Mexico Cancer Biomarkers Market Size, Share, Trends and Forecast by Profiling Technology, Biomolecule, Cancer Type, Application, End User, and Region, 2025-2033

Mexico Cancer Biomarkers Market Overview:

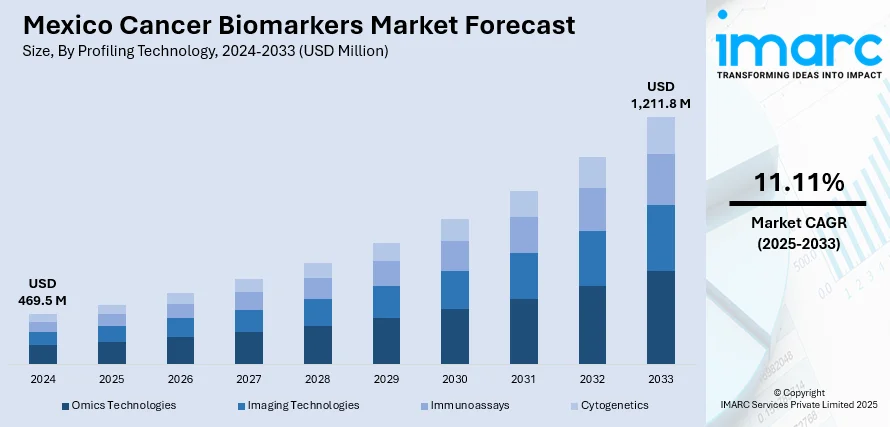

The Mexico cancer biomarkers market size reached USD 469.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,211.8 Million by 2033, exhibiting a growth rate (CAGR) of 11.11% during 2025-2033. Rising cancer incidence, increased awareness and screening programs, growing adoption of precision medicine, advancements in biomarker-based diagnostics, and expanding healthcare infrastructure supporting early detection, targeted therapies, and improved reimbursement policies for cancer-related diagnostic tests and treatments are some of the factors contributing to Mexico cancer biomarkers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 469.5 Million |

| Market Forecast in 2033 | USD 1,211.8 Million |

| Market Growth Rate 2025-2033 | 11.11% |

Mexico Cancer Biomarkers Market Trends:

Expanding Access to Comprehensive Genomic Profiling

The recent regulatory clearance of a broad-spectrum oncology assay detecting over 500 gene biomarkers, including NTRK and RET fusions, marks a shift toward more expansive genetic testing in cancer care. This pan-cancer diagnostic tool enables clinicians to assess multiple tumor types through a single, unified test, streamlining patient evaluation for targeted therapies. In Mexico, where precision oncology is gaining ground, such high-coverage platforms are likely to accelerate the integration of molecular profiling into routine practice. Broader availability of these diagnostics supports early identification of actionable mutations, improving treatment alignment and outcomes. This development also strengthens the infrastructure for biomarker-based decision-making in oncology, reinforcing the role of genomic data in shaping clinical pathways across healthcare institutions. These factors are intensifying the Mexico cancer biomarkers market growth. For example, in August 2024, the FDA approved Illumina’s TruSight Oncology Comprehensive (TSO Comp) test, a pan-cancer assay detecting over 500 gene biomarkers, including NTRK and RET fusions. This milestone paves the way for broader adoption of biomarker-driven cancer diagnostics in regions like Mexico, where precision oncology is expanding.

To get more information of this market, Request Sample

Strengthening Precision Diagnostics in Oncology

A recent initiative involving the co-development of flow cytometry-based companion diagnostics is set to strengthen the diagnostic ecosystem in Mexico. The collaboration is focused on delivering complete solutions, from biomarker panel creation to regulatory-approved diagnostic kits, aimed at improving accuracy in cancer detection and therapy selection. With both collaborators already active in the country, their new efforts are expected to drive adoption of personalized diagnostic tools, particularly in oncology. This development aligns with growing demand for high-throughput, precise testing platforms capable of supporting targeted treatment pathways. Enhanced access to such technologies could significantly improve patient outcomes and support clinical decision-making across various healthcare settings in Mexico. For instance, in July 2024, BD and Quest Diagnostics partnered to develop flow cytometry-based companion diagnostics (CDx) for cancer and other diseases. This collaboration aims to provide end-to-end solutions, from biomarker panel development to FDA-approved diagnostic kits, enhancing personalized treatment options. Given their established operations in Mexico, this initiative is poised to advance the country's cancer biomarker market by introducing innovative diagnostic tools.

Mexico Cancer Biomarkers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on profiling technology, biomolecule, cancer type, application, and end user.

Profiling Technology Insights:

- Omics Technologies

- Imaging Technologies

- Immunoassays

- Cytogenetics

The report has provided a detailed breakup and analysis of the market based on the profiling technology. This includes omics technologies, imaging technologies, immunoassays, and cytogenetics.

Biomolecule Insights:

- Genetic Biomarkers

- Protein Biomarkers

- Glyco-Biomarkers

A detailed breakup and analysis of the market based on the biomolecule have also been provided in the report. This includes genetic biomarkers, protein biomarkers, and glyco-biomarkers.

Cancer Type Insights:

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Stomach Cancer

- Others

The report has provided a detailed breakup and analysis of the market based on the cancer type. This includes breast cancer, lung cancer, colorectal cancer, prostate cancer, stomach cancer, and others.

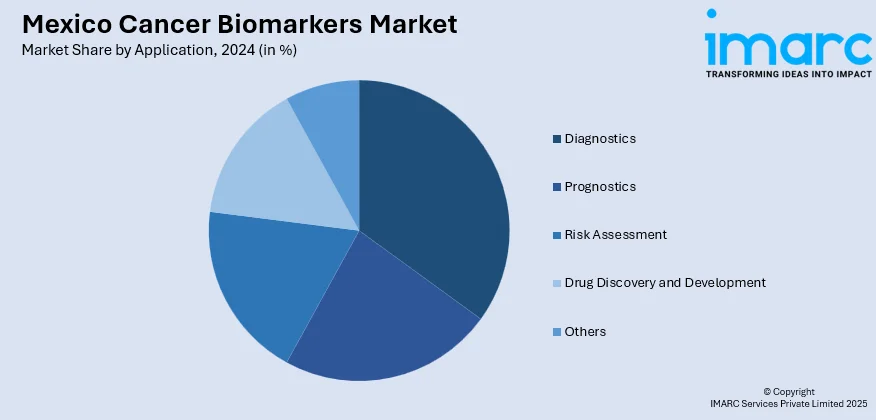

Application Insights:

- Diagnostics

- Prognostics

- Risk Assessment

- Drug Discovery and Development

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes diagnostics, prognostics, risk assessment, drug discovery and development, and others.

End User Insights:

- Hospitals

- Academic and Research Institutions

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, academic and research institutions, ambulatory surgical centers, diagnostic laboratories, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cancer Biomarkers Market News:

- In March 2025, Mexico’s Longevity Medical Institute adopted OncoSeek, an AI-powered multi-cancer detection test by OncoInv, to launch a national screening program. The blood-based test analyzes over 70 protein biomarkers to identify more than 12 cancer types, positioning it as a key tool in Mexico’s cancer diagnostics. This marks a significant advancement in the country’s cancer biomarkers market, especially for adults over 50.

Mexico Cancer Biomarkers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Profiling Technologies Covered | Omics Technologies, Imaging Technologies, Immunoassays, Cytogenetics |

| Biomolecules Covered | Genetic Biomarkers, Protein Biomarkers, Glyco-Biomarkers |

| Cancer Types Covered | Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Stomach Cancer, Others |

| Applications Covered | Diagnostics, Prognostics, Risk Assessment, Drug Discovery and Development, Others |

| End Users Covered | Hospitals, Academic and Research Institutions, Ambulatory Surgical Centers, Diagnostic Laboratories, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cancer biomarkers market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cancer biomarkers market on the basis of profiling technology?

- What is the breakup of the Mexico cancer biomarkers market on the basis of biomolecule?

- What is the breakup of the Mexico cancer biomarkers market on the basis of cancer type?

- What is the breakup of the Mexico cancer biomarkers market on the basis of application?

- What is the breakup of the Mexico cancer biomarkers market on the basis of end user?

- What is the breakup of the Mexico cancer biomarkers market on the basis of region?

- What are the various stages in the value chain of the Mexico cancer biomarkers market?

- What are the key driving factors and challenges in the Mexico cancer biomarkers market?

- What is the structure of the Mexico cancer biomarkers market and who are the key players?

- What is the degree of competition in the Mexico cancer biomarkers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cancer biomarkers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cancer biomarkers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cancer biomarkers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)