Mexico Big Data Security Market Size, Share, Trends and Forecast by Component, Technology, Deployment Mode, Organization Size, End Use Industry, and Region, 2026-2034

Mexico Big Data Security Market Summary:

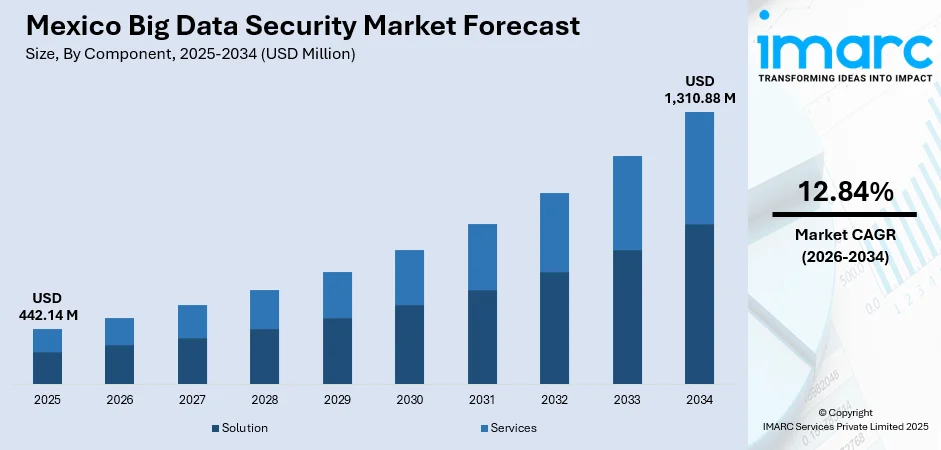

The Mexico big data security market size was valued at USD 442.14 Million in 2025 and is projected to reach USD 1,310.88 Million by 2034, growing at a compound annual growth rate of 12.84% from 2026-2034.

The Mexico big data security market is expanding rapidly due to the country's accelerating digital transformation, the nearshoring phenomenon attracting multinational corporations, and heightened awareness of data protection requirements. Enterprises across sectors are prioritizing robust security frameworks to safeguard sensitive information and ensure regulatory compliance with federal data protection mandates, contributing to the Mexico big data security market share.

Key Takeaways and Insights:

-

By Component: Solution dominates the market with a share of 79.83% in 2025, owing to the comprehensive nature of integrated security platforms encompassing encryption, access management, and threat detection capabilities.

-

By Deployment Mode: Cloud-based leads the market with a share of 54% in 2025, driven by scalability benefits and the proliferation of hyperscale data centers across Mexico.

-

By Organization Size: Large enterprises represent the largest segment with a market share of 73.24% in 2025, fueled by substantial IT security budgets and complex data environments requiring enterprise-grade protection.

-

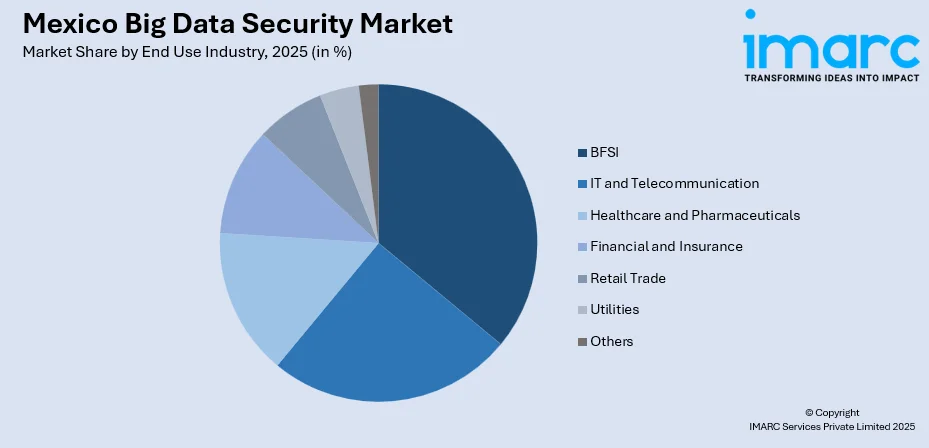

By End Use Industry: BFSI dominates with a market share of 29.76% in 2025, propelled by stringent regulatory oversight from Banxico and the exponential growth of fintech platforms processing sensitive financial data.

-

Key Players: The Mexico big data security market exhibits a moderately consolidated competitive structure with global technology leaders competing alongside regional managed service providers. Major players are actively expanding their presence through local data center investments and strategic partnerships with Mexican enterprises.

To get more information on this market Request Sample

Mexico's big data security landscape is undergoing significant transformation driven by the convergence of digital innovation and heightened cyber threat exposure. The country experienced 324 billion cyberattack attempts during 2024, according to FortiGuard Labs data, underscoring the critical imperative for advanced security infrastructure. Enterprises are increasingly deploying integrated security solutions encompassing data encryption, identity and access management, and security analytics to protect expanding data repositories. The nearshoring phenomenon has catalyzed demand as manufacturing and technology companies relocating operations require robust data protection frameworks compliant with both Mexican regulations and international standards. Cloud security adoption continues accelerating as organizations leverage hyperscale infrastructure from providers establishing local data center regions. The regulatory environment, anchored by the Federal Law on Protection of Personal Data Held by Private Parties, mandates stringent security protocols that are propelling market investment across industry verticals.

Mexico Big Data Security Market Trends:

Accelerating Adoption of AI-Powered Security Analytics

Mexican enterprises are increasingly integrating artificial intelligence and machine learning capabilities into their big data security frameworks to enhance threat detection and automate incident response. IBM unveiled its Guardium Data Security Center in October 2024, a unified SaaS platform designed to safeguard data across hybrid cloud and AI environments using quantum-safe cryptography. This trend reflects broader market recognition that traditional security approaches cannot adequately address the volume and sophistication of modern cyber threats targeting large-scale data environments.

Zero-Trust Architecture Implementation Across Enterprises

Organizations in Mexico are transitioning from perimeter-based security models to zero-trust architectures that authenticate and authorize every access request in real time. This security framework operates on the principle of never trusting any user or device by default, instead validating credentials continuously throughout each session. The paradigm shift is particularly pronounced among financial institutions and manufacturing companies responding to increasingly sophisticated cyber threats and the distributed nature of modern hybrid work environments requiring continuous verification protocols across all network access points.

Cloud-Native Security Solutions Gaining Momentum

The expansion of hyperscale cloud infrastructure in Mexico is driving demand for cloud-native big data security solutions that provide integrated protection across distributed data environments. Amazon Web Services announced plans to invest over USD 5 Billion in its new Mexico Central Region, which launched in January 2025 to serve enterprise customers requiring local data residency and enhanced security capabilities. Cloud-based security offerings enable organizations to implement scalable encryption, automated compliance monitoring, and advanced threat intelligence without extensive on-premises infrastructure investments.

Market Outlook 2026-2034:

The Mexico big data security market outlook remains robust as digital transformation initiatives accelerate across key industries and regulatory compliance requirements intensify. The Mexican Data Center Association projects that direct technology investment in the sector will reach USD 9.19 Billion over the next five years, creating substantial demand for integrated security solutions. Organizations are prioritizing investments in data governance platforms, advanced encryption technologies, and managed security services to protect expanding data ecosystems. The market generated a revenue of USD 442.14 Million in 2025 and is projected to reach a revenue of USD 1,310.88 Million by 2034, growing at a compound annual growth rate of 12.84% from 2026-2034.

Mexico Big Data Security Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Solution |

79.83% |

|

Deployment Mode |

Cloud-based |

54% |

|

Organization Size |

Large Enterprises |

73.24% |

|

End Use Industry |

BFSI |

29.76% |

Component Insights:

- Solution

- Data Discovery and Classification

- Data Authorization and Access

- Data Encryption, Tokenization and Masking

- Data Auditing and Monitoring

- Data Governance and Compliance

- Data Security Analytics

- Data Backup and Recovery

- Services

Solution dominates with a market share of 79.83% of the total Mexico big data security market in 2025.

The solution maintains commanding market leadership as Mexican enterprises prioritize integrated security platforms that deliver comprehensive data protection capabilities. Organizations are deploying unified solutions encompassing data discovery, encryption, access management, and compliance monitoring to address increasingly complex threat environments. The software segment's dominance in big data security markets globally reflects the critical importance of technological solutions in safeguarding large-scale data repositories across diverse infrastructure configurations, as enterprises increasingly prioritize integrated platforms over standalone services.

Advanced solution offerings incorporating artificial intelligence and automation are gaining significant traction as enterprises seek proactive threat detection and rapid incident response capabilities. These intelligent platforms leverage machine learning algorithms to identify anomalous patterns and potential threats before they escalate into security breaches. Mexican organizations are increasingly selecting solution providers offering seamless integration with existing infrastructure while delivering scalable protection as data volumes continue expanding across digital transformation initiatives, enabling businesses to maintain robust security postures without disrupting operational workflows.

Technology Insights:

- Identity and Access Management

- Security Information and Event Management

- Intrusion Detection System

- Unified Threat Management

- Others

Identity and access management solutions enable Mexican enterprises to control user permissions, authenticate credentials, and enforce role-based access policies across big data environments, ensuring only authorized personnel access sensitive information repositories.

Security information and event management platforms aggregate and analyze security data from multiple sources, providing Mexican organizations with centralized visibility into potential threats and enabling real-time incident detection across distributed infrastructure.

Intrusion detection systems monitor network traffic and system activities to identify suspicious behavior and potential security breaches, alerting Mexican enterprises to unauthorized access attempts targeting their big data repositories.

Unified threat management solutions consolidate multiple security functions including firewall, antivirus, and content filtering into single platforms, offering Mexican organizations streamlined protection and simplified management of big data security infrastructure.

Deployment Mode Insights:

- On-premises

- Cloud-based

The cloud-based leads with a share of 54% of the total Mexico big data security market in 2025.

Cloud-based deployment models are experiencing accelerated adoption as Mexican organizations leverage scalable security infrastructure without substantial capital investments in physical hardware. The establishment of hyperscale data center regions by major cloud providers has addressed previous concerns regarding data residency and latency, enabling enterprises to maintain sensitive information within national boundaries. Microsoft launched its first hyper-scale cloud datacenter region in Mexico in May 2024, providing local access to enterprise-grade security services and compliance frameworks aligned with Mexican regulatory requirements.

Small and medium enterprises represent the fastest-growing adopter segment for cloud-based big data security solutions, driven by affordable subscription models and reduced technical complexity. Cloud security enables organizations to implement advanced encryption, multi-factor authentication, and real-time threat monitoring capabilities previously accessible only to large enterprises with dedicated security operations centers. The nearshoring trend is amplifying demand as manufacturing and technology companies require flexible security infrastructure supporting distributed operations across multiple facilities and supply chain partners.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises hold the largest share with 73.24% of the total Mexico big data security market in 2025.

Large enterprises maintain dominant market position due to substantial security budgets, complex data environments, and stringent regulatory compliance obligations requiring comprehensive protection frameworks. These organizations typically operate dedicated security operations centers with specialized personnel managing enterprise-grade platforms across hybrid infrastructure configurations. Their extensive data ecosystems spanning multiple business units, geographic locations, and cloud environments necessitate sophisticated security architectures capable of providing unified visibility and consistent policy enforcement. Large enterprises also face heightened scrutiny from regulators and stakeholders regarding data protection practices.

Multinational corporations expanding operations through nearshoring initiatives represent a significant growth driver as these organizations require security infrastructure meeting both Mexican regulations and international compliance standards including GDPR for European operations. Financial institutions, industrial conglomerates, and telecommunications companies anchor enterprise security spending, driven by regulatory resilience testing requirements and the need to protect critical business data from increasingly sophisticated cyber threats targeting high-value targets across the Mexican economy.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecommunication

- Healthcare and Pharmaceuticals

- Financial and Insurance

- Retail Trade

- Utilities

- Others

The BFSI segment exhibits a clear dominance with a 29.76% share of the total Mexico big data security market in 2025.

The banking, financial services, and insurance sector commands the largest end-use market share driven by stringent regulatory oversight from Banco de México and the exponential growth of digital financial services processing sensitive customer data. Mexico's fintech ecosystem has expanded rapidly with numerous companies utilizing artificial intelligence for analytics and security applications. Financial institutions manage highly sensitive data including transaction records, personal identification information, and credit histories requiring advanced encryption, tokenization, and multi-layered access control mechanisms to prevent unauthorized breaches.

Digital payment adoption across Mexico's rapidly growing smartphone user base significantly expands the attack surface, spurring substantial investments in fraud analytics, identity verification, and real-time transaction monitoring systems. The CNBV introduced enhanced fraud prevention regulations in July 2024 requiring banks to integrate comprehensive security measures into internal control frameworks. Financial institutions are prioritizing big data security investments to comply with Banxico's Cybersecurity Strategy 2024-2027 while protecting against increasingly sophisticated threats targeting the financial sector across Latin America.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market driven by the concentration of manufacturing facilities along the United States border requiring robust data protection infrastructure. Industrial hubs in Monterrey, Tijuana, and Ciudad Juárez are prioritizing cybersecurity investments to support nearshoring operations and cross-border supply chain data flows.

Central Mexico dominates the market anchored by Mexico City's concentration of financial institutions, government agencies, and technology companies requiring enterprise-grade security solutions. The region benefits from hyperscale data center investments and serves as the primary hub for managed security service providers.

Southern Mexico represents an emerging market with growing demand driven by expanding telecommunications infrastructure and digital transformation initiatives across tourism and energy sectors. Organizations in Yucatán and Quintana Roo are increasingly investing in cloud-based security solutions to protect customer data.

Market Dynamics:

Growth Drivers:

Why is the Mexico Big Data Security Market Growing?

Escalating Cyber Threat Landscape Driving Security Investments

Mexico faces an intensifying cyber threat environment that is compelling organizations across all sectors to substantially increase investments in big data security infrastructure. The country has emerged as a primary target for malicious cyber activities in Latin America, with manufacturing surpassing traditionally vulnerable financial and government institutions as the most targeted sector. This escalating threat landscape is driving urgent demand for advanced security solutions capable of protecting large-scale data environments from ransomware, data breaches, and sophisticated persistent threats targeting critical business information.

Digital Transformation and Nearshoring Expansion

The nearshoring phenomenon is fundamentally reshaping Mexico's technology landscape and creating substantial demand for enterprise-grade big data security infrastructure. Mexico attracted $45.3 billion USD in foreign direct investment in 2024, its highest level in over a decade, with significant portions directed toward technology, manufacturing, and digital services sectors requiring robust data protection frameworks. Companies relocating operations from Asia are implementing comprehensive security architectures to protect intellectual property, supply chain data, and customer information while ensuring compliance with both Mexican regulations and international standards. Some of the manufacturing companies in Mexico plan to increase automation investments according to PwC research, creating extensive data-intensive operations requiring scalable security solutions.

Regulatory Compliance Requirements Intensifying

Strengthening regulatory frameworks are compelling Mexican organizations to prioritize big data security investments to avoid penalties and maintain operational licenses. The Federal Law on Protection of Personal Data Held by Private Parties mandates comprehensive security measures for organizations handling sensitive information, while sector-specific regulations impose additional requirements on financial institutions, healthcare providers, and telecommunications companies. Financial institutions must comply with Banxico's Cybersecurity Strategy 2024-2027, which establishes rigorous protocols for protecting banking infrastructure and customer data from cyber threats.

Market Restraints:

What Challenges the Mexico Big Data Security Market is Facing?

Acute Cybersecurity Talent Shortage

Mexico faces a significant shortage of qualified cybersecurity professionals capable of implementing and managing sophisticated big data security solutions. The demand for specialists in cloud security, incident response, and advanced threat detection substantially exceeds available talent supply, constraining organizational capacity to fully leverage security investments. Companies are competing aggressively for limited skilled personnel while simultaneously investing in training programs to develop internal capabilities.

Constrained Federal Cybersecurity Budgets

Federal government allocations for cybersecurity remain below optimal levels relative to the threat environment, with spending representing less than 0.5% of total IT expenditure despite Mexico ranking among the most targeted countries globally for cyber incidents. Austerity-focused budget priorities constrain agency modernization initiatives and limit public sector adoption of advanced big data security solutions, potentially creating vulnerabilities in critical government infrastructure.

Rapidly Evolving Threat Sophistication

The continuous evolution of cyber threats presents ongoing challenges for organizations attempting to maintain effective big data security postures. Attackers are deploying increasingly sophisticated techniques including AI-enhanced malware, advanced persistent threats, and targeted ransomware campaigns that can evade traditional security controls. Organizations must continuously update security infrastructure and threat intelligence capabilities to address emerging vulnerabilities and attack vectors targeting big data environments.

Competitive Landscape:

The Mexico big data security market exhibits a moderately consolidated competitive structure characterized by the presence of established global technology leaders alongside emerging regional service providers. Major international vendors maintain significant market presence through direct enterprise sales and partnerships with local system integrators. These companies are actively expanding Mexican operations through data center investments, regional support capabilities, and localized compliance offerings tailored to Mexican regulatory requirements. Managed security service providers are gaining traction among mid-market organizations seeking enterprise-grade protection without extensive internal security teams, while specialized Mexican cybersecurity firms address niche requirements across specific industry verticals. Strategic partnerships between technology vendors and financial institutions, government agencies, and manufacturing enterprises are shaping competitive positioning and influencing customer adoption patterns.

Recent Developments:

-

March 2024: Eviden, a global leader in digital, cloud, big data, and security services, opened a new Security Operations Center in Monterrey, Mexico. The facility enables advanced cybersecurity services for organizations across the region, expanding capabilities for threat monitoring, incident response, and managed security services supporting enterprise big data protection requirements.

Mexico Big Data Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Technologies Covered | Identity and Access Management, Security Information and Event Management, Intrusion Detection System, Unified Threat Management, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, IT and Telecommunication, Healthcare and Pharmaceuticals, Financial and Insurance, Retail Trade, Utilities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico big data security market size was valued at USD 442.14 Million in 2025.

The Mexico big data security market is expected to grow at a compound annual growth rate of 12.84% from 2026-2034 to reach USD 1,310.88 Million by 2034.

The solution dominated with 79.83% market share in 2025, driven by enterprise demand for integrated security platforms offering comprehensive data protection capabilities including encryption, access management, and threat detection functionalities.

Key factors driving the Mexico big data security market include escalating cyber threats targeting Mexican enterprises, digital transformation acceleration through nearshoring initiatives, expanding regulatory compliance requirements, and hyperscale cloud infrastructure deployment creating demand for advanced security solutions.

Major challenges include acute cybersecurity talent shortages constraining organizational capacity, constrained federal cybersecurity budgets limiting public sector adoption, rapidly evolving threat sophistication requiring continuous security infrastructure updates, and integration complexity across hybrid cloud environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)