Mexico Carpets and Rugs Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2026-2034

Mexico Carpets and Rugs Market Summary:

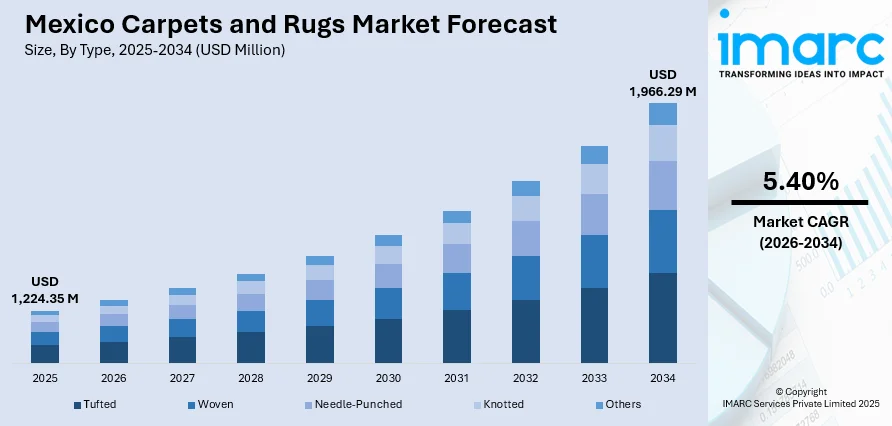

The Mexico carpets and rugs market size was valued at USD 1,224.35 Million in 2025 and is projected to reach USD 1,966.29 Million by 2034, growing at a compound annual growth rate of 5.40% from 2026-2034.

The market is experiencing robust growth fueled by accelerated housing construction, rising middle-class purchasing power, and nearshoring-driven economic expansion across industrial and residential sectors. Government initiatives including expanded mortgage programs and infrastructure investments are creating sustained demand for flooring solutions. The shift toward home renovation, combined with growing consumer preferences for sustainable materials and customizable designs, is reshaping purchasing patterns across mass merchandisers, home centers, and specialty retail channels throughout the Mexico carpets and rugs market share.

Key Takeaways and Insights:

- By Type: Tufted dominates the market with a share of 63% in 2025, driven by efficient manufacturing processes producing massive quantities of tufts per minute, enabling cost-effective production and extensive design flexibility.

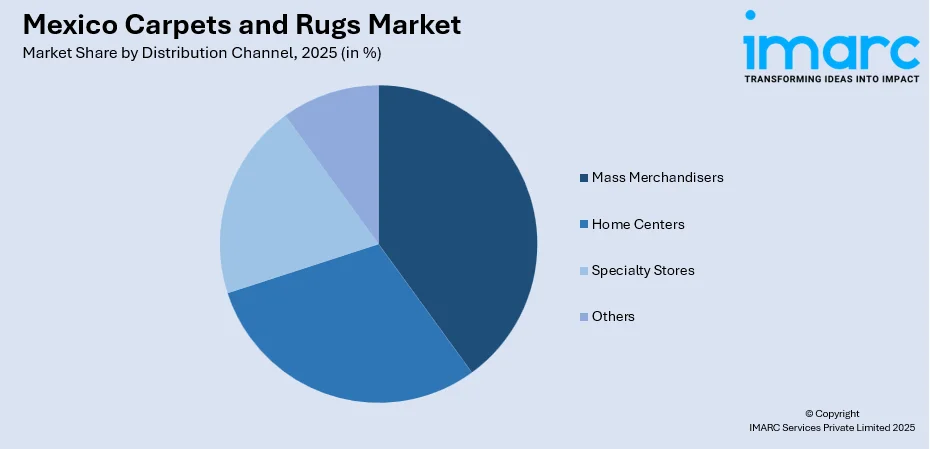

- By Distribution Channel: Mass merchandisers lead the market with a share of 31% in 2025, supported by aggressive retail expansion including major investments from key market players enhancing accessibility across urban and suburban markets.

- By Application: Residential represents the largest segment with a market share of 65% in 2025, fueled by housing stimulus programs, rising property values, and expanding homeowner investment in interior improvements.

- Key Players: The Mexico carpets and rugs market exhibits moderate competitive intensity, with international flooring corporations competing alongside regional manufacturers and specialty retailers across diverse price segments and distribution formats.

To get more information on this market Request Sample

The Mexico carpets and rugs market reflects the country's broader economic transformation, where strategic positioning between industrial expansion and residential development creates sustained flooring demand. The sector benefits from favorable demographic trends including urbanization concentrated in metropolitan corridors, rising household formation rates, and expanding middle-class purchasing power. Major retailers are capitalizing on these dynamics through substantial infrastructure investments, with developments such as Grupo Coppel's allocation of over twelve billion pesos for one hundred new stores nationwide demonstrating confidence in market potential. These expansion initiatives, coupled with enhanced digital service platforms and omnichannel strategies, are improving product accessibility across socioeconomic segments. The convergence of housing stimulus measures, nearshoring-driven wage growth in northern industrial zones, and sustained consumer interest in home improvement creates a favorable environment for market expansion. Additionally, government housing initiatives including INFONAVIT's increased construction target to deliver 1.2 million homes during the current presidential administration provides structural support for sustained flooring demand. In July 2025, this ambitious housing goal represented more than a doubling of initial targets, signaling robust governmental commitment to addressing residential infrastructure needs while simultaneously stimulating construction-related sectors including floor coverings.

Mexico Carpets and Rugs Market Trends:

Sustainability and Eco-Friendly Materials Transformation

Environmental consciousness is fundamentally reshaping material selection and manufacturing processes within the carpet industry, driven by consumer demand for sustainable alternatives and circular economy principles. Recycled materials including regenerated nylon, post-consumer PET fibers derived from plastic bottles, and natural renewable resources like wool and bamboo are gaining market traction. Advanced manufacturing innovations enable production of high-performance carpets incorporating recycled content without compromising durability or aesthetic appeal, with some materials achieving reductions in carbon footprint by up to ninety percent compared to virgin petroleum-based alternatives. The integration of closed-loop recycling systems, biodegradable backings, and low-emission manufacturing processes reflects industry commitment to environmental stewardship. In 2024, LG Electronics introduced its inaugural "Upcycling" workshop at Design Week Mexico 2024, hosted by Universidad Iberoamericana. The event sought to educate students in design and fashion about the environmental effects of the textile industry.

Digital Transformation and E-Commerce Integration

The rapid digitalization of retail channels is fundamentally altering carpet purchasing behaviors and distribution strategies throughout Mexico. Major retailers are investing substantially in omnichannel capabilities, integrating physical showrooms with robust e-commerce platforms and mobile applications to enhance customer convenience and product accessibility. Digital tools including virtual room visualization, augmented reality applications, and online design consultants enable people to preview carpet selections within their living spaces before purchase, reducing decision uncertainty and return rates. The expansion of logistics infrastructure supporting expedited delivery services addresses traditional barriers associated with large format product transportation. Social commerce platforms leveraging Instagram, Facebook, and TikTok are emerging as influential channels for product discovery and purchase facilitation, particularly among younger demographics. IMARC Group predicts that the Mexico e-commerce market is projected to attain USD 175.8 Billion by 2034.

Home Renovation and Customization Boom

Accelerating renovation activity and personalization trends are generating sustained demand for carpet replacements and upgrades across residential and commercial properties. Housing appreciation averaging 9.5 percent annually during the first half of 2024 encourages homeowners to invest in interior improvements, viewing renovations as value-enhancing activities rather than discretionary expenses. The proliferation of design inspiration through digital media platforms, combined with increased time spent at home following pandemic-related behavioral shifts, intensifies consumer focus on creating comfortable, aesthetically pleasing living environments. Customization options including varied textures, patterns, color palettes, and pile heights enable people to achieve distinctive interior aesthetics reflecting personal preferences. Major retailers are responding by expanding product ranges, enhancing in-store design services, and offering installation support to capture renovation-driven demand.

Market Outlook 2026-2034:

The Mexico carpets and rugs market is positioned for sustained expansion throughout the forecast period, supported by favorable macroeconomic conditions and structural demand drivers. The market generated a revenue of USD 1,224.35 Million in 2025 and is projected to reach a revenue of USD 1,966.29 Million by 2034, growing at a compound annual growth rate of 5.40% from 2026-2034. Nearshoring dynamics attracting manufacturing investments to northern regions generate associated infrastructure requirements including industrial facilities, worker housing, and commercial spaces, each requiring flooring solutions. Government housing initiatives targeting new homes create substantial addressable market expansion.

Mexico Carpets and Rugs Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Tufted | 63% |

| Distribution Channel | Mass Merchandisers | 31% |

| Application | Residential | 65% |

Type Insights:

- Tufted

- Woven

- Needle-Punched

- Knotted

- Others

Tufted dominates with a market share of 63% of the total Mexico carpets and rugs market in 2025.

Tufted carpet construction revolutionized the flooring industry by introducing mechanized production methods that dramatically reduce manufacturing time while maintaining exceptional quality standards. The tufting process involves hundreds of needles working simultaneously to insert yarn through primary backing material, creating thousands of precise loops per minute and achieving production speeds up to 2,000 tufts per minute, significantly surpassing traditional weaving techniques. This efficiency translates into cost advantages enabling competitive pricing across market segments, making quality carpets accessible to broader consumer demographics.

Manufacturing versatility allows producers to create diverse textures, patterns, and pile heights through precise control of needle placement, loop formation, and cutting mechanisms, accommodating varied aesthetic preferences from plush residential carpets to durable commercial installations. The process accommodates multiple fiber types including nylon, polyester, and natural materials, providing flexibility to address evolving consumer preferences regarding sustainability and performance characteristics. Advanced computer-controlled tufting machines enable intricate pattern creation through precise yarn color variation and pile height manipulation, producing designs rivaling traditionally woven alternatives while maintaining production efficiency.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Mass Merchandisers

- Home Centers

- Specialty Stores

- Others

Mass merchandisers lead with a share of 31% of the total Mexico carpets and rugs market in 2025.

Mass merchandisers leverage operational scale, purchasing power, and integrated supply chains to deliver competitive pricing while maintaining broad product assortments addressing diverse consumer preferences and budget constraints. These retailers operate expansive store formats offering one-stop shopping convenience, where carpet selections integrate alongside complementary home improvement products including flooring installation tools, furniture, and décor accessories, creating efficient shopping experiences for renovation projects. Strategic store placement in high-traffic commercial zones and suburban developments maximizes accessibility for target demographics including homeowners, contractors, and property management professionals.

The channel benefits from aggressive expansion strategies, demonstrated by substantial infrastructure investments including Grupo Coppel's commitment of over twelve billion pesos to establish one hundred new stores across multiple formats and Home Depot's allocation of 2.86 billion pesos to reach one hundred fifty locations nationwide in 2024, enhancing geographic coverage and market penetration. Digital integration including e-commerce platforms, mobile applications, and omnichannel fulfillment capabilities extends reach beyond physical footprints, addressing evolving preferences for online browsing, price comparison, and convenient delivery options.

Application Insights:

- Residential

- Commercial

Residential exhibits a clear dominance with a 65% share of the total Mexico carpets and rugs market in 2025.

The residential segment benefits from multiple converging demand drivers creating sustained market expansion throughout the forecast period. New housing construction provides primary demand as developers and homeowners specify flooring solutions for properties ranging from affordable housing to luxury residences, with government initiatives targeting 1.1 million new homes from 2024 to 2030, generating substantial addressable opportunities. Renovation and replacement cycles generate ongoing demand as existing carpets reach end-of-life or homeowners pursue aesthetic updates, with housing appreciation annually encouraging investment in value-enhancing improvements.

Rising middle-class incomes enable discretionary spending on quality flooring products, with consumers increasingly prioritizing comfort, aesthetics, and sustainable materials when selecting carpets. Demographic trends including household formation, urbanization, and changing lifestyle preferences shape product specifications, with demand spanning diverse carpet types addressing varied applications from bedrooms and living areas to home offices and entertainment spaces. Moroever, behavior evolution emphasizes home as lifestyle expression, driving interest in customizable carpet options enabling personalized interior design.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a dynamic market characterized by industrial expansion, nearshoring investments, and robust economic growth concentrated in major urban centers including Monterrey, Tijuana, and Ciudad Juárez. The region benefits from proximity to the United States border facilitating manufacturing operations, export activities, and cross-border commerce, with Monterrey serving as Mexico's industrial capital hosting major corporations across steel, cement, glass, automotive, and brewing sectors.

Central Mexico anchored by Mexico City constitutes the largest and most economically significant market region, accounting for substantial national GDP contribution and hosting the country's political, financial, and cultural center. The metropolitan area population exceeding, representing the largest concentration of consumers and highest density market in Mexico. Moreover, economic output contributes to the national GDP, with service sectors dominating employment and income generation. Purchasing power ranks among the highest in Latin America and the Caribbean, supporting demand for premium carpet products across residential and commercial applications.

Southern Mexico encompasses emerging markets characterized by tourism development, urbanization, and demographic growth creating expanding flooring demand across residential and hospitality sectors. Coastal regions including Quintana Roo benefit from tourism infrastructure supporting hotel, resort, and vacation property development requiring carpets for guest rooms, common areas, and residential components. Urban centers including Mérida experience population growth and economic diversification creating residential construction activity.

In other regions infrastructure development including highway construction and port expansion is improving accessibility, facilitating distribution logistics and reducing transportation costs affecting product pricing. Government initiatives targeting regional economic development and housing accessibility create opportunities for market expansion as living standards rise and consumer purchasing power increases throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Mexico Carpets and Rugs Market Growing?

Accelerated Housing Construction and Infrastructure Development

Government housing initiatives combined with private sector residential development are generating substantial flooring demand across Mexico's urban and suburban markets. The ambitious expansion of housing construction targets provides structural support for sustained carpet market growth throughout the forecast period. Governmental commitment to addressing housing deficits manifests through programs including INFONAVIT's substantially increased construction goals, which in July 2025 announced an elevation of housing targets to 1.2 million homes for the current presidential term, more than doubling initial objectives of 500,000 units. This dramatic expansion reflects policy priorities addressing housing accessibility while simultaneously stimulating construction-related industries including flooring products.

Rising Middle-Class Income and Purchasing Power

Economic development elevating household incomes enables discretionary spending on quality flooring products, with middle-class expansion creating a growing consumer base prioritizing comfort, aesthetics, and home value enhancement. INEGI’s 2024 National Survey of Household Income and Expenditure (ENIGH) indicates that the average monthly household income increased to MX$25,955 (US$1,372), reflecting a 10.6% real growth relative to 2022. Income growth concentrated in urban centers and industrial regions generates purchasing power supporting premium carpet selections over basic alternatives, creating opportunities for manufacturers and retailers emphasizing quality, design, and sustainable materials. Property equity accumulation provides financial resources enabling renovation projects without compromising household budgets, removing traditional constraints limiting flooring replacement cycles.

Nearshoring-Driven Economic Growth and Industrial Expansion

The strategic repositioning of manufacturing operations from Asia to Mexico, accelerated by global supply chain reconfiguration and trade policy adjustments, generates substantial infrastructure requirements including industrial facilities, worker housing, and supporting commercial developments, each necessitating flooring solutions across diverse applications. Foreign direct investment flowing into northern states including Nuevo León, Chihuahua, and Baja California creates immediate construction demand while establishing long-term economic foundations supporting sustained market expansion. Industrial Park development accommodates manufacturing operations requiring specialized flooring addressing heavy equipment, chemical resistance, and safety specifications. The Government of the State of Mexico has declared the establishment of six new industrial parks in 2025 with a total investment nearing 3.5 billion pesos and the generation of over 2,800 jobs.

Market Restraints:

What Challenges the Mexico Carpets and Rugs Market is Facing?

High Construction Material Costs and Inflation Pressures

Elevated construction material costs create financial pressures affecting both new building projects and renovation activities, constraining market expansion potential. Inflation in raw materials including petroleum-based carpet fibers, backing materials, and adhesives increases manufacturing costs, translating into higher retail pricing that may dampen consumer demand particularly among price-sensitive segments. Construction cost increases impact project feasibility assessments, potentially delaying or canceling developments that would otherwise generate flooring demand.

Economic Uncertainty and Interest Rate Volatility

Fluctuating interest rates affect mortgage accessibility and refinancing options, influencing homeownership rates and property transaction volumes that drive carpet demand cycles. Higher borrowing costs reduce housing affordability, potentially constraining new home purchases and consequently diminishing primary flooring demand. Economic uncertainty impacts consumer confidence and discretionary spending patterns, with renovation projects and carpet replacements representing expenditures that households may defer during uncertain financial periods.

Limited Affordable Housing Supply and Production Constraints

Insufficient affordable housing inventory relative to demographic demand creates market access barriers for lower-income segments, limiting addressable consumer base for carpet products. Production capacity constraints in residential construction, evidenced by declining dwelling completions during certain periods despite sustained demand, restrict primary flooring opportunities. Regulatory approval processes, land availability constraints, and infrastructure limitations slow residential development rates in high-demand urban areas, creating supply-demand imbalances that elevate property costs while constraining construction volumes.

Competitive Landscape:

The Mexico carpets and rugs market exhibits moderate competitive intensity characterized by diverse participant categories including international flooring corporations, regional manufacturers, specialty retailers, and mass merchandisers competing across multiple dimensions including product quality, pricing strategies, distribution reach, and service capabilities. Market structure reflects balance between established players leveraging brand recognition, operational scale, and technical expertise against emerging competitors emphasizing innovation, sustainability, and targeted market positioning. International manufacturers maintain presence through direct operations or distribution partnerships, offering premium product portfolios featuring advanced performance characteristics, extensive design selections, and established quality reputations. Regional producers compete through cost advantages, local market knowledge, and flexible operations responsive to specific consumer preferences and ordering patterns.

Recent Developments:

- In April 2025, The Natco Home Group, a leading and vibrant provider of flooring and home décor in the USA, today revealed it has finalized an agreement to purchase the Orian Rugs brand from its parent company SP Orian, LLC. Natco Home Group's outstanding products can be found at leading mass retailers, home improvement centers, department stores, and warehouse clubs in the U.S., Canada, and Mexico.

Mexico Carpets and Rugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tufted, Woven, Needle-Punched, Knotted, Others |

| Distribution Channels Covered | Mass Merchandisers, Home Centers, Specialty Stores, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico carpets and rugs market size was valued at USD 1,224.35 Million in 2025

The Mexico carpets and rugs market is expected to grow at a compound annual growth rate of 5.40% from 2026-2034 to reach USD 1,966.29 Million by 2034.

Tufted carpets dominated the market with approximately 63% revenue share, driven by efficient manufacturing processes enabling production of up to 2,000 tufts per minute, cost-effectiveness, and extensive design versatility accommodating diverse aesthetic preferences across residential and commercial applications.

Key factors driving the Mexico carpets and rugs market include accelerated housing construction supported by government initiatives targeting new homes, rising middle-class purchasing power enabling discretionary spending on quality flooring products, and nearshoring-driven economic growth generating substantial infrastructure requirements across industrial facilities, worker housing, and supporting commercial developments throughout northern and central regions.

Major challenges include high construction material costs and inflation pressures affecting project feasibility and consumer discretionary spending, economic uncertainty and interest rate volatility impacting mortgage accessibility and homeownership rates, and limited affordable housing supply creating market access barriers for lower-income segments while production capacity constraints restrict primary flooring opportunities in high-demand urban markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)