Mexico Autocatalyst Market Size, Share, Trends and Forecast by Material, Catalyst Type, Distribution Channel, Vehicle Type, Fuel Type, and Region, 2025-2033

Mexico Autocatalyst Market Overview:

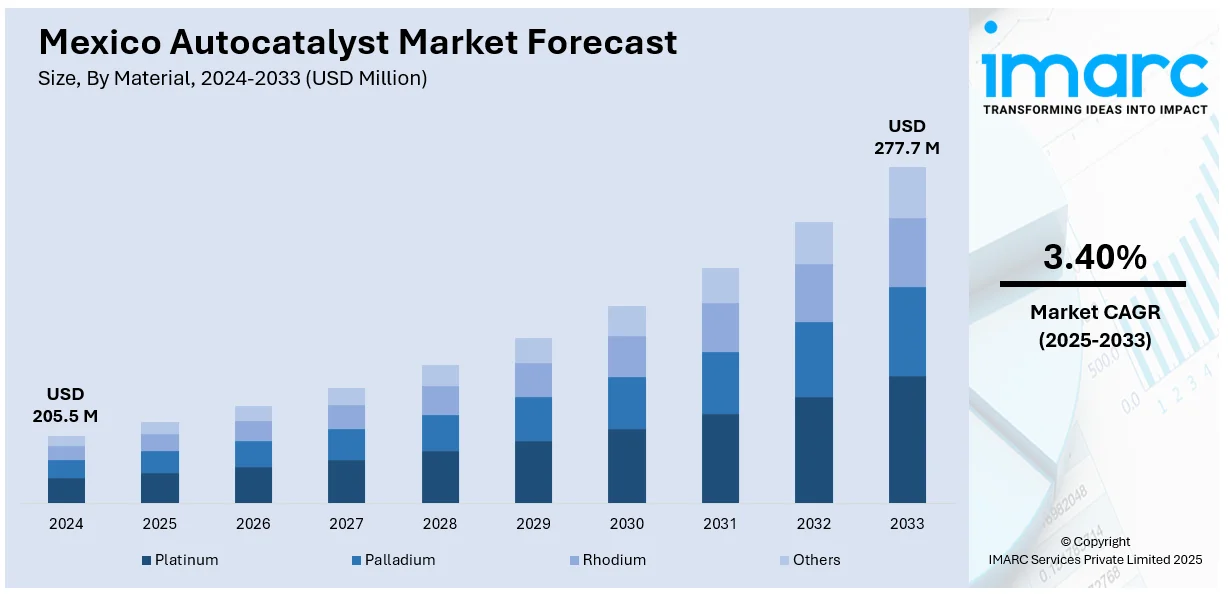

The Mexico autocatalyst market size reached USD 205.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 277.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. Rising vehicle production, emission norms enforcement, growing hybrid adoption, Foreign Direct Investment (FDI) in automotive manufacturing, export-focused assembly, urban air quality regulations, supplier integration with U.S. automakers, and advances in catalyst formulations are factors fostering the Mexico autocatalyst market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 205.5 Million |

| Market Forecast in 2033 | USD 277.7 Million |

| Market Growth Rate 2025-2033 | 3.40% |

Mexico Autocatalyst Market Trends:

Rising Vehicle Production in Mexico

Mexico has emerged as a prominent automotive manufacturing hub, with increasing output of both passenger and commercial vehicles. Backed by competitive labor costs and a robust network of suppliers, the country has become an attractive base for automakers such as General Motors, Volkswagen, and Nissan. In 2024, vehicle production in Mexico surpassed 4 million light vehicles, marking a steady recovery post-pandemic and creating consistent demand for emission control technologies. As each new vehicle requires a catalytic converter to comply with environmental norms, the scaling output directly supports the autocatalyst market. Additionally, the expansion of assembly plants, particularly in northern and central regions, is leading to higher demand for localized supply of catalytic systems, which is propelling the Mexico autocatalyst market growth.

Implementation of Emission Control Standards

The enforcement of strict vehicular emission regulations under the NOM-042-SEMARNAT standard is a significant driver of the autocatalyst market in Mexico. This standard outlines maximum permissible limits for hydrocarbons, carbon monoxide, nitrogen oxides, and particulate matter in vehicle exhausts, aligned with global benchmarks such as Euro IV and V. In line with this, automakers are required to equip vehicles with advanced catalytic converters capable of reducing toxic emissions to meet compliance thresholds. This regulatory pressure has prompted increased use of three-way catalysts, which simultaneously convert carbon monoxide, hydrocarbons, and nitrogen oxides (NOx) into less harmful substances. Additionally, government efforts to improve urban air quality, particularly in Mexico City and Guadalajara, have further emphasized the need for clean automotive technologies, which is boosting the market growth.

Growth in Foreign Direct Investment in Automotive Manufacturing

As per the Mexico autocatalyst market forecast, the automotive sector continues to attract strong foreign direct investment (FDI), which is playing a pivotal role in strengthening the autocatalyst supply chain. Key global automakers and component manufacturers are expanding their footprint in the country, investing in new assembly lines, engine plants, and emission technology facilities. In 2023, Mexico attracted approximately USD 36.1 billion in foreign direct investment (FDI), with the transportation equipment sector, primarily automotive, receiving USD 7.4 billion, making it the top recipient among manufacturing subsectors. As production scales up and emission standards tighten, these investments are enabling manufacturers to integrate catalytic converters directly into new models. Furthermore, foreign suppliers of autocatalyst materials, such as platinum group metals and ceramic substrates, are increasingly partnering with Mexican firms, ensuring localized, cost-effective sourcing and further accelerating market maturity, which is creating a positive market outlook.

Mexico Autocatalyst Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, catalyst type, distribution channel, vehicle type, and fuel type.

Material Insights:

- Platinum

- Palladium

- Rhodium

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes platinum, palladium, rhodium, and others.

Catalyst Type Insights:

- Two-way

- Three-way

- Four-way

A detailed breakup and analysis of the market based on the catalyst type have also been provided in the report. This includes two-way, three-way, and four-way.

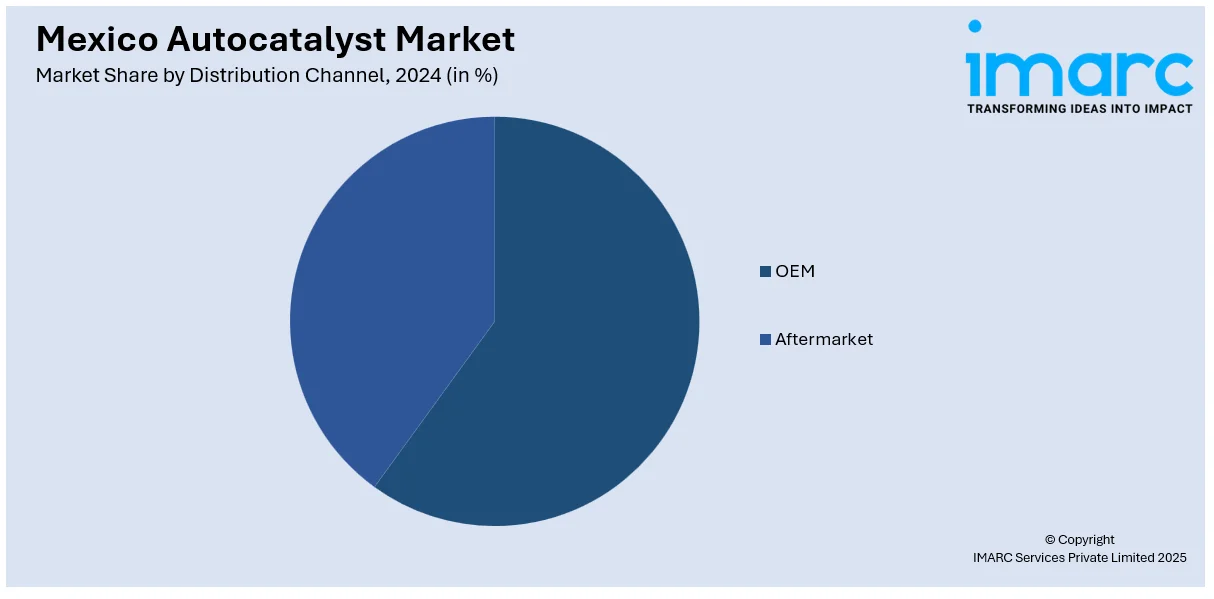

Distribution Channel Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEM and aftermarket.

Vehicle Type Insights:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car, light commercial vehicle, heavy commercial vehicle, and others.

Fuel Type Insights:

- Gasoline

- Diesel

- Hybrid Fuels

- Hydrogen Fuel Cell

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes gasoline, diesel, hybrid fuels, and hydrogen fuel cell.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Autocatalyst Market News:

- In 2024, GM Mexico partnered with VEMO and Evergo to enhance electric vehicle adoption, providing customers with credits and access to over 1,000 charging stations nationwide, signaling a move away from traditional combustion engines.

Mexico Autocatalyst Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Platinum, Palladium, Rhodium, Others |

| Catalyst Types Covered | Two-way, Three-way, Four-way |

| Distribution Channels Covered | OEM, Aftermarket |

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle, Others |

| Fuel Types Covered | Gasoline, Diesel, Hybrid Fuels, Hydrogen Fuel Cell |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico autocatalyst market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico autocatalyst market on the basis of material?

- What is the breakup of the Mexico autocatalyst market on the basis of catalyst type?

- What is the breakup of the Mexico autocatalyst market on the basis of distribution channel?

- What is the breakup of the Mexico autocatalyst market on the basis of vehicle type?

- What is the breakup of the Mexico autocatalyst market on the basis of fuel type?

- What is the breakup of the Mexico autocatalyst market on the basis of region?

- What are the various stages in the value chain of the Mexico autocatalyst market?

- What are the key driving factors and challenges in the Mexico autocatalyst market?

- What is the structure of the Mexico autocatalyst market and who are the key players?

- What is the degree of competition in the Mexico autocatalyst market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico autocatalyst market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico autocatalyst market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico autocatalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)