Mexico Artificial Insemination Market Size, Share, Trends and Forecast by Type, Source Type, End Use, and Region, 2025-2033

Mexico Artificial Insemination Market Overview:

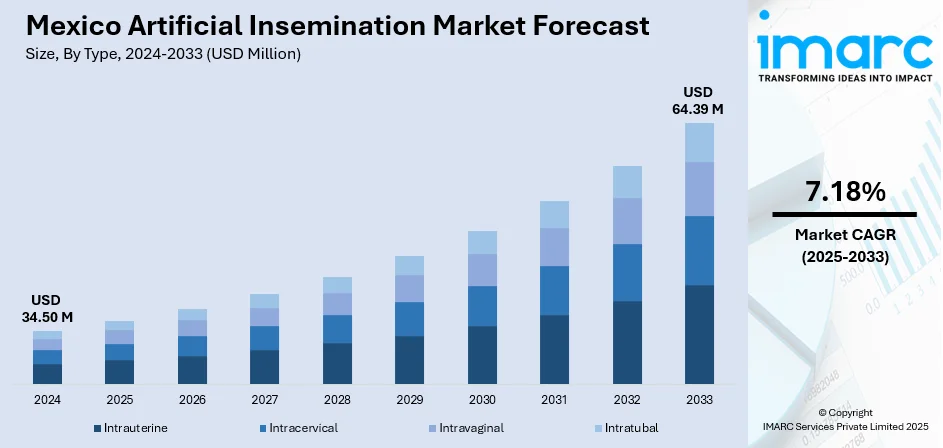

The Mexico artificial insemination market size reached USD 34.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 64.39 Million by 2033, exhibiting a growth rate (CAGR) of 7.18% during 2025-2033. Rising demand for high-quality livestock genetics, growing adoption of advanced reproductive technologies, increased government support for sustainable animal husbandry, and expansion of artificial insemination infrastructure by key players are driving the Mexico artificial insemination market by enhancing productivity, improving breeding efficiency, and meeting the rising consumer demand for meat and dairy products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.50 Million |

| Market Forecast in 2033 | USD 64.39 Million |

| Market Growth Rate 2025-2033 | 7.18% |

Mexico Artificial Insemination Market Trends:

Government Support and Agricultural Modernization Policies

A significant driver of the artificial insemination market in Mexico is the government's robust support for modernizing the agricultural and livestock sectors. Over the past decade, the Mexican government has implemented a series of policies, incentives, and subsidies designed to promote the adoption of reproductive technologies in animal breeding, particularly artificial insemination. These initiatives are part of a broader national strategy aimed at enhancing productivity, ensuring food security, and reducing dependence on imported animal products. Key programs such as the "Programa de Fomento Ganadero" and PROGAN (“Programa de Producción Pecuaria Sustentable Ordenamiento Ganadero y Apícola”) have played a crucial role in promoting sustainable livestock production. These programs provide financial assistance and technical training to farmers, particularly in rural areas, to facilitate the adoption of artificial insemination methods. The overarching goal of these efforts is to improve the genetic quality of local herds, increase meat and milk production, and reduce the prevalence of diseases, which are prevalent concerns in Mexico’s agricultural regions. Additionally, partnerships between the government, private biotechnology firms, and research institutions have facilitated the transfer of technology, making artificial insemination machinery and services more accessible. As a result, artificial insemination is no longer confined to large-scale commercial farms but is increasingly being adopted by small and medium-sized agricultural enterprises.

To get more information on this market, Request Sample

Rising Demand for High-Quality Animal Protein

Another significant factor influencing the artificial insemination market in Mexico is the rising domestic demand for high-quality animal protein, particularly beef and dairy products. As the country experiences demographic and economic shifts, including an expanding middle class, urbanization, and changes in dietary preferences, there has been a marked increase in the consumption of premium-quality animal protein. Urban consumers, in particular, are seeking leaner meats, organic dairy, and hormone-free animal products, necessitating precise and efficient breeding methods. Artificial insemination plays a pivotal role in addressing these evolving consumer demands. By enabling selective breeding, artificial insemination allows producers to enhance desirable genetic traits such as meat marbling, milk fat content, disease resistance, and reproductive efficiency. This results in healthier and more productive livestock that is better suited to meet the market’s demand for high-quality protein. Furthermore, as competition from imports intensifies and there is a greater emphasis on food quality and traceability, domestic producers are increasingly required to meet international standards.

Mexico Artificial Insemination Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, source type, and end use.

Type Insights:

- Intrauterine

- Intracervical

- Intravaginal

- Intratubal

The report has provided a detailed breakup and analysis of the market based on the type. This includes intrauterine, intracervical, intravaginal, and intratubal.

Source Type Insights:

- AIH-Husband

- AID-Donor

A detailed breakup and analysis of the market based on the source type have also been provided in the report. This includes AIH-husband and AID-donor.

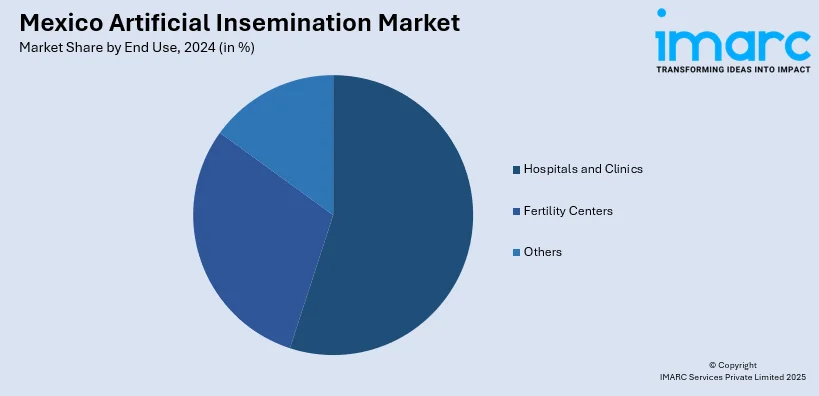

End Use Insights:

- Hospitals and Clinics

- Fertility Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals and clinics, fertility centers, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Artificial Insemination Market News:

- April 2025: A baby was born through an IVF procedure predominantly executed by remotely operated robots via automating intracytoplasmic sperm injection (ICSI). The procedure was conducted in Guadalajara, Mexico, with embryologists and engineers in Hudson, New York, overseeing the process remotely. The technology, developed by Conceivable Life Sciences, automates 23 critical steps of ICSI, including sperm selection and injection, aiming to enhance precision and reduce human error.

- September 2024: Mexico introduced its first litter of Mexican gray wolf pups conceived through artificial insemination. The procedure was carried out at Mexico City's Chapultepec Zoo, where a female wolf, unable to conceive naturally due to physical issues, gave birth to two pups back in May 2024.

Mexico Artificial Insemination Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Intrauterine, Intracervical, Intravaginal, Intratubal |

| Source Types Covered | AIH-Husband, AID-Donor |

| End Uses Covered | Hospitals and Clinics, Fertility Centers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico artificial insemination market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico artificial insemination market on the basis of type?

- What is the breakup of the Mexico artificial insemination market on the basis of source type?

- What is the breakup of the Mexico artificial insemination market on the basis of end use?

- What is the breakup of the Mexico artificial insemination market on the basis of region?

- What are the various stages in the value chain of the Mexico artificial insemination market?

- What are the key driving factors and challenges in the Mexico artificial insemination market?

- What is the structure of the Mexico artificial insemination market and who are the key players?

- What is the degree of competition in the Mexico artificial insemination market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico artificial insemination market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico artificial insemination market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico artificial insemination industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)