Mexico Car Audio Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, Sound Management, Sales Channel, and Region, 2025-2033

Mexico Car Audio Market Overview:

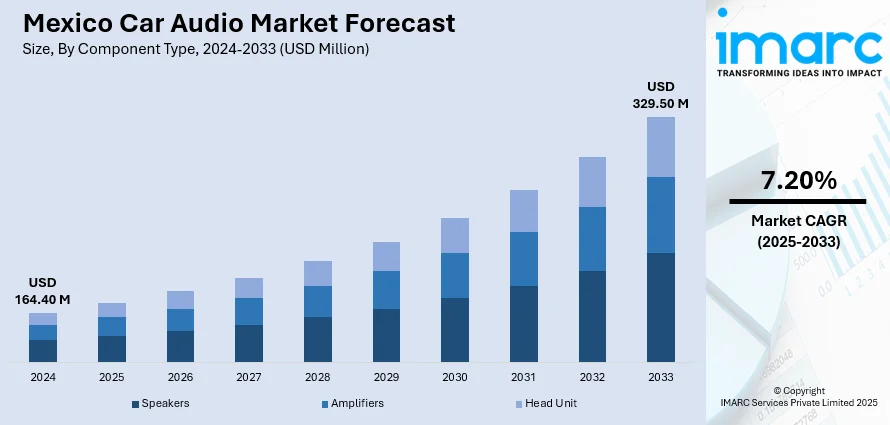

The Mexico car audio market size reached USD 164.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 329.50 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market is driven by rising consumer demand for enhanced in-vehicle entertainment and connectivity. The integration of advanced technologies like Bluetooth and voice control, along with the popularity of aftermarket upgrades, also escalates the product demand. An expanding e-commerce platforms enabling consumers to explore a wide range of products from local and global brands is further contributing to the increasing Mexico car audio market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 164.40 Million |

| Market Forecast in 2033 | USD 329.50 Million |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Car Audio Market Trends:

Technological Advancements and Integration of Smart Features

Technological advancements are significantly shaping the Mexico car audio market, with increasing integration of smart features and personalized experiences. Because of voice-controlled assistants, wireless streaming, AI-based settings, and real-time changes, many people now expect more from car audio. Many high-caliber cars are now equipped with surround sound and noise-canceling systems to give drivers and passengers an outstanding listening experience. The inclusion of voice and touchless commands improves safety for drivers and follows the growing trend of protecting both the passengers and the car’s interior. With more electric and hybrid cars appearing on Mexico’s roads, the use of top-quality, connected audio in vehicles is rising.

Rising Demand for In-Car Entertainment and Connectivity

In Mexico, the demand for enhanced in-car entertainment is steadily increasing, driven by consumers seeking a more immersive and connected driving experience. With the help of Bluetooth, Android Auto, and Apple CarPlay, drivers have an easy way to enjoy music, get directions, and chat while driving. Additionally, more young drivers who love using technology are driving the need for these features. Higher commute times caused by the growth of cities have encouraged people to improve their cars with top-quality audio systems. As a result, in-car entertainment and connectivity have become essential factors propelling the Mexico car audio market growth.

Growth of E-Commerce and Aftermarket Customization

The expansion of e-commerce platforms in Mexico has greatly influenced the accessibility and diversity of car audio systems, enabling consumers to explore a wide range of products from local and global brands. Online shopping provides detailed product comparisons, user reviews, and competitive pricing, encouraging both first-time and repeat purchases. This accessibility supports the flourishing aftermarket segment, where car owners, particularly young consumers, invest in customized audio solutions to personalize their vehicles. From upgraded speakers and subwoofers to multimedia head units, aftermarket customization allows users to enhance both aesthetics and sound quality. The synergy between e-commerce and personalization has become a significant growth driver for the Mexico car audio market, encouraging broader consumer participation.

Mexico Car Audio Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, vehicle type, sound management, and sales channel.

Component Type Insights:

- Speakers

- Amplifiers

- Head Unit

The report has provided a detailed breakup and analysis of the market based on the component type. This includes speakers, amplifiers, and head unit.

Vehicle Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicles (SUVs)

- Multi-Purpose Vehicles (MPVs)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes hatchback, sedan, sports utility vehicles (SUVs), and multi-purpose vehicles (MPVs).

Sound Management Insights:

- Voice Recognition

- Manual

A detailed breakup and analysis of the market based on the sound management have also been provided in the report. This includes voice recognition and manual.

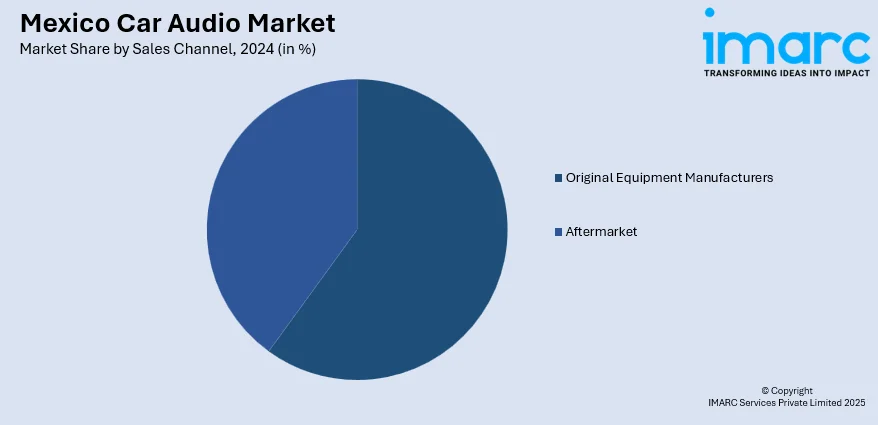

Sales Channel Insights:

- Original Equipment Manufacturers

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes original equipment manufacturers and aftermarket.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Car Audio Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Speakers, Amplifiers, Head Unit |

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicles (SUVs), Multi-Purpose Vehicles (MPVs) |

| Sound Managements Covered | Voice Recognition, Manual |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico car audio market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico car audio market on the basis of component type?

- What is the breakup of the Mexico car audio market on the basis of vehicle type?

- What is the breakup of the Mexico car audio market on the basis of sound management?

- What is the breakup of the Mexico car audio market on the basis of sales channel?

- What is the breakup of the Mexico car audio market on the basis of region?

- What are the various stages in the value chain of the Mexico car audio market?

- What are the key driving factors and challenges in the Mexico car audio market?

- What is the structure of the Mexico car audio market and who are the key players?

- What is the degree of competition in the Mexico car audio market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico car audio market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico car audio market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico car audio industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)