Mexico Biosimilar Market Size, Share, Trends and Forecast by Molecule, Manufacturing Type, Indication and Region, 2025-2033

Mexico Biosimilar Market Size, Share & Analysis:

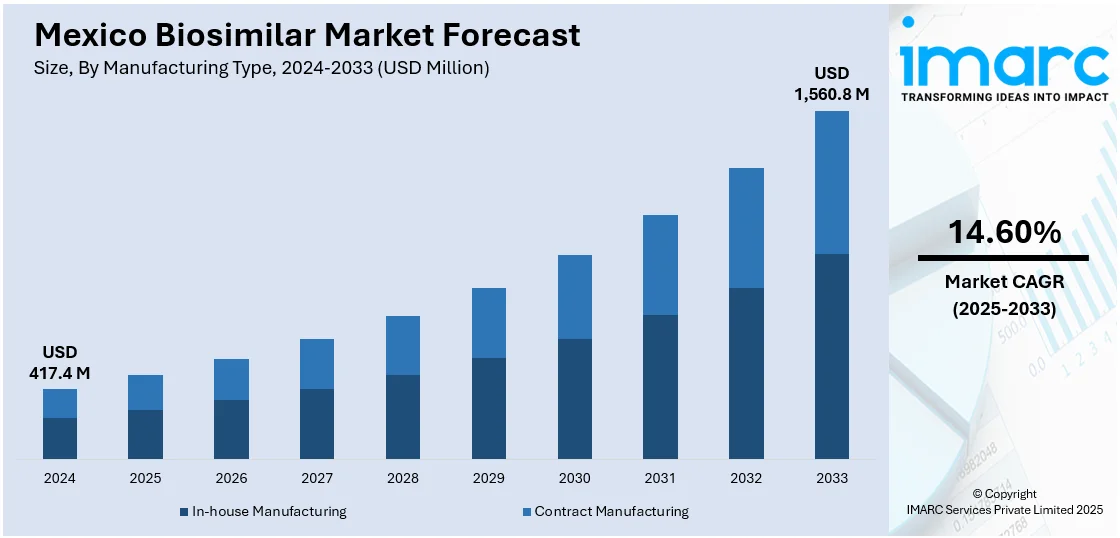

The Mexico biosimilar market size reached USD 417.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,560.8 Million by 2033, exhibiting a growth rate (CAGR) of 14.60% during 2025-2033. The market is driven by the increasing price of biologic drugs, government efforts to contain healthcare expenses, and demand for cost-effective treatments. Moreover, the growing awareness and acceptance by healthcare providers and regulatory enhancements about biosimilars are also increasing the Mexico biosimilar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 417.4 Million |

| Market Forecast in 2033 | USD 1,560.8 Million |

| Market Growth Rate 2025-2033 | 14.60% |

Mexico Biosimilar Market Analysis:

- Key Market Drivers: Government cost-containment measures, increasing chronic disease burden, and rising healthcare demand are propelling biosimilar uptake. Favorable regulatory changes and patent losses of biologics also boost Mexico biosimilar market demand.

- Key Market Trends: Rise in local production, partnerships, and emphasis on monoclonal antibodies are recent trends. Acceptance among physicians and patients for biosimilars is also increasing with improved awareness and similar clinical effectiveness.

- Key Opportunities: There is market opportunity in unpenetrated rural markets, oncology, and autoimmune disease treatments. Incentives for domestic production, enhancing pharmacovigilance systems, and simplifying the regulatory process are excellent opportunities for biosimilar companies and investors alike.

- Key Challenges: Physician trust limitations, regulatory obstacles, and patent litigation are significant growth inhibitors. Infrastructure shortfalls, brand loyalty to originator companies, and pressures on prices also remain important challenges in the Mexico biosimilar market forecast.

Mexico Biosimilar Market Trends:

Increasing Adoption of Biosimilars in Oncology Treatments

One of the most important trends propelling the Mexico biosimilar market growth is the increasing use of biosimilars for oncology indications. Cancer therapy, which frequently involves biologic treatments, has been a primary focus for biosimilar development, as most biologics are expensive and not affordable to most of the population. When original biologics' patents expire, biosimilars provide a lower-cost option for patients and healthcare systems alike. In Mexico, where access to costly cancer therapies is low, biosimilars are becoming a critical answer in making high-quality oncology treatments more available. The government has increasingly been promoting the utilization of biosimilars in order to decrease healthcare expenses, which has expedited their approval and market adoption. In addition, the favorable clinical effects of biosimilars, in combination with cost benefits, are encouraging an increasing number of healthcare professionals to look at these options, thus boosting their use in cancer treatment.

Government Support and Regulatory Framework Development

The biosimilar regulatory environment in the country has become much better, which has helped increase the size of the Mexico biosimilar market share. The Mexican government has acted to encourage the development and use of biosimilars by establishing a more favorable regulatory climate. The Federal Commission for Protection against Sanitary Risk (COFEPRIS) has established stringent biosimilar approval guidelines, facilitating easier approval processes for manufacturers while making sure the drugs are tested with high standards of safety and efficacy. Also, government health policies to check rising healthcare expenditures have promoted biosimilar drug utilization as a lower-cost alternative to biologic medications, especially among public sector stakeholders. Mexico's increasing interest in biosimilars follows the general trend of cost control in healthcare systems. As regulatory systems continue to evolve to facilitate faster market introduction of biosimilars, the trend is likely to persist, favoring both patients and healthcare providers by making necessary treatments more accessible.

Rising Awareness and Acceptance of Biosimilars Among Healthcare Professionals

An increase in awareness and acceptance of biosimilars among healthcare professionals in Mexico is another significant trend that is fueling Mexico biosimilar market analysis. Previously, physicians and healthcare professionals were somewhat hesitant to transition from originator biologics to biosimilars because they were worried about their safety, effectiveness, and interchangeability. With more clinical information coming to hand and real-world experience of biosimilar performance, healthcare professionals are increasingly confident to prescribe biosimilars. Alongside this, there has been rising education effort, training, and greater industry co-operation, contributing to better appreciation of biosimilars. Mexico's professional associations and healthcare organizations have strongly supported biosimilar use, underscoring benefits to both pocket and access. Such change is increasingly erasing the initial misgivings regarding biosimilars and winning acceptance at an ever-increasing scale of market. As healthcare professionals increasingly adopt biosimilars, the Mexico biosimilar market outlook is poised to continue its path toward Mexico biosimilar market growth.

Mexico Biosimilar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on molecule, manufacturing type, and indication.

Molecule Insights:

- Infliximab

- Insulin Glargine

- Epoetin Alfa

- Etanercept

- Filgrastim

- Somatropin

- Rituximab

- Follitropin Alfa

- Adalimumab

- Pegfilgrastim

- Trastuzumab

- Bevacizumab

- Others

The report has provided a detailed breakup and analysis of the market based on the molecule. This includes infliximab, insulin glargine, epoetin alfa, etanercept, filgrastim, somatropin, rituximab, follitropin alfa, adalimumab, pegfilgrastim, trastuzumab, bevacizumab, and others.

Manufacturing Type Insights:

- In-house Manufacturing

- Contract Manufacturing

The report has provided a detailed breakup and analysis of the market based on the manufacturing type. This includes in-house manufacturing and contract manufacturing.

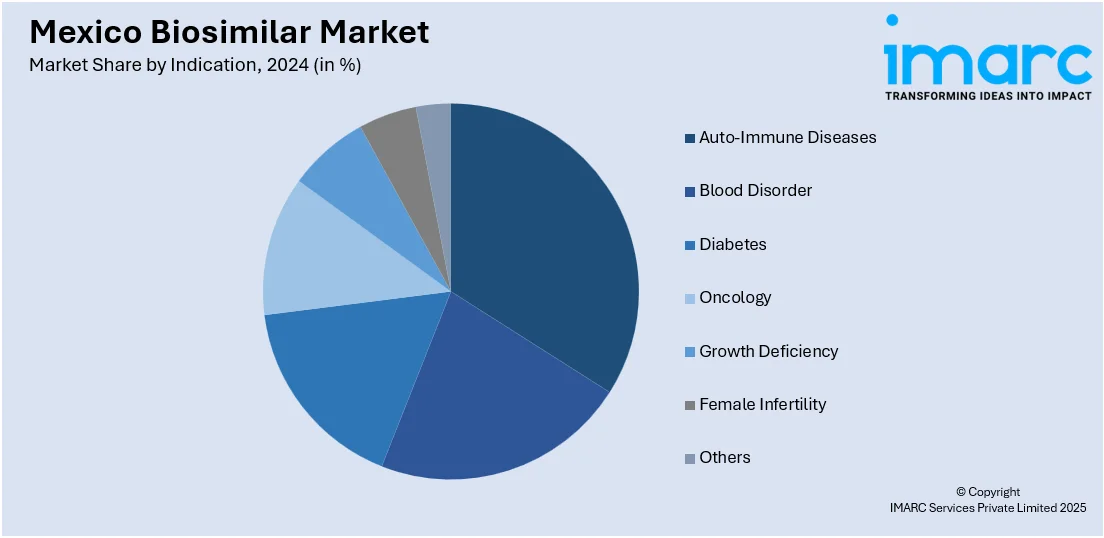

Indication Insights:

- Auto-Immune Diseases

- Blood Disorder

- Diabetes

- Oncology

- Growth Deficiency

- Female Infertility

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes auto-immune diseases, blood disorder, diabetes, oncology, growth deficiency, female infertility, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biosimilar Market News:

- In July 2024, Boehringer Ingelheim partnered with GoodRx to offer its unbranded adalimumab biosimilar, referencing Humira, at $550 per 2-pack—a 92% discount. This initiative improves access for uninsured or underinsured patients with autoimmune diseases. Meanwhile, a new ustekinumab biosimilar launched in Europe, and Mexico approved a bevacizumab biosimilar, marking continued global expansion of affordable biologic alternatives in the pharmaceutical market.

- In February 2024, Mexico’s COFEPRIS unveiled an ambitious biosimilar strategy to boost local production and improve access. The plan includes regulatory reforms, new expert teams, and close industry collaboration to ensure biocomparability and global standards. Praised as regionally unique, the initiative aims to position Mexico as a biosimilar hub. Its continuity may depend on political transitions or strong industry advocacy post-election to retain current COFEPRIS leadership.

Mexico Biosimilar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Molecules Covered | Infliximab, Insulin Glargine, Epoetin Alfa, Etanercept, Filgrastim, Somatropin, Rituximab, Follitropin Alfa, Adalimumab, Pegfilgrastim, Trastuzumab, Bevacizumab, Others |

| Manufacturing Types Covered | In-house Manufacturing, Contract Manufacturing |

| Indications Covered | Auto-Immune Diseases, Blood Disorder, Diabetes, Oncology, Growth Deficiency, Female Infertility, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biosimilar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biosimilar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biosimilar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Mexico biosimilar market was valued at USD 417.4 Million in 2024.

The Mexico biosimilar market is projected to exhibit a CAGR of 14.60% during 2025-2033, reaching a value of USD 1,560.8 Million by 2033.

Key factors driving the Mexico biosimilar market include rising healthcare costs, patent expirations of biologics, increasing prevalence of chronic diseases, supportive government regulations, and growing demand for affordable treatments. Local manufacturing capabilities and expanding healthcare coverage also contribute to the market's growth and adoption of biosimilar therapies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)