Mexico Car Subscription Market Size, Share, Trends and Forecast by Service Provider, Vehicle Type, Subscription Period, End Use, and Region, 2026-2034

Mexico Car Subscription Market Overview:

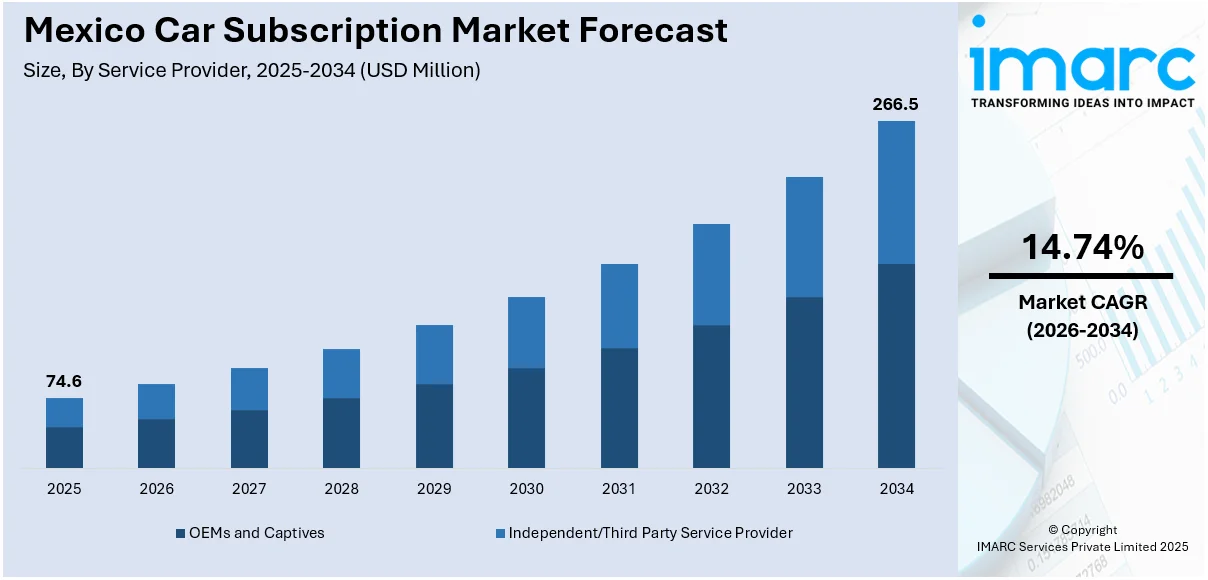

The Mexico car subscription market size reached USD 74.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 266.5 Million by 2034, exhibiting a growth rate (CAGR) of 14.74% during 2026-2034. The market is gaining significant traction as consumers seek flexible, commitment-free alternatives to car ownership. Urbanization, rising digital adoption, and shifting preferences among younger demographics are also escalating product demand. Moreover, subscription models offering bundled services including insurance, maintenance, and roadside assistance are some of the growth-inducing factors contributing to the rise in of Mexico car subscription market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 74.6 Million |

| Market Forecast in 2034 | USD 266.5 Million |

| Market Growth Rate 2026-2034 | 14.74% |

Mexico Car Subscription Market Trends:

Urbanization and Digital Adoption

Mexico’s rapid urbanization and widespread digital adoption are reshaping mobility preferences, especially among city dwellers. According to the data published by the Worldometer, as of April 2025, Mexico's population is 131,743,924, with an estimated mid-year figure of 131,946,900. Approximately 87.86% of the population, live in urban areas, highlighting Mexico's significant urbanization. As more people migrate to urban areas with congested roads and limited parking, the appeal of traditional car ownership is declining. Instead, consumers are gravitating toward flexible, app-based mobility solutions that fit their urban lifestyles. The growing penetration of smartphones and improved internet access have enabled seamless access to car subscription platforms, allowing users to browse, book, and manage vehicles through a single app. These platforms offer convenience, transparency, and speed qualities that resonate with the digitally savvy population in cities like Mexico City, Monterrey, and Guadalajara. On-demand vehicle access also supports shared economy models and reduces the burden of maintenance and ownership. This digital shift is a key driver of innovation and adoption, strengthening the foundation of Mexico’s growing car subscription market.

To get more information on this market Request Sample

Bundled Service Packages

Bundled service offerings are becoming a major attraction in Mexico’s evolving car subscription landscape. These packages typically include insurance, routine maintenance, repairs, and roadside assistance under a single monthly fee, eliminating the stress and unpredictability of separate car ownership expenses. This all-inclusive model appeals particularly to urban professionals, expats, and younger consumers who value convenience, transparency, and predictable costs. Users can drive without worrying about unexpected repair bills, dealing with insurance claims, or finding a trustworthy mechanic. This streamlined approach simplifies mobility and enhances user satisfaction, making it easier for individuals to access and maintain a vehicle on their terms. As more platforms adopt these bundled models, customer retention and trust are improving, which is accelerating adoption. The growing demand for such comprehensive, no-hassle mobility solutions is a strong contributor to Mexico car subscription market growth.

Growing Demand for Flexibility

Consumers in Mexico are increasingly favoring car subscription services to avoid the financial and logistical burdens of traditional ownership. Rising costs of vehicle purchase, depreciation, insurance, and registration are prompting a shift toward flexible alternatives. Subscription models allow users to access vehicles without long-term contracts or loans, offering the freedom to switch cars or cancel with minimal notice. This flexibility is particularly attractive to younger professionals, expatriates, and short-term residents who seek mobility without being tied down. It also appeals to individuals testing specific models before committing to a purchase. As economic uncertainty and evolving lifestyles reshape consumer priorities, demand for adaptable vehicle access is rising steadily. The ability to pay a flat monthly fee for a fully managed mobility solution continues to reshape expectations and purchasing behavior, making flexibility a key factor driving market growth.

Mexico Car Subscription Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service provider, vehicle type, subscription period, and end use.

Service Provider Insights:

- OEMs and Captives

- Independent/Third Party Service Provider

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes OEMs and captives and independent/third party service provider.

Vehicle Type Insights:

- IC Powered Vehicle

- Electric Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes IC powered vehicle and electric vehicle.

Subscription Period Insights:

- 1 to 6 Months

- 6 to 12 Months

- More Than 12 Months

A detailed breakup and analysis of the market based on the subscription period have also been provided in the report. This includes 1 to 6 months, 6 to 12 months, and more than 12 months.

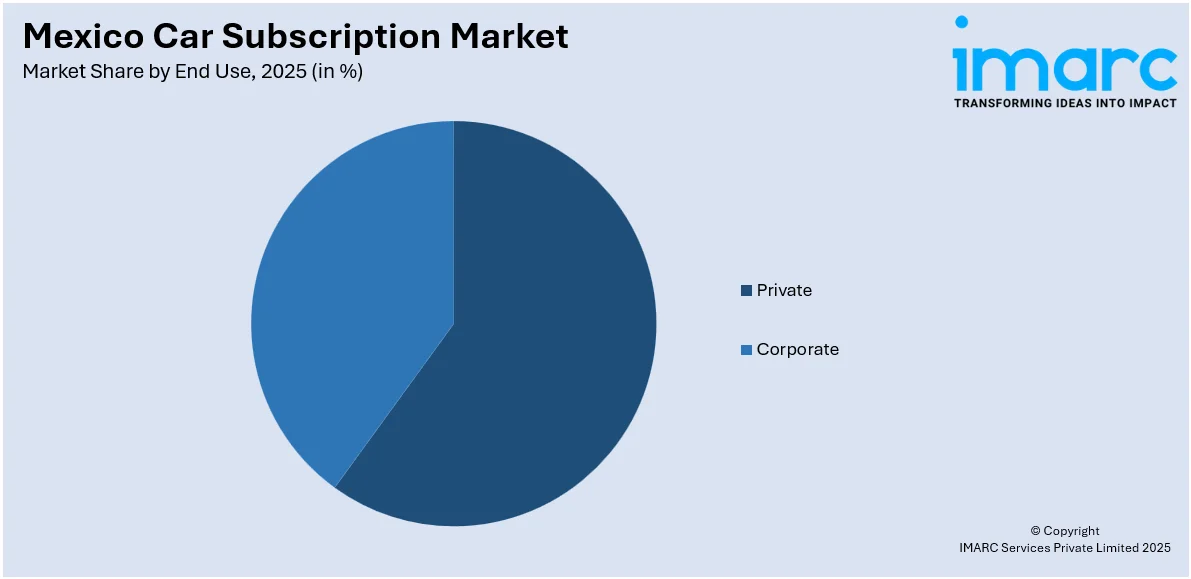

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Private

- Corporate

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes private and corporate.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Car Subscription Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | OEMs and Captives, Independent/Third Party Service Provider |

| Vehicle Types Covered | IC Powered Vehicle, Electric Vehicle |

| Subscription Periods Covered | 1 to 6 Months, 6 to 12 Months, More Than 12 Months |

| End Uses Covered | Private, Corporate |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico car subscription market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico car subscription market on the basis of service provider?

- What is the breakup of the Mexico car subscription market on the basis of vehicle type?

- What is the breakup of the Mexico car subscription market on the basis of subscription period?

- What is the breakup of the Mexico car subscription market on the basis of end use?

- What is the breakup of the Mexico car subscription market on the basis of region?

- What are the various stages in the value chain of the Mexico car subscription market?

- What are the key driving factors and challenges in the Mexico car subscription market?

- What is the structure of the Mexico car subscription market and who are the key players?

- What is the degree of competition in the Mexico car subscription market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico car subscription market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico car subscription market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico car subscription industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)