Mexico Asphalt Pavers Market Size, Share, Trends and Forecast by Type, Paving Range, and Region, 2025-2033

Mexico Asphalt Pavers Market Overview:

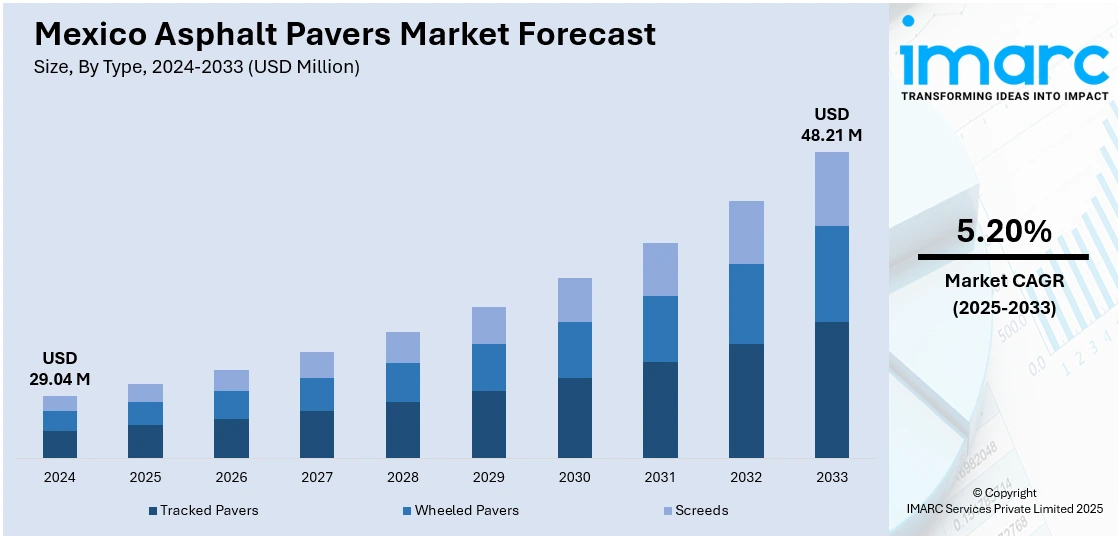

The Mexico asphalt pavers market size reached USD 29.04 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 48.21 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is growing due to major public infrastructure investments and rising demand for safer, low-emission equipment. Projects covering road repaving, bridge upgrades, and rural connectivity are driving equipment adoption, supporting long-term expansion in Mexico asphalt pavers market share across public and private sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.04 Million |

| Market Forecast in 2033 | USD 48.21 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Asphalt Pavers Market Analysis:

- Major Market Drivers: The asphalt pavers market analysis points out that growth is fueled by increasing urbanization, high infrastructure investments, and state-supported road upgradation programs. Increasing demand for cost-effective, long-lasting paving equipment on highways, airports, and business developments continues to spur overall market growth in the nation.

- Key Market Trends: The market is increasingly influenced by automation, GPS guided pavers, and telematics integration that improve construction productivity. Environment-friendly and sleek paving machinery are gaining traction in city-centered projects, demonstrating Mexico asphalt pavers market trends towards sustainability and advanced road construction technologies.

- Competitive Landscape: The market research shows a competitive landscape with international brands leading, supplemented by domestic players, with focus on innovation, after-sales support, and renting solutions. Distribution networks and strategic alliances help in fulfilling growing demand for road and infrastructure projects.

- Challenges and Opportunities: While high capital expenditures, raw material price volatility, and the lack of skilled operators create challenges, the potential comes from increasing infrastructure budgets, public-private ventures, and the take-up of new paving technologies, promising long-term potential within Mexico's shifting construction and transport sectors.

Mexico Asphalt Pavers Market Trends:

Public Infrastructure Push Driving Equipment Demand

Mexico’s asphalt pavers market is being driven by an aggressive government-led infrastructure expansion plan that aims to improve connectivity, road safety, and economic integration across states. A consistent increase in public spending on roads and highways is creating large-scale opportunities for paving equipment suppliers, particularly those offering high-efficiency, heavy-duty machines suited for extensive repaving and new construction. The market is responding to demand for machines that can perform continuous, high-volume work while ensuring speed and precision. Contractors working across federal and rural corridors require reliable, durable pavers capable of operating in diverse site conditions. In May 2025, the Mexican government announced a USD19 Billion investment plan for road infrastructure through 2030. The plan included 9,400km of repaving, 2,220km of priority roads, 2,107km of rural roads, and rehabilitation of 68 bridges. These initiatives were part of broader programs such as Lázaro Cárdenas del Río and the Guerrero highway reconstruction effort. This scale of activity significantly increased demand for asphalt pavers and related equipment. As a result, manufacturers and rental providers experienced increased orders, signaling continued growth. The long-term commitment to road development is expected to fuel equipment demand further, boosting the Mexico asphalt pavers market share and reinforcing its role in national infrastructure advancement.

To get more information on this market, Request Sample

Operator Safety and Emission Efficiency Trends

Health and safety regulations, coupled with a growing focus on environmental sustainability, are influencing purchasing decisions in Mexico’s asphalt pavers market. Construction firms are now favoring pavers with advanced safety features, improved operator comfort, and reduced noise and emissions. These changes reflect a broader trend of aligning construction practices with international environmental standards and labor safety norms. Equipment that offers lower emissions, noise reduction, and intuitive automation is becoming a preferred choice, particularly for urban projects, night works, and areas with restricted access. Contractors seek machines that enhance worker well-being and contribute to sustainability targets without compromising performance. In August 2024, Vögele introduced its Dash 5 Asphalt Paver series, which included several safety and eco-efficiency upgrades. Features like ground-level commissioning with Paver Access Control (PAC), integrated LED lighting, automatic hardtop locking, and the EcoPlus emission-reduction package positioned the paver as a strong fit for the evolving Mexican market. These improvements reduced accident risk, improved night-time visibility, and supported quieter, cleaner operations—critical for compliance in high-sensitivity zones. As equipment buyers place greater emphasis on operator health and environmental impact, such advancements are shaping equipment standards. The trend is pushing manufacturers to develop smarter, safer pavers, reinforcing the sustainability shift in Mexico asphalt pavers market demand.

Mexico Asphalt Pavers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type and paving range.

Type Insights:

- Tracked Pavers

- Wheeled Pavers

- Screeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes tracked pavers, wheeled pavers, and screeds.

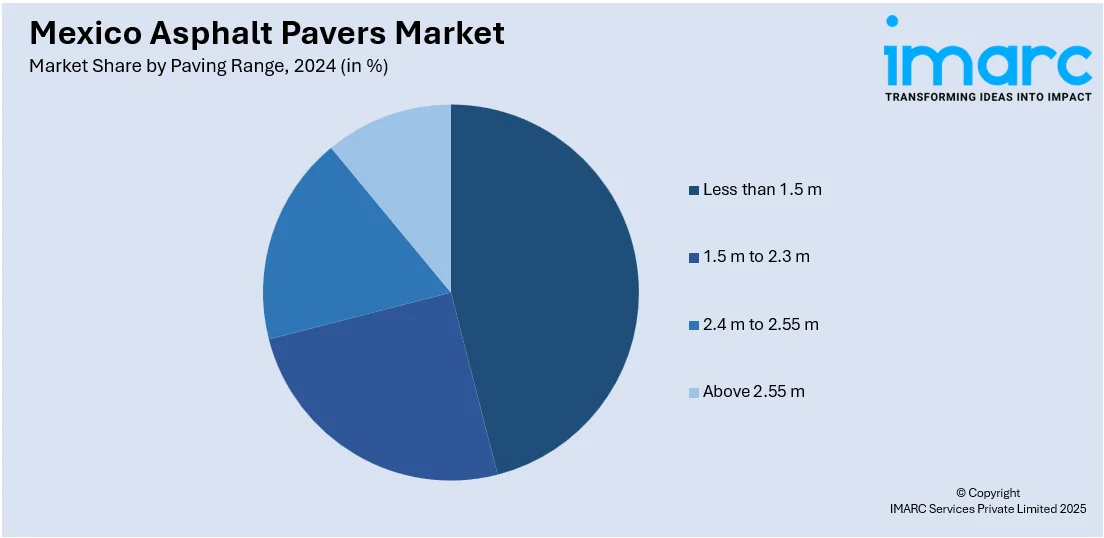

Paving Range Insights:

- Less than 1.5 m

- 1.5 m to 2.3 m

- 2.4 m to 2.55 m

- Above 2.55 m

A detailed breakup and analysis of the market based on the paving range have also been provided in the report. This includes less than 1.5 m, 1.5 m to 2.3 m, 2.4 m to 2.55 m, and above 2.55 m.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Asphalt Pavers Market News:

- In August 2024, Vögele launched its Dash 5 Asphalt Paver with PAC ground-level commissioning, modern LED lighting, and the EcoPlus emission-reduction package. These features directly address changing safety, health, and sustainability concerns in the Mexico Asphalt Pavers Market, accelerating demand for advanced paving equipment.

Mexico Asphalt Pavers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tracked Pavers, Wheeled Pavers, Screeds |

| Paving Ranges Covered | Less than 1.5 m, 1.5 m to 2.3 m, 2.4 m to 2.55 m, Above 2.55 m |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico asphalt pavers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico asphalt pavers market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico asphalt pavers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The asphalt pavers market in Mexico was valued at USD 29.04 Million in 2024.

The Mexico asphalt pavers market is projected to exhibit a (CAGR) of 5.20% during 2025-2033, reaching a value of USD 48.21 Million by 2033.

The market is fueled by massive government infrastructure outlays, increasing urbanization, and growing demand for reliable road connectivity. Government investments in high-speed highways, rural roads, and bridge renewal stimulate equipment adoption. Innovation in automation, sustainability, and operator safety increases efficiency further, driving robust demand for advanced paving machinery in Mexico's transportation and construction industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)