Mexico Artisanal Chocolate Market Size, Share, Trends and Forecast by Product Type, Ingredients, Distribution Channel, Consumer Demographics, Application, and Region, 2025-2033

Mexico Artisanal Chocolate Market Overview:

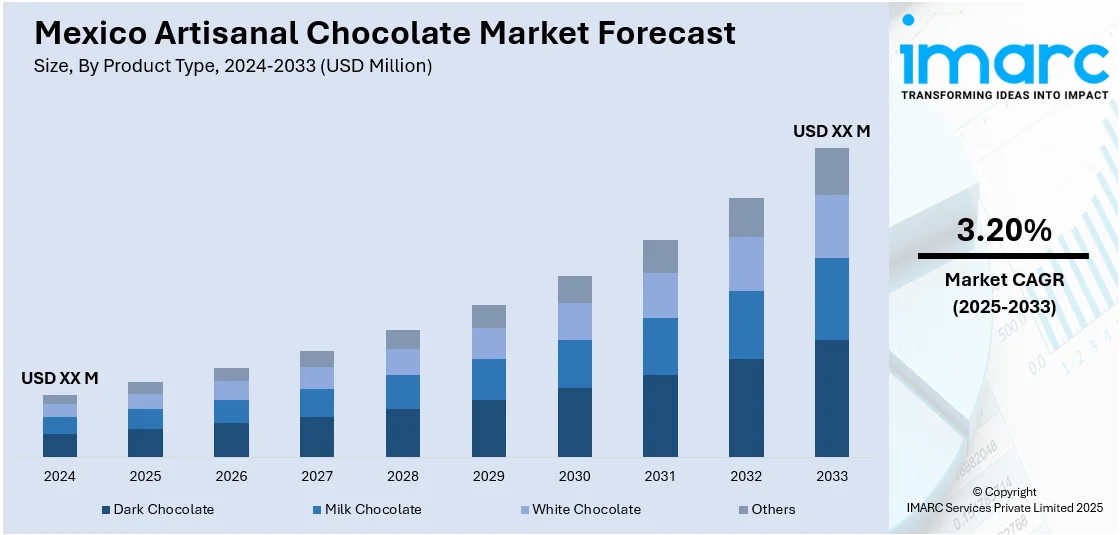

The Mexico artisanal chocolate market size is exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The market is driven by the rising consumer appreciation for premium, handcrafted chocolates rooted in the country’s rich cacao heritage. Demand for authentic, sustainable, and culturally inspired products is growing, supported by culinary tourism and evolving taste preferences. Local chocolatiers are innovating with traditional techniques and unique flavors, enhancing the overall industry dynamism and contributing to the growth of the Mexico artisanal chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 3.20% |

Mexico Artisanal Chocolate Market Analysis:

- Key Drivers: Enhanced consumer appetite for high-end, authentic, ethically produced products propels artisanal chocolate. Mexico's rich cocoa tradition, increased health consciousness, and tourist growth also contribute to local brands. Encouragement from government initiatives supporting cacao farmers and origin storytelling also propels artisanal chocolate's increasing popularity.

- Key Market Trends: Single-origin chocolates, bean-to-bar, organic certifications, and creative flavors combining indigenous ingredients such as chili, mezcal, or coffee, are key Mexico artisanal chocolate trends. Cultural aesthetic packaging tells the story. Distribution is extended by e-commerce and specialty stores, and sustainability practices and fair-trade sourcing become ever more essential to attracting conscious consumers.

- Market Opportunities: Mexico's artisanal chocolate market presents firm opportunities in international exports, capitalizing on increasing demand for high-quality craft chocolate globally. Synergies with tourism, gastronomy, and hospitality industries increase visibility. Online channels support direct-to-consumer sales, while sustainable supply chains and farmer empowerment enhance brand positioning, providing differentiation versus industrial chocolate.

- Market Challenges: Based on the Mexico artisanal chocolate market analysis, some of the most significant market challenges are high costs of production, fragmented supply chains, and mass-produced chocolate competition. Small companies have limited capital, scalability, and exportation constraints. Climate change poses a threat to cocoa yields, while price sensitivity from consumers limits growth. Maintaining consistent quality and dealing with international certification requirements present additional barriers for artisanal chocolate manufacturers.

Mexico Artisanal Chocolate Market Trends:

Revival of Traditional Chocolate-Making Techniques and Heritage

The Mexican artisanal market of chocolate is highly driven by the re-emergence and celebration of the traditional approach to chocolate production, richly embedded in the national culture and history. Artisan chocolatiers are using the old practice of stone grinding (metate) and hand tempering to produce chocolates that reflect indigenous tradition in addition to adhering to modern standards of quality. Consumers are becoming more interested in products that represent true Mexican cacao culture, providing an unparalleled, immersive journey to their experiences and the history of the country. This cultural revival is not only preserving artisanal methods but also providing opportunities for small producers and local communities to differentiate their offerings in the premium chocolate market, fueling consumer interest and supporting the Mexico artisanal chocolate market growth.

To get more information on this market, Request Sample

Influence of Culinary Tourism and Gastronomic Innovation

Mexico’s growing status as a global culinary destination is amplifying interest in artisanal chocolate, both from tourists seeking authentic local experiences and from domestic consumers inspired by the country’s vibrant gastronomic culture. Culinary tourism promotes the discovery of the regional cacao variety, tasting chocolate and workshops that also promote the prestige of artisanal chocolate. Simultaneously, local chocolatiers are experimenting with local ingredients such as chili, cinnamon, and mezcal, thus creating unique products that combine heritage with contemporary culinary artistry. Such innovation, coupled with further exposure through festivals, restaurants, and gourmet stores, makes artisanal chocolate an important part of Mexico’s emerging food culture in terms of Mexico artisanal chocolate market demand. For instance, in May 2023, Barry Callebaut, the top producer of premium chocolate and cocoa goods globally, maintained its ongoing quest for innovation and new opportunities for its clients. This time, it is excited to introduce two essential products in the Mexican market: Callebaut NXT and SICAO Zero, offering consumers options that are beneficial without compromising on indulgence.

Expansion of Niche Retail and Online Distribution Channels

The availability of artisanal chocolate in niche retail outlets, specialty shops, gourmet food stores, and online platforms is facilitating greater market reach across Mexico. Artisanal chocolatiers are leveraging these channels to connect directly with consumers, offering curated experiences, personalized packaging, and storytelling that highlights product authenticity and origin. The growth of e-commerce and social media marketing has further expanded the market, enabling chocolatiers to target broader and more diverse audiences, including international buyers. These platforms allow small and medium-sized chocolate producers to build brand awareness and compete effectively in the premium segment, supporting the overall dynamism of the artisanal chocolate sector in Mexico.

Mexico Artisanal Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, ingredients, distribution channel, consumer demographics, and application.

Product Type Insights:

- Dark Chocolate

- Milk Chocolate

- White Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dark chocolate, milk chocolate, white chocolate, and others.

Ingredients Insights:

- Organic and Natural Ingredients

- Conventional Ingredients

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes organic and natural ingredients, and conventional ingredients.

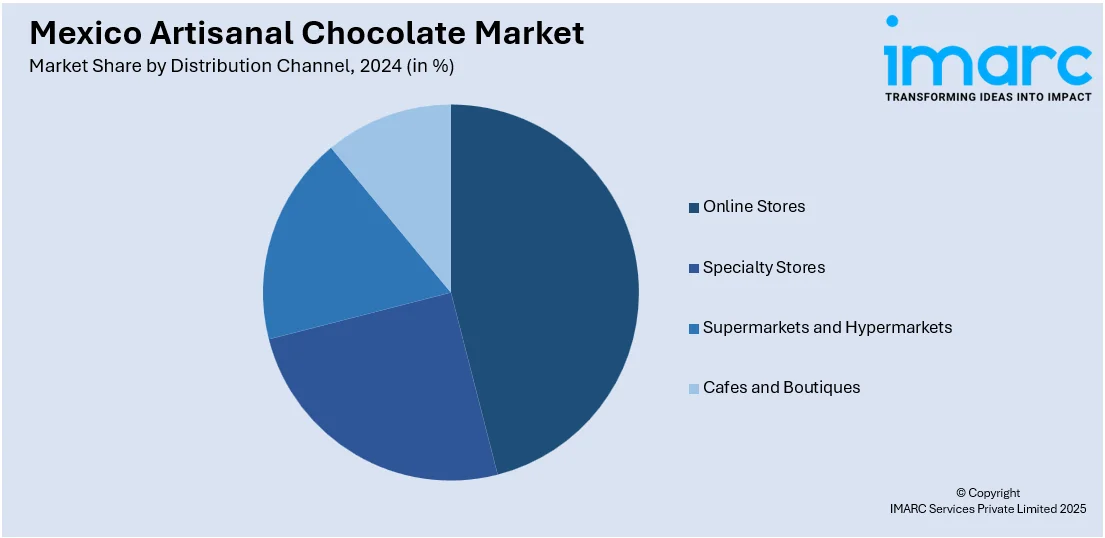

Distribution Channel Insights:

- Online Stores

- Specialty Stores

- Supermarkets and Hypermarkets

- Cafes and Boutiques

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores, specialty stores, supermarkets and hypermarkets, and cafes and boutiques.

Consumer Demographics Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the consumer demographics have also been provided in the report. This includes premium and mass.

Application Insights:

- Direct Consumption

- Bakery and Confectionery

- Beverages

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes direct consumption, bakery and confectionery, and beverages.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Artisanal Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dark Chocolate, Milk Chocolate, White Chocolate, Others |

| Ingredients Covered | Organic and Natural Ingredients, Conventional Ingredients |

| Distribution Channels Covered | Online Stores, Specialty Stores, Supermarkets and Hypermarkets, Cafes and Boutiques |

| Consumer Demographics Covered | Premium, Mass |

| Applications Covered | Direct Consumption, Bakery and Confectionery, Beverages |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico artisanal chocolate market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico artisanal chocolate market on the basis of product type?

- What is the breakup of the Mexico artisanal chocolate market on the basis of ingredients?

- What is the breakup of the Mexico artisanal chocolate market on the basis of distribution channel?

- What is the breakup of the Mexico artisanal chocolate market on the basis of consumer demographics?

- What is the breakup of the Mexico artisanal chocolate market on the basis of application?

- What is the breakup of the Mexico artisanal chocolate market on the basis of region?

- What are the various stages in the value chain of the Mexico artisanal chocolate market?

- What are the key driving factors and challenges in the Mexico artisanal chocolate market?

- What is the structure of the Mexico artisanal chocolate market and who are the key players?

- What is the degree of competition in the Mexico artisanal chocolate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico artisanal chocolate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico artisanal chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico artisanal chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)