Mexico Battery Energy Management Systems Market Size, Share, Trends and Forecast by Component, Topology, Battery Type, Application, and Region, 2026-2034

Mexico Battery Energy Management Systems Market Summary:

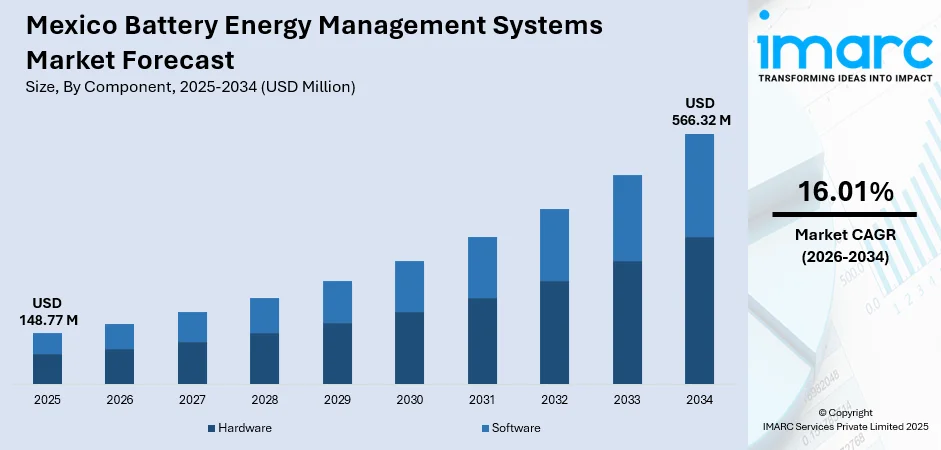

The Mexico battery energy management systems market size was valued at USD 148.77 Million in 2025 and is projected to reach USD 566.32 Million by 2034, growing at a compound annual growth rate of 16.01% from 2026-2034.

Mexico's battery energy management systems market is experiencing robust expansion driven by the country's accelerating energy transition and industrial modernization. The increasing focus on incorporating renewable energy, combined with the requirement for a stable and reliable power grid and efficient power distribution, is fueling demand for advanced energy management solutions. The nation's strategic position as a nearshoring hub and its commitment to sustainable energy infrastructure further strengthen market prospects across industrial, commercial, and utility-scale applications.

Key Takeaways and Insights:

-

By Component: Hardware dominates the market with a share of 68% in 2025, driven by extensive deployment of battery monitoring units and control systems essential for real-time performance optimization across industrial and commercial installations.

-

By Topology: Distributed leads the market with a share of 42% in 2025, reflecting growing preference for decentralized energy storage configurations that enhance system reliability and enable localized power management in manufacturing facilities.

-

By Battery Type: Lithium-ion batteries represent the largest segment with a market share of 56% in 2025, owing to superior energy density, longer operational lifespan, and declining costs that make them ideal for both utility-scale and commercial applications.

-

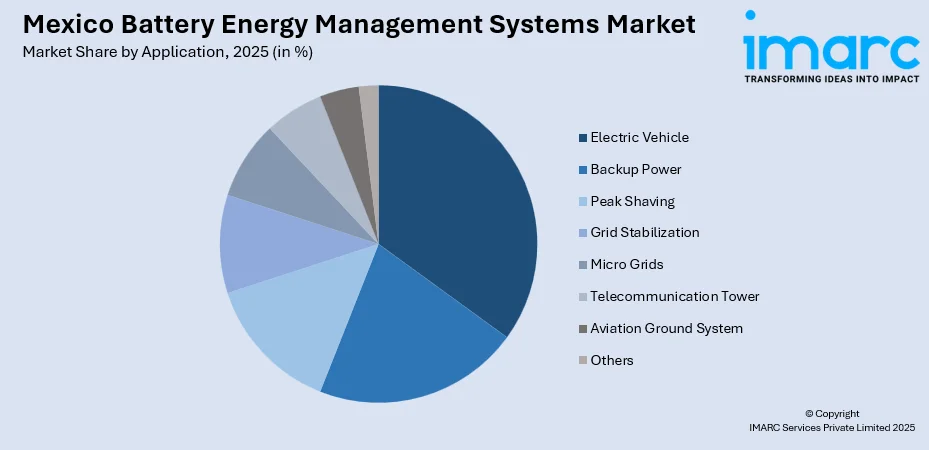

By Application: Electric vehicle dominates with a share of 33% in 2025, supported by Mexico's emergence as a major EV manufacturing hub and the rapid expansion of charging infrastructure across urban centers.

-

By Region: Northern Mexico exhibits clear dominance with a 37% share in 2025, attributable to the concentration of industrial manufacturing clusters in Monterrey, Chihuahua, and border states benefiting from nearshoring investments.

-

Key Players: The Mexico battery energy management systems market demonstrates a moderately competitive landscape, featuring both global technology firms and local system integrators vying for market share. Global leaders leverage advanced technological capabilities while local players capitalize on market knowledge and service networks to address diverse application requirements.

To get more information on this market Request Sample

Mexico's battery energy management systems market is positioned at the intersection of industrial growth, energy security imperatives, and sustainability mandates. The country's National Electric System Development Program (PRODESEN) for 2024-2038 identifies energy storage as a strategic pillar, projecting substantial storage capacity requirements to support renewable integration and grid reliability. The March 2025 regulatory milestone requiring all new solar and wind projects to incorporate battery systems equivalent to 30% of their installed capacity with a minimum three-hour discharge duration represents a landmark policy shift that positions Mexico as a regional benchmark for energy storage development. Northern Mexico's industrial corridor, anchored by Monterrey and extending through Chihuahua and Tamaulipas, serves as the primary demand center where manufacturing facilities increasingly deploy BEMS solutions to optimize power consumption, reduce operational costs, and ensure production continuity amid grid constraints.

Mexico Battery Energy Management Systems Market Trends:

Integration of Artificial Intelligence and IoT for Predictive Battery Analytics

Advanced BEMS deployments in Mexico increasingly incorporate artificial intelligence algorithms and Internet of Things connectivity to enable predictive maintenance, real-time performance optimization, and automated load balancing. The Mexico internet of things market size reached USD 15,339.0 Million in 2024. Looking forward, the market is expected to reach USD 46,079.0 Million by 2033, exhibiting a growth rate (CAGR) of 13% during 2025-2033. These smart systems analyze operational data patterns to anticipate battery degradation, optimize charging cycles, and dynamically adjust energy distribution based on consumption forecasts. The technological sophistication enhances system longevity while reducing operational expenditures, making AI-enabled BEMS particularly attractive for industrial facilities in Northern Mexico's manufacturing corridors where production uptime is paramount.

Growing Adoption of Second-Life Battery Applications

The circular economy approach to battery utilization is gaining momentum in Mexico, with retired electric vehicle batteries being repurposed for stationary energy storage applications. This practice extends battery lifecycle value while providing cost-effective storage solutions for commercial and industrial users. The trend aligns with sustainability objectives and addresses supply chain considerations, particularly as Mexico's EV manufacturing sector expands and generates increasing volumes of batteries suitable for second-life applications in less demanding stationary storage roles. According to the U.S. Department of Commerce, Mexico shipped electric vehicles worth USD 3.127 billion to the United States during the first quarter of 2024, underscoring its rising importance in the EV sector.

Expansion of Distributed Energy Storage in Commercial Sectors

Commercial facilities across Mexico are increasingly deploying distributed BEMS configurations to achieve energy independence, manage peak demand charges, and ensure operational resilience. Retail establishments, hospitality venues, and healthcare facilities are implementing behind-the-meter storage solutions that enable participation in demand response programs while providing backup power capabilities. The Mexico retail market size reached USD 475.2 Billion in 2025. Looking forward, the market is expected to reach USD 698.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.38% during 2026-2034, driving higher electricity demand across commercial facilities. The trend is particularly pronounced in urban centers experiencing grid congestion and in regions with high electricity tariffs where storage economics favor self-consumption optimization.

Market Outlook 2026-2034

The outlook for Mexico’s battery energy management systems market remains highly favorable, driven by supportive regulations, growing industrial activity, and the ongoing energy transition. Policy frameworks encourage the integration of storage solutions, enhancing grid reliability and renewable energy utilization. Expanding industrial operations, particularly in key manufacturing regions, are increasing demand for efficient energy management to ensure operational continuity and cost optimization. Simultaneously, the development of the electric vehicle sector is creating additional opportunities for battery management solutions across both commercial and industrial applications, reinforcing long-term market growth prospects. The market generated a revenue of USD 148.77 Million in 2025 and is projected to reach a revenue of USD 566.32 Million by 2034, growing at a compound annual growth rate of 16.01% from 2026-2034.

Mexico Battery Energy Management Systems Market Report Segmentation

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Hardware |

68% |

|

Topology |

Distributed |

42% |

|

Battery Type |

Lithium-ion Batteries |

56% |

|

Application |

Electric Vehicle |

33% |

|

Region |

Northern Mexico |

37% |

Component Insights

- Hardware

- Battery Monitoring Unit

- Battery Control Unit

- Communication Network

- Others

- Software

- Supervisory Control and Data Acquisition

- Advance Distribution Management Solution

- Outage Management System

- Generation Management System

- Others

The hardware dominates with a market share of 68% of the total Mexico battery energy management systems market in 2025.

Hardware components form the foundational infrastructure of battery energy management systems, encompassing battery monitoring units, control units, and communication networks that enable real-time performance tracking and system optimization. The substantial market share reflects the capital-intensive nature of BEMS deployments, where physical components constitute the majority of initial investment. Battery monitoring units provide essential voltage, current, and temperature sensing capabilities critical for maintaining safe operating parameters and maximizing battery longevity across diverse application environments.

The prominence of hardware investments is further reinforced by Mexico's industrial expansion, where manufacturing facilities require robust physical infrastructure to manage increasingly complex energy storage configurations. Communication networks within BEMS enable data transmission between monitoring components and central control systems, supporting the integration of storage assets into broader energy management architectures. The hardware segment's dominance is expected to persist as deployments scale across utility, commercial, and industrial applications, demanding reliable physical systems capable of operating in challenging environmental conditions.

Topology Insights

- Distributed

- Centralized

- Modular

The distributed topology leads with a share of 42% of the total Mexico battery energy management systems market in 2025.

Distributed topology configurations are gaining preference in Mexico's BEMS market due to their inherent advantages in system resilience, scalability, and localized power management capabilities. This architecture distributes battery management functions across multiple nodes rather than concentrating control in a single unit, enhancing fault tolerance and enabling continued operation even when individual components experience failures. Manufacturing facilities in Northern Mexico increasingly adopt distributed topologies to ensure production continuity and optimize energy flows across complex industrial processes.

The distributed approach aligns with Mexico's evolving energy landscape, where decentralized renewable generation necessitates corresponding distributed storage and management infrastructure. Commercial and industrial users benefit from the topology's ability to scale incrementally, adding storage capacity and management nodes as requirements expand without requiring a complete system redesign. The architecture's compatibility with microgrid configurations further strengthens its appeal as businesses seek greater energy independence and resilience against grid instability affecting industrial corridors.

Battery Type Insights

- Lithium-ion Batteries

- Lead Acid Batteries

- Nickel Cadmium Batteries

- Sodium Sulfur Batteries

- Sodium-ion Batteries

- Flow Batteries

- Others

The lithium-ion batteries exhibit clear dominance with a 56% share of the total Mexico battery energy management systems market in 2025.

Lithium-ion technology has established market leadership in Mexico's BEMS sector, driven by compelling performance characteristics including high energy density, superior round-trip efficiency, and extended cycle life compared to legacy battery chemistries. The technology's declining cost trajectory has significantly improved project economics, enabling deployment across applications ranging from residential backup systems to utility-scale installations supporting renewable energy integration. Major BESS projects in Mexico, including utility-scale solar-plus-storage facilities, predominantly specify lithium-ion solutions.

The automotive industry's massive investments in lithium-ion battery manufacturing have created beneficial spillover effects for stationary storage applications through technology advancement and supply chain development. Mexico's position as a growing electric vehicle production hub further reinforces lithium-ion adoption as battery management expertise developed for automotive applications transfers to stationary BEMS deployments. The technology's established supply chains, proven performance record, and continuing innovation in energy density and safety features position lithium-ion batteries to maintain market leadership throughout the forecast period.

Application Insights

Access the comprehensive market breakdown Request Sample

- Electric Vehicle

- Backup Power

- Peak Shaving

- Grid Stabilization

- Micro Grids

- Telecommunication Tower

- Aviation Ground System

- Renewable Energy

- Standalone Solar

- Solar Diesel Hybrid

- Wind Energy

- Solar Wind Hybrid

- Others

- Others

The electric vehicle dominates with a share of 33% of the total Mexico battery energy management systems market in 2025.

Electric vehicle applications represent the largest demand segment for battery energy management systems in Mexico, reflecting the country's emergence as a significant EV manufacturing and adoption market. BEMS solutions in EV applications optimize battery performance, extend range capabilities, manage thermal conditions, and ensure safe charging operations across the vehicle's operational lifecycle. Mexico's automotive manufacturing corridor produces numerous electric and plug-in hybrid models, with major automakers expanding EV production capacity in states including Nuevo León, Guanajuato, and San Luis Potosí.

The expansion of public and private charging infrastructure across Mexican urban centers creates additional BEMS demand for station-level energy management that optimizes grid interaction, manages peak loads, and enables demand response participation. The first quarter of twenty twenty-five witnessed substantial growth in electrified vehicle sales, with industry associations reporting ambitious targets for EV market penetration by the end of the decade. This trajectory ensures sustained demand for sophisticated battery management solutions capable of maximizing battery investment value while maintaining safety and performance standards throughout increasingly demanding operational cycles.

Regional Insights

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico exhibits clear dominance with a 37% share of the total Mexico battery energy management systems market in 2025.

Northern Mexico's market leadership reflects the region's concentration of industrial manufacturing activity, nearshoring investments, and energy-intensive operations requiring sophisticated power management solutions. States including Nuevo León, Chihuahua, Coahuila, and Tamaulipas host manufacturing clusters serving automotive, electronics, aerospace, and appliance industries, where a reliable power supply and energy cost management are critical operational requirements. Monterrey has established itself as the industrial hub, attracting significant foreign direct investment and hosting the headquarters of major Mexican corporations.

The region's proximity to the United States markets and existing trade infrastructure enhances its attractiveness for manufacturing investments that drive BEMS demand. Industrial real estate in Northern Mexico experienced substantial expansion with record absorption rates as companies established or expanded operations to capitalize on nearshoring opportunities. The concentration of automotive manufacturing, including electric vehicle and component production, creates natural synergies with battery management technology deployment. Grid infrastructure constraints in rapidly industrializing areas further motivate businesses to invest in BEMS solutions that ensure operational resilience and optimize energy consumption patterns.

Market Dynamics

Growth Drivers

Why is the Mexico Battery Energy Management Systems Market Growing?

Regulatory Mandates Supporting Renewable Energy Storage Integration

Mexico’s evolving regulatory environment is acting as a strong catalyst for the growth of the battery energy management systems market. Clear policy frameworks now support the integration of energy storage within the national power system, recognizing its role in grid stabilization and renewable energy integration. Requirements encouraging the pairing of battery systems with new renewable projects are strengthening Mexico’s position as a regional leader in energy storage adoption. This regulatory clarity enhances investor confidence while generating consistent demand for BEMS solutions in utility-scale renewable applications. Long-term planning priorities further indicate sustained policy support for energy storage deployment. For instance, Mexico’s Power Sector Development Plan for the 2025–2039 period outlines a significant expansion of clean energy and storage capacity by the end of the decade. The roadmap emphasizes solar power as the primary contributor to new clean generation, followed by wind energy, with battery storage forming a substantial share of the overall additions. The majority of this planned capacity expansion will be led by the state-owned utility, CFE, underscoring its central role in driving the country’s renewable and energy storage development.

Industrial Expansion and Nearshoring-Driven Energy Demand

Mexico's industrial sector expansion, accelerated by nearshoring trends reshaping global manufacturing supply chains, is generating substantial demand for battery energy management solutions. Manufacturing facilities relocating from Asia to Mexico require reliable power infrastructure capable of supporting high-value production operations where downtime carries significant financial consequences. Northern border states have captured the majority of nearshoring-related industrial absorption, with manufacturing clusters in automotive, electronics, and advanced manufacturing driving electricity consumption growth. Industrial facilities increasingly deploy BEMS to manage energy costs, ensure production continuity, and meet corporate sustainability commitments. The projected industrial electricity consumption increase through the end of the decade creates a substantial addressable market for energy management solutions that optimize power utilization and provide backup capabilities during grid disruptions affecting manufacturing corridors. For instance, in November 2025, Livoltek Mexico marked the introduction of its latest Commercial and Industrial battery energy storage solution, a liquid-cooled BESS designed for C&I applications, at a launch event in Mexico City. The gathering attracted a wide range of senior stakeholders from the energy, utilities, EPC, distribution, and investment communities, reflecting strong industry interest in advanced energy storage technologies.

Electric Vehicle Ecosystem Development

Mexico's emergence as a significant electric vehicle manufacturing and adoption market is driving parallel growth in battery energy management systems demand. Major automakers have committed to expanding EV production in Mexico, with substantial increases in electrified vehicle output projected through the forecast period. The domestic EV market witnessed remarkable sales growth as consumer adoption accelerated alongside charging infrastructure expansion. BEMS solutions are essential throughout the EV ecosystem, from vehicle battery management, ensuring optimal performance and longevity, to charging station energy management, optimizing grid interaction and user experience. The Mexico electric vehicle battery market size reached USD 1,148.85 Million in 2024. Looking forward, the market is expected to reach USD 9,222.29 Million by 2033, exhibiting a growth rate (CAGR) of 26.04% during 2025-2033. The government's supportive policy stance, including proposed electromobility promotion legislation and energy storage integration requirements, reinforces the favorable environment for EV-related BEMS deployment. The anticipated expansion of the EV manufacturing supply chain within Mexico creates additional opportunities for localized battery management technology development and deployment.

Market Restraints

What Challenges the Mexico Battery Energy Management Systems Market is Facing?

High Initial Capital Investment Requirements

The substantial upfront capital expenditure required for comprehensive battery energy management system deployments presents a significant barrier to broader market adoption, particularly among small and medium enterprises. Hardware components, installation, and integration costs can represent considerable investments that extend payback periods and challenge project financing, especially for commercial applications where energy savings must justify the initial outlay within acceptable timeframes.

Limited Local Manufacturing and Technology Import Dependence

Mexico's BEMS market currently relies heavily on imported components and systems, creating supply chain vulnerabilities and cost sensitivities to currency fluctuations and international trade dynamics. The limited domestic manufacturing capacity for advanced battery management components constrains the market's ability to scale rapidly while maintaining competitive pricing. Technology dependence also limits customization capabilities and increases lead times for specialized applications.

Skilled Workforce Availability for Advanced Battery Analytics

The deployment and operation of sophisticated battery energy management systems require specialized technical expertise that remains scarce in the Mexican labor market. The shortage of engineers and technicians trained in advanced battery analytics, IoT integration, and energy management system optimization creates operational challenges and increases reliance on foreign technical support. Training and certification programs have not yet scaled sufficiently to meet the growing demand from expanding installations.

Competitive Landscape

The Mexico battery energy management systems market exhibits a moderately fragmented competitive structure characterized by participation from global technology leaders, regional system integrators, and emerging local players. International corporations leverage technological sophistication, established supply chains, and financial resources to address utility-scale and large commercial projects requiring proven solutions with performance guarantees. Regional integrators compete through local market knowledge, service responsiveness, and pricing flexibility that appeals to mid-market commercial and industrial customers. The competitive environment is evolving as global energy storage leaders establish stronger Mexican presence through direct operations and strategic partnerships with local distributors. Technology differentiation increasingly centers on software capabilities, particularly artificial intelligence-enabled predictive analytics and integration with broader energy management platforms that deliver enhanced value beyond basic battery monitoring functions.

Recent Developments

-

In March 2025, at RE+ Mexico 2025, Sungrow unveiled its next-generation PowerTitan 2.0 energy storage system to support Mexico's renewable transition. The liquid-cooled solution enhances grid resilience with grid-forming technology and reduces installation time through its all-in-one modular design.

-

In May 2024, Enphase Energy launched its IQ Battery 5P in Mexico, featuring five kilowatt-hour capacity that can be configured in scalable arrangements to support residential clean energy transition and grid independence.

Mexico Battery Energy Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Topology’s Covered | Distributed, Centralized, Modular |

| Battery Types Covered | Lithium-ion Batteries, Lead Acid Batteries, Nickel Cadmium Batteries, Sodium Sulfur Batteries, Sodium-ion Batteries, Flow Batteries, Others |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico battery energy management systems market size was valued at USD 148.77 Million in 2025.

The Mexico battery energy management systems market is expected to grow at a compound annual growth rate of 16.01% from 2026-2034 to reach USD 566.32 Million by 2034.

Hardware components dominated the market with a 68% share in 2025, driven by extensive deployment of battery monitoring units, control units, and communication networks essential for real-time performance optimization across industrial and commercial installations throughout Mexico.

Key factors driving the Mexico battery energy management systems market include regulatory mandates requiring energy storage integration with renewable projects, industrial expansion fueled by nearshoring investments, growing electric vehicle ecosystem development, and increasing adoption of smart energy management technologies.

Major challenges include high initial capital investment requirements limiting adoption among smaller enterprises, heavy reliance on imported components creating supply chain vulnerabilities, limited local manufacturing capacity, a shortage of skilled workforce for advanced battery analytics, and cybersecurity concerns associated with digitally connected energy management systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)