife and growing tourism sector. These venues provide premium consumption experiences that justify higher price points while allowing brands to engage consumers effectively. Recovery in the hospitality sector continues to strengthen on-trade performance across major urban centers and tourist destinations, positioning the channel as a key driver of overall alcoholic beverage sales.

On-trade growth is further reinforced by experiential marketing, live events, and social gatherings that increase per-occasion spending. Urbanization and rising disposable incomes in cities like Mexico City, Guadalajara, and Monterrey encourage more frequent visits to bars and restaurants. Premium spirits, craft beers, and signature cocktails perform particularly well in these settings, where professional service and appealing ambiance enhance brand perception, cementing the importance of on-trade channels in Mexico’s alcohol market.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico exhibits a clear dominance with a 45% share of the total Mexico alcoholic beverages market in 2025.

Central Mexico commands market leadership through concentration of population, economic activity, and consumer spending in metropolitan areas including Mexico City and surrounding states. The region benefits from diverse retail infrastructure, extensive hospitality venues, and higher disposable incomes supporting premium product consumption. Central Mexico's dominant position reflects urbanization patterns, concentrated distribution networks, and strong local demand, effectively serving the nation’s largest consumer market while attracting new brands and encouraging innovation across the alcoholic beverages sector.

The region’s dominance is further reinforced by strong logistics connectivity, enabling efficient distribution from major production hubs to both on-trade and off-trade outlets. Central Mexico also hosts a high concentration of corporate offices, cultural events, and international tourism, driving consistent demand across beverage categories. Ongoing investments in retail modernization and hospitality expansion continue to elevate consumption levels, sustaining Central Mexico’s leadership in the national alcoholic beverages market.

Market Dynamics:

Growth Drivers:

Why is the Mexico Alcoholic Beverages Market Growing?

Rising Disposable Incomes and Urbanization

Mexico's expanding middle class and growing urbanization patterns drive increased alcoholic beverage consumption across premium and mass-market segments. Rising disposable incomes enable consumers to explore higher-quality products, premium brands, and craft alternatives that were previously inaccessible. Urban lifestyle changes foster greater participation in nightlife activities, dining occasions, and social gatherings where alcohol consumption features prominently. Major industry players are supporting this shift, with Grupo Modelo (AB InBev) planning over US $3.6 billion investment in Mexico to modernize plants, aid local producers, and bolster infrastructure, reflecting strong domestic demand. The demographic shift toward younger, urban populations creates sustained demand for diverse beverage options that align with contemporary preferences and aspirational consumption patterns.

Tourism Industry Expansion and Hospitality Growth

Mexico's thriving tourism sector significantly contributes to alcoholic beverages market expansion through increased on-trade consumption in hotels, resorts, restaurants, and entertainment venues. International visitors seeking authentic Mexican experiences drive demand for traditional spirits including tequila and mezcal while supporting premium product consumption. Tourism-focused regions including beach destinations and cultural centers experience concentrated hospitality development that expands alcohol distribution channels and consumption opportunities throughout the year, further stimulating local economies, creating jobs, and encouraging investment in beverage innovation and marketing initiatives.

Product Innovation and Premiumization Trends

Continuous product innovation across all beverage categories propels market growth by addressing evolving consumer preferences and creating new consumption occasions. Premiumization trends drive value growth as consumers increasingly invest in craft spirits, artisanal products, and aged varieties that command higher price points. For example, the Mexican government and industry regulators launched the Agave Responsable Social (ARS) certification program in 2025 to strengthen the agave‑tequila production chain by supporting traditional growers and promoting sustainable practices, enabling more authentic and innovative tequila products to enter the market. Ready-to-drink innovations, flavor experimentation, and health-conscious alternatives expand market reach to previously underserved consumer segments while established brands refresh portfolios to maintain relevance with younger demographics.

Market Restraints:

What Challenges the Mexico Alcoholic Beverages Market is Facing?

Regulatory Restrictions and Taxation Policies

The Mexican alcoholic beverages market operates within stringent regulatory frameworks governing production, advertising, and distribution that impact industry operations. Excise taxes and special consumption taxes increase product costs, potentially affecting consumer demand particularly in price-sensitive segments. Advertising restrictions limiting alcohol promotion require manufacturers to develop alternative marketing strategies that maintain brand visibility within regulatory compliance requirements.

Health Awareness and Responsible Drinking Campaigns

Growing public health awareness regarding alcohol consumption impacts market dynamics as campaigns promoting responsible drinking influence consumer behavior patterns. Health-conscious consumers increasingly moderate alcohol intake or shift toward lower-alcohol alternatives, affecting traditional product segment growth. Government initiatives addressing alcohol-related health issues may introduce additional consumption restrictions affecting market expansion potential.

Raw Material Supply Challenges and Cost Pressures

Agave supply constraints particularly affect tequila and mezcal production, creating raw material cost pressures that impact pricing and availability. Climate variability affects agricultural inputs including barley and grapes used in beer and wine production. Rising input costs challenge manufacturers to balance quality maintenance with competitive pricing while managing supply chain complexities across diverse product categories.

Competitive Landscape:

The Mexico alcoholic beverages market operates within a highly competitive environment characterized by presence of multinational brewing corporations, traditional Mexican spirits producers, and emerging craft beverage manufacturers. Market leaders including Grupo Modelo, Heineken Mexico, and established tequila houses leverage extensive distribution networks, brand heritage, and significant marketing investments to maintain dominant positions. Competition intensifies through premiumization strategies, product innovation, and digital marketing initiatives targeting younger consumer demographics. The craft segment attracts new entrants offering artisanal products that differentiate through quality, authenticity, and regional identity. Strategic acquisitions, distribution partnerships, and export expansion characterize competitive strategies as participants seek to capture growth opportunities across domestic and international markets.

Recent Developments:

-

In Nov 2025, Grupo Modelo and premium chocolatier Turín teamed up to release Negra Modelo Chocolate Turín, a limited-edition lager blending dark malt with semiamargo cacao notes for the 2025 holiday season in Mexico. The seasonal beer targets festive occasions and gourmet pairings.

Mexico Alcoholic Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Alcoholic Contents Covered | High, Medium, Low |

| Flavors Covered | Unflavored, Flavored |

| Packaging Types Covered | Glass Bottles, Tins, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico alcoholic beverages market size was valued at USD 24.82 Billion in 2025.

The Mexico alcoholic beverages market is expected to grow at a compound annual growth rate of 2.28% from 2026-2034 to reach USD 30.40 Billion by 2034.

Beer dominated the Mexico alcoholic beverages market with a share of 71%, driven by deep cultural integration in Mexican social traditions, established domestic brands, and consistent consumer preference across all demographic segments.

Key factors driving the Mexico alcoholic beverages market include rising disposable incomes, growing urbanization, expanding tourism industry, premiumization trends toward craft products, innovative RTD launches, and widening distribution networks across modern retail and digital platforms.

Major challenges include regulatory restrictions and taxation policies affecting production and advertising, health awareness campaigns promoting responsible drinking, raw material supply challenges particularly agave shortages, and competition from low-alcohol and non-alcoholic alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)