Mexico Carbon Capture and Storage Market Size, Share, Trends and Forecast by Service, Technology, End Use Industry, and Region, 2025-2033

Mexico Carbon Capture and Storage Market Overview:

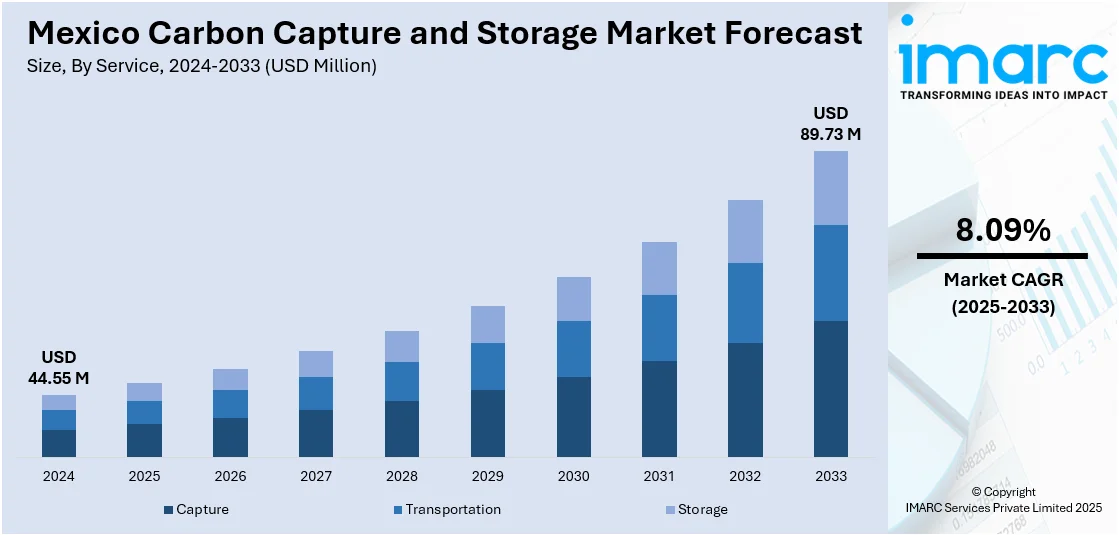

The Mexico carbon capture and storage market size reached USD 44.55 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 89.73 Million by 2033, exhibiting a growth rate (CAGR) of 8.09% during 2025-2033. The Mexican market is driven by the enforcement of favorable government regulations and policies. Besides this, Mexican industrial emissions are increasing, and hence there is a pressing need for proper carbon management solutions. This, along with the technological advancements to improve the efficiency and cost-effectiveness are expanding the Mexico carbon capture and storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 44.55 Million |

| Market Forecast in 2033 | USD 89.73 Million |

| Market Growth Rate 2025-2033 | 8.09% |

Mexico Carbon Capture and Storage Market Trends:

Government Policies and Regulations

The Mexican market is driven by the enforcement of favorable government regulations and policies. The government of Mexico is working hard towards the reinforcement of its environmental infrastructure by enforcing regulations that support carbon emissions reduction. Such policies entail financial incentives, tax relief, and regulating frameworks that are attracting both public and private sectors to implement carbon capture and storage (CCS) technologies. The government is also engaging in global climate treaties, which further affects the ranking of low-carbon technologies. With these regulations still in the process of change, companies are increasingly adjusting to the nation's ambitious carbon emissions reduction standards. This assistance is enabling the creation of an enabling environment for CCS technology development and deployment, setting the Mexican market on the path to growth and innovation in carbon management practices. These initiatives are contributing significantly to lowering the carbon footprint of industries like oil and gas, cement, and power generation. One of the most important pillars of Mexico's renewable energy legal framework is the Energy Transition Law (LTE), adopted in 2015. The law determines the basis for the sustainable management of energy sources and clearly outlines objectives. It has been provided that at least 35% of the electricity produced within the country should be clean by 2024. This act is intended to curtail fossil fuel dependency and enhance the use of environment-friendly technology.

Growing Industrial Emissions

Mexican industrial emissions are increasing, and hence there is a pressing need for proper carbon management solutions. Oil and gas, manufacturing, and cement manufacturing are the key sectors that emit large amounts of carbon dioxide. With the growth in these industries, their share in the country's overall greenhouse gas emissions also grows. Firms in these sectors are now actively looking for ways to minimize their environmental footprint and meet international climate agreements, resulting in an increasing demand for CCS technology. Increasing awareness about the environmental footprint of high-emission industries is motivating firms to look into carbon capture techniques as a way to meet their sustainability objectives. Since the emissions from such industries continue to increase, the demand for effective solutions such as CCS is also growing. As a result, the Mexican CCS market is growing as companies aim to satisfy national and international climate objectives while ensuring operational performance.

Technological Advancements and Partnerships

Technological advancements in CCS to improve the efficiency and cost-effectiveness of CCS systems are impelling the Mexico carbon capture and storage market growth. Leading global and local companies are forming strategic partnerships to enhance their capabilities in capturing, transporting, and storing carbon dioxide. These collaborations are making cutting-edge CCS technologies more accessible and scalable for the Mexican market. Furthermore, advancements in CO2 storage sites, monitoring techniques, and the development of more advanced capture technologies are making CCS a more attractive investment. As research and development (R&D) continue to progress, CCS systems are becoming more commercially viable, allowing companies to integrate these solutions into their operations. This ongoing innovation is fueling the market growth, as companies are increasingly relying on new technologies to help meet carbon reduction targets and maintain their environmental responsibilities. This shift towards advanced CCS technologies is providing a clear pathway to a sustainable future for Mexico’s industrial sectors. The United States, Mexico, and Canada set an historic objective to purchase 50% of North America's entire power generation from renewable, nuclear, carbon capture and storage (CCS) and energy efficiency technologies by 2025. President Obama, Canadian Prime Minister Justin Trudeau, and Mexican President Enrique Peña Nieto announced the continental ambition, under the North American Climate, Clean Energy and Environment Partnership, at the "Three Amigos" North America Leader's Summit in Ottawa, Canada.

Mexico Carbon Capture and Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, technology, and end use industry.

Service Insights:

- Capture

- Transportation

- Storage

The report has provided a detailed breakup and analysis of the market based on the service. This includes capture, transportation, and storage.

Technology Insights:

- Post-combustion Capture

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

The report has provided a detailed breakup and analysis of the market based on the technology. This includes post-combustion capture, pre-combustion capture, and oxy-fuel combustion capture.

End Use Industry Insights:

- Oil and Gas

- Coal and Biomass Power Plant

- Iron and Steel

- Chemical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, coal and biomass power plant, iron and steel, chemical, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Carbon Capture and Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Capture, Transportation, Storage |

| Technologies Covered | Post-combustion Capture, Pre-combustion Capture, Oxy-fuel Combustion Capture |

| End Use Industries Covered | Oil and Gas, Coal and Biomass Power Plant, Iron and Steel, Chemical, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico carbon capture and storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico carbon capture and storage market on the basis of service?

- What is the breakup of the Mexico carbon capture and storage market on the basis of technology?

- What is the breakup of the Mexico carbon capture and storage market on the basis of end use industry?

- What is the breakup of the Mexico carbon capture and storage market on the basis of region?

- What are the various stages in the value chain of the Mexico carbon capture and storage market?

- What are the key driving factors and challenges in the Mexico carbon capture and storage market?

- What is the structure of the Mexico carbon capture and storage market and who are the key players?

- What is the degree of competition in the Mexico carbon capture and storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico carbon capture and storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico carbon capture and storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico carbon capture and storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)