Mexico CCTV Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Mexico CCTV Market Overview:

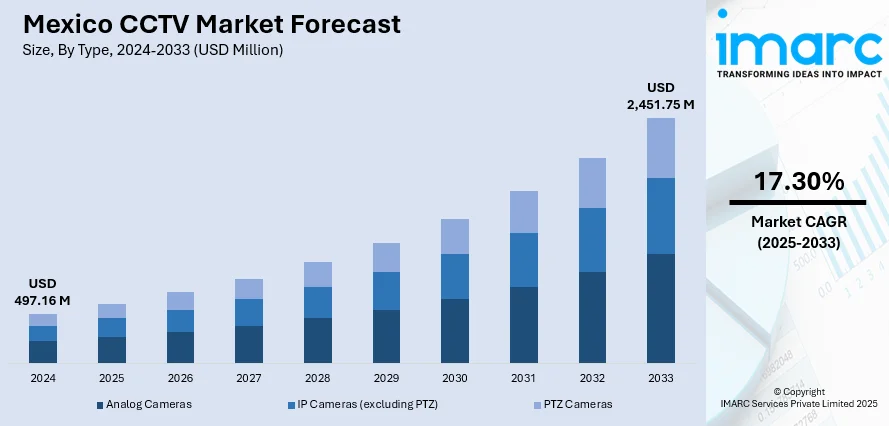

The Mexico CCTV market size reached USD 497.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,451.75 Million by 2033, exhibiting a growth rate (CAGR) of 17.30% during 2025-2033. The market is growing due to high crime levels, which increased the requirement for more secure solutions. Public safety initiatives by the Mexican government, including the mounting of surveillance systems in public places; technological innovation in surveillance devices, including high-definition cameras and cloud storage technologies; and growing implementation of smart city initiatives and infrastructure development programs have accelerated the adoption of sophisticated surveillance technologies, further increasing the Mexico CCTV market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 497.16 Million |

| Market Forecast in 2033 | USD 2,451.75 Million |

| Market Growth Rate 2025-2033 | 17.30% |

Mexico CCTV Market Trends:

Urban Surveillance Expansion

Mexico is experiencing growth in urban surveillance programs, especially in capital cities such as Mexico City, Guadalajara, and Monterrey, as municipal governments are heavily investing in intelligent surveillance infrastructure as part of comprehensive smart city plans. Densely populated city centers are focusing on security, traffic control, and crime deterrence using CCTV systems with centralized monitoring centers. Public transportation networks, roads, and public squares are prime focus points, where the camera network allows law enforcement officials to observe current activities. Urban authorities are also employing the same systems for support in coordinating emergency response as well as in handling public events. These innovations portray a significant passion for developing new public safety infrastructure and increasing city governance using technology. The incorporation of CCTV into larger digital infrastructure initiatives marks a long-term and forward-looking trend that enhances both security and operational effectiveness, further supporting the Mexico CCTV market growth.

Expansion in Retail and Hospitality Sectors

Mexico's retail and hospitality industries are investing on sophisticated CCTV systems to improve customer security, prevent theft, and streamline business processes. As the nation becomes a leading tourist destination and urban areas witness a retail boom, companies are giving high priority to video surveillance to ensure safe and effective environments. Shopping malls, hotels, restaurants, and entertainment spots are installing high-definition cameras with remote access capabilities that enable real-time monitoring and operational control. In addition to security, these systems are also being utilized to monitor foot traffic, customer behavior, and employee performance, allowing data-driven decision-making. Well-known tourist destinations like Playa del Carmen, Cancún, and Los Cabos are some of the places where advanced CCTV systems are now the norm. This is an indication of how the Mexican private sector is embracing video technology for security purposes, and also to improve guest experience and operational efficiency.

Adoption of Smart and Integrated Technologies

Mexico's CCTV industry is transforming itself with the use of intelligent technologies that keep pace with international digital trends. IP cameras, analytics driven by artificial intelligence, and cloud storage are becoming the norm, facilitating more intelligent and flexible surveillance systems. These technologies make features like facial recognition, automatic license plate reading, and real-time notification possible, making security systems in various sectors more efficient. Moreover, the integration with smart infrastructure initiatives is becoming common, particularly in newer cities such as Querétaro and Tijuana. Local governments and businesses are increasingly implementing centralized systems that aggregate feeds from various locations, enhancing coordination and decision-making. The shift to cloud-based and AI-powered systems enables easy scalability, making surveillance systems more versatile for small businesses and large cities alike.

Mexico CCTV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

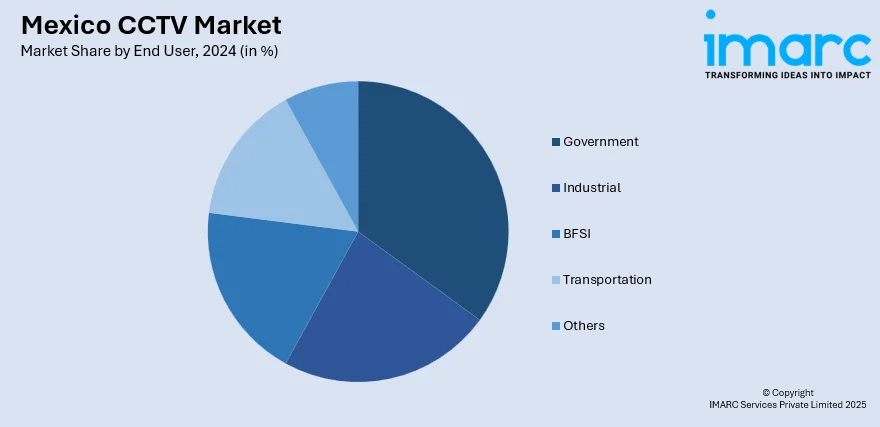

End User Insights:

- Government

- Industrial

- BFSI

- Transportation

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes government, industrial, BFSI, transportation, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico CCTV Market News:

- In February 2025, Clara Brugada Molina, the Head of Government of Mexico City, initiated the most significant video surveillance initiative aimed at enhancing the security of the capital, enabling the setup of 40,800 additional surveillance cameras. The officials stated that this approach will achieve a target of 150 thousand devices linked to the Control, Computing, Command, Communications, and Citizen Contact Center (C5) of the capital by the end of the six-year period.

Mexico CCTV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (Excluding PTZ), PTZ Cameras |

| End Users Covered | Government, Industrial, BFSI, Transportation, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico CCTV market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico CCTV market on the basis of type?

- What is the breakup of the Mexico CCTV market on the basis of end user?

- What is the breakup of the Mexico CCTV market on the basis of region?

- What are the various stages in the value chain of the Mexico CCTV market?

- What are the key driving factors and challenges in the Mexico CCTV market?

- What is the structure of the Mexico CCTV market and who are the key players?

- What is the degree of competition in the Mexico CCTV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico CCTV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico CCTV market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico CCTV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)