Mexico Cargo Handling Equipment Market Size, Share, Trends and Forecast by Equipment Type, Propulsion Type, Application, and Region, 2025-2033

Mexico Cargo Handling Equipment Market Overview:

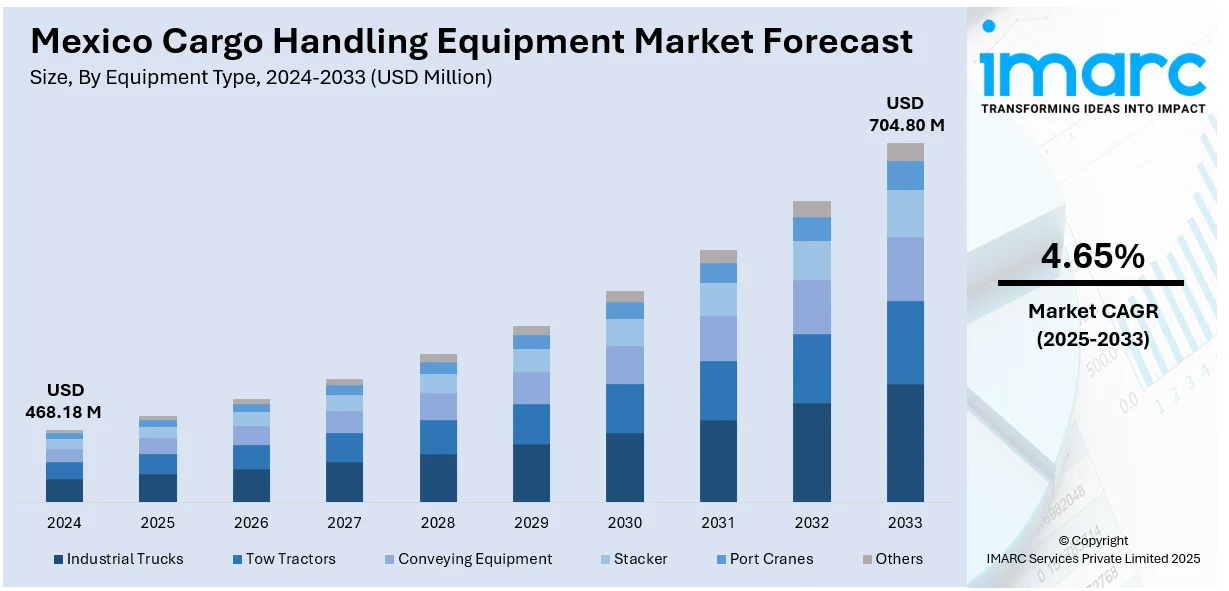

The Mexico cargo handling equipment market size reached USD 468.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 704.80 Million by 2033, exhibiting a growth rate (CAGR) of 4.65% during 2025-2033. The market is experiencing growth driven by increased port automation and the adoption of sustainable solutions. Moreover, Mexico cargo handling equipment market share is expanding as demand for eco-friendly, efficient solutions rises.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 468.18 Million |

| Market Forecast in 2033 | USD 704.80 Million |

| Market Growth Rate 2025-2033 | 4.65% |

Mexico Cargo Handling Equipment Market Trends:

Rising Demand for Port Automation in Mexico

The Mexican cargo handling equipment market growth is undergoing a significant shift as major ports adopt automation to enhance operational performance. In response to increasing volumes of international trade and capacity shortages, Mexican ports are embracing technologies such as automated guided vehicles (AGVs), robotic cranes, and terminal operating systems. These technologies are assisting in lessening labor-intensive operations, reducing expenses, and enhancing speed and precision of handling. Mexico's automation push is also a tactical decision to respond to labor shortages and achieve faster vessel turnaround times—key drivers in sustaining competitiveness vis-à-vis international shipping centers. Among major developments, a number of ports along the Gulf of Mexico and Pacific coastlines have begun adding automated stacking cranes and AI-based traffic management systems to optimize container flows. These systems are improving safety, minimizing human error, and driving overall throughput efficiency higher. In the future, machine learning and predictive analytics are likely to continue enhancing real-time decision-making and allocation of resources in Mexican ports to provide operators with more control over logistics.

Shift Towards Green and Sustainable Equipment

Mexico's cargo handling industry is also moving towards environmentally friendly operations on account of strict regulatory environments and growing investor and community demands. The industry is witnessing a growing trend in the adoption of electric powered cargo handling equipment, such as electric forklifts, straddle carriers, and terminal tractors. The reduced-emission options not only minimize environmental impacts but also save fuel and long-term maintenance costs. Large ports like Veracruz and Lázaro Cárdenas are installing hybrid-powered cranes that combine electric motors with diesel engines, maximizing energy efficiency during peak operations. Furthermore, there are attempts to integrate renewable energy sources—specifically solar panels and wind turbines to supply on-site handling systems. Ports are also investing in smart monitoring solutions that assist in monitoring emissions, controlling energy consumption, and maintaining compliance with developing environmental standards. These efforts reinforce Mexico's more extensive climate goals within international regimes and place its cargo handling industry as an innovative, sustainable element of the logistics system.

Mexico Cargo Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on equipment type, propulsion type, and application.

Equipment Type Insights:

- Industrial Trucks

- Tow Tractors

- Conveying Equipment

- Stacker

- Port Cranes

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes industrial trucks, tow tractors, conveying equipment, stacker, port cranes, and others.

Propulsion Type Insights:

- IC Engine

- Electric

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes IC engine and electric.

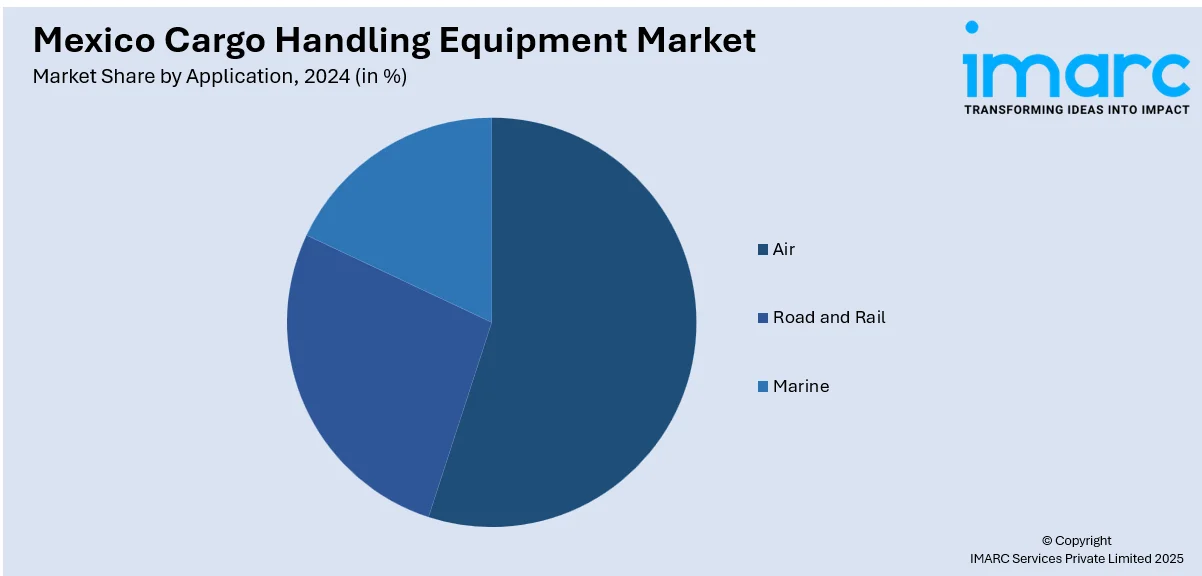

Application Insights:

- Air

- Road and Rail

- Marine

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes air, road and rail, and marine.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cargo Handling Equipment Market News:

- May 2025: ICTSI’s Contecon Manzanillo terminal in Mexico added two STS cranes and four RTGs to boost its capacity to 2 Million TEU. This expansion, following a USD 300 Million investment in 2024, strengthens container handling efficiency and enhances Mexico’s position in global logistics.

- April 2024: APM Terminals made significant investments in cargo handling equipment, securing 240 units for terminals across Latin America, Africa, and Europe. This included cranes, electric tractors, and automated equipment for key facilities like APM Terminals Lazaro Cardenas, Mexico.

Mexico Cargo Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Industrial Trucks, Tow Tractors, Conveying Equipment, Stacker, Port Cranes, Others |

| Propulsion Types Covered | IC Engine, Electric |

| Applications Covered | Air, Road and Rail, Marine |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cargo handling equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cargo handling equipment market on the basis of equipment type?

- What is the breakup of the Mexico cargo handling equipment market on the basis of propulsion type?

- What is the breakup of the Australia cargo handling equipment market on the basis of application?

- What is the breakup of the Mexico cargo handling equipment market on the basis of sales channel?

- What is the breakup of the Mexico cargo handling equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico cargo handling equipment market?

- What are the key driving factors and challenges in the Mexico cargo handling equipment market?

- What is the structure of the Mexico cargo handling equipment market and who are the key players?

- What is the degree of competition in the Mexico cargo handling equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cargo handling equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cargo handling equipment market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cargo handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)