Mexico Automotive Aftermarket Accessories Market Size, Share, Trends and Forecast by Product Type, Vehicle Type, Sales Channel, End User, and Region, 2025-2033

Mexico Automotive Aftermarket Accessories Market Overview:

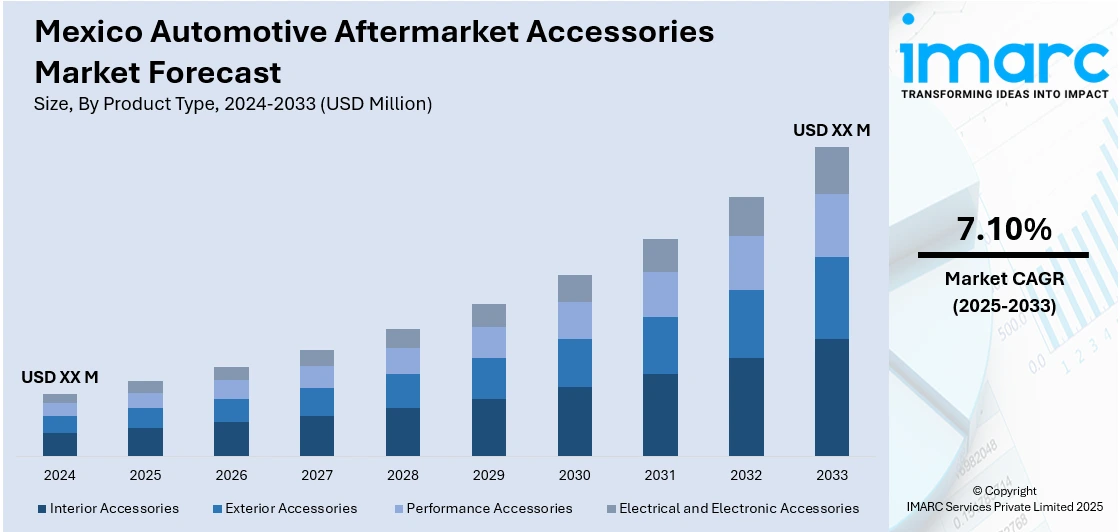

The Mexico automotive aftermarket accessories market size is projected to expand at a growth rate (CAGR) of 7.10% during 2025-2033. At present, the increased number of automobiles on Mexican roads is driving the demand for automotive aftermarket equipment. Besides this, the expansion of e-commerce channels and the increasing number of online retail websites are impelling the market growth. This trend, along with the rising awareness about vehicle maintenance, are expanding the Mexico automotive aftermarket accessories market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 7.10% |

Mexico Automotive Aftermarket Accessories Market Insights:

- Key Market Drivers: Greater car ownership, fueling greater enthusiasm for car personalization, and a resale boom are taking primary roles in driving accessories demand to higher levels. All these factors, both on their own and together, encourage greater application of utility-based as well as cosmetic car enhancements.

- Market Trends: There is growing demand for technology-driven, green, and customized automobile accessories. Consumers are increasingly opting for connected solutions, stylish interiors, and performance-enhancing parts, with easy plug-and-play solutions proving particularly popular among younger, tech-savvy drivers.

- Competitive Landscape: The sector is controlled by a varied group of domestic and international manufacturers and suppliers. Companies are targeting strengthening online presence, product design localization, and optimizing the efficiency of distribution to meet consumer demand and compete in a fragmented market.

- Challenges and Opportunities: In spite of threats like imitation goods and price sensitivity, opportunities for growth are strong through innovation, digital channels, and product compatibility with electric vehicles. Improved consumer awareness and improved after-sales service can further release market growth opportunities.

Mexico Automotive Aftermarket Accessories Market Trends:

Growing Culture of Customization Among Car Owners

Among the major driving forces of the Mexico automotive aftermarket accessories market is the growing consumer culture of customizing vehicles. With vehicles increasingly becoming a symbol of lifestyle and status, the consumer is increasingly looking for cosmetic as well as performance upgrades ranging from customized wheels and body kits to high-end lighting systems and infotainment upgrades. This desire for individuality is particularly strong in younger demographics and urban drivers, who desire to differentiate their vehicles in a otherwise homogenized auto culture. Successful online commerce and auto enthusiast forums also raise visibility to and availability of customization. Auto body shops and accessory vendors are responding with an expanded, diversified product catalog to meet unique tastes and price points. This demand increase is driving the Mexico automotive aftermarket accessories market analysis, capturing the way consumer wants are evolving along with lifestyle trends and greater discretionary spending on vehicle personalization.

To get more information on this market, Request Sample

Technology Advances Fueling Accessory Adoption

Increased use of smart technologies in automobile usage is transforming demand for Mexico's aftermarket accessories. Add-ons such as reverse vision cameras, GPS navigation, wireless charging, heads-up displays, and Bluetooth systems are now standard upgrade features for owners who are tech-savvy. Since original vehicle equipment may lack the newest technologies, consumers choose aftermarket ones to enhance safety, connectivity, and entertainment aspects. As per the reports, in February 2024, Stellantis extended bproautoparts.com to Mexico, providing part number lookups, fitment calculators, and dealer finders, complementing its commitment to expansion in the independent aftermarket business. Moreover, installer manufacturers and accessory firms are emphasizing compatibility with modern vehicle electronics, heightening consumer confidence in aftermarket products even more. Ease of installation and the availability of plug-and-play accessories are also attracting DIY consumers. Such digital add-ons are a backbone for the Mexico automotive aftermarket accessories market forecast, with the segment consistently growing as digital adoption increases and automobile users concentrate on technology-driven convenience and functionality.

Sustainability and Utility Accessories on the Rise

Sustainability-based driving habits and growing demand for functional accessories are revolutionizing the Mexican aftermarket space. Car owners are investing in utilitarian items like roof racks, all-weather floor mats, cargo liners, and protective coatings that enhance utility and preserve vehicle value. There is also increased demand for eco-friendly accessories with recyclable or biodegradable materials as environmental awareness spreads. Consumers are increasingly seeking accessories that offer an amalgamation of performance, protection, and environmentally friendly integrity. The trend also finds support in the increasing outdoor recreation and off-road activities in Mexico, driving sales of durable weather-resistant accessories. This new pattern of demand is critical in influencing Mexico automotive aftermarket accessories market demands, highlighting the way sustainability, functionality, and lifestyle relevance are transforming the consumer demand in the market.

Mexico Automotive Aftermarket Accessories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, vehicle type, sales channel, and end user.

Product Type Insights:

- Interior Accessories

- Seat Covers

- Floor Mats and Carpets

- Dashboard Accessories

- Steering Covers

- Others

- Exterior Accessories

- Body Kits

- Spoilers and Skirts

- Wind Deflectors

- Roof Racks

- Others

- Performance Accessories

- Exhaust Systems

- Air Filters

- Suspension Kits

- Turbochargers

- Others

- Electrical and Electronic Accessories

- Car Audio Systems

- Lighting

- Navigation and Infotainment Systems

- Parking Assist Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes interior accessories (seat covers, floor mats and carpets, dashboard accessories, steering covers, and others), exterior accessories (body kits, spoilers and skirts, wind deflectors, roof racks, and others), performance accessories (exhaust systems, air filters, suspension kits, turbochargers, and others), and electrical and electronic accessories (car audio systems, lighting, navigation and infotainment systems, parking assist systems, and others).

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, commercial vehicles, and two-wheelers.

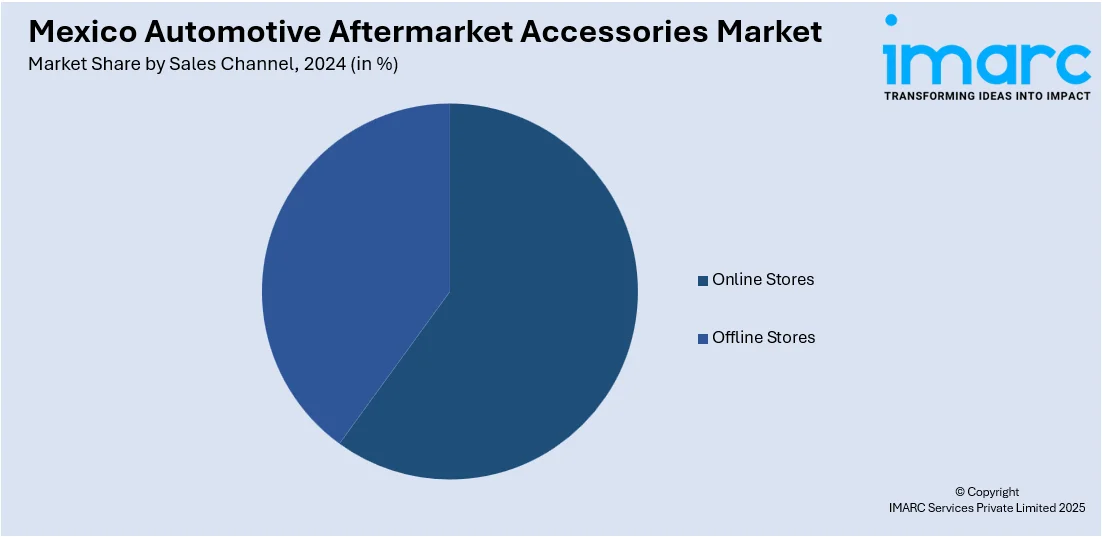

Sales Channel Insights:

- Online Stores

- Offline Stores

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes online stores and offline stores.

End User Insights:

- Individual Consumers

- Automotive Repair and Service Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual consumers and automotive repair and service centers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In January 2025, GiPA introduced "Pulso del Aftermarket en Marcas Chinas" in Mexico, a new tool centered on Chinese-brand vehicles. With Chinese automobile models capturing almost 9% market share in 2024, the tool provides strategic feedback on owner behavior, aftermarket requirements, and OEM value propositions to aid adaptation in the market.

Mexico Automotive Aftermarket Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers |

| Sales Channels Covered | Online Stores, Offline Stores |

| End Users Covered | Individual Consumers, Automotive Repair and Service Centers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive aftermarket accessories market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive aftermarket accessories market on the basis of product type?

- What is the breakup of the Mexico automotive aftermarket accessories market on the basis of vehicle type?

- What is the breakup of the Mexico automotive aftermarket accessories market on the basis of sales channel?

- What is the breakup of the Mexico automotive aftermarket accessories market on the basis of end user?

- What is the breakup of the Mexico automotive aftermarket accessories market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive aftermarket accessories market?

- What are the key driving factors and challenges in the Mexico automotive aftermarket accessories market?

- What is the structure of the Mexico automotive aftermarket accessories market and who are the key players?

- What is the degree of competition in the Mexico automotive aftermarket accessories market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive aftermarket accessories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive aftermarket accessories market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive aftermarket accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)