Mexico CBD Products Market Size, Share, Trends and Forecast by Source, Distribution Channel, Application, and Region, 2026-2034

Mexico CBD Products Market Summary:

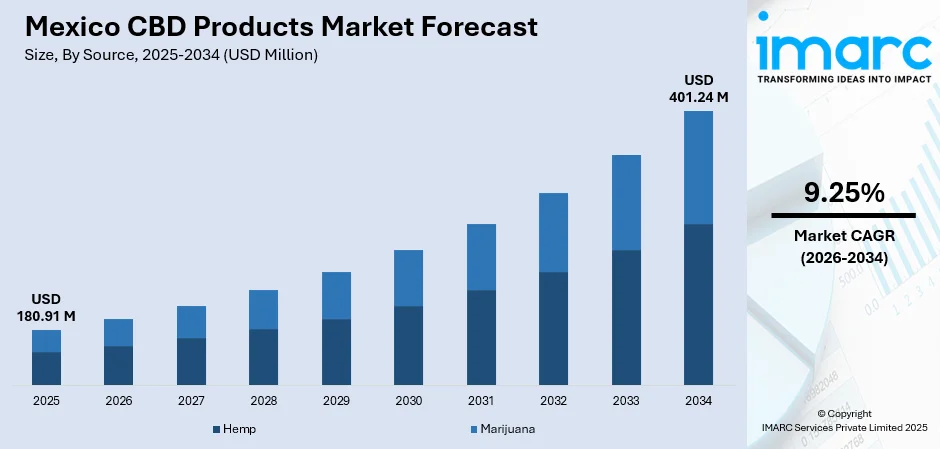

The Mexico CBD products market size was valued at USD 180.91 Million in 2025 and is projected to reach USD 401.24 Million by 2034, growing at a compound annual growth rate of 9.25% from 2026-2034.

The Mexico CBD products market is experiencing robust expansion, driven by increasing consumer awareness about therapeutic benefits associated with cannabidiol compounds. The growing preference for natural wellness alternatives is reshaping purchasing behaviors, as consumers are seeking holistic solutions for stress relief, pain management, and skincare applications. Progressive regulatory developments by COFEPRIS are creating clearer pathways for compliant market entry while e-commerce platforms are enabling convenient product accessibility nationwide. These converging factors are strengthening Mexico CBD products market share across diverse consumer segments.

Key Takeaways and Insights:

-

By Source: Hemp dominates the market with a share of 78% in 2025, owing to favorable regulatory treatment for hemp-derived products, widespread availability across retail and online channels, and strong consumer preference for plant-based wellness solutions.

-

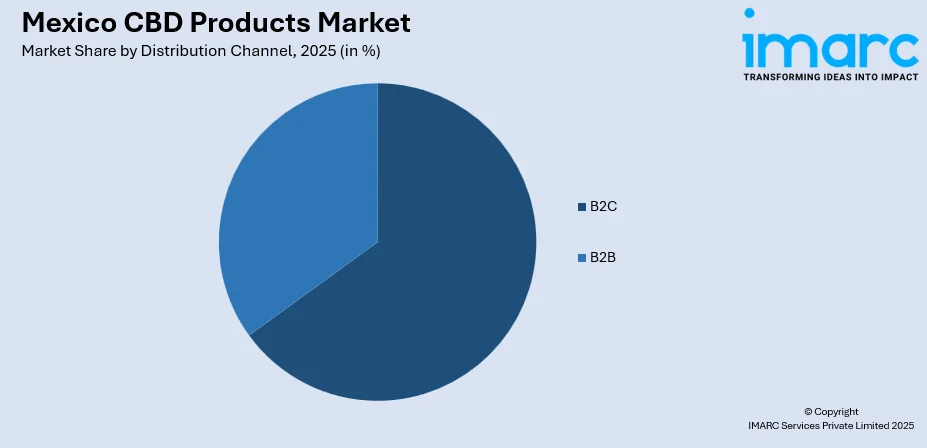

By Distribution Channel: B2C leads the market with a share of 65% in 2025, driven by the rapid expansion of e-commerce platforms offering direct consumer access to CBD products, increasing smartphone penetration, and the growing trust in online wellness product purchases.

-

By Application: Wellness exhibits a clear dominance with 71% share in 2025, reflecting the rising consumer inclination towards natural remedies for stress management, sleep enhancement, and daily self-care routines over pharmaceutical applications.

-

Key Players: Key players are fueling the market growth in Mexico by obtaining regulatory authorizations, expanding distribution networks, developing innovative product formulations, and establishing strategic partnerships. Their investments in compliance frameworks, quality assurance protocols, and e-commerce capabilities strengthen market accessibility and consumer confidence across the country.

To get more information on this market Request Sample

The Mexico CBD products market is advancing as regulatory clarity improves and consumer acceptance of cannabidiol-based solutions strengthens across wellness and personal care applications. The market benefits from Mexico's position as one of the largest personal care markets in Latin America, with consumers increasingly seeking natural and organic ingredients in their health products. In February 2024, Xebra Brands Ltd., through its subsidiary Elements Bioscience, received the first-ever federal authorization from COFEPRIS for the importation, launch, and sale of a CBD tincture product in Mexico. This milestone demonstrates the regulatory pathway becoming clearer for compliant CBD products, encouraging investments in quality assurance and market development. The expanding middle-class population with rising disposable incomes is fueling the demand for premium wellness products, while digital transformation across retail channels is enabling brands to reach the underserved regions effectively.

Mexico CBD Products Market Trends:

Product Diversification and Format Innovations

The Mexico CBD products market is witnessing rapid diversification beyond traditional oils and tinctures into edibles, topicals, capsules, beverages, pet care, and cosmetics. This evolution addresses varying consumer preferences for convenient and discreet consumption methods. Companies are developing formulations combining CBD with complementary ingredients, such as melatonin, vitamins, and adaptogens. The trend is attracting new demographic segments, including elderly consumers and women seeking natural alternatives, supporting Mexico CBD products market growth across multiple product categories.

E-Commerce Channel Expansion

Digital retail platforms are becoming the primary distribution channel for CBD products in Mexico as e-commerce integration accelerates. As reported by the Mexican Online Sales Association (AMVO), online retail sales hit MXD 789.7 Billion (USD 43 Billion) in 2024, indicating a year-over-year increase of over 20%. In 2024, e-commerce penetration hit around 84%, indicating a rapidly expanding group of digital consumers with more advanced product expectations. Online channels provide discreet purchasing environments that help overcome social stigma barriers while enabling brands to offer detailed product information and personalized recommendations to wellness-focused consumers.

Natural Wellness and Self-Care Movement

Mexican consumers are increasingly gravitating towards holistic health solutions as the wellness industry expands nationwide. As per IMARC Group, the Mexico health and wellness market size reached USD 52.3 Billion in 2024. CBD products align with the growing preference for natural remedies that address stress, anxiety, sleep disorders, and skincare concerns without synthetic chemicals. The strong demand for organic and naturally-derived ingredients in cosmetics and supplements is creating substantial opportunities for CBD-infused product development.

Market Outlook 2026-2034:

The Mexico CBD products market outlook remains favorable, as regulatory frameworks continue to evolve towards clearer commercialization pathways. The market generated a revenue of USD 180.91 Million in 2025 and is projected to reach a revenue of USD 401.24 Million by 2034, growing at a compound annual growth rate of 9.25% from 2026-2034. Growth will be supported by continued e-commerce expansion, increasing consumer awareness about CBD benefits, and progressive regulatory actions by COFEPRIS enabling legal market operations. Strategic partnerships between international brands and local distributors will strengthen product availability and market penetration across diverse geographic regions.

Mexico CBD Products Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Source | Hemp | 78% |

| Distribution Channel | B2C | 65% |

| Application | Wellness | 71% |

Source Insights:

- Hemp

- Marijuana

Hemp dominates with a market share of 78% of the total Mexico CBD products market in 2025.

Hemp offers a legally clearer and commercially viable source of cannabidiol compared to marijuana-derived CBD. Hemp contains naturally low THC levels, making it easier for producers to align with regulatory expectations and reduce compliance risks. Its versatility allows use across multiple product categories, including oils, tinctures, edibles, cosmetics, and wellness supplements. Additionally, hemp cultivation supports consistent CBD extraction, stable supply chains, and cost-effective production, encouraging manufacturers to scale operations and meet growing consumer demand efficiently.

Another key reason for hemp’s dominance is its broad acceptance among consumers and businesses seeking non-intoxicating wellness solutions. Hemp-derived CBD is widely perceived as safe, natural, and suitable for daily use, supporting demand in health and personal care segments. Its adaptability to Mexico’s agricultural conditions further strengthens domestic sourcing potential. Combined with lower processing complexity and strong compatibility with global CBD trade standards, hemp remains the preferred raw material, reinforcing its leading position in the Mexico CBD products market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- B2B

- B2C

B2C leads with a share of 65% of the total Mexico CBD products market in 2025.

B2C dominates the Mexico CBD products market due to strong direct consumer demand for wellness, personal care, and lifestyle-oriented CBD products. Consumers increasingly prefer purchasing oils, gummies, topicals, and supplements through retail stores, pharmacies, wellness outlets, and online platforms. The B2C model allows brands to engage directly with customers, build trust, and educate them about product benefits and usage. Easy product accessibility, smaller purchase quantities, and growing awareness of CBD’s non-intoxicating properties further support higher consumer adoption through B2C channels.

Additionally, B2C channels enable companies to respond quickly to changing consumer preferences and introduce new formulations, flavors, and product formats. Digital marketing, e-commerce platforms, and social media play a key role in expanding brand visibility and customer reach. As per IMARC Group, the Mexico e-commerce market size reached USD 54.4 Billion in 2025. Subscription models and direct feedback loops also help companies improve product positioning and customer loyalty. As demand is driven largely by individual health and wellness needs rather than bulk industrial use, B2C continues to dominate the Mexico CBD products market.

Application Insights:

- Pharmaceutical

- Wellness

Wellness exhibits a clear dominance with a 71% share of the total Mexico CBD products market in 2025.

The wellness application segment captures the majority of CBD product demand, as Mexican consumers increasingly seek natural solutions for daily health management. Products targeting stress relief, sleep enhancement, skincare, and general well-being resonate strongly with health-conscious consumers preferring botanical alternatives.

CBD-infused skincare products are gaining significant traction in the market due to their anti-inflammatory, antioxidant, and anti-aging properties, appealing to consumers seeking natural beauty solutions. The wellness category benefits from lower regulatory barriers compared to pharmaceutical applications, enabling faster market entry for compliant products. Companies are developing diverse formats, including oils, capsules, topical creams, and beverages, to address specific wellness needs while building consumer trust through quality certifications and transparent sourcing practices.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico presents significant opportunities for CBD product expansion due to proximity to the United States market and higher disposable incomes in industrial corridors. States, including Nuevo León, Chihuahua, and Baja California, feature urbanized population with strong awareness about wellness trends. The region's established cross-border commerce infrastructure facilitates product importation while manufacturing investments support local economic development and employment growth.

Central Mexico represents the primary consumption hub for CBD products, driven by increasing population density in Mexico City metropolitan area and surrounding states. The region features the highest concentration of retail outlets, e-commerce distribution centers, and health-conscious consumers seeking premium wellness products. The urban population demonstrate strong adoption rates for innovative health solutions while digital infrastructure enables efficient direct-to-consumer (D2C) delivery services across densely populated areas.

Southern Mexico presents emerging opportunities for CBD market development, as digital connectivity and e-commerce penetration expand into previously underserved communities. States, including Oaxaca, Chiapas, and Guerrero, feature growing awareness about natural wellness products among populations with traditional appreciation for botanical remedies. The region's climate supports potential cultivation opportunities while tourism sectors create additional demand channels for wellness-oriented CBD products.

Market Dynamics:

Growth Drivers:

Why is the Mexico CBD Products Market Growing?

Growing consumer awareness about wellness and natural remedies

Rising awareness about health, wellness, and preventive care is a major factor driving the Mexico CBD products market expansion. Consumers are increasingly looking for natural, plant-based alternatives to manage stress, pain, sleep issues, and general well-being. CBD products are widely perceived as non-intoxicating and suitable for daily use, making them attractive to health-conscious individuals. Social media, word-of-mouth, and exposure to global wellness trends have helped normalize CBD usage, especially among urban and younger populations. In January 2024, Mexico had 90.20 Million social media users, representing 70.0% of the entire population. As people become more informed about holistic health approaches, CBD is often positioned as a functional wellness ingredient rather than a pharmaceutical product. This perception reduces stigma and increases acceptance. The shift towards self-care, mental well-being, and lifestyle health solutions continues to expand the consumer base, supporting steady growth of CBD oils, edibles, beverages, and personal care products across Mexico.

Expanding applications across multiple product categories

The versatility of CBD across a wide range of product categories is strongly fueling the market growth in Mexico. CBD is used in oils, tinctures, gummies, capsules, beverages, cosmetics, skincare products, and topical formulations. This wide application allows brands to target diverse consumer needs, including relaxation, pain relief, skin health, and general wellness. Personal care and beauty products infused with CBD are gaining popularity due to their association with calming and anti-inflammatory properties. Food and beverage (F&B) innovations further expand consumption occasions beyond traditional supplements. This diversification reduces dependence on a single product segment and encourages experimentation among consumers. As manufacturers continue to develop new formats, flavors, and delivery systems, CBD products become more accessible and appealing, accelerating adoption and supporting long-term market expansion across multiple consumer segments in Mexico.

Growing participation of startups and new brands

The entry of startups and emerging brands is driving innovations and competition in the Mexico CBD products market. New players are introducing creative formulations, localized branding, and targeted products tailored to specific consumer needs. Startups often focus on niche segments, such as stress relief, sleep support, skincare, or sports recovery, expanding overall market scope. As per IMARC Group, the Mexico skincare market size reached USD 2.1 Billion in 2024. Increased competition improves product variety, affordability, and accessibility. Smaller brands also leverage digital marketing and D2C strategies to reach customers efficiently. This entrepreneurial activity fosters experimentation and faster response to market trends. As more companies are entering the space, awareness is increasing and distribution networks are expanding. The growing number of market participants strengthens consumer confidence and accelerates adoption, contributing to the sustained growth of CBD products across Mexico.

Market Restraints:

What Challenges the Mexico CBD Products Market is Facing?

Regulatory Uncertainty and Compliance Complexity

Despite progressive developments, Mexico lacks comprehensive regulatory frameworks, specifically governing CBD product commercialization, creating uncertainty for market participants. Companies must navigate complex authorization processes requiring extensive documentation while regulatory interpretations may vary across product categories and applications.

Gray Market Competition and Product Quality Concerns

Unregulated CBD products without proper testing or quality assurance continue circulating through informal channels, undermining consumer confidence and creating price competition challenges for compliant operators. The proliferation of unauthorized products complicates market development and raises safety concerns among potential consumers unfamiliar with quality differentiation.

Limited Consumer Education and Awareness

Many Mexican consumers remain unfamiliar with CBD's therapeutic properties, proper usage, and quality indicators, limiting market adoption rates. Cultural associations between CBD and recreational cannabis create perception barriers that require sustained educational efforts to overcome and build mainstream consumer acceptance.

Competitive Landscape:

The Mexico CBD products market is characterized by emerging competition, as companies pursue regulatory authorizations and establish distribution networks. Market participants are differentiating through product quality certifications, diverse format offerings, and strategic partnerships with established retail and e-commerce platforms. Companies with COFEPRIS authorizations hold significant competitive advantages, as regulatory compliance becomes a key market entry barrier. Investments in formulation expertise, quality assurance infrastructure, and brand development are intensifying, as participants are seeking to capture market share in the rapidly evolving wellness segment. International brands are entering through partnerships with local distributors possessing regulatory expertise and established commercial relationships.

Recent Developments:

-

In December 2025, HGI Industrial Technologies S.A. de P.I. de C.V. and Santa Rosa Green Seeds obtained official import licenses from COFEPRIS permitting the import, registration, and sale of CBD, CBG, and other cannabinoid products with less than 1% THC in Mexico. The authorization encompassed a wide variety of hemp-derived items, such as extracts, health products for consumers, cosmetics, nutraceuticals, and food-grade uses for human consumption.

-

In March 2025, Xebra Brands Ltd announced a strategic partnership with BSK Holdings Inc to launch Elements-branded CBD products in Mexico via e-commerce platforms. The collaboration targeted Mexico's rapidly expanding online retail market and leveraged BSK's expertise in building successful CBD and hemp brands, including Manitoba Harvest.

Mexico CBD Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Hemp, Marijuana |

| Distribution Channels Covered | B2B, B2C |

| Applications Covered | Pharmaceutical, Wellness |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico CBD products market size was valued at USD 180.91 Million in 2025.

The Mexico CBD products market is expected to grow at a compound annual growth rate of 9.25% from 2026-2034 to reach USD 401.24 Million by 2034.

Hemp dominated the market with a share of 78%, due to legal clarity for industrial hemp, cost efficiency, scalable cultivation, consistent cannabinoid content, easier sourcing, and acceptance across wellness, food, and care segments.

Key factors driving the Mexico CBD products market include progressive regulatory developments by COFEPRIS, rapid e-commerce expansion enabling direct consumer access, growing preference for natural wellness solutions, increasing consumer awareness about CBD therapeutic benefits, and rising disposable incomes among the middle-class population.

Major challenges include regulatory uncertainty and complex authorization processes, competition from unregulated gray market products, limited consumer education about CBD benefits and quality standards, cultural perception barriers, and high compliance costs for market participants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)