Mexico Baby Food and Infant Formula Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Mexico Baby Food and Infant Formula Market Overview:

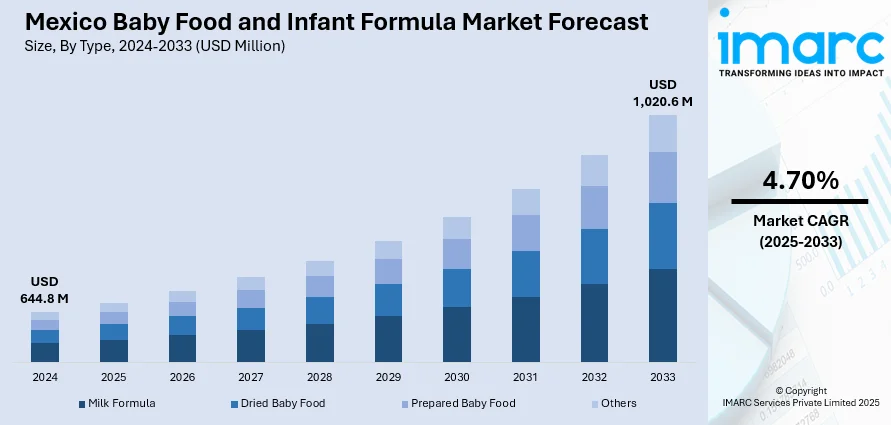

The Mexico baby food and infant formula market size reached USD 644.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,020.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The market is driven by increasing urbanization, rising female workforce participation, growing awareness about infant nutrition, and a shift toward premium and organic products. Additionally, declining birth rates have led parents to invest more in high-quality nutrition for fewer children, thus contributing to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 644.8 Million |

| Market Forecast in 2033 | USD 1,020.6 Million |

| Market Growth Rate 2025-2033 | 4.70% |

Mexico Baby Food and Infant Formula Market Trends:

Urbanization and Changing Lifestyles

Mexico’s rapid urbanization has transformed traditional lifestyles, especially among young families. As more people move to cities, daily routines become busier, reducing time for preparing homemade baby food. This shift increases demand for convenient, ready-to-eat baby meals and infant formulas, which is fueling the Mexico Baby Food and Infant Formula Market share. In urban settings, access to retail stores, supermarkets, and e-commerce platforms offering diverse baby food options has expanded significantly. Additionally, modern parents often have smaller family support systems, making quick, nutritious feeding solutions a necessity. Urban families opt for trusted meal brands because these firms provide essential items that allow for faster meal preparation and high levels of nutrition, which suits their time-sensitive requirements and city living environment.

Increased Focus on Infant Nutrition and Health

Mexican parents are becoming more informed about the importance of proper nutrition during the early stages of a child’s life. The Mexico baby food and infant formula market growth is also influenced by increased access to health education, pediatric guidance, and digital resources, which have contributed to a heightened awareness of infant dietary needs. As a result, demand is rising for baby foods and infant formulas that provide essential nutrients like DHA, iron, and vitamins. Many parents are now choosing products based on nutritional content and safety credentials. This growing focus on developmental health and immunity-building is pushing manufacturers to innovate with fortified, age-specific, and doctor-recommended formulations that cater to increasingly health-conscious consumers.

Growth in Premium and Organic Product Preferences

The demand for premium and organic baby food and infant formula is accelerating in Mexico, driven by growing consumer concern about food safety and long-term health impacts. Parents are increasingly opting for products free from additives, preservatives, and synthetic ingredients. The rise in disposable incomes, especially among urban middle-class families, enables a shift toward natural, non-GMO, and organic-certified options, creating a positive impact on the Mexico baby food and infant formula market outlook. International brands and local producers are responding by launching high-end lines that emphasize quality, transparency, and ethical sourcing. This preference for clean-label, organic products also aligns with broader global trends in infant nutrition and reflects changing values in Mexican parenting choices.

Mexico Baby Food and Infant Formula Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes milk formula, dried baby food, prepared baby food, and others.

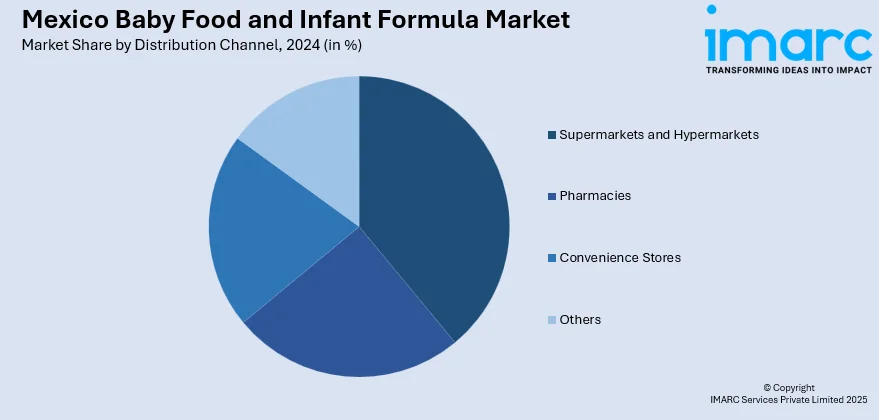

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Baby Food and Infant Formula Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Milk Formula, Dried Baby Food, Prepared Baby Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico baby food and infant formula market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico baby food and infant formula market on the basis of type?

- What is the breakup of the Mexico baby food and infant formula market on the basis of distribution channel?

- What is the breakup of the Mexico baby food and infant formula market on the basis of region?

- What are the various stages in the value chain of the Mexico baby food and infant formula market?

- What are the key driving factors and challenges in the Mexico baby food and infant formula market?

- What is the structure of the Mexico baby food and infant formula market and who are the key players?

- What is the degree of competition in the Mexico baby food and infant formula market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico baby food and infant formula market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico baby food and infant formula market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico baby food and infant formula industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)