Mexico Assisted Reproductive Technology Market Size, Share, Trends and Forecast by Product, Type, End Use, and Region, 2025-2033

Mexico Assisted Reproductive Technology Market Overview:

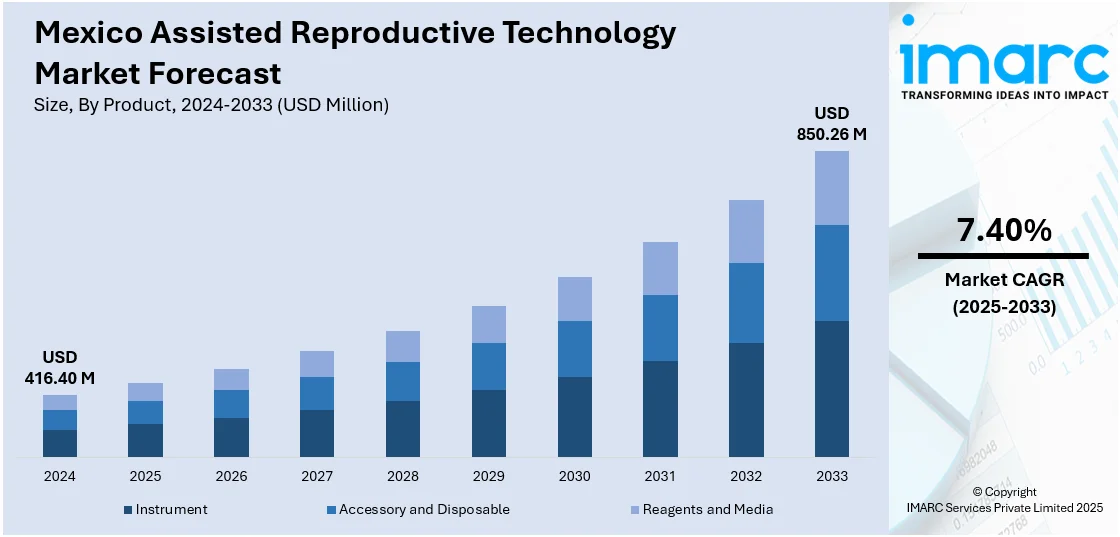

The Mexico assisted reproductive technology market size reached USD 416.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 850.26 Million by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. Rising infertility, medical tourism, and growing public awareness are boosting demand for fertility services in Mexico. Affordable IVF and ICSI, policy support, tech advancements, and expanding private fertility clinics are fueling growth. Greater societal acceptance of diverse family structures, increased fertility preservation, broader insurance coverage, and collaborations between global and local providers also contribute to the sector's rise. These factors collectively strengthen the Mexico assisted reproductive technology market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 416.40 Million |

| Market Forecast in 2033 | USD 850.26 Million |

| Market Growth Rate 2025-2033 | 7.40% |

Mexico Assisted Reproductive Technology Market Trends:

Rising Infertility Rates

Mexico assisted reproductive technology (ART) market is being propelled by increasing infertility in men and women. For instance, in 2023, Mexico's total fertility rate has been decreasing, reaching 1.91 births per woman, which is below the replacement rate of 2.1. Moreover, the declining pattern is suggestive of broader demographic shifts and may be connected to increased infertility rates. Factors such as heightened stress, sedentary lifestyle, poor diet, and a rising rate of obesity and diabetes are inducing reduced fertility. Women are also postponing pregnancy due to career reasons or delayed marriages, further reducing the natural conception period. Male infertility due to lifestyle and environmental reasons is also on the rise. These trends are prompting more couples to avail themselves of ART options as effective therapies to conceive. Moreover, clinics are seeing more patients, especially in urban areas, where awareness and access are higher. With infertility becoming more common and less of a stigma, demand for clinical diagnosis and advanced fertility treatment is rising steadily, which is further driving the Mexico assisted reproductive technology market growth.

Public Awareness and Education

Growing public awareness and access to information have become key drivers of the ART market in Mexico. Educational campaigns by fertility clinics, social media content, and support groups are making assisted reproductive options more visible and understood. Many individuals and couples now actively seek guidance on fertility issues much earlier, leading to timely medical consultations and higher success rates for ART procedures. Moreover, the availability of Spanish-language educational resources has made it easier for a wider population to understand the processes involved in IVF, ICSI, and other treatments. Clinics are also investing in patient counseling and outreach programs to build trust and encourage informed decision-making. This shift toward greater knowledge is changing how people approach fertility issues, reducing misconceptions, and driving market demand.

Growth in Medical Tourism

Mexico’s affordability, proximity to the United States, and high-quality healthcare infrastructure have positioned it as a hub for fertility-related medical tourism. According to the reports, in April 2025, Hope IVF Mexico gave birth to the first child born from conception using a fully robotic IVF system guided by artificial intelligence. This technology, developed by Conceivable Life Sciences, minimizes human intervention, making it more precise and successful. Moreover, patients from countries like the US and Canada increasingly travel to cities, such as Tijuana, Guadalajara, and Mexico City to access advanced reproductive care at a fraction of the cost back home. Many clinics in Mexico are internationally accredited and offer bilingual staff, personalized care, and advanced facilities, which further boost confidence among foreign patients. In addition to this, the legal environment around certain ART procedures, like surrogacy or donor programs, is more favorable in parts of Mexico compared to stricter regulations elsewhere. These advantages are making cross-border reproductive care a growing trend. The influx of international patients not only brings in revenue but also encourages local clinics to continuously upgrade their services and technologies to remain competitive, further supporting the overall development of the assisted reproductive technology market in Mexico.

Mexico Assisted Reproductive Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, type, and end use.

Product Insights:

- Instrument

- Sperm Separation System

- Cryosystem

- Incubator

- Imaging System

- Ovum Aspiration Pump

- Cabinet

- Micromanipulator

- Laser Systems

- Others

- Accessory and Disposable

- Reagents and Media

- Cryopreservation Media

- Semen Processing Media

- Ovum Processing Media

- Embryo Culture Media

The report has provided a detailed breakup and analysis of the market based on the product. This includes instruments (sperm separation systems, cryosystems, incubators, imaging systems, ovum aspiration pump, cabinet, micromanipulator, laser systems, and others), accessory and disposable items, and reagents and media (cryopreservation media, semen processing media, ovum processing media, and embryo culture media).

Type Insights:

- In-Vitro Fertilization (IVF)

- Fresh Donor

- Frozen Donor

- Fresh Non-Donor

- Frozen Non-Donor

- Artificial Insemination

- Intrauterine Insemination

- Intracervical Insemination

- Intravaginal Insemination

- Intratubal Insemination

The report has provided a detailed breakup and analysis of the market based on the type. This includes in-vitro fertilization (IVF) (fresh donor, frozen donor, fresh non-donor, and frozen non-donor) and artificial insemination (intrauterine Insemination, intracervical Insemination, intravaginal Insemination, and intratubal insemination).

End Use Insights:

- Fertility Clinics and Other Facilities

- Hospitals and Others

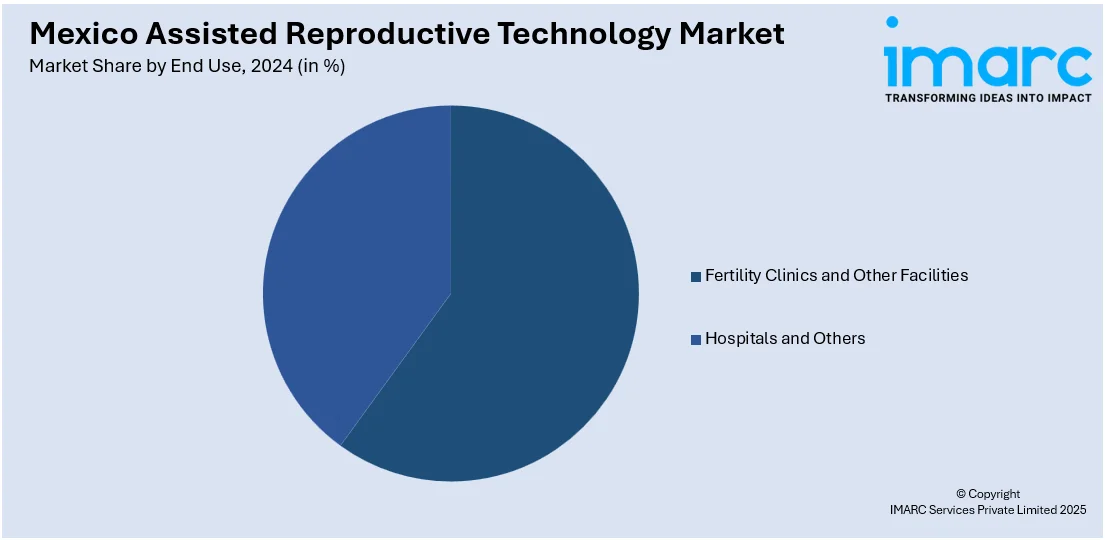

The report has provided a detailed breakup and analysis of the market based on the end use. This includes fertility clinics and other facilities and hospitals and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Assisted Reproductive Technology Market News:

- In May 2024, Conceivable Life Sciences, based in Guadalajara, is developing robots and AI models to automate key stages of IVF, including egg preparation, sperm selection, fertilization, incubation, and freezing. The technology aims to streamline and enhance the IVF process, potentially reducing costs and improving accessibility.

- In April 2025, a 40-year-old woman in Guadalajara gave birth to the first baby conceived using a fully automated, artificial intelligence (AI) powered intracytoplasmic sperm injection (ICSI) system developed by Conceivable Life Sciences. The AI system autonomously selected healthy sperm, used a laser to immobilize them, and performed precise injections, achieving greater consistency and efficiency.

Mexico Assisted Reproductive Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Types Covered |

|

| End Uses Covered | Fertility Clinics and Other Facilities, Hospitals and Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico assisted reproductive technology market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico assisted reproductive technology market on the basis of product?

- What is the breakup of the Mexico assisted reproductive technology market on the basis of type?

- What is the breakup of the Mexico assisted reproductive technology market on the basis of end use?

- What is the breakup of the Mexico assisted reproductive technology market on the basis of region?

- What are the various stages in the value chain of the Mexico assisted reproductive technology market?

- What are the key driving factors and challenges in the Mexico assisted reproductive technology market?

- What is the structure of the Mexico assisted reproductive technology market and who are the key players?

- What is the degree of competition in the Mexico assisted reproductive technology market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico assisted reproductive technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico assisted reproductive technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico assisted reproductive technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)